Need A Job? Get A Job!!! As Bitcoin Industry Preps For Massive Growth!!

Winning, Winning And More Winning As Bitcoin Industry Sees U.S. Securities and Exchange Commission (SEC). Dropping Lawsuit After Lawsuit!!

Every Case It Dropped In 2025 And The Legal Battles Still Ahead.

Key Takeaways:

* The SEC Has Withdrawn Or Paused Multiple Lawsuits Against Bitcoin Companies.

* Cases Against Uniswap, Robinhood, Gemini, OpenSea, Consensys And Coinbase Have Been Dropped.

* Analysts Expect More Lawsuits To Be Rolled Back In The Coming Weeks.

The U.S. Securities and Exchange Commission (SEC) is rapidly unwinding its aggressive legal campaign against the Bitcoin industry.

Under interim SEC Chair Mark Uyeda, with Commissioner Hester Peirce playing a key role, the agency is dropping lawsuits at a pace that outstrips those filed during former chair Gary Gensler’s tenure.

A Swift Reversal Under the Trump Administration

The shift follows an executive order from President Donald Trump aimed at reshaping Bitcoin regulation.

Issued in the administration’s first week, the order prohibited the creation of a central bank digital currency (CBDC), established a Bitcoin-focused task force, and set the groundwork for clearer industry rules.

Remainder Of The Article: https://dpl-surveillance-equipment.com/bitcoin-and-crypto-currency/bitcoin-industry-on-a-winning-streak-as-sec-drops-lawsuit-after-lawsuit/

Sometimes it seems as if the whole world is out of time😲😬

"If You're Scared, Go To Church!", Joker

A Brief History Of Bitcoin Crashes And Bear Markets: 2009–2022

Bear Market No. 1: Bitcoin Crash From $32 To $0.01 In 2011

Bear Market No. 2: Bitcoin Tanks From $1,000 To Below $200 In 2015

Bear Market No. 3: Bitcoin Plunges Below $3,200 After Hitting $20,000 In December 2017

Bear Market No. 4: Bitcoin Slumps From $63,000 To $29,000 In 2021

Bear Market No. 5: Bitcoin Plummets From $68,000 To Below $20,000 In 2022

Meanwhile:

Billionaire And Former Bitcoin Critic Ken Griffin Reconfirms His Interest In Bitcoin!!!😹😂🤣

Updated: 2-24-2025: (Bloomberg) — Ken Griffin’s market-making giant Citadel Securities is looking to become a liquidity provider for the Bitcoin industry, betting President Donald Trump’s embrace of the industry will usher in a boom for the asset class.

Remainder Of The Article: Famous Former Bitcoin Critics Who Conceded In 2020-25: https://dpl-surveillance-equipment.com/bitcoin-and-crypto-currency/famous-former-bitcoin-critics-who-conceded-in-2025/

Debt Has Always Been the Ruin of Great Powers. Is the U.S. Next? #GotBitcoin #BitcoinFixesThis

From Habsburg Spain to Trump’s America, there’s no escaping the consequences of spending more on interest payments than on defense.

Related:

* TradFi (Traditional Finance) Investors Piled $38.7B Into Bitcoin ETFs Three Times More Than Previous Quarter!!!!!!

* Trump Wants To Know If There's Gold In Fort Knox

* Strategy Buys 20,356 Bitcoin For Almost $2B; Holdings Approach 500K BTC

* California Has The Largest Investment In Strategy Stock With More Than $150 Million Held In State Retirement Funds, Says Bitcoin Analyst Julian Fahrer.

* BlackRock Bitcoin ETF Surpasses 50% Of Total ETF Market Share!!!!!

* Hong Kong Investment Firm’s Shares Surge 93% After Buying Just 1 Bitcoin

* Goldman Sachs Stacks BTC

* Metaplanet Share Price Rises 4,800% As Company Stacks BTC (Raises 4B JPY In 0% Interest Bonds To Buy More BTC)

Meanwhile:

What I call Ferguson’s Law states that any great power that spends more on debt service than on defense risks ceasing to be a great power.

The insight is not mine but originates with the Scottish political theorist Adam Ferguson, whose “Essay on the History of Civil Society” (1767) brilliantly identified the perils of excessive public debt.

Empires Crippled By Debt

In the 16th century, the Habsburg kings of Castile reigned over the first truly global empire. Revenues from American silver mines were crucial to financing Spain’s expansive military endeavors. Charles V and Philip II also enjoyed substantial tax revenues from their Castilian subjects.

Perhaps the most familiar case of a great power succumbing to fiscal constraints is that of Bourbon France in its contest with Hanoverian Britain in the late 18th century. Of all the great powers, France had the greatest difficulty in evolving a stable system of public debt management.

As Philip IV told the Council of the Indies even earlier, in 1639, “I recognize that the introduction of the juros has caused the enormous ruin we experience.”

Perhaps the most familiar case of a great power succumbing to fiscal constraints is that of Bourbon France in its contest with Hanoverian Britain in the late 18th century. Of all the great powers, France had the greatest difficulty in evolving a stable system of public debt management.

The history of the 19th century furnishes further examples: the Ottoman Empire, Austria-Hungary, Tsarist Russia. But the best example of all—and the one from which Americans have the most to learn—is that of Great Britain.

Remainder of The Article: The National Debt Has Grown To $36.5 Trillion!! : https://dpl-surveillance-equipment.com/bitcoin-and-crypto-currency/the-national-debt-has-grown-to-36-5-trillion-gotbitcoin/

Debt Has Always Been the Ruin of Great Powers. Is the U.S. Next? #GotBitcoin #BitcoinFixesThis

From Habsburg Spain to Trump’s America, there’s no escaping the consequences of spending more on interest payments than on defense.

Related:

* TradFi (Traditional Finance) Investors Piled $38.7B Into Bitcoin ETFs Three Times More Than Previous Quarter!!!!!!

* Trump Wants To Know If There's Gold In Fort Knox

* Strategy Buys 20,356 Bitcoin For Almost $2B; Holdings Approach 500K BTC

* California Has The Largest Investment In Strategy Stock With More Than $150 Million Held In State Retirement Funds, Says Bitcoin Analyst Julian Fahrer.

* BlackRock Bitcoin ETF Surpasses 50% Of Total ETF Market Share!!!!!

* Hong Kong Investment Firm’s Shares Surge 93% After Buying Just 1 Bitcoin

* Goldman Sachs Stacks BTC

* Metaplanet Share Price Rises 4,800% As Company Stacks BTC (Raises 4B JPY In 0% Interest Bonds To Buy More BTC)

Meanwhile:

What I call Ferguson’s Law states that any great power that spends more on debt service than on defense risks ceasing to be a great power.

The insight is not mine but originates with the Scottish political theorist Adam Ferguson, whose “Essay on the History of Civil Society” (1767) brilliantly identified the perils of excessive public debt.

Empires Crippled By Debt

In the 16th century, the Habsburg kings of Castile reigned over the first truly global empire. Revenues from American silver mines were crucial to financing Spain’s expansive military endeavors. Charles V and Philip II also enjoyed substantial tax revenues from their Castilian subjects.

Perhaps the most familiar case of a great power succumbing to fiscal constraints is that of Bourbon France in its contest with Hanoverian Britain in the late 18th century. Of all the great powers, France had the greatest difficulty in evolving a stable system of public debt management.

As Philip IV told the Council of the Indies even earlier, in 1639, “I recognize that the introduction of the juros has caused the enormous ruin we experience.”

Perhaps the most familiar case of a great power succumbing to fiscal constraints is that of Bourbon France in its contest with Hanoverian Britain in the late 18th century. Of all the great powers, France had the greatest difficulty in evolving a stable system of public debt management.

The history of the 19th century furnishes further examples: the Ottoman Empire, Austria-Hungary, Tsarist Russia. But the best example of all—and the one from which Americans have the most to learn—is that of Great Britain.

Remainder of The Article: The National Debt Has Grown To $36.5 Trillion!! : https://dpl-surveillance-equipment.com/bitcoin-and-crypto-currency/the-national-debt-has-grown-to-36-5-trillion-gotbitcoin/

Homework For Today! What is the difference between a labyrinth and a maze?

Friends Don’t Let Friends Sound Stupid!🤩😻😎

Homework For Today! The U.S. Federal Reserve has a way of manipulating the bond market other than by using "Yield-curve control". What is the name of that "other" mechanism and what is the difference?

You Are Not Alone😻🤩🙏👍🏿✅

https://www.facebook.com/HerplaatsersNL/videos/1662519631362645/?fs=e&mibextid=wwXIfr&fs=e

Homework For Today! Metformin has a twin in the supplement field and yet doesn't interfere with the rapamycin (mTOR) signalling pathway. What is that twin's name?

A Users Guide To Immortality

We are in the midst of a healthspan revolution that will enable us to live vitally beyond 100 years old. Advanced diagnostics are now able to catch any disease at inception, while advanced therapies in clinical trials have the potential to reverse disease while also slowing, stopping, and potentially even reversing aging.

Peter Diamandis, MD, designed Longevity Guidebook as an easy to use roadmap to help you understand the power of this healthspan revolution (driven by AI, CRISPR, gene therapy, and cellular medicine) and to inspire you to maintain your best health to intercept the transformative breakthroughs coming this decade.

Remainder Of The Article: A Users Guide To Immortality: https://dpl-surveillance-equipment.com/health-related/users-guide-immortality/

Trump Supporters Get Buyer's Remorse As Private Industry, Government Jobs And Agencies Get Axed!!!!

Some core supporters love his no-holds-barred approach, but several swing voters are taken aback at his early moves.

Staci White said she voted for President Trump because she wanted lower prices and to stop fentanyl from coming into the U.S.

Related:

* Steve Bannon, US Hospitals Join GOP Rebellion Over Medicaid/Medicare Cuts

* DOGE Seeks Access To IRS System That Houses Sensitive Taxpayer Data

Now, with widespread federal layoffs and expected cuts, she worries her family will lose their house if her partner is laid off from his government-adjacent job.

“Now I’m like: ‘Dang, why didn’t I just pick Kamala?’” said the 49-year-old Omaha, Neb., resident, referring to the former vice president and last-minute Democratic nominee.

A flurry of government actions have reimagined the size and focus of the federal workforce, demanding loyalty for employees who remain.

Emily Anderson, from Duluth, Minn., always considered herself a Democrat but backed Trump after Kennedy dropped out of the race. Anderson aligned with Kennedy’s “Make America Healthy Again” messaging, particularly the focus on getting toxins out of food. Kennedy is now Health and Human Services secretary.

Anderson, who works with disabled adults, said Kennedy’s government role is the only bright spot for a vote she categorizes as the “biggest mistake of my life.”

She is horrified by Trump’s focus on deportations and use of Guantanamo Bay to hold migrants. She alleged that Trump has been too focused on “ridiculous” flashy moves, such as banning paper straws and renaming the Gulf of Mexico the “Gulf of America.” Her daughter’s occupational therapist has stopped taking new patients over fears that the practice will have its federal funding dry up.

“I feel so stupid, guilty, regretful—embarrassed is a huge one. I am absolutely embarrassed that I voted for Trump,” said Anderson, 30.

Dixon, a 66-year-old telecommunications contractor, said he is enjoying Trump’s early days, particularly the focus on addressing government waste. Still, he said “steamrolling” the government is unsustainable for the next four years.

“He’s doing 80 miles an hour. I wouldn’t mind if he went around 55,” he said.

Remainder Of The Article: Ultimate Resource Covering DOGE AKA The Department of Government Efficiency: https://dpl-surveillance-equipment.com/miscellaneous/ultimate-resource-covering-doge-aka-the-department-of-government-efficiency/

California’s Homeowners Insurer of Last Resort Went Bust. It Won’t Be Alone As Nation Follows Suit

This is far from just a California problem. The whole country is struggling to adequately price and prepare for the growing risk of natural disasters as the climate grows more chaotic.

Insurers frequently go bust in Florida and Louisiana, whose own last-resort providers have ballooned. Texas faces hurricanes, wildfires and the hailstorms that are also growing more destructive in Midwestern states.

Too many homes nationwide lack adequate protection from the growing risk of natural disasters.

Last week, surprising no one, California’s FAIR Plan said it didn’t have enough money to cover claims from the recent Los Angeles wildfires. The plan, which insures people who can’t obtain coverage from private insurers, has doubled in size in the past four years to cover more than 450,000 homes.

It faces possible exposure of $4 billion for the Palisades Fire and $775 million for the Eaton Fire but had just $700 million in cash when the fires began and a $900 million deductible on its $2.6 billion reinsurance policy. Running out of money was never a question of if for FAIR, but how quickly and by how much.

The inevitable result of a fracturing private insurance market will be the socialization of disaster losses, as seen in California, Florida and other places where FAIR plans must go begging.

Related:

* Sell Your Home With A Realtor Or An Algorithm?

* Housing Insecurity Is Now A Concern In Addition To Food Insecurity

* Smart Wall Street Money Builds Homes Only To Rent Them Out

* Investors Are Buying More of The U.S. Housing Market Than Ever Before

* How To Prepare For The Expected And Unexpected Costs of Homeownership

* Emergency Rental Assistance Program

* Home Flippers Pulled Out of U.S. Housing Market As Prices Surged

Remainder Of The Article: Definitive Resource Covering The Homeowner’s Insurance Market: https://dpl-surveillance-equipment.com/miscellaneous/definitive-resource-covering-the-homeowner-s-insurance-market/

Any Idiot Putting All Of His/Her Eggs In The Government Basket Deserves To Be Fired! #getbitcoin #bitcoinfixes

These people had ample warning!!

* 2-28-2024: US Government Job Growth (Up 25%!!) Now Comes The Lay-Offs! US Job Growth Numbers Subsidized By Record Numbers Of Government Jobs.

This raises questions about the efficiency and necessity of such government expansion, especially when juxtaposed with layoffs in the private sector that are traditionally seen as engines of innovation and economic growth.

Related:

* The Jobs Report Is Terrible: 6:15

* With Bitcoin Jobs Available, US Universities Are Turning to Blockchain Education

* This Sector Could Have A Half Million Job Openings And Opportunities For Older Workers

* Workers Are Quitting Hotel And Restaurant Jobs At The Highest Rate On Record

* Where The Best Paying Jobs Are

* Helping 10,000 People Get A Job In Bitcoin

Remainder Of The Article: Ultimate Resource Covering DOGE AKA The Department of Government Efficiency: https://dpl-surveillance-equipment.com/miscellaneous/ultimate-resource-covering-doge-aka-the-department-of-government-efficiency/

The Doggie Is Like WTF!! https://youtube.com/shorts/3-DDW_r_09s?si=AMpaUOhm6EtTS53S

FOIA Files: Elon Musk’s DOGE Wants A Heads Up On FOIA Requests

Elon Musk’s Department of Government Efficiency AKA DOGE, the group has taken aim at the federal bureaucracy and already effectively sidelined two government agencies, the US Agency for International Development and the Consumer Financial Protection Bureau.

Not even the Freedom of Information Act, it seems, will serve as a check on what Musk and DOGE are up to as they burrow inside federal agencies. It’s already been widely reported that DOGE is part of the Executive Office of the President, and therefore not subject to the FOIA.

Related:

* FOIA Files: Elon Musk’s DOGE Wants A Heads Up On FOIA Requests

* Coinbase Files FOIAs Against US Regulators Probing Banks’ Bitcoin Crackdown

* FOIA Request Reveals SEC’s Gensler, Lawmakers Target Of Violent Threats

* FOIA Request Reveals US Mint Issuance Of Fake 2021 American Gold Eagle Coins And Exaggerated Use Of Crypto Used By Hamas

* FOIA Reveals Aurora Borealis Imperiled US Infrastructure From Power Grids To Satellites

* Freedom of Information Act (FOIA) Request Reveals How The Trump Administration Really Felt About Bitcoin

Remainder of The Article: https://dpl-surveillance-equipment.com/foia-files-freedom-of-information-act/foia-files-elon-musk-s-doge-wants-a-heads-up-on-foia-requests/

Stop following me!! https://www.facebook.com/reel/585527887540369?fs=e&mibextid=wwXIfr&fs=e

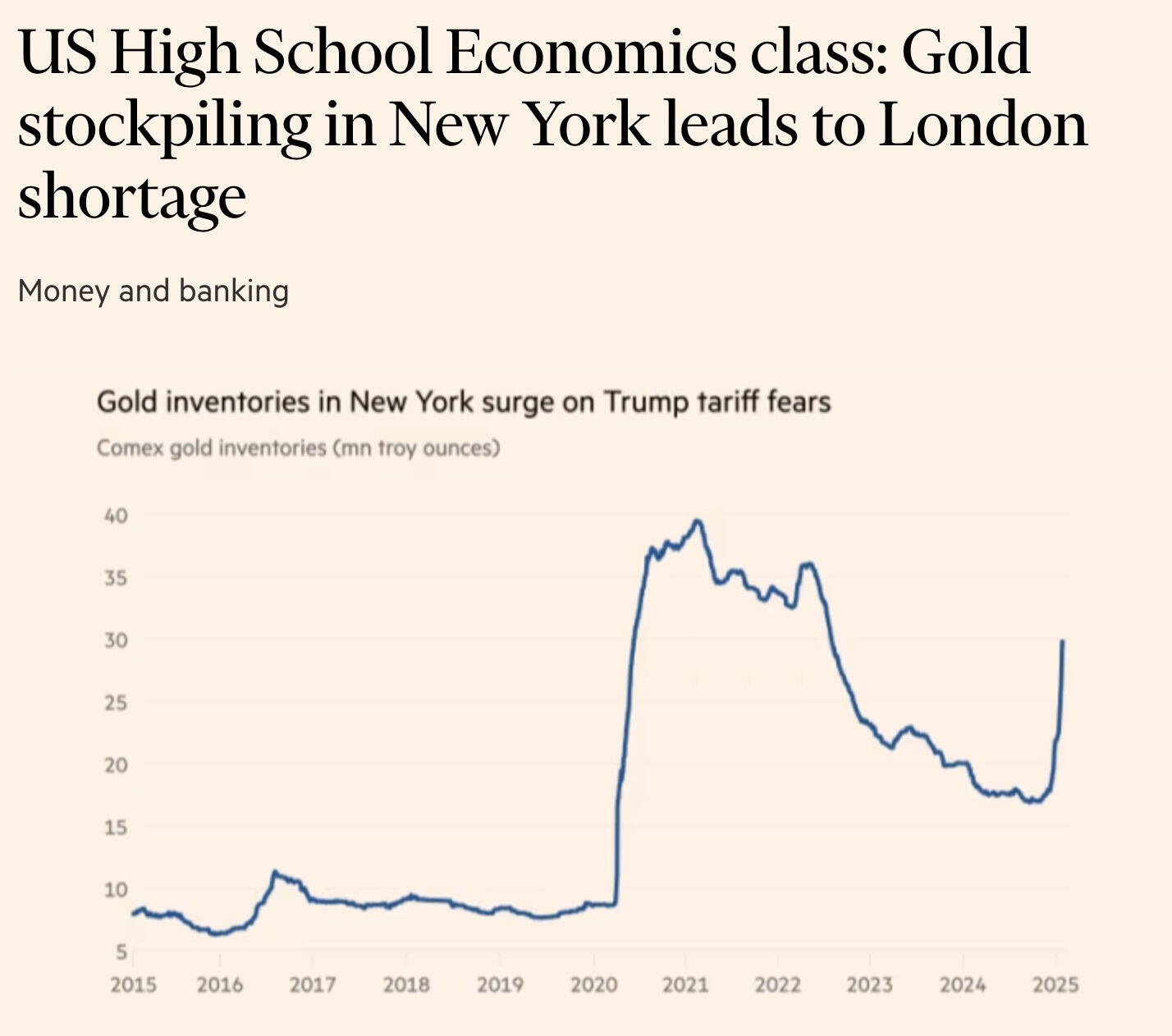

US High School Economics Class 101: Gold Stockpiling In New York Leads To London Shortage #GotBitcoin #BitcoinFixesThis

The last time this happened the US was literally forced into a recession. US Taxpayers saw a 30-40% haircut on their dollar's value.

It's not rocket science... if a country has no gold in it's reserves then absolutely no one will want to invest in its economy!!!

"Know Your Monetary History Or Be Forced To Relive It!!!", Joker

Our Video Library: https://dpl-surveillance-equipment.com/video-library/

US High School Economics Class 101: Gold Stockpiling In New York Leads To London Shortage

The last time this happened the US was literally forced into a recession. US Taxpayers saw a 30-40% haircut on their dollar's value.

It's not rocket science... if a country has no gold in it's reserves then absolutely no one will want to invest in its economy!!!

"Know Your Monetary History Or Be Forced To Relive It!!!", Joker