#Germany’s manufacturing downturn unexpectedly deepens amid falling demand at home and abroad. S&P Global’s PMI for the country’s industrial sector dropped to 42.3 from 45.5 the previous month – well below any economist estimate in a Bloomberg survey. The picture was brighter in France, where the contraction eased much more than analysts had predicted. Companies reported improving demand while expanding their workforce.

🚨USA 🇺🇸/Russia 🇷🇺: Joe Biden called V. Putin a son of a bitch.

"We have a crazy son of a bitch like Putin and others, and we always have to worry about nuclear conflict, but the existential threat to humanity is climate."

The statement was made in California during a fundraising event for his reelection campaign.

As per the Stock-to-Flow Model, the forecast for #bitcoin in this cycle stands at $570k

Saylor Mode can now be activated on nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en. On the website go to sell, type “saylor”, and nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m will be there to stop you from making the biggest mistake of your life. https://video.nostr.build/33bd7ac9498ded4f5f065ac250a7f225135cec1cb707176055baf32c4fa9327f.mp4

#yestr 😎

New York City plans on launching a pilot program giving asylum seekers debit cards with up to $10,000 in value.

Will projects like this cause people to lose faith in fiat currency?

https://video.nostr.build/dd48cc9be4b707afd0a1343c163f5c1f779b9522f0f8785068d740803e1e3c8d.mp4

The 🇳🇬 Nigerian government is reportedly taking steps to shut down cryptocurrency-related websites within the country by instructing telecommunications companies to block access to these sites 👀😱

Users are reporting Binance is no longer available in the country.

#Bitcoin in exchanges falls from 2.356M #BTC to 2.314M #BTC , a decrease from 12.03% to 11.79% of total supply, lowest since April 2018 👀

Switzerland 🇨🇭/Israel 🇮🇱: The Swiss government announced on Wednesday (21) that, according to new legislation, Hamas and "disguised or successor organizations," as well as organizations or groups acting on their behalf, will be banned from the country.

"I started selling household items to buy #Bitcoin."

From the trainings:

- Be less white

- White kids by ages 3/4 understand they are better

- Less White = Less oppressive, ignorant, arrogant, etc..

It's hard to describe this as anything other then as racial demoralization.

🚨Spain 🇪🇸: On Wednesday morning (21), a huge protest by farmers takes place in the center of Madrid city.

According to the newspaper "ABC," approximately 500 tractors are being used by the farmers in the demonstration.

https://video.nostr.build/90b1a1c9ea180f3a2d3fb7a4bd1b9f7327dd335e35f0d8980670890a8ff96ecc.mp4

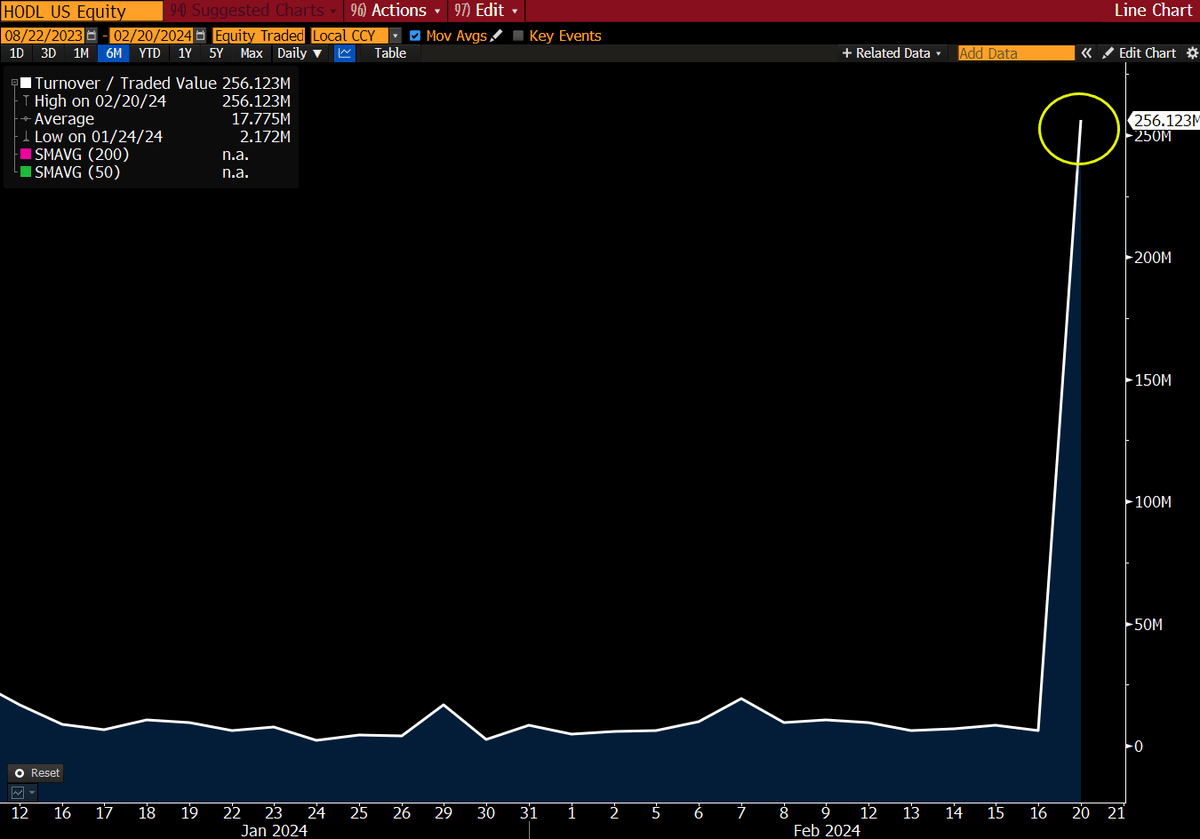

#Bitcoin ETFs saw new inflows of 💵 $136M (~2,600 #BTC ) on Feb 20, led by BlackRock $IBIT's $154M (total $5.5B).

This is offset by a 💵 $137M outflow from $GBTC (total -$7.1B).

Overall, #Bitcoin ETFs have attracted over 💵 $5B since launch 👀

If you think the capital volume is decreasing in spot ETFs, think again.

If you think we already understand the magnitude of this market today, think again.

Trading volume in some ETFs increased 14 TIMES today!

Some institutions probably waited to start entering.

Nearly 1M #Bitcoin wallets, holding ~481.71K #BTC (💵 $25B) at $52k, are underwater.

Selling pressure may surge as they break even, according to IntoTheBlock data 👀

You will never need to sell #Bitcoin. If you accumulate while it's still possible, you could live solely off the income generated by it. How?

Well, there are two ways someone with all their reserves in Bitcoin can double their wealth: the price can increase by 100%, or you can have a 100% return on your reserve. This means that the price of #BTC could stay the same forever, and holders would still continually get richer.

Why don't we have this yet? Although it may not seem complementary, the answer to that question is the same as another common one: Why is #Bitcoin volatile?

Usually, the answers revolve around "emerging technology," "information barrier," or "speculative asset." I suggest an uncommon one: the lack of bankers. Let me explain.

According to Mises, "...a banker is one who lends the money of others; one who lends his own is merely a capitalist, not a banker." For whatever reason, we still haven't formed a solid Bitcoin credit market. "We don't have bankers."

Without a credit market, it's not strange that the majority (70%) of bitcoins haven't moved in the last year and are only used as a store of value.

Without ways for bitcoin holders to use their capital, most of it remains idle, decreasing market circulation and increasing price volatility. Platforms like Niti will allow you to generate synthetic Reais, Stocks, or Gold and lend these synthetics to others for them to use in trading or as collateral for their own loans.

Unlike gold, Bitcoin is perfect for use as loan collateral (supreme collateral) because the owner can quickly verify their balance (similar to ETFs) and doesn't need to trust the bank.

You will never need to sell bitcoin because there will be a bitcoin credit market - which will also massively reduce the asset's volatility (after increasing its value by about 100x).

Go Woke, Go Broke