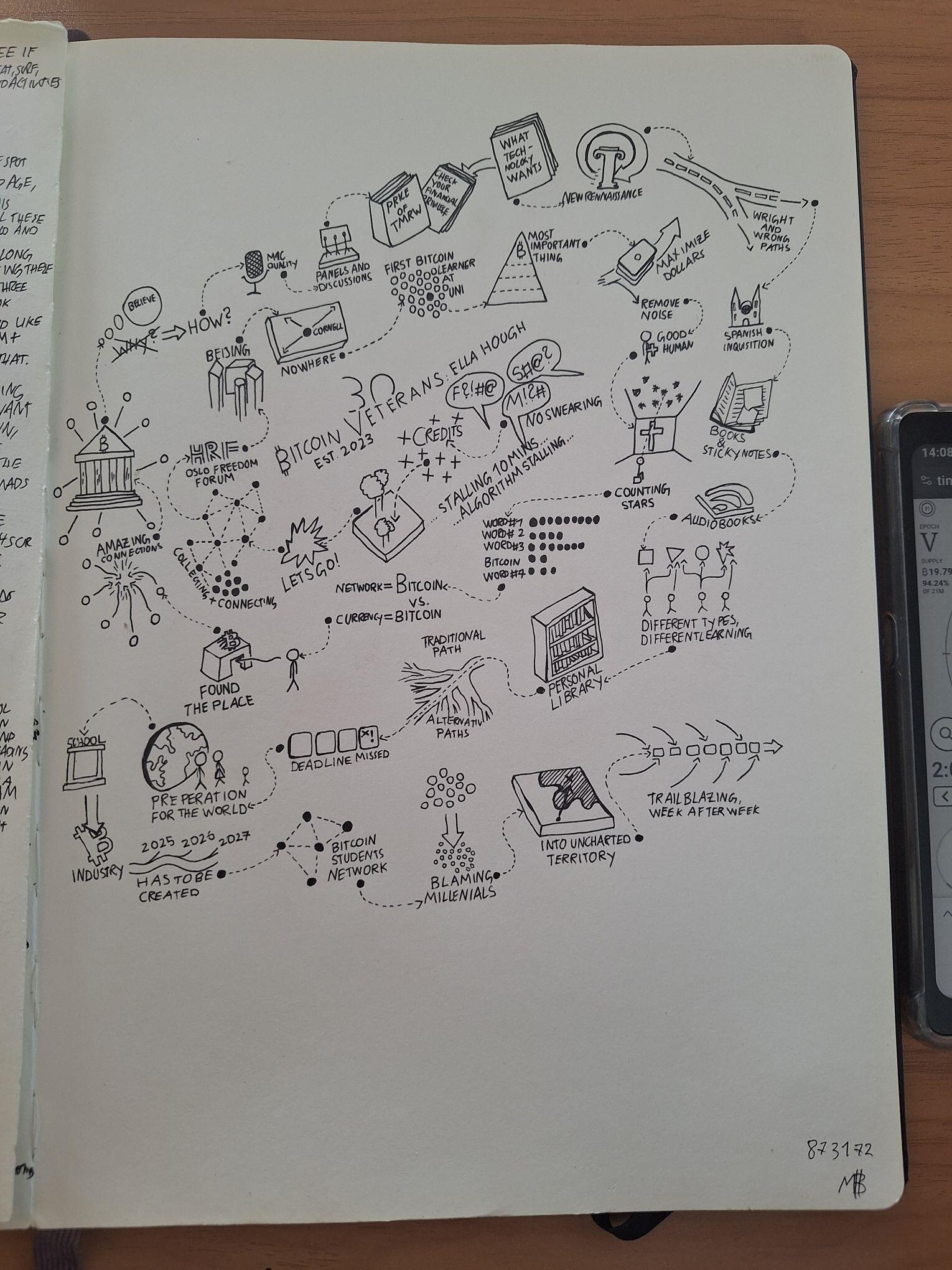

finally got around making a sketch of a podcast with nostr:nprofile1qqsp2wdswcnnykz6jg5skv34tth9qw34x22ev4l42jcje25hjzt5yxspp4mhxue69uhkummn9ekx7mqpz4mhxue69uhk2er9dchxummnw3ezumrpdejqzyrhwden5te0dehhxarj9emkjmn9thr03m ! what an amazing soul in this universe! nostr:nprofile1qqsqt94cze77fkfxhgt9s2rfxmht6gjn96n8asf2jrq8szkkdhclexgprfmhxue69uhhyetvv9ujuumgd96xvmmjvdjjummwv5hszxnhwden5te0wfjkccte9emk2mrvdaexgetj9ehx2ap0qy88wumn8ghj7mn0wvhxcmmv9uvturtf had her on almost a year ago with a great discussion about learning, connecting the dots, and the paths in life you take.

which episode do you want to see sketched out next?

https://video.nostr.build/a216f38175305bdf6664e45781ba1340437730712ad5b7e1964efbe1f33a9876.mp4

Dive into it here: https://fountain.fm/episode/ckLZEo88Ny2Gy0lrvJ4M

What's that dashboard looking app on your phone?

I can't figure out why normally smart people can't get it. This guy gets it with gold and oil, but his brain cannot get it worth #bitcoin.

“Of all the prices to support, why would the government choose to support, by accumulating a sterile inventory, a bunch of Bitcoin?

What does "prices to support" even mean?

And what's a "sterile inventory?" I feel like we're just making up things here.

Sometimes I think there's an on/off toggle switch in people's brains. And somehow when someone hears the word "bitcoin," the switch is flipped and brain just goes to OFF.

https://www.cryptopolitan.com/us-treasury-sec-calls-bitcoin-reserve-crazy/

I gotta say, the #bitcoin rollercoaster is a big part of the fun. Hodl on.

If you want a physical paperback copy, I'll send you one.

Trump Appoints Paul Atkins to Run the SEC and The Bitcoin Bulls Go Wild! https://ecency.com/bitcoin/@bigtakosensei/trump-appoints-paul-atkins-to

Had to give a follow to a fellow Hiver.

If you'd put $100 on this guy's advice back in July 12, 2017, you'd now have $4,578.

"The best time to plant a tree was 20 years ago, the second best time is now."

100k

I like this viewpoint. Reminds me of a Will Roger's quote, "Good judgment comes from experience, and a lot of that comes from bad judgment."

So, it's a femail bomber now?

Any possibility of getting "Kicking the Hornet's Nest" (https://www.amazon.com/Kicking-Hornets-Nest-Complete-Cryptocurrency/dp/1304040534) onto your website as a "books" resource? (See more "Kicking" links at https://crrdlx.vercel.app/kicking)

"Kicking" is similar to "The Book of Satoshi" in that both contain Satoshi's writings. However, I feel it is not the same. Distinguishing features and reasons to perhaps consider including "Kicking":

. "Kicking" contains all of Satoshi's public writings ("The Book of Satoshi" does not).

. There is very, very little commentary…it is Satoshi's words.

. Edition 3 includes the 2024 COPA trial email dump, which is considerable.

. There is a free digital download (as well as the paperback version).

Bottom line, I feel "Kicking" has many more of Satoshi's words, especially after COPA, hence, the completeness and chronology seem important. So, I thought I'd just ask. No problem if a no-go, just askin'.

-crrdlx

That time of year. Thankful for so many things.

#Christmas

Wen Enroncoin? If you're going to go crypto degen, let's go all out.

Fun to watch the Christmas colors blinking.

300 tons of gold was found recently (so says China). #bitcoin fixes this with real scarcity.

https://www.foxnews.com/world/largest-gold-deposit-world-worth-83-billion-found-china

The thing is, it is the thing.

tldr; A common bitcoin criticism is, "It's not backed by anything." Well, the thing is, bitcoin is the thing.

One of the most common criticisms of bitcoin is the line, "Bitcoin isn't backed by anything." Years ago I was at a semi-social thing hosted by a financial advisor. Although I didn't care how he would answer, I was curious and asked, "What do you think about bitcoin?" He answered, "Well, it doesn't have any intrinsic value, it isn't backed by anything." Then he added something about "tulips."

Regarding the tulips, that argument was actually okay in my view. A few reasons: (1) This was years ago, and the idea of bitcoin either going to zero or a million was real. Back then, zero was actually the better bet. Bitcoin at a million was crazy talk, a surefire way to be laughed at as a quack. (2) Tulips actually do have a degree of scarcity. Each year there are only so many bulbs to go around. Of course, more can be grown, almost infinitely I would guess. But, there is a natural time element of progation and maturation involved, not to mention decay. So, in the least, tulip bulbs have a physical, natural limit built in as a throttle to the total supply and to the emission rate. Compare tulips to fiat money...no throttle there. (3) Today, every single memecoin is tulip mania. A few people fumble in early, play the timeline well, make a ton of some such cryptocurrency. The vast majority get rekt, the tulip mania ends, and everyone moves on to the next tulip memecoin. Early on, thinking of bitcoin in this way wasn't ridiculous thinking at all. At this point though, I feel we're past "tulips."

Regarding intrinsic value, I guess those critics are correct. You can't make jewelry out of bitcoin or plant them and later admire the pretty colors. But, let's face it, gold and tulips really don't have a ton of intrinsic value either. There are some uses to these things, not a ton, but bitcoin has none intrinsically. Yet, the intrinsic value of gold, or 17th century tulips, or fiat money, or bitcoin really isn't the point. The point is just the value, intrinsic, extrinsic, existential, whatever value. No one buys gold coins to melt them down and gild their kitchen stool. No one buys tulip bulbs to plant them and grow them because they're pretty...well, you got me on this one...people actually do do this! No one obtains fiat paper money to wallpaper their home. The point is, people obtain these things because they have value, which can be transferred to get other things, which in turn make their life better.

It was a gold bug who recently brought this to my mind. He repeated the old, "bitcoin isn't backed by anything" line. Two things on this:

First, I've always thought bitcoin actually is backed by something. It's not backed by something physical, as in "backed by gold" or "backed by crude oil." It's backed by something better. Bitcoin is backed by the trust that the immutable Bitcoin system is. This is hard for the simpleton to follow, me included...it took years. It's easy to understand, "You give me $1000 I'll give you a pebble of gold." Rather, bitcoin is backed by the code which sets the emission and limits the supply to 21 million and the fact that no one or no group can alter this. Talk about being backed by trust. We can fully trust that 2 + 2 = 4, every single time, and no one can alter that fact. The immutability of Bitcoin is what hard codes the scarcity that gives bitcoin its value.

Secondly, and this is what came to my mind the other day, being "backed" by something has an implication underneath. The idea of being "backed by something" implies that, one day, you will or could trade that item in. Gold-backed dollars imply that I could swap pieces of paper for physical gold. I guess the ultimate game plan with tulips was to ride them to the market high, then to swap them out for the Dutch currency of the day. Gold, frankly, isn't backed by anything (similar to bitcoin). What do you swap gold for? Dollar bills? That's bass ackward. The fact that it has a few uses physically is not why it's value is where it is. It is the scarcity of gold that gives it value.

Bitcoiners are usually aware of the Matrix meme about not having to trade in your bitcoin for fiat dollars. That's it. Bitcoin is not backed by dollars, or anything else. The thing is, bitcoin is the thing.

#bitcoin

Didn't expect Christmas-time photos on # Thanksgiving day, but I took them.