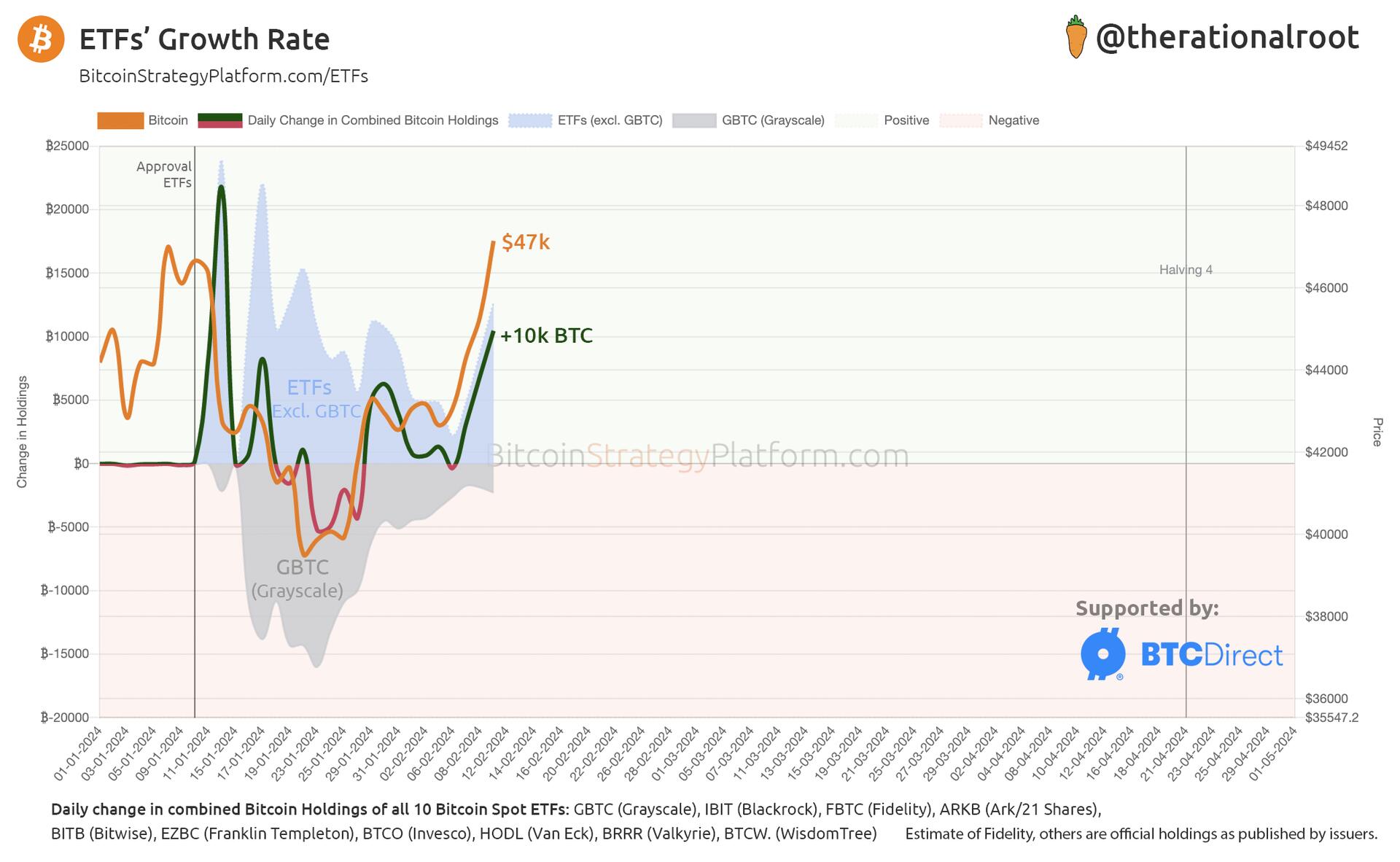

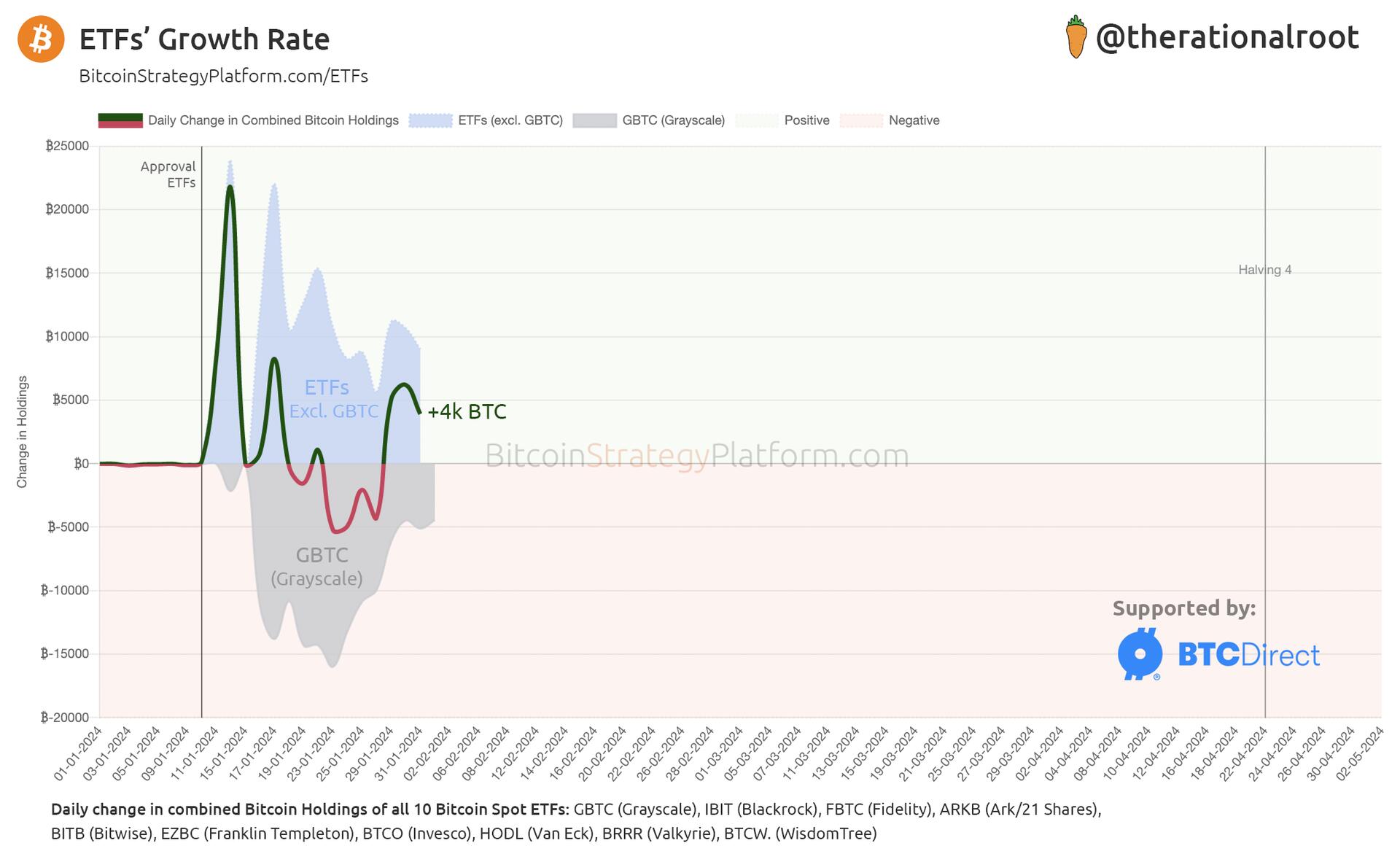

10k BTC net inflow to ETFs in a single day. #Bitcoin price showing high correlation with ETFs’ flows. Supply already tight, NGU!

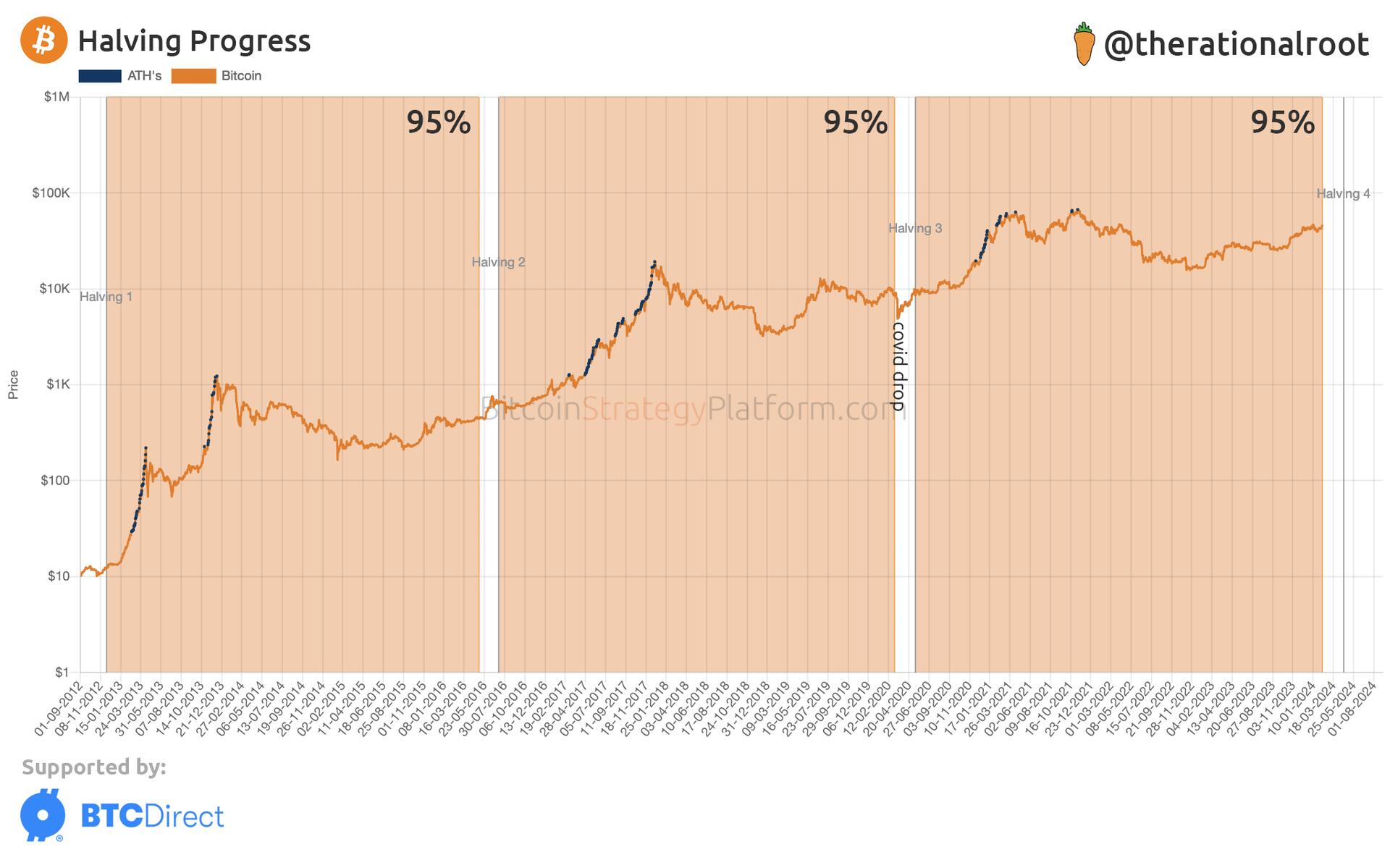

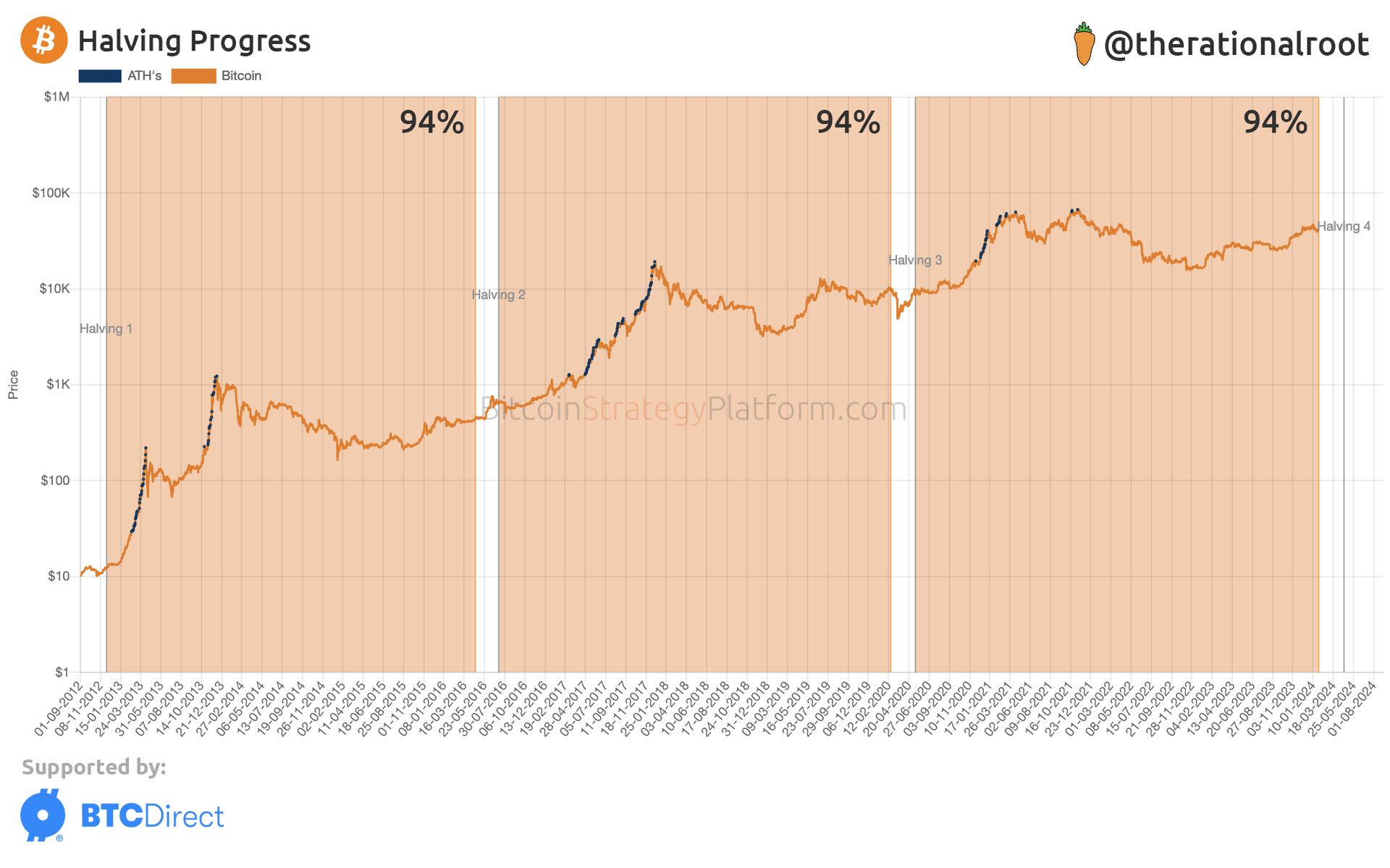

Halving progress 95%. #Bitcoin

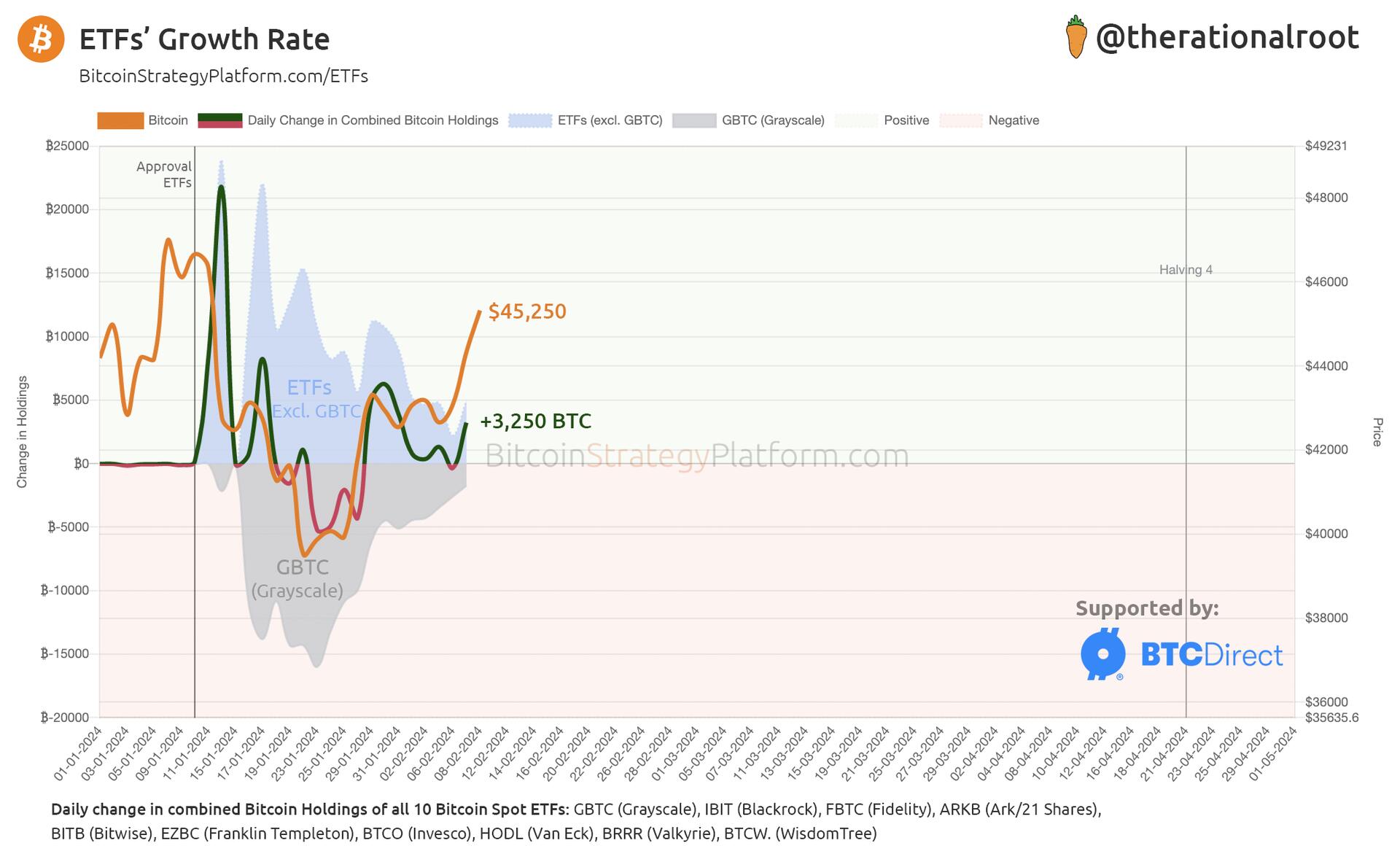

ETFs' net inflow +3,250 BTC.

$45,250 #Bitcoin

Correlation with ETFs' flows.

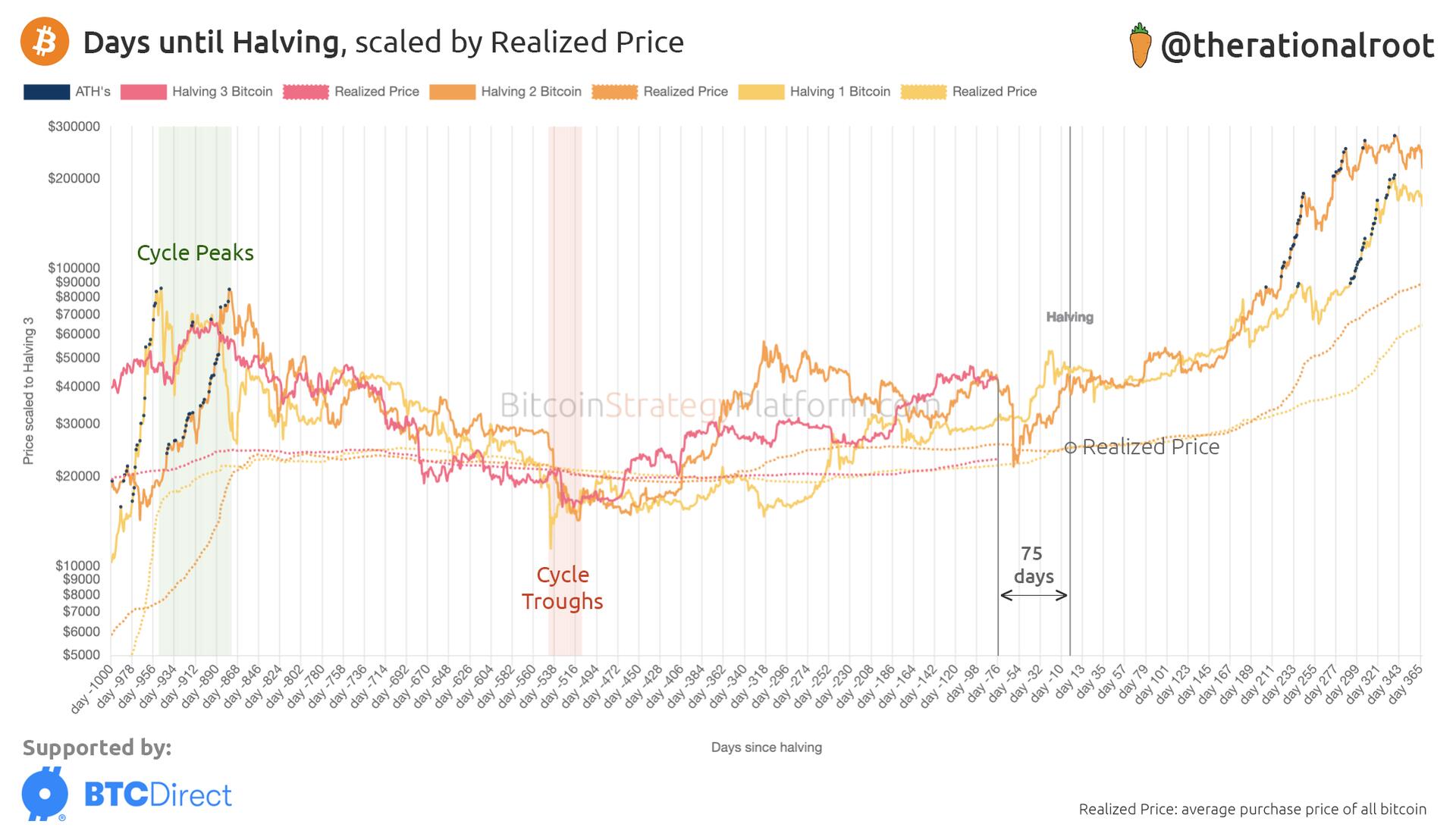

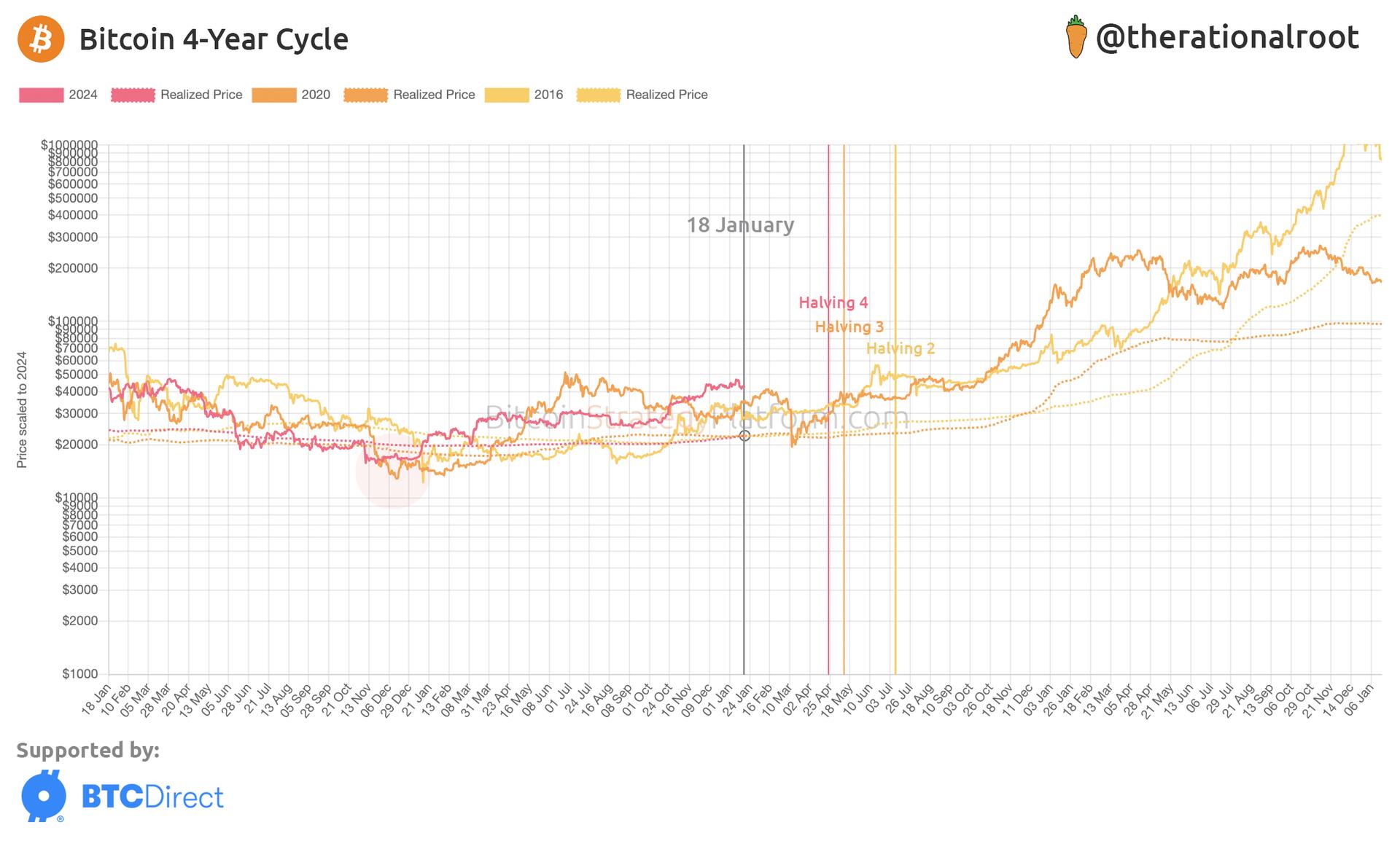

Cycle comparison: 75 days until the Halving.

#Bitcoin

How about the new #Bitcoin Hoodie?!

Now available at 👉 21mil.nl

@TheRationalRoot 🥕 merch.

Check out today’s Bitcoin Strategy newsletter covering the update to our ETF Tracker — now featuring the ETFs' Growth Rate! 👇

https://www.bitcoinstrategyplatform.com/news/etfs-growth-rate

Spot ETFs’ Growth Rate: +4,000 BTC/Day.

- Grayscale’s outflows slowing

- Other ETFs seeing substantial inflows

#Bitcoin 🧵

On-chain value map. #Bitcoin

🟢 Green zones highlight 'fair value' periods. Around Bitcoin Halvings (both pre and post), the price often hovers in these green zones. Observe how both the entire bull market phases (marked by blue price dots for ATHs) and bottom formations deviate from the fair value range.

The value map is based on the metrics: realized cap, liquid supply and coin days destroyed.

Halving progress 94%. #Bitcoin

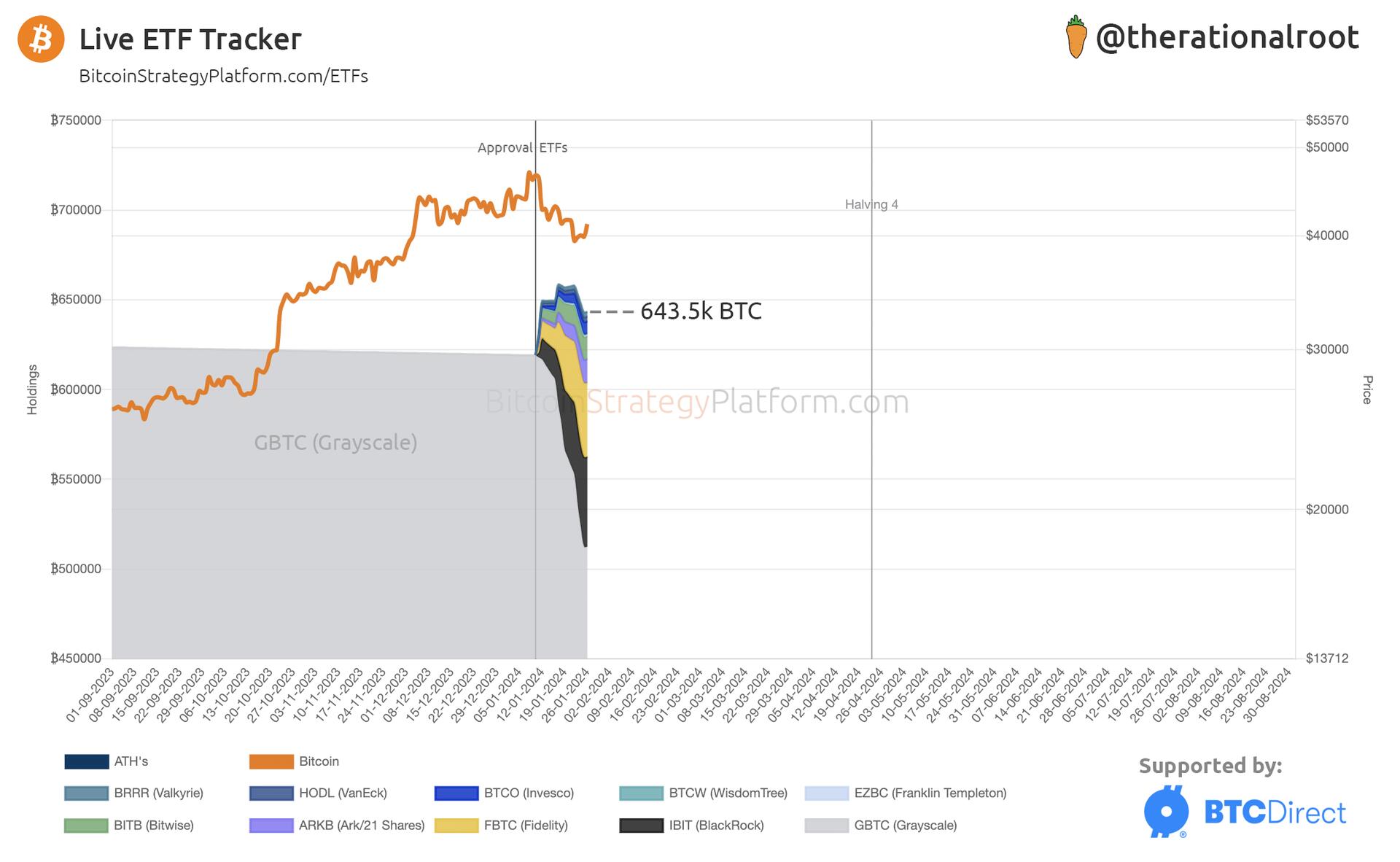

Read the latest Bitcoin Strategy newsletter here 👇

https://www.bitcoinstrategyplatform.com/news/live-etf-tracker

Read the latest Bitcoin Strategy newsletter, where we discuss the ETF Tracker and GBTC outflows, including a chart of FTX holdings sell-off. 👇

https://www.bitcoinstrategyplatform.com/news/live-etf-tracker

Proud to present the live #Bitcoin ETF Tracker.

It's not like we were not overvalued, for good reasons, at more than 0.5 standard deviations from the STH cost basis. The current reset is very healthy. #Bitcoin

For today's investors, the optimal DCA time frame is 89 days — aimed to minimize risk and maximize profit, based on the current position in the 4-year cycle. Those adopting an 89-day DCA, even at the least opportune moment, were in profit within 3 years! #Bitcoin

Disclaimer: historical performance doesn't assure future results.

cc: nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z

Read more in the latest Bitcoin Strategy newsletter 👇:

https://www.bitcoinstrategyplatform.com/news/dca-strategy-tool-optimal-duration

For today's investors, the optimal DCA time frame is 89 days — aimed to minimize risk and maximize profit, based on the current position in the 4-year cycle. Those adopting an 89-day DCA, even at the least opportune moment, were in profit within 3 years! #Bitcoin

Disclaimer: historical performance doesn't assure future results.

cc: nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z

Check out the latest Bitcoin Strategy newsletter unveiling the optimal Dollar-Cost-Average time frame based on #Bitcoin's 4-year cycle.

h/t: nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z

https://www.bitcoinstrategyplatform.com/news/dca-strategy-tool-optimal-duration

The 4-year cycle, incl. realized price (dotted lines), aligned by today's date. #Bitcoin

In every cycle, we've seen dips below fair value. Past trends hint at potential sideways movement. Downside risks may be "restrained", thanks to factors like ETFs, Halving, and a less over-extended market than 2019. Note, fair value is on the rise.

The on-chain value map is based on the metrics: realized cap, liquid supply and coin days destroyed.