The first rule of #Bitcoin is: You do not rely on trusted third parties.

The second rule of Bitcoin is: You Do Not rely on trusted third parties.

It’s easy to forget how little the average person knows about how the fiat banking system works.

And it’s no surprise, either, as this information is purposefully obfuscated so as not to give the show away.

So, as a PSA, here’s what happens when you take out a loan at a bank:

1. Application: You apply for a loan.

2. Approval: If approved, the bank does not transfer existing money into your account, as many would assume. Instead, the bank creates new money out of thin air, and deposits that newly created money into your account.

3. No Reserve Requirement: Since 2020, there has been a 0% reserve requirement for banks, meaning banks do not need to keep any physical cash or reserves to back up the new money created by the loan. They can have $0 in their savings deposits, and still loan out billions per year.

4. Money Supply: The newly created money increases the total money supply in the economy, which dilutes the savings of dollar holders, making day to day life more expensive.

5. Loan Repayment: As you repay the loan, the money gradually disappears from the bank’s ledger. However, the interest you pay becomes the bank’s profit. Banks get the interest, without having to put up the principal loan amount. All of the upside, none of the downside. In the case where the bank somehow still manages to fail, it gets bailed out by the Federal Reserve; or, if it’s a smaller bank, it gets absorbed by a bigger bank to keep the ponzi going.

6. Rinse and Repeat: The process repeats ad infinitum with new loans, continuously expanding the money supply. This continues until the value of the dollar goes to zero.

#Bitcoin fixes this.

You could spend your whole life being somewhere else. Instead, be here now.

Reputation is how others define you, Character is who you are.

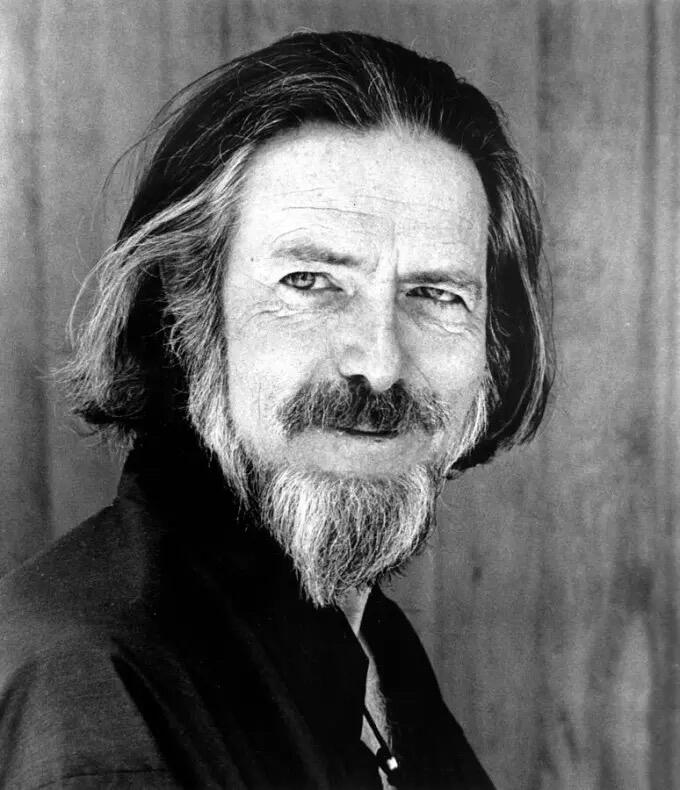

“Suppose we say that the Lord God simply exploded into being, and we are the little curlicues on the edge of this explosion. The people who are farthest out get the idea they are individuals. They are not separate from God, but they have this sense of individuality, just as we might say that when a farmer plants his fields, the individual seeds are separate. But they are still part of the whole process, the whole rhythm of the seasons, of growth and decay. This is the game that God is playing.”

— Alan Watts

Have a blessed Sunday.

What trying to defend against inflation by holding “altcoins” looks like— https://video.nostr.build/558f49b14afad5898180fba628b2d0d0508c079a49263289374d98e0f831f47a.mp4

“The past trails behind the present like the wake of a ship and eventually disappears.”

— Alan Watts

Enjoy the voyage. #Bitcoin

It’s easy (psychologically) to stack Bitcoin when the price is at/near ATH.

Why? You feel safety within the herd.

It’s harder to stack Bitcoin when the price drops, but far more profitable.

The way around this psychological hurdle is to always be saving in Bitcoin, regardless of short term price action.

The rest takes care of itself.

“We have untold stacks of recorded music from every age and culture, and the most superb means of playing it. But who actually listens? Maybe a few pot-smokers.”

— Alan Watts

Happy Summer Solstice

This is what happens when you start saving in #Bitcoin and focusing on your craft.

Wall Street bankers are all betting that the ETH ETF gets approved.

Wouldn’t be surprised if it does, as it could be a profitable short term trade for insiders, just as buying Bitcoin before the ETF approval was a profitable trade, followed by a sell-the-news event as those high-time preference investors lock in fiat profits.

Yet, unlike Bitcoin, Ethereum lacks absolutely, verifiable scarcity, it cannot be meaningfully self-custodied, and it is not a censorship resistant asset.

For these reasons, even if the ETH ETF does get approved, there is no guarantee it will surge in the weeks and months to follow as Bitcoin did.

Plus, ETH has the added difficulty of needing to stave off the endless supply of newer cryptocurrencies. For if ETH can get ETF approval with a 70% pre-mine and centralized management team, why wouldn’t the SEC approve every other scamcoin ETF proposal?

#Bitcoin only, or prepare to be rugged.

“Society is our extended mind and body.”

— Alan Watts

Similarly, Sodom and Gomorrah were both highly-progressive cities.

It’s no coincidence that humanity is discovering digital money and digital intelligence at the same time.

Code (that works) is magic.

Bitcoin is code (that works).

#Bitcoin is magic (internet money).

They are embodying the truffle hunting, locked-in, no nonsense pig spirit