🔥🔥NEW!! - Macro Minute: The Fertility Crisis: Why Economic Decline, Not Technology, Will Boost Birth Rates

Exploring the link between wealth, fertility, and technological progress—why a global economic regression may be the only path to reversing declining birth rates.

Tried something new, quick 5 min video version of this article. #bitcoin

🚨NEW!! 🚨 Bitcoin Minute: Clarity on Why Bitcoin Is A Geopolitical Hedge

The perennial #bitcoin FUD debunked. Tactical versus Strategic Hedges, what's the difference. Why critics are wrong about bitcoin and #WWIII.

https://www.bitcoinandmarkets.com/bitcoin-minute-clarity-on-why-bitcoin-is-a-geopolitical-hedge/

NEW!! - Bitcoin Fundamentals Report #307 🔥🔥

Weekly #Bitcoin Recap: SEC Battles, #China Stimulus Impact, #FTX, Price Analysis, ETF Inflows, and Mining Sector Update

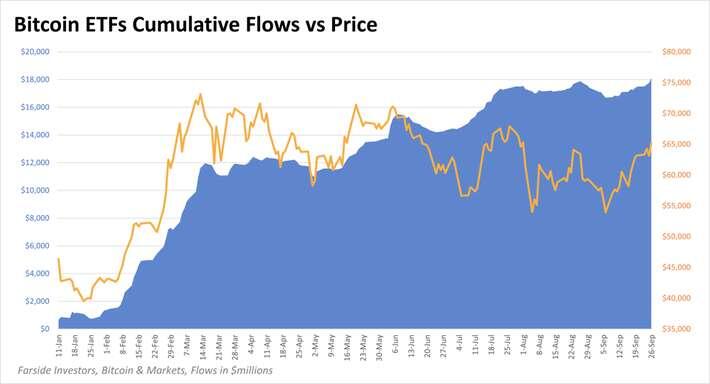

#Bitcoin ETF inflows picking up again at ATH. Price' s turn to catch up!

Bitcoin’s Q4 Setup: Record ETF Performance And Powerful Tailwinds

🔥HOT!! - Macro Minute: More Signs of Recession, 5y5y Forward and Breakevens

How the 5Y5Y Forward and breakevens reveal transitory #inflation and signal a looming #recession through market inversions.

https://www.bitcoinandmarkets.com/macro-minute-signs-of-recession-5y5y-forward-breakevens/

Live stream in 30 to discuss this week's #Bitcoin Fundamentals Report!

TG t.me/bitcoinandmarkets

YT https://www.youtube.com/@btcmarketupdate

Rumble https://rumble.com/c/BTCandMarkets

🚨Bitcoin Fundamentals Report #306

The latest updates on the Bitcoin industry, including options for BlackRock’s Bitcoin ETF, MicroStrategy’s ongoing Bitcoin purchases, macroeconomic factors impacting Bitcoin, and a closer look at mining trends.

My newest post on Forbes! Check it out, share to #bitcoin skeptics!

🔥The Truth About Bitcoin: Busting The Biggest Myths

Clearing Up Misconceptions About Illicit Use, Intrinsic Value, and Environmental Impact

I will be live streaming the #FOMC decision at 2pm ET.

Join me and add your comments and questions!

#Fed #InterestRates

TG t.me/bitcoinandmarkets

YT https://www.youtube.com/@btcmarketupdate

Rumble: https://rumble.com/c/BTCandMarkets

🔥🔥Macro Minute: Overproduction Does Not Bring Demand, #China's Economic Illiteracy

Exposing the Economic Nonsense of Central Planning: How China's Overproduction and Misguided Policies Undermine Their Own Economy

🔥NEW!! - #Bitcoin Minute: False Assumptions About Gold vs Bitcoin

Exploring misconceptions about #gold's failure as money, the role of elasticity in economic systems, and why $BTC offers a solution to the pitfalls of centralized, credit-based systems

https://www.bitcoinandmarkets.com/bitcoin-minute-false-assumptions-about-gold-vs-bitcoin/

This is what a 50 bps cut this week would look like in comparison to the US 2Y. #fed #FOMC

If they cut only 50 bps, be prepared for 50 or more next meeting.

#Bitcoin Fundamentals Report #305 out now! 🔥

Comprehensive free bitcoin newsletter.

Federal Reserve Rate Cuts, Altcoin Declines, and the Growing Dominance of $BTC in an Uncertain Economic Landscape

Subscribe and join us for the LIVE stream in 10 mins!

https://www.bitcoinandmarkets.com/r305/

TG t.me/bitcoinandmarkets

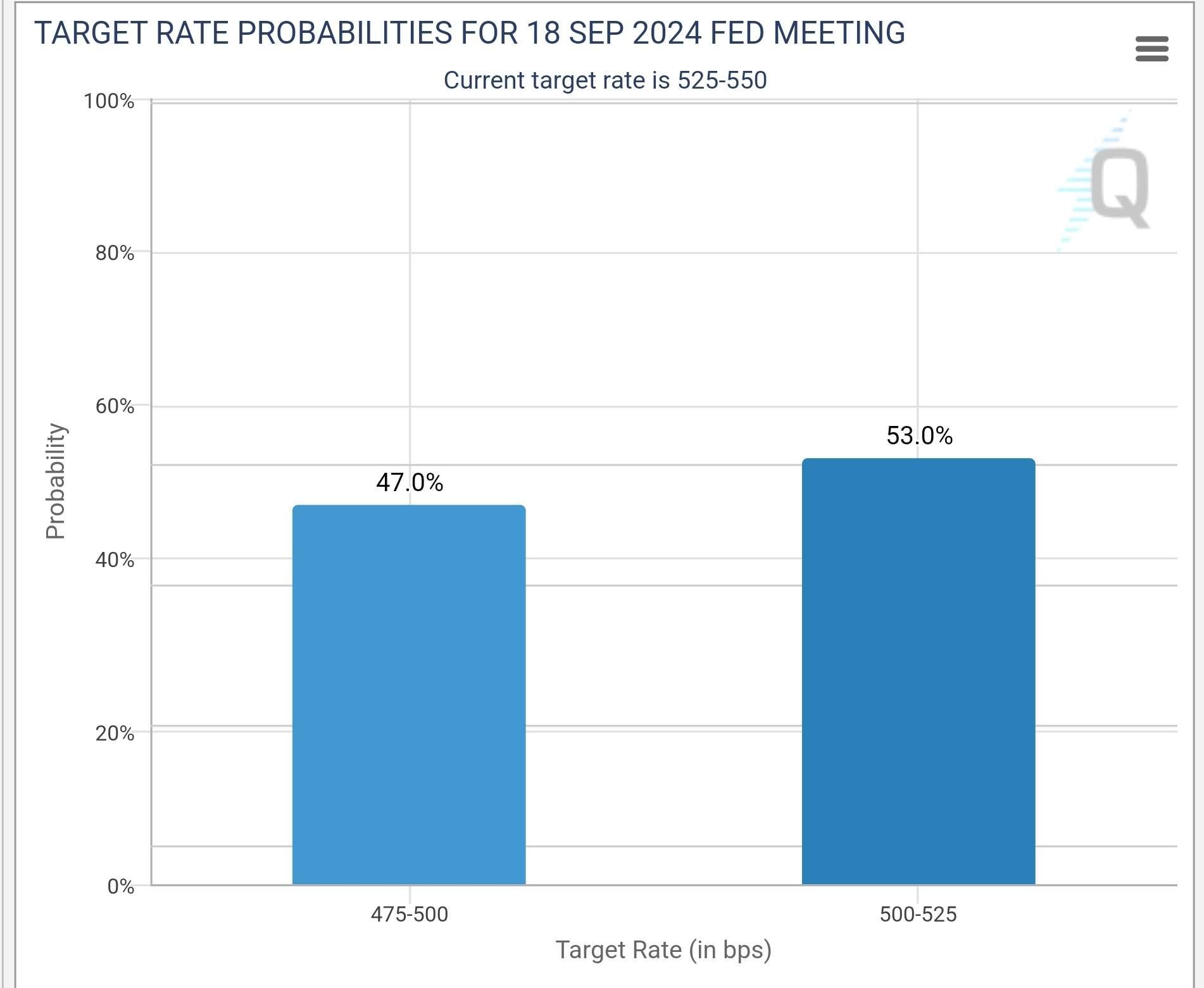

#Fed rate cut odds shifting back toward 50 bps today. Almost even again. What changed?

My first post on Forbes!

3 Concepts Investors Must Know About #Bitcoin’s 4-Year Cycles

Driven by a unique process called "the halving," these cycles create periods of both growth and volatility.

Read and follow author for more quality bitcoin content!

There is plenty of spare #OIL capacity in the world, 5.8 mmbpd in OPEC and a US sector straggled by regulation from the current administration. All this while demand is slowing and soon to fall due to recession.

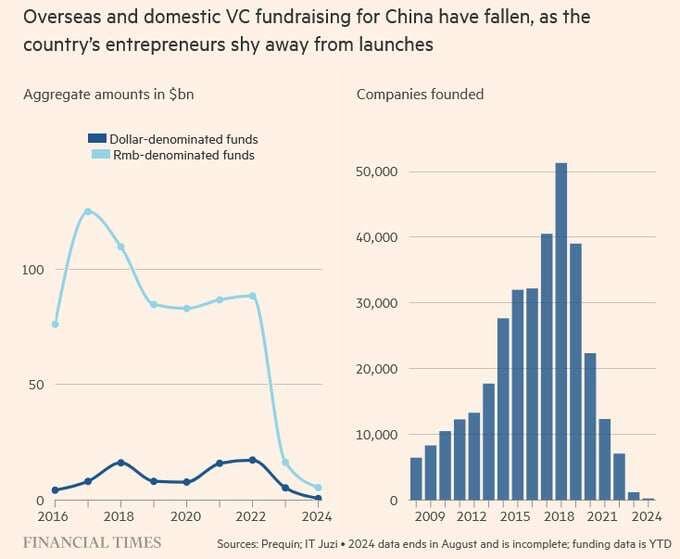

If you thought I was joking about #China's economic model being broken. This is what collapse looks like.

💢 Canada has cut 3 times, The ECB now 2 cuts. Primed for FOMC next week.

https://www.zerohedge.com/markets/ecb-cuts-rates-25bps-expected-projects-worsening-stagflation