GM!

Today and every day is a gift to be grateful for.

Today and every day is a good day to save in #bitcoin for a prosperous future.

Peace be with you

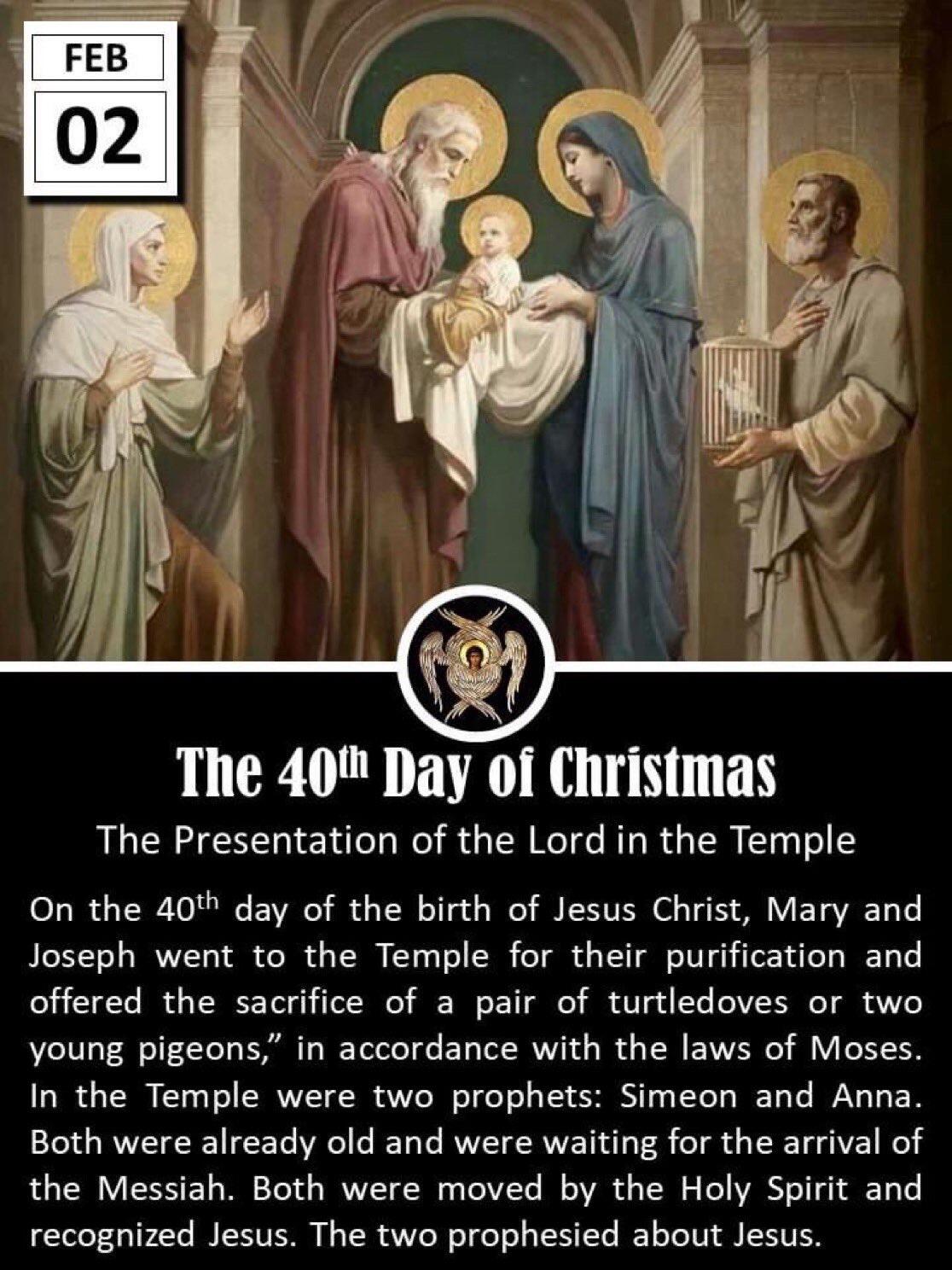

“Today the Church celebrates the Feast of the Presentation of the Lord which occurs forty days after the birth of Jesus and is also known as Candlemas Day, since the blessing and procession of candles is included in today's liturgy.”

#Jesus

#Christ

#Lightoftheworld

#Sunday

#Candlemas

Nice to meet you! Followed. I am here for the freedom tech!

Good morning nostr:npub13kwjkaunpmj5aslyd7hhwnwaqswmknj25dddglqztzz29pkavhaq25wg2a of the wonderful posts!

O God, my God, to Thee do I wake at break of day.

For Thee my soul thirsteth; for Thee my flesh longeth, O how exceedingly!

In a desert, pathless, and waterless land: so have I come before Thee in the holy place, that I might see Thy power and Thy glory.

#gm

#God

#Jesus

#Christ

#introductions

#bitcoin

#nostr

Global productivity gains are deflationary and grow the value of #bitcoin while you sleep.

💪🏻🚀🔥

Exciting, beast of a show, nostr:npub1hk0tv47ztd8kekngsuwwycje68umccjzqjr7xgjfqkm8ffcs53dqvv20pf and nostr:npub16le69k9hwapnjfhz89wnzkvf96z8n6r34qqwgq0sglas3tgh7v4sp9ffxj ! Let’s build a world with #bitcoin and #nostr at the foundation. Here’s the true and good! nostr:note1s2mufy5ssrymgjau2wwlerpgrcafzfq90pysmf5tj3kr7xsrrlnsf8k5nz

Ross is free

#bitcoin is freedom money.

Thank you, President #Trump and all who worked so hard for this day!

#Bitcoin does not need a US Strategic Bitcoin Reserve, the US needs a Strategic Bitcoin Reserve.

We all need a break from this important but at times thankless work. I am sure you have had a more positive impact than you know. We are all in this journey together to help people get on the Bitcoin Standard. Enjoy your well-deserved rest!

CD149: BITCOIN POLICY AND P2P RIGHTS WITH ZACK SHAPIRO

https://cdn.satellite.earth/7a9e5d4054bb51ba8edeaa85fe992f2ffad9883b1afaf94760d8404ba20a2b4d.mp4

Joe Scarborough seems to own enough #bitcoin to be able to freely speak his mind without fearing repercussions. Bitcoin is freedom money. Way to go, Joe! LFG!!

My gratitude level for finding #bitcoin is usually highest in the morning. Then again, it may be the coffee….

GM #nostr!

Imagine a world where all the gains created by ever expanding human productivity and technology flow through to all 8 billion human beings on this planet. What a way to bring the gift and blessings of life to all. Bitcoin is the transformational protocol that makes it possible. Thank you, nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe for your heart, vision, and inspiring commitment!

#bitcoin

#bitcoin DCA is the way to remain calm when financial markets get hairy. Stay humble and stack sats. nostr:note1kxj5z2kn84j2c5uhx8klhg9vw4s93ne4433nsjrdq6ka83dt95vqukn94m

“Things could get hairy in financial markets this week.

Quick explanation of what's going on and why we may be about to see a little chaos:

George Washington is wreaking havoc.

The dollar index (DXY) has risen from 100 in September to 110 as of this morning.

That's just shy of the peak of 113 that it set in 2022.

Markets have rallied since late 2022 partially because everyone believed we saw the peak of dollar strength AND the peak in bond yields.

But now global yields are surging towards new highs despite the Fed cutting rates.

This is perhaps the most alarming bit for global markets.

Most investors figured long-term bond yields would FALL once the Fed started cutting.

But we've seen the exact opposite.

Is this a sign that investors have lost confidence in US bonds due to extreme fiscal deficits and 125% debt to GDP?

Are they worried that sudden cuts from Elon's DOGE efforts will merely send the US into a deep recession, lower tax receipts, and actually worsen the deficit?

Quite possibly.

When bond yields fall, it gets cheaper to take on new debt and the party can go on.

But when the dollar is rising, existing dollar debt gets HARDER to pay back, especially if you're a foreigner who needs to pay back dollar debts with a weaker currency.

So what do you do if your debt is suddenly getting more expensive?

You have to start selling whatever you can to get dollars to pay back your debt.

That means selling whatever liquid assets you have: Stocks, bonds, Bitcoin, gold, etc.

That's why rapidly rising yields can lead to downward price action in all other assets.

The higher the dollar goes, the more people need to sell to service their debts.

Things are particularly acute in the UK.

Not only have UK bond yields risen to new highs, but the pound is falling steeply at the same time.

This is typically seen in emerging markets when investors realize that rising yields don't signal a value buy - but rather that a currency crisis may be imminent.

So how does it end?

If it's allowed to continue without any intervention, this trend of dollar up, yields up, dollar up more, most other assets down... will likely accelerate.

The important thing to remember as an investor is this:

Debt is still used as the underlying collateral for the banking system.

If yields are allowed to rise uncontrollably, bond portfolios plummet in value, the entire banking system is insolvent, and everything comes crashing down.

That will almost certainly not be allowed.

So what's the solution?

The same as always: Currency devaluation.

Central bankers can start buying bonds again to keep yields from exploding higher.

The outcome remains binary: Either they let everything collapse, or the devalue currencies and keep the music going.

In both cases, you want hard assets without counter-party risk.

Bitcoin and gold.

It's clear that many more investors have come to this same conclusion.

The last time the dollar was at these levels, Bitcoin was below $20,000 and gold was around $1,650

Today Bitcoin is above $90,000 and Gold is up 63% from 2022 lows.

Remember what you own, stay solvent, and if you have a good amount of cash, you may have some solid buying opportunities if this is allowed to continue.

Don't forget that we've had multiple moments like this over the past 4 years.

And more liquidity has always been the end result.

Those who held their nerve and kept the big picture in mind the past have been handsomely rewarded.

This time will likely not be different.” - nostr:npub1g4lp0dl2j75ytgx3l287m2vhvktx0r363t6xm3n8r4qwq5xws47swgxt9c

There is no God beside Thee.

#God

#Father

#Son

#Holy Spirit