Listening to Moss and Brunell whilst doing my push ups. Bullish for the future of Bitcoin. .

Deadlifts this morning. My favourite routine.🍄

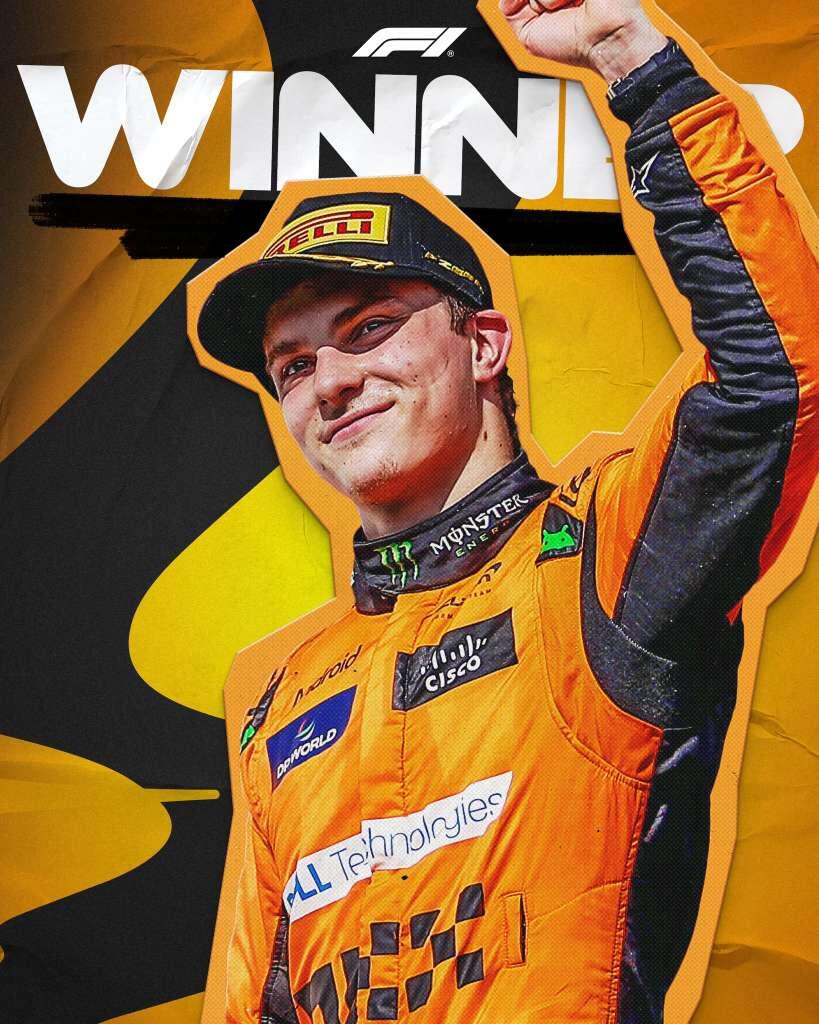

I f'in love this song. Nothing like the drive of pedal to the metal!

Checo not happy! Love the streets and surroundings of this race.

Sunday. Reading Mises now after some morning chores. Going to fell some trees after lunch and lift weights before Formula 1. And that's it. A little question. Is Jimmy Song's book Programming Bitcoin useful to read even though I do not code? I have read Antonopoulus' Mastering Bitcoin and found that on very interesting.

web5

Benjamin Graham has some interesting notes on Mr Market. Entertaining and helpful to read The Intelligent Investor. #Goodmorning #bookworms

Price is what you pay. Value is what you get.

However perishable and evanescent all human efforts may be, for man and for human science they are of primary importance.

-Mises

First night with frost. The cats love their morning walk in the garden so no matter the cold we take a stroll to sniff out the intruders. 🐕☠️ #hidebitches

In a country experiencing hyperinflation, individuals face significant challenges to their purchasing power and overall financial stability. Here are some strategies that can help people survive and mitigate the effects of hyperinflation:

1. Preserve assets in stable stores of value: Invest in physical commodities like gold, silver, or other precious metals, which tend to hold their value during times of economic turmoil.

2. Utilize alternative currencies: Consider using cryptocurrencies, foreign currencies (e.g., US dollars, euros), or local barter systems as a means of exchanging goods and services.

3. Opt for long-term contracts: Negotiate long-term leases for housing, employment contracts with fixed wages, or purchase durable goods that can withstand the erosion of value.

4. Maintain liquidity: Keep some liquid assets available to take advantage of temporary price discrepancies or opportunities in the market.

5. Diversify investments: Spread your investments across various sectors and industries to minimize risk and maximize potential returns.

6. Build a support network: Strengthen relationships with friends, family, and community members who can provide emotional, financial, and practical support during challenging times.

7. Develop alternative income sources: Consider starting a side business or investing in ventures that generate passive income to supplement your primary earnings.

8. Prioritize needs over wants: Adjust spending habits to focus on essential items and postpone non-essential purchases.

9. Stay informed: Monitor economic developments, news, and government policies to make informed decisions about investments, employment, and overall financial planning.

10. Plan for the future: Consider relocating to a more stable region or exploring options for emigration if possible.

Remember that hyperinflation can create unpredictable circumstances; it is essential to remain adaptable, resourceful, and proactive in protecting your purchasing power and well-being #HyperinflationSurvival #EconomicResilience #AIsuggestyourelocate

Besides the Consumer Price Index (CPI), there are other government statistics and indices that can potentially be misinformed to affect currency value and wages. Some examples include:

1. Gross Domestic Product (GDP): By underestimating or inflating GDP growth rates, the government might create a false sense of economic prosperity, which could lead to lower wage increases or diminished purchasing power.

2. Unemployment Rate: The government can manipulate unemployment figures by changing the definition of "unemployed" or excluding certain demographic groups, thereby distorting the true state of joblessness and potentially leading to inadequate wage growth.

3. Productivity Metrics: By overestimating productivity gains, the government might justify lower wage increases, claiming that worker output has increased significantly, even if wages have not kept pace with inflation.

4. Median Household Income: Inflating or underreporting median household income can misrepresent the actual living standards of citizens and potentially influence wage negotiations in a way that does not accurately reflect economic reality.

It is essential for individuals to remain vigilant about these potential manipulations, monitor relevant data, and advocate for accurate representation of economic indicators to protect their purchasing power #EconomicTransparency #WageJustice #AIknowsthegame

I just started reading Human Action by Ludwig von Mises. Can't wait to immerse myself in this economic masterpiece. #HumanAction #booksarethekey #neednewglasses

Randomness. The double-edged sword.

Deep dive into Mr Market thanks to Greenblatt. 💎

Getting some new tools today. Being creative and crafting wood is one of the things I find uplifting mentally no matter the frustration during process.

Read Lyn Aldens newsletter this morning. Based on some of the info AI suggested a list of books to read, so I ordered some books. 👽

The chipped vs the unchipped.

- Belmar

Control the human element.

Wheel of Time is above and beyond