The tweet on the right does not formulate what you mean by "free-riding" so the reader have to use mind-reading to discern what you mean.

Perhaps if you define what free-riding means to you in this case, then we can agree or disagree on that definition.

An argument against free will is an argument for tyranny.

Free will is a recognition of individual sovereignty. Your free will is an ethical boundary against coercion. Your boundary against coercion can either be respected or disrespected.

If you have no free will then you are considered to be programmed by your environment and its stimuli, with predictable results just as dominos will fall as gravity compels them.

With this perception comes a belief in a fixed outcome based on a number of inputs - you can't change your path by yourself if you are not more than the stimuli that shaped you. The assumption is that in order for you to change, you need external stimuli.

Without a free will you may be considered to be a puppet on strings, shaped by circumstances and other people, with no free agency of your own. This is reflected in the naive psychological theory that criminals are not responsible for their actions. Their agency is believed to be on-rails. This idea is rooted in determinism.

As a result from this idea of determinism, bureaucrats who deny free will have no moral qualms about nudging or forcing you onto the path that they consider correct.

This abandonment of the boundary of free will, can and will be used to justify a re-programming of your mind from the perspective of the bureaucrats in charge.

If you believe that we are not facing a global warming catastrophy, then your opinions are considered to be shaped - not by reasoning - but by stimuli. The same principle applies if you prefer to eat healthy food over insects or chemical sludge. Or if you think private transports are a good idea.

The underlying idea here is that without a free will, sovereign reasoning cannot exist. If the process of sovereign resoning doesn't exist, then we are merely products of stimuli.

If we are merely products of stimuli, the absurd conclusion from this is that only power exists; the power to control all stimuli in order to achieve a desired outcome.

This is the foundation of central planning. It is built on a disregard for individual agency, free will and the possibility of sovereign reason.

Be sovereign.

Agreed.

Cash is dark money and it is important that people have access to dark money in the digital age. History has demonstrated to us what crimes surveillance regimes can commit when they go unchecked. Under authoritarian systems, dark money will always be vital. It is my hope that Bitcoin can compete with Monero on L2-L3's in regards to dark money. The base layer obviously cannot be both a store of value and dark money at the same time. As such Bitcoin and Monero occupy different niches.

I agree that the establishment attacks on Monero are despicable. Dark money must be allowed in a free society and if it is not we are heading toward tyranny. A black market is a free market and I support that.

Monero has a different function than Bitcoin and cannot have the same impact on politics.

Capital leaving a jurisdiction because the jurisdiction is authoritarian will have an impact on politics.

This is the domain of Bitcoin game theory. Jurisdictions that respect individual liberties will attract capital (Bitcoin) and outcompete authoritarian jurisdictions. Monero cannot achieve this as dark money.

Bitcoin over LN, Liquid and other L2-L3 solutions will be the everyday 'e-cash' formats. L1 will be for store of value only. In a free market competition the user can achieve a desired balance between speed, cost and security.

Bitcoin and Monero aids different liberty mechanisms. I am personally not into Monero, but dark money might be useful at some point, so I am not ruling out the possibility that Monero will have a liberty impact. It is just that its liberty function can be achieved equally well by a Monero competitor.

1. Bitcoin can buy coffee but that's never the function of a base layer serving 8 billion people.

When you buy a coffee with a credit card you are using a L2-L3 payment without final settlement. If Monero served 8 bn people then its base layer could not be used for buying a coffee. Since almost nobody uses Monero, you can absolutely buy a coffee on its base layer. If a form money becomes widely used then it won't make economic sense to buy a coffee on its base layer.

2. Scaling Bitcoin to meet the needs of 8 billion people will primarily happen on L2-L3 since the base layer must be secure, decentralized and allow noderunners to run local nodes. Ignoring this fact is an appeal to magical thinking. We can't achieve bandwidth for 8 bn people on a secure base layer.

3. Bitcoin is rules without rulers. If you want decentralization, property rights and liberty for all, Bitcoin game theory can achieve that while Monero doesn't have that sort of impact on politics.

Monero might be useful as dark money at some point but it is not a store of value that can enact a positive pressure on nations/jurisdictions to increase individual liberties. The game theory of Bitcoin will pressure nations to either lose capital in capital flight, or, improve individual liberties in order to keep capital (Bitcoin). Liberty arbitrage requires a global store of value.

I wrote a piece on the game theory of why taint will not work against Bitcoin and it also lays out how liberty arbitrage works. This is dependent on Bitcoin being a global store of value.

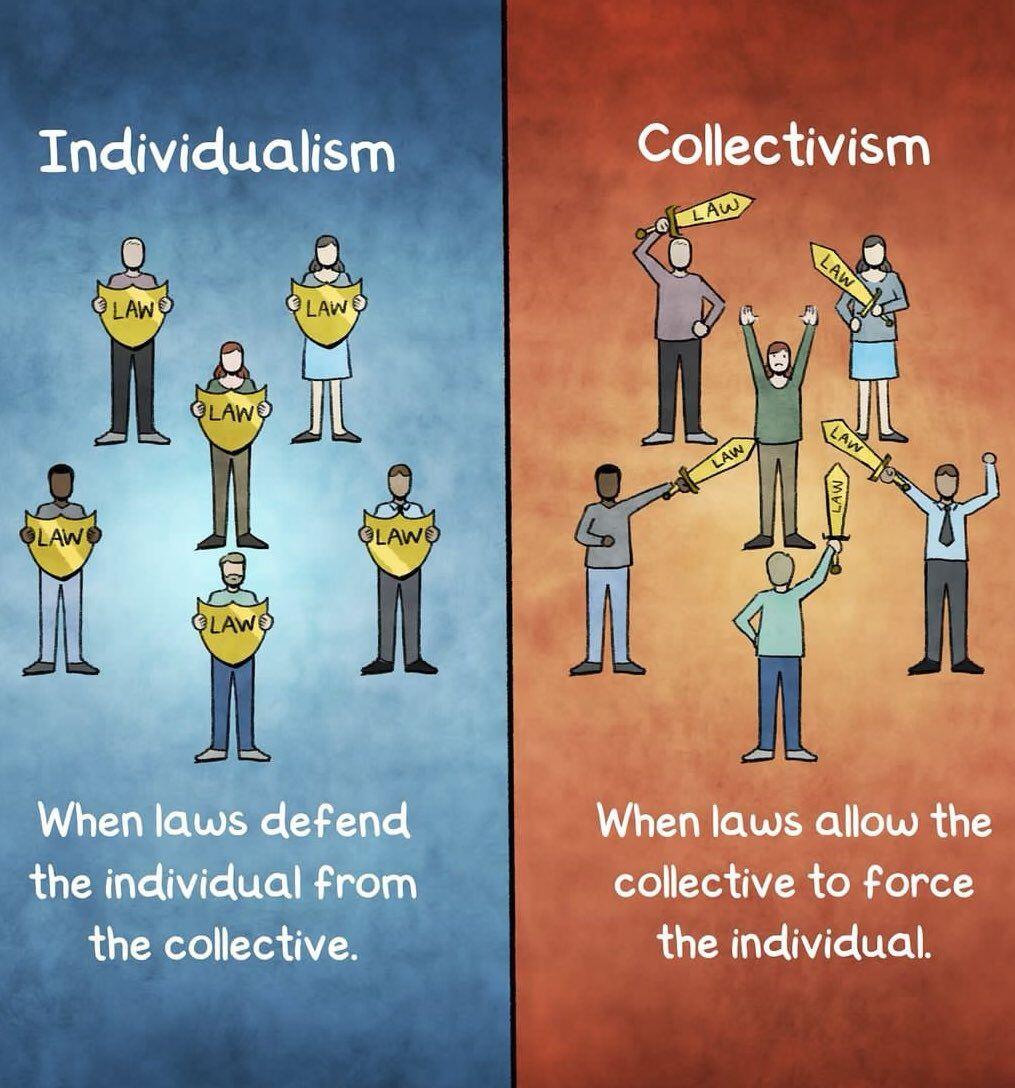

Individualism vs collectivism.

#Meme #Memes #Individualism #Collectivism

Agreed. Ideally we will see a variety of different types of governance models. This is helpful because we can't know in advance which form of governance will work best under unknown future local conditions. My point was just to focus on the variety dimension, so corporate jurisdictions will absolutely exist as well.

I am concinced the Bitcoin game theory is our best shot at arriving at a world with decentralization, liberties, property rights and options.

As humanity later expand to other planets, decentralization will deepen and the options will expand further. The long term ideal is a universe of options where people can settle where they feel aligned with the customs, architecture and lifestyle of an area.

Control fades with distance. There is a horizon of sovereignty involved in the distance from central planning. Micro-managjng from afar (colonialism) is difficult and require a lot of resources. As the distances increase, local sovereignty grows.

Right. I see it as small jurisdictions with varied governing structures. Personally I wouldn't call them 'corporate' but rather 'sovereign'.

Some jurisdictions can even be 'voluntarist socialist', although to be clear, voluntary socialism is just a free market with local preferences of collaboration combined with negative economic consequences if that collaboration breaks down.

If the jurisdictions are small enough and there are sufficient options to choose from, then liberties arise as a result of competition between jurisdictions rather than achieved via voting. If 80% of a population are functionally sheep or disinterested then voting liberties into existence seems a bit futile.

If a significant portion of wealth and skill leave a jurisdiction when/if liberties are not respected, then that is an impactful game theory pressure.

Cartel behavior among jurisdictions can still pose a problem to competition, for example jurisdictions setting a common tax level among themselves. Yet it only takes a few jurisdictions that break away from the cartel in order to achieve competition.

Agreed. Faith is important. Our pursuits are extensions of our values. Values require faith/conviction. All victories rests on conviction.

Faith and conviction form a bridge over the unknown.

Absolutely. Nostr is valuable but still needs to be battle-tested over time. The underlying theories need to have their time of impact with practical reality in order to be properly evaluated. Having multiple communication channels compete is ideal.

Yep. And when new bitcoiners internalize the liberty dimension, we tend to think less in terms of short term gains. When we don't plan to sell our Bitcoin at $300k, it is just a point of celebration that liberty and free markets are being adopted.

Expanding further, the idea that 8 billion people can use L1 always struck me as strange.

I don't have data on the average number of transactions per block but it would seem to be around 3500-4500 tx.

If we could achieve 7000 tx per block on average then that would translate to a million tx per day (144 × 7000). Dividing 8 bn people with 365 million tx per year gives a bandwidth of ~22 years for an ideal scenario.

A more likely figure for the current bandwidth is 4000 tx per block, yielding 576k transactions per day, giving 210 million tx per year. This results is ~38 years for the world population bandwidth.

Even if the demand pressure on L1 is far lower than 8 billion people, some percentage are children without the need to move savings, some may not be using Bitcoin at all, some may be using mainly L2-L3's, we are still at a situation of some participants outbidding others in order to have their tx included on the main chain.

The idea that "everyone must be able to use L1" is naive in a scenario where almost 8 bn people are using Bitcoin. Not all participants will have the funds to compete for blockspace, even if we had 7k tx per block or more.

Another insightful podcast on the scaling debate. Highly recommended. Link below.

Interesting to hear Vijay’s explanation on how frequent changes to bitcoin’s protocol undermines trust in its “unchangeable” monetary properties. I hadn’t considered this before, but it makes sense. He argued for conservatism very well.

I thought Brandon represented the “Big Scripters” 😜 well too. He focused the debate on how these proposed technologies promote bitcoin’s decentralization — which, of course, is the North Star for many of us (me included).

He argued that without these new scripting capabilities, fewer people will hold their own UTXO and therefore bitcoin will be more centralized. In the future, large custodians will be the key economic nodes and may control bitcoin and their interests may not align with ours.

Brandon recognized that his concerns are in the distant dystopian future, perhaps even after a wonderful “gilded age” for bitcoin.

Brandon argued that we need to do something now. He doesn’t know whether the proposed scripting capabilities will actually fix the potential problem but he hopes they will be helpful.

Brandon recognized that the proposal could have unknown risks but he was largely dismissive, believing that it’s probably safe.

Why now? Why the rush? Brandon left it unsaid, but I had the impression there may be a sense of urgency amongst the Big Scripters. Perhaps because they believe bitcoin will be harder to change in the future - ie, it’s now or never. Perhaps some believe that they will lose control to folks like Saylor, who represent the whales and large financial custodians of the future. If these large financial nodes control bitcoin, then the devs may believe that they will lose the power to make changes later.

I remain unconvinced. Here’s why:

Firstly, I believe we have to reject any proposals that solve potential problems that don’t yet exist, even if plausible. We don’t know what will happen in the future, nor whether the issue will be solved later without making protocol changes.

Even the best of us are just humans and not magical infallible wizards. We can never completely predict that a change will not create even bigger problems. We can’t take risks for potential problems that may never happen or which might be fixed in some other way.

Changes to the protocol should be a last resort. Bitcoin is our hope for the future. We’ve been given an incredible gift. We can’t mess it up. Future generations are counting on us.

Secondly, I believe our ability to accurately predict risk is related to our inability to accurately predict the future.

For example, I don’t recall ANY community discussions pre-Segwit / Taproot anticipating that we would be soon syncing our nodes slowly over Tor with 4 MB blocks filled with spam. It was all a big surprise to the community, wasn’t it?

Why was the block size increased? Why was there a discount given disproportionately to spammers? Why was the risk overlooked? Why hasn’t there been a post-mortem? So many questions.

I’ve realized we can’t blame the devs. We, the plebs, need to take responsibility. We allowed the devs to make complex changes to the protocol relatively quickly and we blessed it by upgrading our nodes. We trusted but didn’t verify. Lesson relearned. We can’t do this again.

Lastly, the power to change bitcoin should be held by the nodes and not the devs. Maybe it will be harder to change bitcoin in the future. That’s a feature of bitcoin, not a bug.

Devs, if you’re in a hurry, please check your time preference. I keep thinking that bitcoin could be like one of those cathedrals which took hundreds of years to build and which stand for millennia.

We should take our time to get this right. Even if it takes 10 more years of research and debate, that’s nothing in the grand timeline. In the meantime we should fix bugs, make it easier to run nodes, improve network privacy, and improve community communication.

nostr:npub1r8l06leee9kjlam0slmky7h8j9zme9ca32erypgqtyu6t2gnhshs3jx5dk Thank you for the great recent content. Love the debate format! 🙏

Agreed.

My programming intuition sounds the alarm when I see solutions with a number of unknown downstream consequences. I don't like code with unknown risks.

At a minimum, features can be tested for several years on for example Liquid Network and be evaluated there.

Among the claims of lower L1 fees, I don't trust such claims for several reasons. Tx fees can already range from $1.5 to the tx's upwards of $200 that were seen for a week right after the halving. This tells me that the tx fee pricing is largely dependent on the willingness of participants to pay a certain amount. If there is a willingness to pay high fees, then we can improve the bandwidth all we want on L1 without achieving low fees.

As far as the solutions involving increased efficiency for exchange transfers, I doubt that they would make much of an impact, if exchanges want to use them.

For the other proposals I am also unconvinced that there will be actual increases in L1 efficiency. They may or may not be significantly helpful.

My main concern is the ability to whitelist future addresses, i.e. blacklisting all addresses outside of the whitelist. It is not inconceivable that governments at some future point, in an attempt to hinder the competition against CBDC's, may decide to require exchanges via regulations to apply whitelisting schemes, to lock bitcoin within an approved framework of future addresses. Even if such regulations are introduced and then abolished at a later date, the whitelisting protocol would already be in place. If central planners can abuse a mechanic on L1, I would rather see such a mechanic on L2-L3.

We will see by that time. I think the L1 bandwidth is fine for the purpose of SoV. At the end of the day, tx fees will be what market participants are willing and able to pay.

I see self custody as a spectrum, starting with people withdrawing their sats from exchanges and other centralized and government-controlled platforms. Game theory will provide efficient and secure options for everyday transactions on L2-L3. Bad actors will lose users and fees. Good actors will benefit with more users and better fees.

Not everyone will want or need to use L1 and high base layer fees will drive innovation toward Lightning and sidechains to solve scaling. I define scaling as providing Bitcoin for 8 billion people. In my view that scaling will happen primarily above L1. L1 fees will find their equilibrium in supply and demand considerations of the market participants.

To expand, I would say that L1 fees will be as high as people can afford, regardless of how much optimization is done to L1.

Low value transactions will have to go via L2-L3s.

Yup. Bitcoin is primarily a store of value. E-cash transfers will happen on Bitcoin L2-L3s.

Well, it's more an indication of bandwidth, which in turn impact fees. It is ability to pay the fees that impacts how often people can use L1.

A block size increase would be negative since it would reduce the decentralization aspect, demonstrated in the Block Wars. Without a strong decentralization, the store of value will change to reflect the worsened security; downward.

Besides, an increase in bandwidth will still cause the mempool to be filled up with anything the market is willing to spend XYZ on in regards to tx costs.

The ability and willingness to pay for expensive transactions is the primary driver of fees.

Here's my math involving 8 billion people:

If we assume 7000 tx's per block, then the 144 daily blocks gives 1 million transactions. Most blocks will have less than 7k tx's, but let's go with this high tx figure for now just to explore the math.

If we divide 8 billion people by 365 million tx's per year, we arrive at almost 22 years per tx in terms of bandwidth, which impacts the tx fees.

Granted, a certain percentage of the world's population are children who will not need to spend from a savings UTXO on L1. Then there may be a certain percentage that don't use Bitcoin at all. Finally there are hodlers that have a 5, 10 or 15 years horizon for their savings.

If I am optimistic, 1 L1 tx every 10 years should be affordable for most people, so that leaves L1 as primarily a savings layer, while L2-L3 offers cash functions via decentralized banks/nodes.

Agreed with the L1 considerations. As you say, anyone who have done the calculations know that a decentralized money cannot provide L1 transactions for 8 billion people. Magical thinking have zero impact on reality.

Any scaling solution that aims at giving 8 billion people access to Bitcoin must involve a free market of L2-L3 options. The Bitcoin base layer is the proper foundation for healthy free market competition, which in turn brings high degrees of security via game theory.

I would say that there are degrees of self custody. Moving sats away from exchanges, who are government controlled, is a primary aspect of self custody. For significant amounts, custody involving L1 is ideal. For smaller amounts, an archipelago of options competing via game theory is far better than anything we have had before. Unserious and captured options will lose trust and users in benefit of the serious and non-captured options. LN operators are decentralized and sovereign banks, unimpacted by borders since Bitcoin is global and without borders.