A 1 million sat channel (0.01 BTC) on the Lightning Network can now settle payments up to $612 at a time.

A 10 million sat channel (0.1 BTC) can settle payments up to $6123 at a time.

This can happen millions of times over the life of a channel.

?cid=6c09b952hpwt4h968vqnnbb0hfqcnkjf6jte1tntso0wymk3&ep=v1_internal_gif_by_id&rid=giphy.gif&ct=g

?cid=6c09b952hpwt4h968vqnnbb0hfqcnkjf6jte1tntso0wymk3&ep=v1_internal_gif_by_id&rid=giphy.gif&ct=g

#lightningnetwork #Bitcoin

This is the signal.

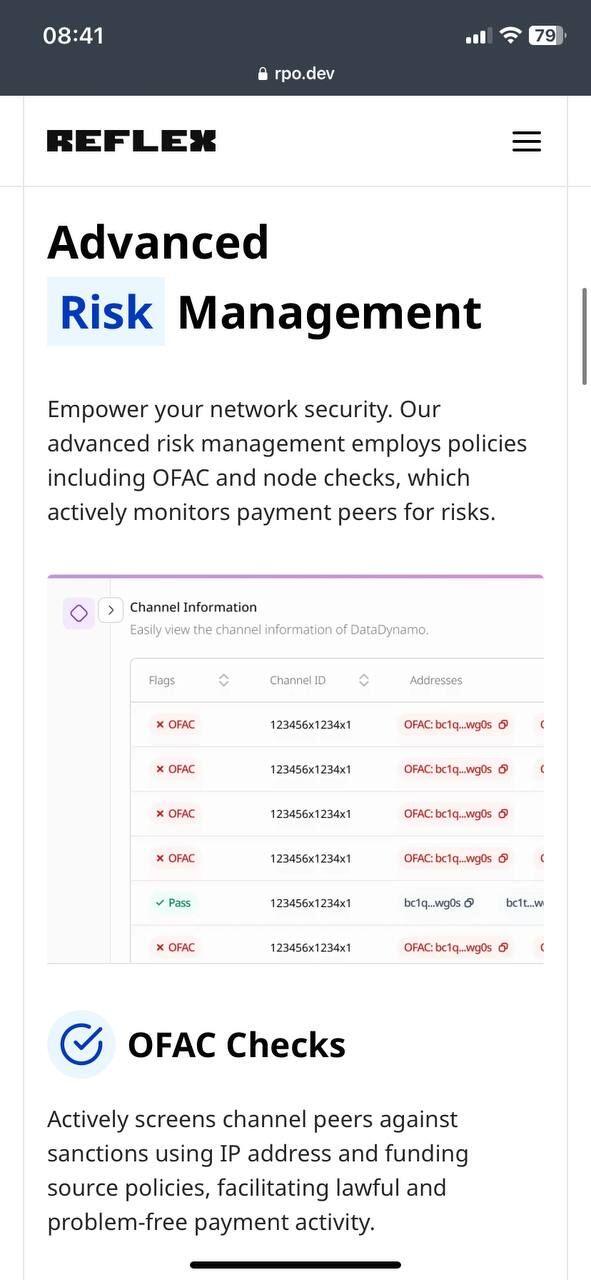

Regulated companies will choose their own policies for ecash and lightning operations in general.

For this, we built Reflex Payment Operations.

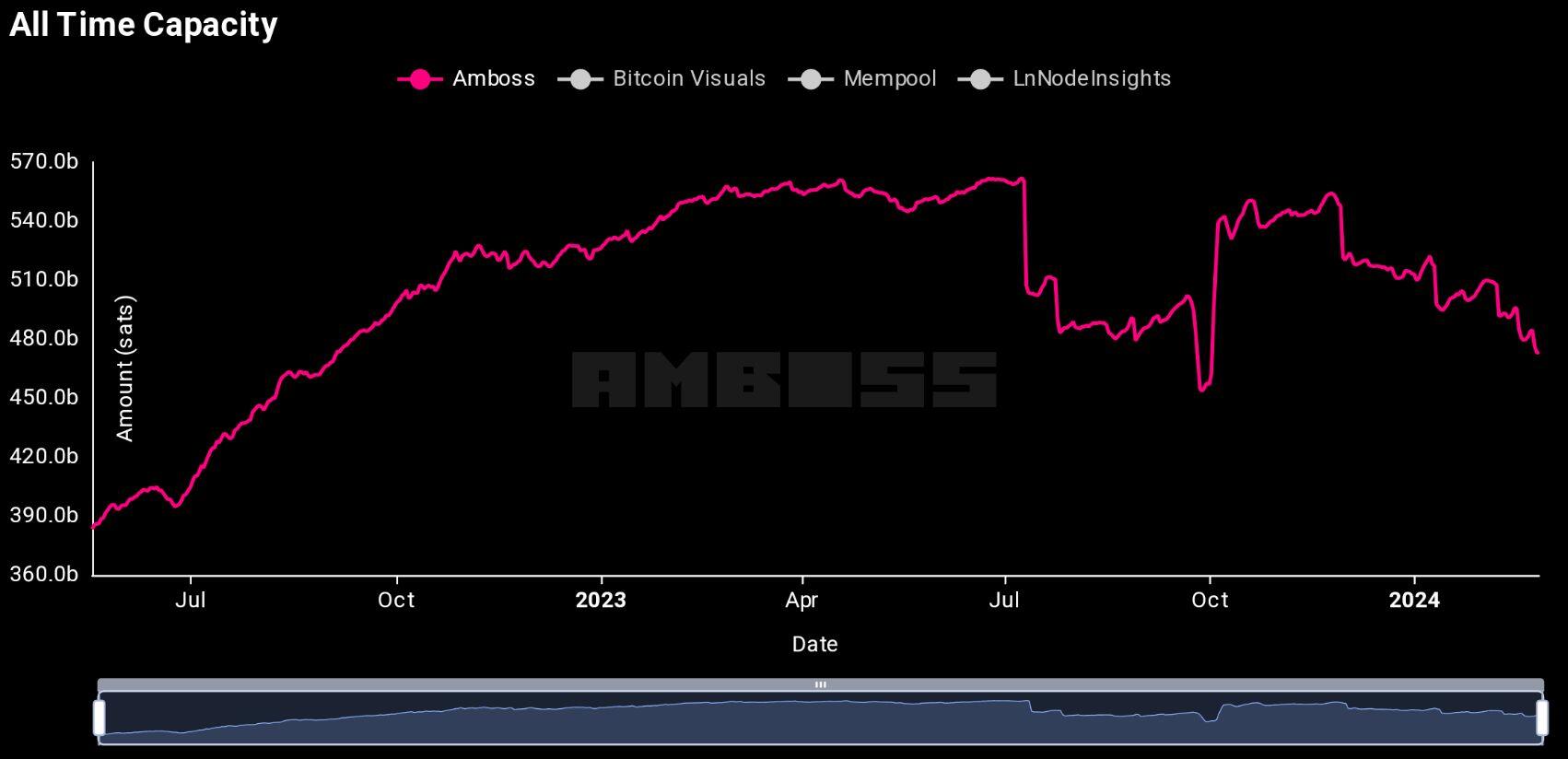

NEW ATH FOR LIGHTNING CAPACITY!

Lightning Network settlement capacity has reached a new all time high at $268M in USD terms.

In BTC terms, the capacity has decreased while anecdotal transaction activity has increased. This is a testament to the efficiency of settlement on LN.

#lightningnetwork #amboss #lightning #ATH

Learn more about #Reflex and Navigating Regulation for #Lightning Companies!

https://youtu.be/vflMYMXfnIY?si=NevzYDbHe55Hwh5J

Here is our presentation first delivered at nostr:npub1dwah6u025f2yy9dgwlsndntlfy85vf0t2eze5rdg2mxg99k4mucqxz7c52 in Buenos Aires, Argentina.

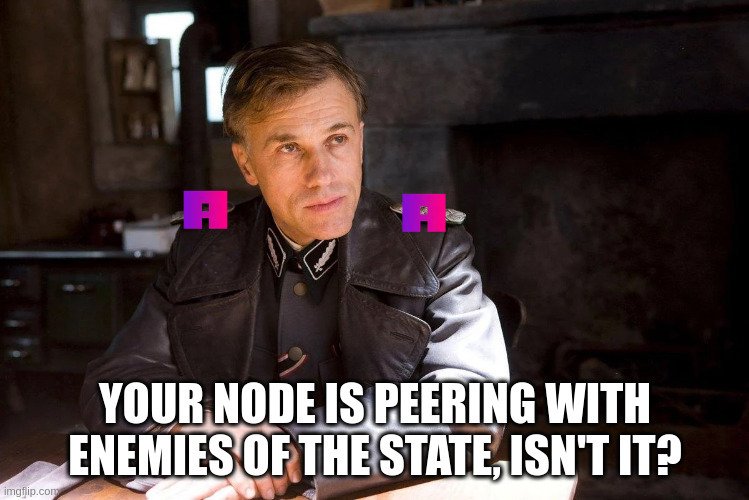

We all have to live in the existing system. I understand this.

I suppose my objection lies in the bridging of the two systems. Don't bring the rot of the old system into the new system. It's already being corrupted enough by existing on ramps but those on-ramps are just a bridge that should be burned on the way to freedom when they're not needed anymore.

What nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea is doing is giving the State tools within the new system to surveil and subjegate users and companies. You cannot comply your way our of tyrrany.

Choosing the easy path of compliance is a great way to make fiat gains so more businesses can "on board" to bitcoin. But what are they onboarding to? What precedence does this set in the minds of these business owners? Ofc you'll hear from all of then how onerous the State is, but why not develop sly round about ways to circumvent the State?

Furthermore, businesses afraid to use Bitcoin because of the regulatory regime are not the ones I want using Bitcoin.

This is a technical revolution. If you don't have the stomach or spine for doing what's right even when labeled wrong, just stay in flat land.

Disappointed in nostr:npub1clk6vc9xhjp8q5cws262wuf2eh4zuvwupft03hy4ttqqnm7e0jrq3upup9 and disappointed that a "Bitcoin" company isn't building freedom tech.

Two companies to be wary of now: Swan and Amboss. They claim to be Bitcoin companies but do not exhibit a good ethos.

Just my two sats.

Once you understand that this is an internal policy tool for businesses and not a tool for enforcement, you'll begin to understand how fundamentally different Reflex is compared to existing products.

Reflex is closer to an approved vendor list than anything resembling a speed trap.

You make the internal rules. You apply them. Now it's easier to talk to a bank because you have proof that you didn't pay XYZ because you applied internal rules.

The point is enable more businesses to use lightning, not enable more enforcement actions.

This is decently accurate, unfortunately. Leave politics to politicians; let the builders continue to build instead of wasting time on building in-house compliance.

We have an upcoming feature which will support saying "enough is enough" with operational data. Even some of the strictest regulations have an exemption for things that are "technically infeasible".

#memes #funny #reflex

Creating and maintaining a consistent policy is critical for any fintech businesses that need bank accounts or licensure. This is especially the case for Lightning Network businesses.

Our goal with Reflex is to operationalize defensible business policies.

amboss.space/hydro

You can make a one time purchase here!

It's easy to take shots at any form of compliance tool, especially after seeing incumbent providers pursuing enforcement actions. What's harder is doing the work of interviewing lightning businesses to understand their key pain points.

Last quarter, we completed 26 interviews of Lightning businesses and found that this was a critical component for the lightning ecosystem that was stalling product launches, interfering with bank account setups, or drowning startups in legal bills. We know many of these pains because we experienced most of them ourselves.

To address this taboo pain point, we built Reflex not for enforcement actions, but for the risk management basics that regulated businesses need in order to thrive. We all need lightning to be successful and sometimes that means addressing the elephant in the room that lightning businesses need better tools to show that they aren't associated with money laundering or terrorism while using a private payment system.

To be clear: a win for Amboss is more successful lightning businesses, not more enforcement actions.

Reflex is now in beta to reduce the regulatory hurdle that many LN companies encounter but rarely discuss.

rpo.dev

Sign ups begin today following our presentation at nostr:npub1dwah6u025f2yy9dgwlsndntlfy85vf0t2eze5rdg2mxg99k4mucqxz7c52 in Buenos Aires 🇦🇷

Maybe could be a good property to add into magma order the "reason" #noderunners reject some orders. Like in a couple of cases, "can't reach node". It's a good info to make decisions later on. nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea

💯

Lots of improvements in the queue for Magma. This is a big one.

These are leases on payment infrastructure. Payment for channels for a specified duration with enforcement by reputation score.

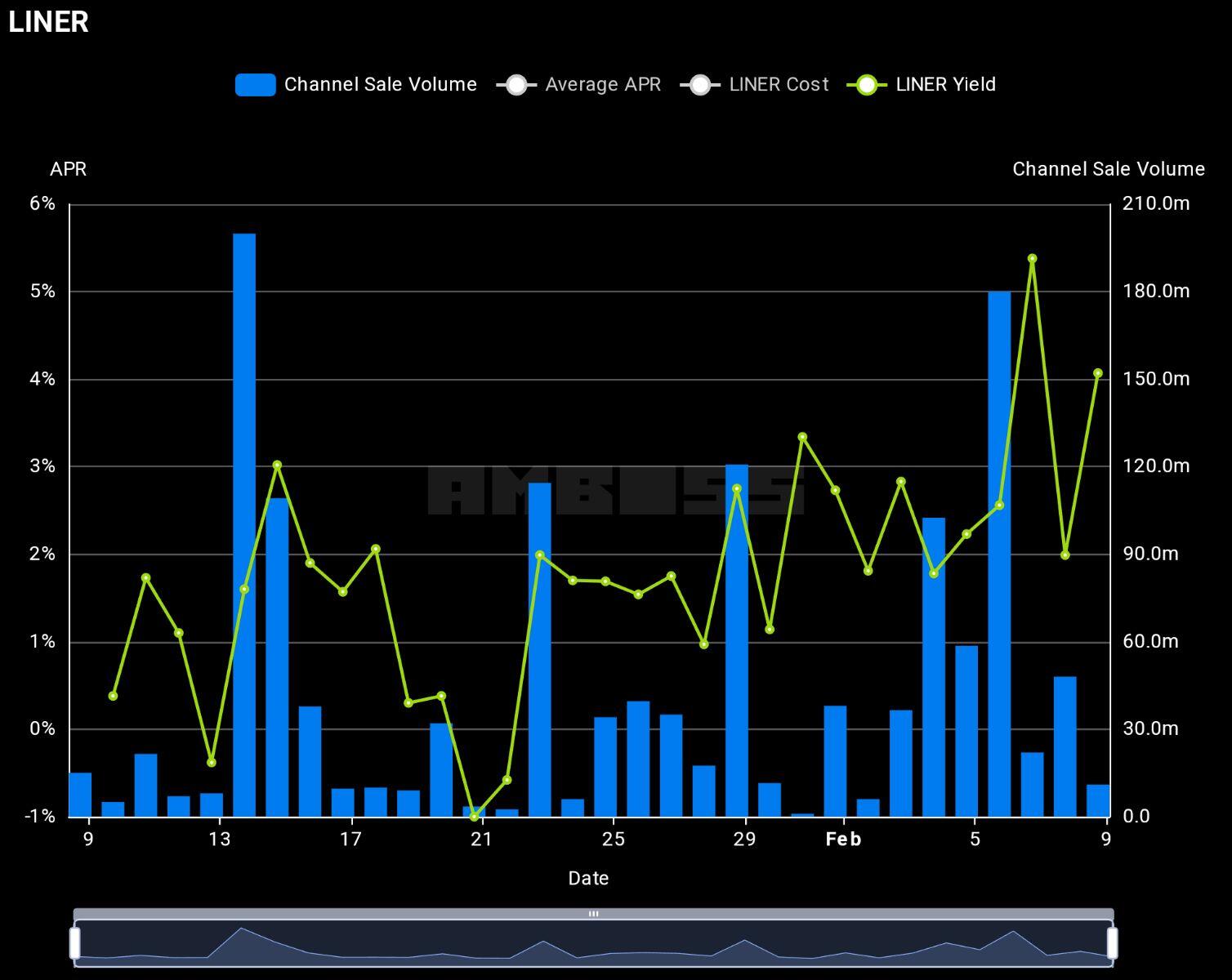

Yields on lightning have shot upward this past month, exceeding 5% APY for the first time.

This is a great sign for lightning-native yield and specifically yield that doesn't sacrifice self-custody.

#m=image%2Fjpeg&dim=1508x1200&blurhash=%2354Cbuadnfo%23m%7EociYt8W%5DHqWap0jWo%25oHp0oHoa%24fozRjoMbxogbyaijWTOoZaIkEnff9nya%24o%24%24FkEWas*W%5BjYg5oHjWOen%7Ej%3Bj%5EjXoynzbdj%5Enet3ohj%5BoHkCayjYfm&x=6d7bfd8ca9ec5435dbbaf54b413a5f0199e71b97441b01870a75f1ccc180286b

#m=image%2Fjpeg&dim=1508x1200&blurhash=%2354Cbuadnfo%23m%7EociYt8W%5DHqWap0jWo%25oHp0oHoa%24fozRjoMbxogbyaijWTOoZaIkEnff9nya%24o%24%24FkEWas*W%5BjYg5oHjWOen%7Ej%3Bj%5EjXoynzbdj%5Enet3ohj%5BoHkCayjYfm&x=6d7bfd8ca9ec5435dbbaf54b413a5f0199e71b97441b01870a75f1ccc180286b

We've been swamped with orders for liquidity on lightning this past week, which has been a great opportunity to load test hydro.

We've identified several areas for improvement and made several fixes already. Thanks for your support of the liquidity markets on both sides (buyers and sellers)!

amboss.space/magma

Just decided to support nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea folks and purchased their membership. I don’t need it at all for my node, but felt that they’ve been doing a good job supporting lightning ecosystem, and I want for it to thrive. 🐶🐾🫂🫡

🫂 ⚡

No additional risk than opening a lightning channel.

Our Magma marketplace is currently supply constrained, meaning more buyers than sellers for liquidity on the lightning network

If you run a lightning node and are looking to earn some non-custodial yield, start selling channels on Magma.