CBDC Dangers

The Hidden Risks of Central Bank Digital Currencies

1

Government Control

CBDCs could enable governments to track and monitor every transaction made by citizens.

2

Negative Interest Rates

With CBDCs, central banks could easily impose negative interest rates on holdings and so effectively charging people for saving money.

3

Centralized Power

A CBDC centralizes control over money in the hands of the government or central bank. This reduces the role of commercial banks and potentially leading to a concentration of financial power.

4

Financial Exclusion

In countries where financial inclusion is low, the rollout of a CBDC might marginalize those who lack access to digital infrastructure or are uncomfortable with digital transactions.

5

Capital Controls

Governments could use CBDCs to implement strict capital controls, which limits the ability of individuals to move money out of the country or invest it as they see fit.

6

Government Misuse

In authoritarian regimes or times (see COVID), CBDCs could be used to enforce political objectives, such as freezing the assets of dissidents or controlling the financial behavior of citizens based on social credit scores or other arbitrary criteria.

7

Data Leaks

With CBDCs, large amounts of sensitive financial data would be stored in centralized databases, which increases the risk of data leaks. Such breaches could expose individuals' financial activities and personal informations.

8

Cybersecurity

CBDCs would be prime targets for cyber attacks, including state-sponsored operations. A successful attack on a CBDC system could destabilize an entire economy.

Prioritize privacy gains over price gains.

If payment is not voluntary, coercion is used.

If coercion is used, one is oppressed.

Oppression is slavery.

Thanks for the beer, anon! 🍻

Not your keys, not your coins.

Bitcoin's lack of fungibility is highlighted by its traceable nature; stolen funds failed to gain privacy on RAILGUN and were returned to the original address. This expose the inherent risk of identifiable transactions on the blockchain.

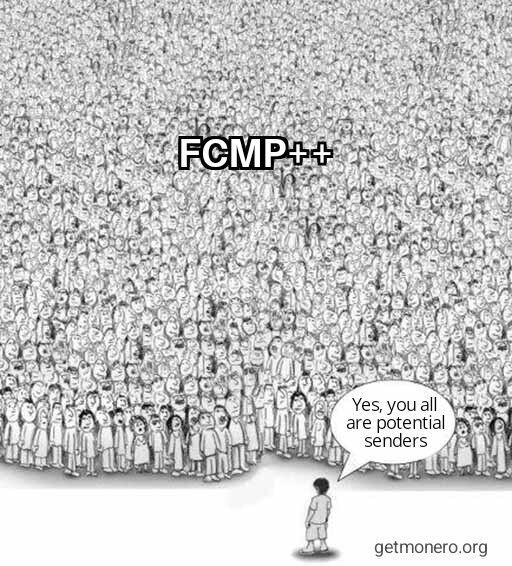

Full-Chain Membership Proofs (FCMP++) are on the way to Monero! This upgrade will boost privacy and security. Still a work in progress, but they are making sure it’s rock solid before it’s ready for prime time.

One year ago, Monero was priced at $149.40 per XMR. Today, it's at $158.89, a modest increase of 6.35% after a year of delistings from major central exchanges. And FCMP++ is coming ...

Unwort des Jahres:

Personalisieren