INCENTIVES: If one believes fiat will decrease in value and Bitcoin will rise in value, they are incentivized to take a loan in fiat and invest in Bitcoin, paying the loan back later and profiting from the difference - also called a **carry trade**.

The weaker the local currency, the more of a no-brainer it becomes to borrow it.

In this process, through the loans, banks create **more** weak currency, amplifying the problem.

The immediate effect of this is that **the local** price of Bitcoin goes up. The higher local price incentivizes traders to perform **arbitrage** for profit - buy the cheaper bitcoin in foreign dollars, sell it for the more expensive local currency, then sell the local currency for dollars.

This additional sell pressure **further** weakens the local currency.

The local central bank is powerless - it has limited tools to deal with this that cannot be applied for a prolonged period of time.

Take Peru as an example in the attached image:

- Bitcoin market cap at $22,000 - $424B

- Peru GDP - $223B

-- an excerpt from the 2-minute version of Speculative Attack (2014): https://2minutebitcoin.org/blog/bitcoin-speculative-attack-on-the-dollar-2014

When the price goes up, critics say

> “it’s only a bubble”

And when it inevitably goes down

> “it’s returning to its inherent value (zero)”

Of course, Bitcoin always proves them wrong.

Instead, each cycle, Bitcoin prints higher highs and never goes to zero.

Despite that, the same old prediction inevitably always comes back.

- an excerpt from the 2-minute version of Bitcoin Hypermonetization: Bubble Talk (2013) originally posted here https://www.2minutebitcoin.org/blog/bitcoin-hypermonetization-bubble-talk-2013

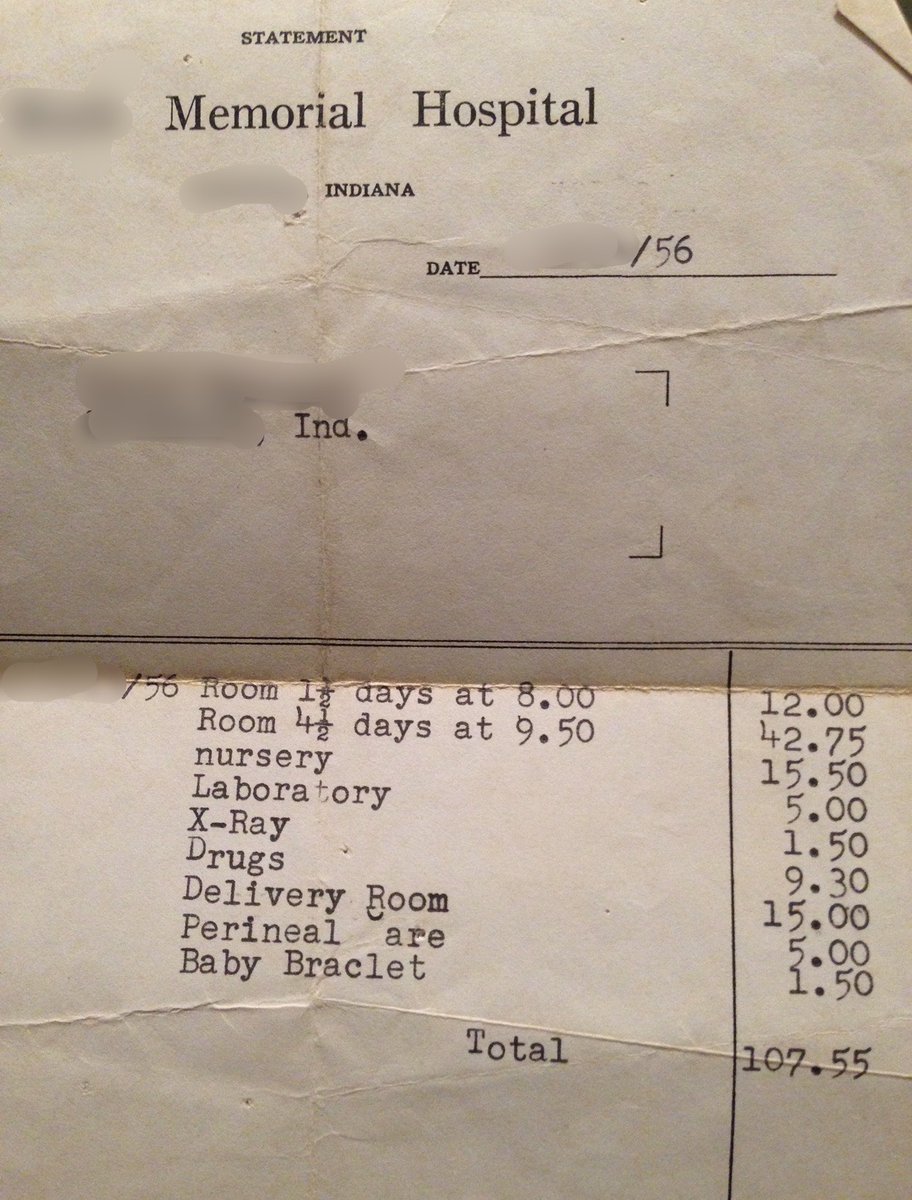

The cost of delivering a baby and one week recovery in 1956

A state’s basic functions are to:

1. preserve its borders

2. protect peace

3. honor private property rights

4. enforce contract law

5. ensure there’s non-violent means for dispute resolution.

These are means of guarding people so as to allow commerce to be conducted smoothly.

A traditional empire produces security.

They have this saying about Genghis Khan and the Mongols - when they controlled all of Asia, a virgin could’ve ridden from one end of the empire to the other with a pot of gold on her head without being molested.

The Mongols made a point - don’t fuck with the system. If anything gets stolen/anybody gets hurt, they show up with an army and kill everybody for 100 miles in every direction.

The #1 export of the U.S is security. If you look at its bases, they’re basically everywhere besides China and Russia.

-- an excerpt from the Saylor Series Episode 2 - the Rise of Man through the Dark and Steel Ages, its 2-minute version can be found here https://www.2minutebitcoin.org/blog/saylor-series-episode-2-the-rise-of-man-through-the-dark-and-steel-ages-robert-breedlove

Throughout history, governments always used their local monopoly on violence to extract value/rents/tax from those conducting business and creating economic surplus in their guarded territory.

In history - might is right. People have been competing to become the ultimate gatekeeper. The reason they pursue this is because it’s the least-resistance path to become wealthy.

Indeed, the first people to become wealthy in history were those that were able to specialize in violence, or religion, to establish monopolies on local police and local commerce.

-- an excerpt from the Saylor Series Episode 2 - the Rise of Man through the Dark and Steel Ages, its 2-minute version can be found here https://www.2minutebitcoin.org/blog/saylor-series-episode-2-the-rise-of-man-through-the-dark-and-steel-ages-robert-breedlove

An asset bubble is not the same type of bubble a rising medium of exchange may experience.

Bitcoin does have its manias and crashes.

However, claiming that Bitcoin is a bubble and totally dismissing the system is painfully incorrect.

The truth is:

- Bitcoin’s exchange rate is in a temporary bubble phase at a given point in time.

Bubbles do not raise the utility of the underlying asset - a house remains the same physical asset regardless of the price.

-- an excerpt from the 2-minute version of Bitcoin Hypermonetization: Bubble Talk (2013), originally posted in https://www.2minutebitcoin.org/blog/bitcoin-hypermonetization-bubble-talk-2013

Empires fight to get the ability to tax an ever-greater territory.

The ancient European empires fought themselves all the time because they wanted to be the ones to own the mercantile network in the Mediterranean so that they can tax it.

The definition of a smuggler or a pirate is one who doesn’t want to give you half their stuff. Empires used navies to stop this.

This is where we got the term free port - a port where you don’t need to give up half your stuff.

-- an excerpt from the Saylor Series Episode 2 - the Rise of Man through the Dark and Steel Ages, its 2-minute version can be found here https://www.2minutebitcoin.org/blog/saylor-series-episode-2-the-rise-of-man-through-the-dark-and-steel-ages-robert-breedlove

The Roman empire lasted for 700 years!

Their most profound idea was that leadership rotated every year:

- common faith: people perceived they’re protecting a common good (society) versus someone’s dynasty

- every human has an ego and wants their turn: this removed in-fighting between powerful families

- created competition in the market for talent

Companies today have the same owner for decades. Decentralized organisms like Bitcoin are superior precisely because of this rotation.

- an excerpt from the 2-minute version of https://www.2minutebitcoin.org/blog/saylor-series-the-rise-of-man-through-the-stone-and-iron-ages-episode-1-2020

***Money becomes more useful the more people use it**.*

This is the opposite of how most investments work.

- If the price of a stock goes up, then the value decreases because its dividend yield is smaller in proportion to its price. If the price goes up too much, an investor would eventually want to sell for something cheaper, as they can objectively see it is overpriced.

- By contrast, $100 worth of bitcoins today has a better value than $100 worth several years ago, even though the price of Bitcoin is much greater. The reason is that the utility of bitcoin (money) has increased! There is more **optionality** for each dollar. There are more opportunities to unload the bitcoins at the owner's discretion.

It is precisely this positive feedback between price and value that means that the growth of money can be self-sustaining. *(Unfortunately, it equally applies to the downside too - its demonetization can be self-sustaining.)*

Money, through network effects, group psychology and social beliefs can therefore drive its own value into a practically-unlimited top value.

This is incredibly unintuitive to most people - everybody looks at assets like a business, expecting it to require hard work and prudent strategy in order for it to grow. Some even go as far as to critique Bitcoin as worthless because it doesn't produce income. This only exposes their fundamental misunderstanding of what money is.

-- an excerpt from It's Not About The Technology, It's About The Money (2016), its 2-minute version can be found here: https://2minutebitcoin.org/blog/bitcoin-is-about-the-money-not-the-blockchain-technology

Hidden taxation through inflation is also an advantage in war.

A country that taxes a lot through printing massive amounts will collect more money than one that only taxes through income. Said country can allocate more to military purposes and win a war against the other country.

The game theory of a world-wide sound-money standard is unstable - once one player abandons it, it incentivizes others to do so as well.

Similar dynamic was the rise of the nation-state itself – it proved stronger than the feudal state due to having larger national armies, and that forced feudal states to turn nation-states too.

-- an excerpt from the 2-minute version of An Honest Account of Fiat Money (2018), originally posted in https://www.2minutebitcoin.org/blog/an-honest-account-of-fiat-money-2018

Taxation is a parasitic relationship. Just like parasites don’t entirely kill their host but rather prolong them for longevity - the government doesn’t tax 100% because that would drain the victim of all funds and kill them.

There is an optimal tax rate on a spectrum which extracts the maximum value for the longest time - and it is always more than what a free market would require.

Similarly, monopolists never set the price so high as to kill the consumer, but keep it abruptly high to leech from them.

-- an excerpt from the Saylor Series Episode 2 - the Rise of Man through the Dark and Steel Ages, its 2-minute version can be found here https://www.2minutebitcoin.org/blog/saylor-series-episode-2-the-rise-of-man-through-the-dark-and-steel-ages-robert-breedlove

Speculative attacks - the for-profit shorting of a foreign currency - are widespread throughout history.

1. 🇬🇧 George Soros & Black Wednesday (1992): Soros bet against the British pound, forcing the central bank to leave the fixed-exchange-rate ERM and devalue the pound, making over $1 billion in profit.

2. 🌏 Asian Financial Crisis (1997-1998): Speculators attacked the Thai baht, leading to its devaluation and a domino contagion effect on other Southeast Asian currencies (Indonesia, South Korea, Malaysia).

3. 🇲🇽 Mexican Peso Crisis (1994-1995): A devaluation in the peso triggered this speculative attack as investors sold their peso-denominated assets. This loss of confidence forced Mexico to accept a U.S./IMF-led bailout and led to widespread contagion in other emerging markets.

4. 🇷🇺 Russian Financial Crisis (1998): Low oil prices and high debt fueled a speculative attack on the ruble, causing it to plummet and leading to a severe recession and sharp increase in inflation.

5. 🇦🇷 Argentine Currency Crisis (2001-2002): An unsustainable fixed-to-the-dollar exchange rate system led to a speculative attack on the peso, resulting in a 70% devaluation and economic crisis.

Bitcoiners have long (since 2014!) speculated how Bitcoin will eventually be leveraged to perform a speculative attack, as we all know that good money drives out the bad money.

Learn more about what a speculative attack is and how Bitcoin can be used in such by reading this 2-minute summary of Speculative Attack (2014) - www.2minutebitcoin.org/blog/bitcoin-speculative-attack-on-the-dollar-2014

Bitcoin improves over the dollar (and other fiat currencies) where it actually counts.

- The dollar is not very good for storing “just in case”. (loses value due to inflation)

- You can’t carry cash around or the police will take it, and if you leave it in a bank, you can have your account frozen and the money drained if you use it for purposes deemed unacceptable.

You cannot own dollars the way that you can own bitcoins. It is not that Bitcoin comes at no risk; it is rather that you can always expect to have **the same** fraction of the total later on, if you secure them properly.

-- an excerpt from It's Not About The Technology, It's About The Money (2016), its 2-minute version can be found here: https://2minutebitcoin.org/blog/bitcoin-is-about-the-money-not-the-blockchain-technology

[Fiat money](https://www.2minutebitcoin.org/blog/an-honest-account-of-fiat-money-2018 ) is the result of a social contract.

People give the state control over money, and the state uses it to manage the economy, redistribute wealth and fight crime.

- an excerpt from the 2-minute version of Unpacking Bitcoin's Social Contract (2018), originally posted in https://www.2minutebitcoin.org/blog/unpacking-bitcoins-social-contract-2018

If you don’t have your monetary power secured virtually, then your physical security is always at risk. You can’t leave nor protect yourself.

One of the most compelling cases for Bitcoin is for refugees trying to flee a war zone.

With gold, people with guns can take it away from you. They shoot you and take everything.

With Bitcoin, you are much more flexible:

- you can program it to pay them a bit before you go and a bit after (time-locked), so that they let you pass, but if they kill you, they can’t get everything.

- you have the ability to lie/hide how much you have

Bitcoin is first order beneficial to economic security, second order beneficial to physical security.

-- an excerpt from the Saylor Series Episode 2 - the Rise of Man through the Dark and Steel Ages, its 2-minute version can be found here https://www.2minutebitcoin.org/blog/saylor-series-episode-2-the-rise-of-man-through-the-dark-and-steel-ages-robert-breedlove

The more demand for money there is, the less risky it is for an individual person to hold money.

Similarly, the less demand there is, the more risky it is for a person to hold it.

If you were the first person to sell goods or labor for money, then you would probably look insane or immensely stupid to bet that other people would want this stuff in the future.

On the other hand, if many people are using money, then you are merely depending on there not being a hyperinflationary event in the immediate future.

In that case, you might look insane or stupid for worrying about such a remote possibility at all.

-- an excerpt from It's Not About The Technology, It's About The Money (2016), its 2-minute version can be found here: https://2minutebitcoin.org/blog/bitcoin-is-about-the-money-not-the-blockchain-technology