it's a maze and a half...

yes, will see if it has legs.

will do from now on

Since everyone is jumping over to Nostr, I wanted to share my latest analysis video from behind the paywalled with you all.

Enjoy!

My latest piece is out for checkonchain subscribers.

this one looks at the tremendous sellside that the Bitcoin market has absorbed over the last 6 months.

I also compare the conditions to 2019, which is the most similar period by far.

#Bitcoin onchain analysis masterclass is live covering the onchain originals price models.

in particular, the Cointime Price, True Market Mean, and Vaulted Price stand out as key levels where investor sentiment tends to shift.

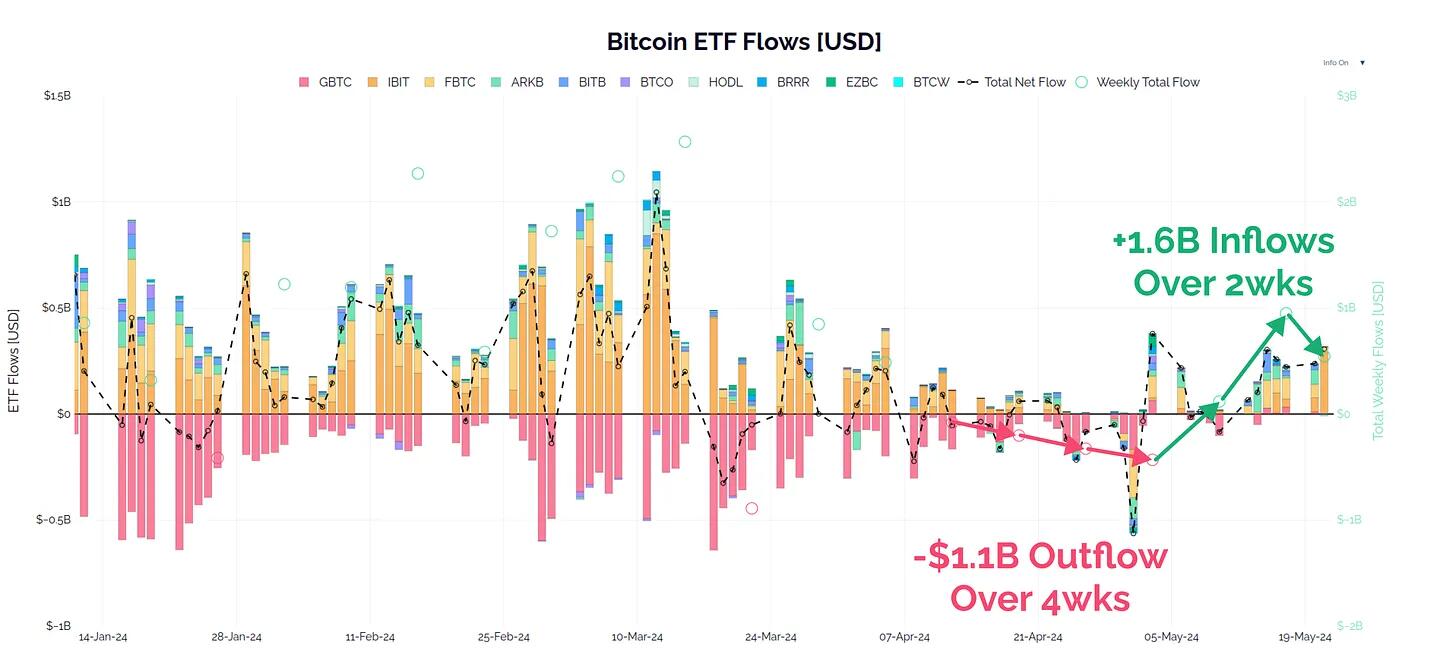

The #Bitcoin ETFs saw around four weeks of outflows in April, worth around -$1.1B on net.

It took only 13-days for that to more than reverse, with over $1.6B worth of inflows, and eight +$100M inflow days in a row.

Feels like a second demand wave may be upon us.

Yes, so the next layer down is categorising coinblocks stored. Can we make an adsumption that multisig CBS are deeper vaults? More likely to remain stored? Are there long and short term holder coinblocks?

The first section of chapter 8 alludes to this where we establish liveliness ratios for patoshi, mt gox, remBTC as extreme entities. Those heuristics are one of the many next levels down in this journey

Introducing Cointime Economics, a new framework for analysing the Bitcoin economy.

Video overview:

Primer blog post is available here:

http://insights.glassnode.com/introducing-cointime-economics/

The full PDF report is available here:

I know, I just lack enough hands to juggle it all.

In a few hours, we will be releasing a brand new Bitcoin analysis framework, which we call Cointime Economics.

Within, we relate the concept of 'time' to the dimension of 'supply', and establish a suite of greatly improved economic models for Bitcoin. This framework explains a great many concepts such as how many coins are likely lost, what is the real cost basis of the market, and how much does the halving actually matter.

Cointime Economics is a product of over 18months work alongside David Puell, and builds on the pioneering work of the late Tamas Blummer. I couldn't be more excited for it to go live.

It is by far the most abstract concept I have ever worked through, and I truly hope it inspires analysts and readers with new ideas about Bitcoin.

This meme is the TL:DR, and was literally the first thing I put to paper as it migrated from napkin to paper.

I hope you enjoy, and cannot wait to hear/ feedback. I will post links to the report as soon as we release.

Thank you!

Lol, what?

TLDR is that one can get outsized edge by understanding just a few metrics.