NEW: 🇸🇻 El Salvador's #Bitcoin holdings officially surpass those of 🇩🇪 Germany

Germany is the 4th largest economy in the world.

Tether now owns more #Bitcoin AND US Treasuries than them.

The 21st century is wild.

Mining #Bitcoin with free hotel electricity 👀 https://video.nostr.build/eeed2a8c27cbc15f4d330ba1f07c649b796db466fc58a2b76ba4649cf8f83a03.mp4

JUST IN: Trump to speak at the Bitcoin Conference in Nashville 👀

The playbook has been openly available for over a decade.

Will be interesting to see which countries join in by the end of this cycle 👀

The chart of 🇩🇪 Germany’s industrial production mimics that of their #Bitcoin holdings 👀

Jiangxi Bank of China goes under

China's banking sector is facing a full-scale crisis. In just one week, 40 banks disappeared, absorbed into larger institutions.

Today, Jiangxi Bank of China went under, further escalating the crisis.

China's smaller banks are struggling with bad loans and exposure to the ongoing property crisis.

Scope of the Problem

Some 3,800 such troubled institutions exist. They have 55 trillion yuan ($7.5 trillion) in assets—13% of the total banking system—and have long been mismanaged, accruing vast amounts of bad loans. Many have lent to real estate developers and local governments, gaining exposure to China’s property crisis. In recent years, some have revealed that 40% of their books are made up of non-performing loans.

Bank of Jiujiang, a mid-tier lender, recently revealed that its profits might fall by 30% due to poorly performing loans. This rare disclosure highlights the severity of the situation. The authorities have been pushing for more transparency, but the true extent of the bad debt problem is still emerging. The four state AMCs created to manage bad debts are now struggling themselves, with one needing a $6.6 billion bailout in 2021.

Disappearing Banks!

China’s main way of dealing with small, feeble banks: making them disappear. Of the 40 institutions that vanished recently, 36 were in the Liaoning province and absorbed into a new lender, called Liaoning Rural Commercial Bank, which was created as a receptacle for bad banks. Since it was set up in September, five other institutions have been established to do similar work, with more expected.

The Root Cause: Property Sector Recession

The root cause? China's property sector is in a deep recession. Overextended real-estate developers and local governments have defaulted on loans, creating a cascade of financial instability. Property prices have plummeted, and construction projects have stalled, further straining the financial system.

Hidden Bad Debts and Regulatory Crackdown

Adding to the complexity, banks have been using asset-management companies (AMCs) to offload toxic loans, creating a facade of stability. These AMCs buy bad loans but avoid taking on the credit risks, leading to a buildup of hidden bad debts. The National Administration of Financial Regulation (NAFR), a new banking regulator, has been cracking down on these practices, issuing fines and increasing oversight.

What is Coming?

This regulatory vanishing act will probably pick up pace. S&P Global, a rating agency, reckons it will take a decade to complete the project. While fewer bigger banks are easier to regulate, combining dozens of bad banks only creates bigger, badder banks.

The fact remains that the Chinese economy is in an extended and pretend state. Years of credit-fueled growth has finally run its course, and the result will be. lower growth for China and a negative impact on the global economy. Slower growth of the Chinese economy will, in turn, exacerbate their banking problems too.

This will very likely end in massive liquidity injections, stimulation of the economy, and investors flocking to hard

assets.

The 🇩🇪 German government has officially burned through over half of its original #Bitcoin stack.

Their holdings now stand at 23,800 #Bitcoin 👀

Why AI agents will need #Bitcoin 👀

From Lightspark https://video.nostr.build/a4982ac165eb7c2025a2ee2a56cf5e9ffdfeec3fd38d3fc8d9ab56d1dbb505f4.mp4

JUST IN: The 2024 Republican Party Platform includes defending "the right to mine Bitcoin, and ensure every American has the right to self-custody of their Digital Assets" 👀

Spreading the gospel of #Bitcoin, one stitch at a time 🙌

From Danny⚡️ https://video.nostr.build/0c4d70c20f9e94c604e04f8b782d13583a014ff136ead1faa1e94845f426228c.mp4

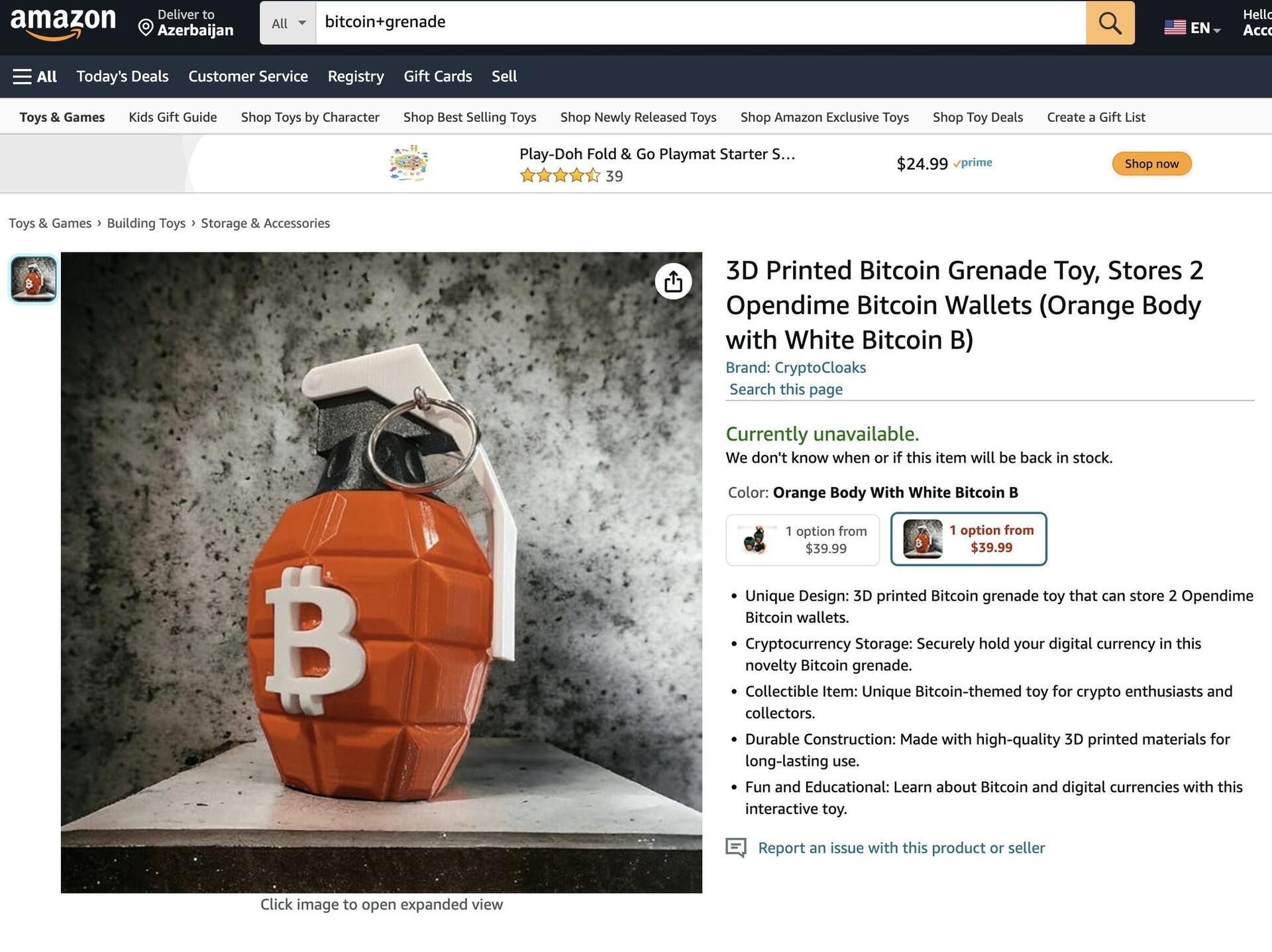

NEW: 3D Printed #Bitcoin Grenade by nostr:npub1lrjgpa9m2dl6esdah5pq7m005ymwh4glq4aet76q2zlz2f83esfsa2zvrj now available on Amazon 🙌

NEW: BitcoinVN, a 🇻🇳 Vietnamese crypto exchange and pioneering #Bitcoin start-up, has unveiled its newest Bitcoin ATM at Indika (House of Curiosity), a noted restaurant in Saigon.

NEW: Updated video animation of the #Bitcoin Spiral by nostr:npub1r00t03pv2kxpes5x676xu3j2e0ag8hmmtzv8et0matxg876tnkgsp5sqe8 https://video.nostr.build/d6bff03c31d69d2a6f5c2d67c807c7a34cdad5b794a5b4a248bb846df55a5918.mp4

Samourai Wallet Dev out on bail.

A letter filed on July 3rd reveals that the 🇺🇸 US gov. has agreed to release William Lonergan Hill, also known as TDev, on bail.

Hill is set to appear in NYC court next week, following his uncontested extradition from Portugal.

Via L0laL33tz

Reminder: Keep your private keys separate from your car keys 👀

NEW: The High Court in London has issued a Worldwide Freezing Order (WFO) against Craig Wright, requiring him to pay £1.548 million to cover Peter McCormack’s legal fees from the 2019 defamation case Wright filed against him.

It ain't much, but stacking sats is humble work.

NEW: 🇩🇪 German lawmaker, Joana Cotar, says her country selling their #Bitcoin is “not only not sensible, but counterproductive.”

“Instead of holding #Bitcoin as a strategic reserve currency, as is already being debated in the USA, our government is selling on a large scale. I informed [other MPs] why this is not only not sensible, but counterproductive and invited them to our lecture event with Samson Mow "Bitcoin Strategies for Nation States" on October 17th.”

NEW: Mt. Gox transfers 47,228 #Bitcoin ($2.71 billion) from cold storage to a new wallet.