A hesitant consumer market makes for a prime market for bitcoin true believers.

Nothing in particular. Privacy (and each individual’s rights to privacy) is a continually evolving issue, with new risks to privacy rights, tools to protect individuals privacy, and matters that deserve particular attention nearly every day.

The fight to preserve personal privacy, expand it where necessary, and resolve infringements on personal privacy is never ending, and requires constant vigilance.

Much like our ever shortening attention span (e.g. the ability to read a novel). As the years progress “small talk” — something that I have always, myself, considered a “simple skill”, and sign of basic social development — appears to be becoming an increasingly “lost art.”

Something that is nothing more than simply the ability to approach a stranger and discuss… Literally anything.

It pains be to blame The Internet, and mass communication in general. Something that is core infrastructure and a technology as a whole that I have dedicated my life to building — something I deeply believe to be one of the most essential technologies humankind has ever developed… and something that *should* improve our social skills and attention, yet has empirically shown to be very much not the case.

One would hope that as new technologies continue to develop human development will reach a certain equilibrium where the negatives can be curtailed as the positive effects permeate the adoption of said technologies… But as for when we reach that point (or if such a point even *can* be reached) remains elusive.

#Privacy is a human right. nostr:naddr1qqgrzd3nvdjxxvnxxcmxxcmrxvervq3q8dlusgmprudw46nracaldxe9hz4pdmrws8g6lsusy6qglcv5x48sxpqqqp65w8clqra

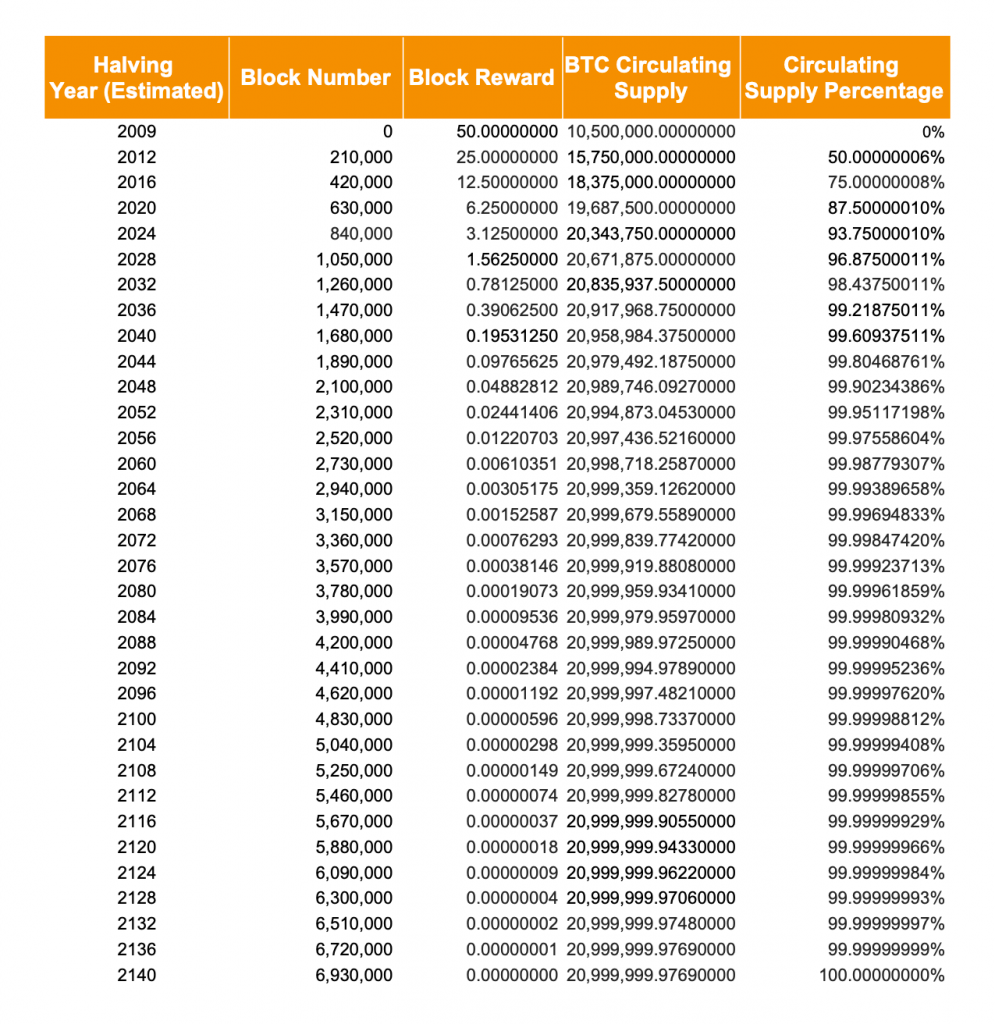

I fully agree with the supposition, but it can’t be overstated what a significant paradigm shift that is when compared to what hetetofor has been considered the the primary focus of a massive global network of miners: to mint new coins. Notably at a relatively predictable rate, and volume.

Go to any “mining calculator” and the calculation is made based upon a relatively predictable set of values:

- the current difficulty

- the networks total hash rate

- your hashrate relative to the rest of the network

- the number of coins you are guaranteed to receive upon mining said block.

While these calculators vastly over-simplify the profitability of mining, they still provide *something* predictable,

Like clockwork, approximately every 10min, 3.125BTC is minted.

But at the point when all coins have been minted, mining revenue will cease to have that mathematically predictable reward from each new block.

Instead the mining rewards become the value of that block space and, more specifically, the value of the work being processed in each batch of transactions. Which is notably a far more complex series of variables than the simple transacting of a currency changing hands.

Moreover the value of that block space is (and will continue to) become a growing list of complex variables that will become increasingly more difficult to predict as a myriad of applications that exist atop the bitcoin blockchain continue to grow:

- Layer2 activity (something that is notably in it’s earliest phase of development — the STX network, blockstreams “liquid” assets, etc.)

- On-chain reconciliation of activity across the rapidly growing lightning network.

- Any other novel applications yet to be developed.

And finally, last but not least:

- Simple on-chain transactions of bitcoin (as a base currency) being sent one wallet to another.

With all of these activities combined it is obvious that mining will certainly continue to be profitable. But nonetheless this is a complex combination of variables that will each fluctuate both independently of one another and effectively in competition with one another for inclusion in each new block.

I don’t think anyone questions the success of bitcoin as a project (and a grand experiment). There is little doubt that mining will continue to be extremely profitable (the visa and Mastercard networks sure are).

The question is what will be what the biggest market, network, and blockchain development initiatives will have on the mining sector.

As things stand, a large part of what miners use to determine profitability is a static block reward from newly minted coins. Once that it no longer a factor the things that determine the probability of each block (and the volume of transactions in each block) are determined by an increasingly large number of variables that are notably not as predicable as the assured X number of minted coins per block.

Once all coins are mined it becomes a very different game.

What that game ends up looking like is a very big question mark that we can only guess at.

While Henry Ford had more than a few less admirable qualities and ideas (many that are arguably simply a product of the time in which he lived), when it comes to the concept of an “energy currency” he was very much ahead of his time.

That we live in an increasingly energy-based economy is clear — from oil and gas, to nuclear power and renewable energy — world politics, wars, and our global economy hinges on energy production (and the markets and supply chains that fuel each nations ability to meet their own energy production needs).

Going one step further, to the logical conclusion of #bitcoin (and other #PoW #cryptocurrency) these are, quite literally, “energy currency” in digital form. nostr:naddr1qq2nw7zyw3057u6r8pz5znndfef56amrgc6kcq3qqpjn9jued55ypjjdjac7vrl5378rrnwjwuwvxl9zh5hshlv09z6qxpqqqp65wsr923l