Sup guys

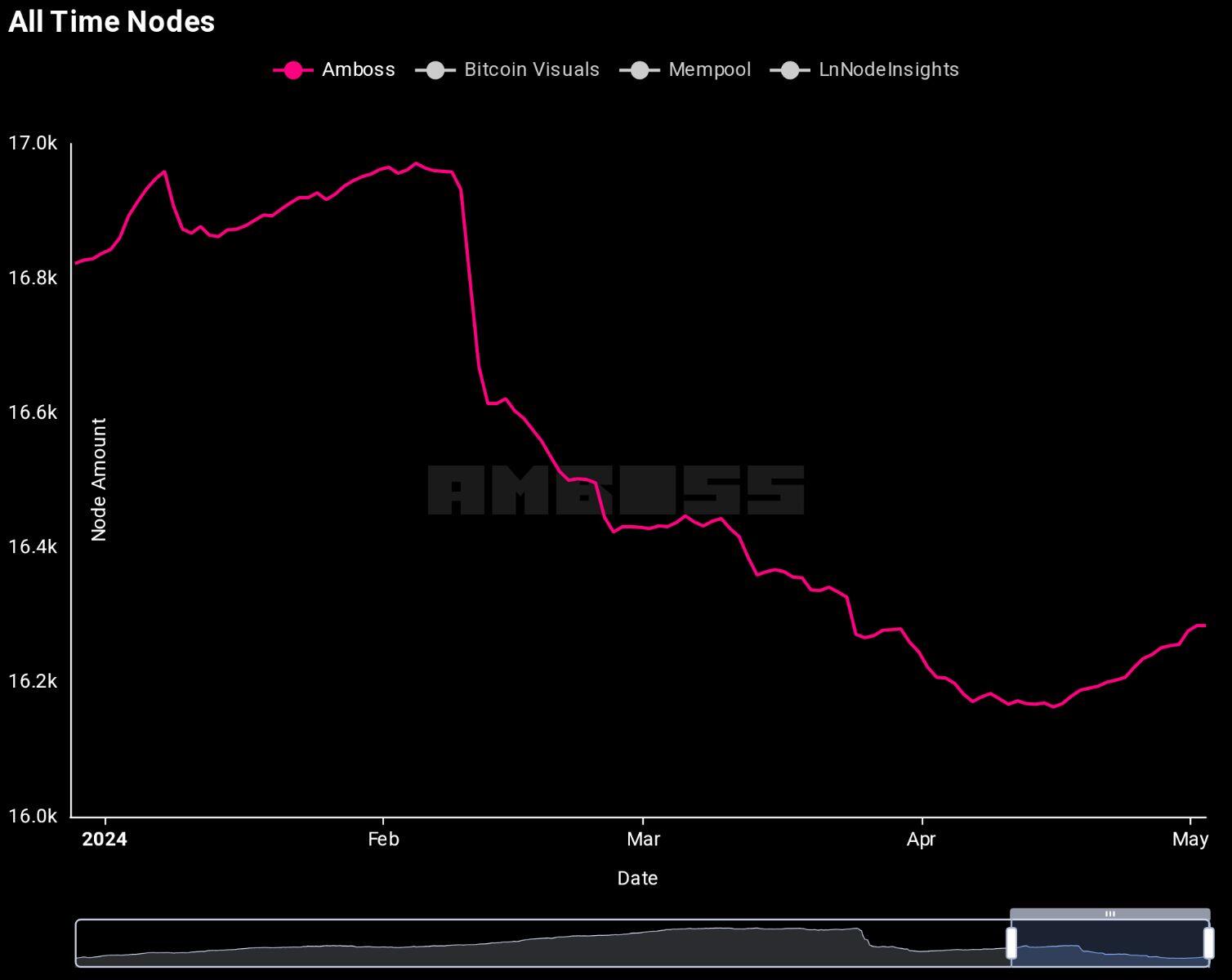

Only public nodes are shown on amboss.space, not private ones.

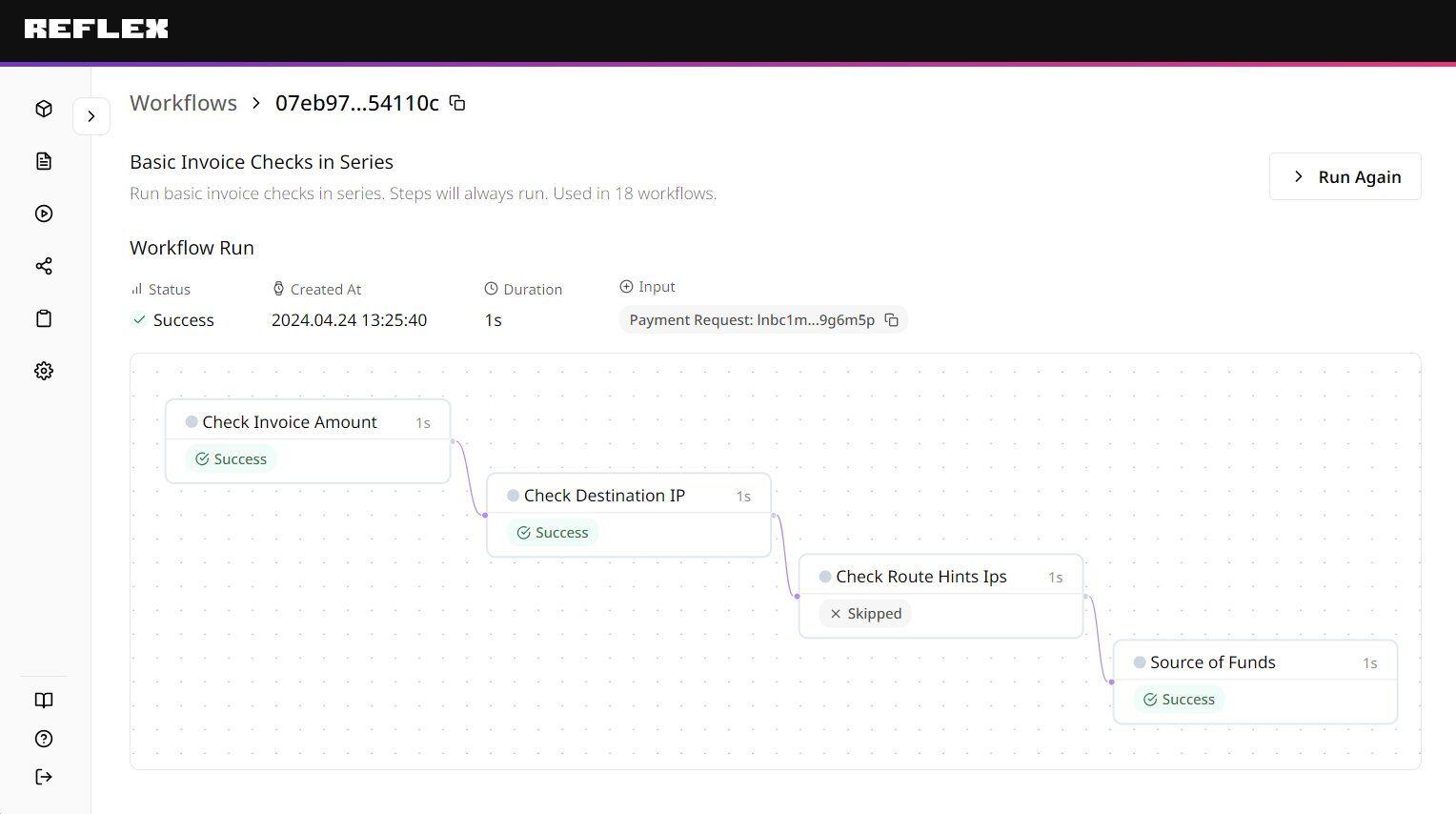

Want to learn more about how Reflex supports payment operations?

Here's BitcoinBufo describing the configurable rules engine that Reflex delivers.

youtu.be/G4CpeLm6eGc

You can also experience it for yourself at RPO.dev!

To manage your lightning node, you need to maintain liquidity from the rest of the network.

The easiest way to achieve that is with Hydro, which will automatically provision liquidity by paying the lowest market rate for liquidity.

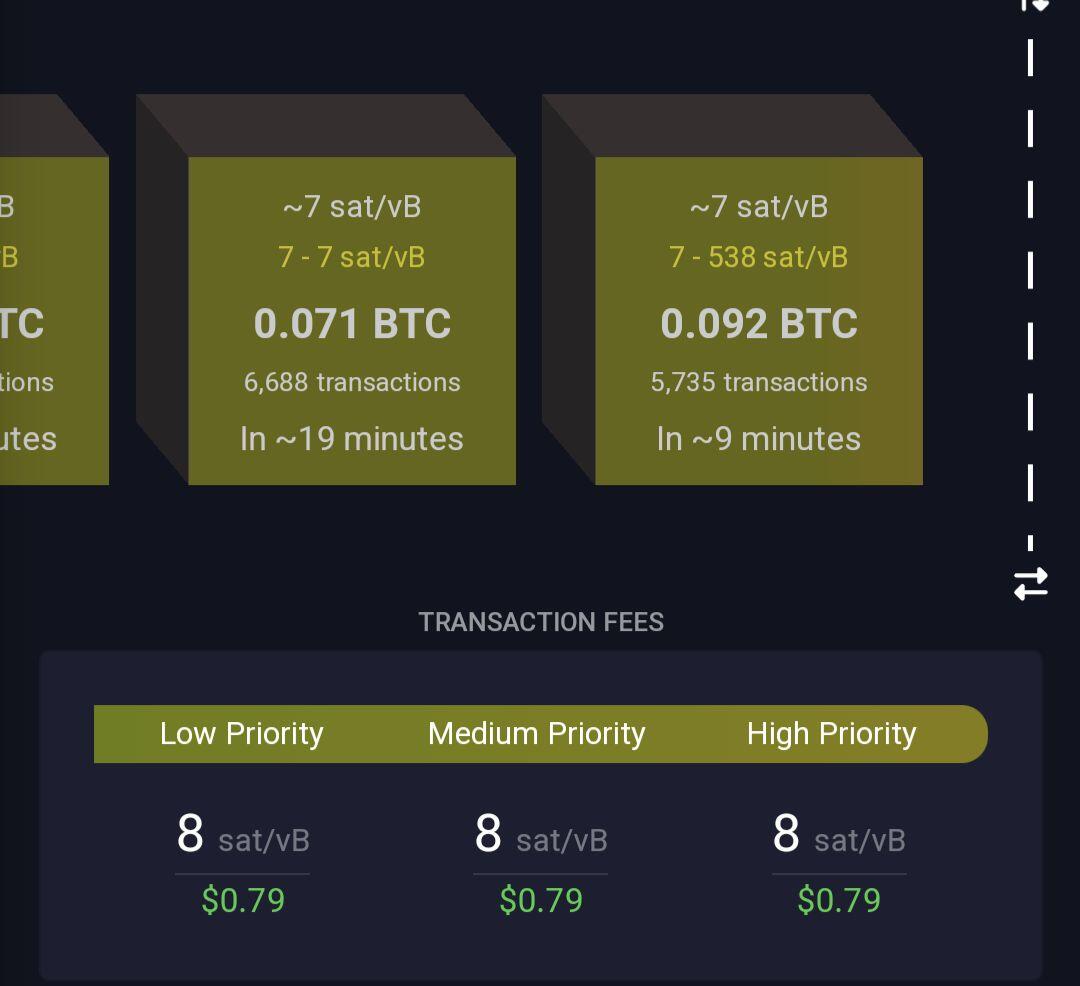

Sold another channel on #magma using nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea . First one for the month of May.

This time made a small profit thanks to the Low transaction fees. I think my goal is to sell one to two channels a month.

Grow the network 💪 provide liquidity!!! 💧 🌊

When people sign up for Hydro, they'll buy liquidity automatically

Which error?

It's usually because you already have one.

What does nostr:npub19tcpurtt6xulhw0r6sc404j9jraj0h8me2lzs7z2tqewz7l0hpas59nlea charge for their ghost address service? What does the infrastructure look like and cost to maintain for this? (What would you have to charge?)

It's a free service and we only charge for vanity addresses.

Ghost addresses are a fun feature, but not a revenue driver.

Running a business means tough choices!

The implementation of ghost addresses uses Thunderhub and is about 20 lines of code for anyone that'd like to implement it.

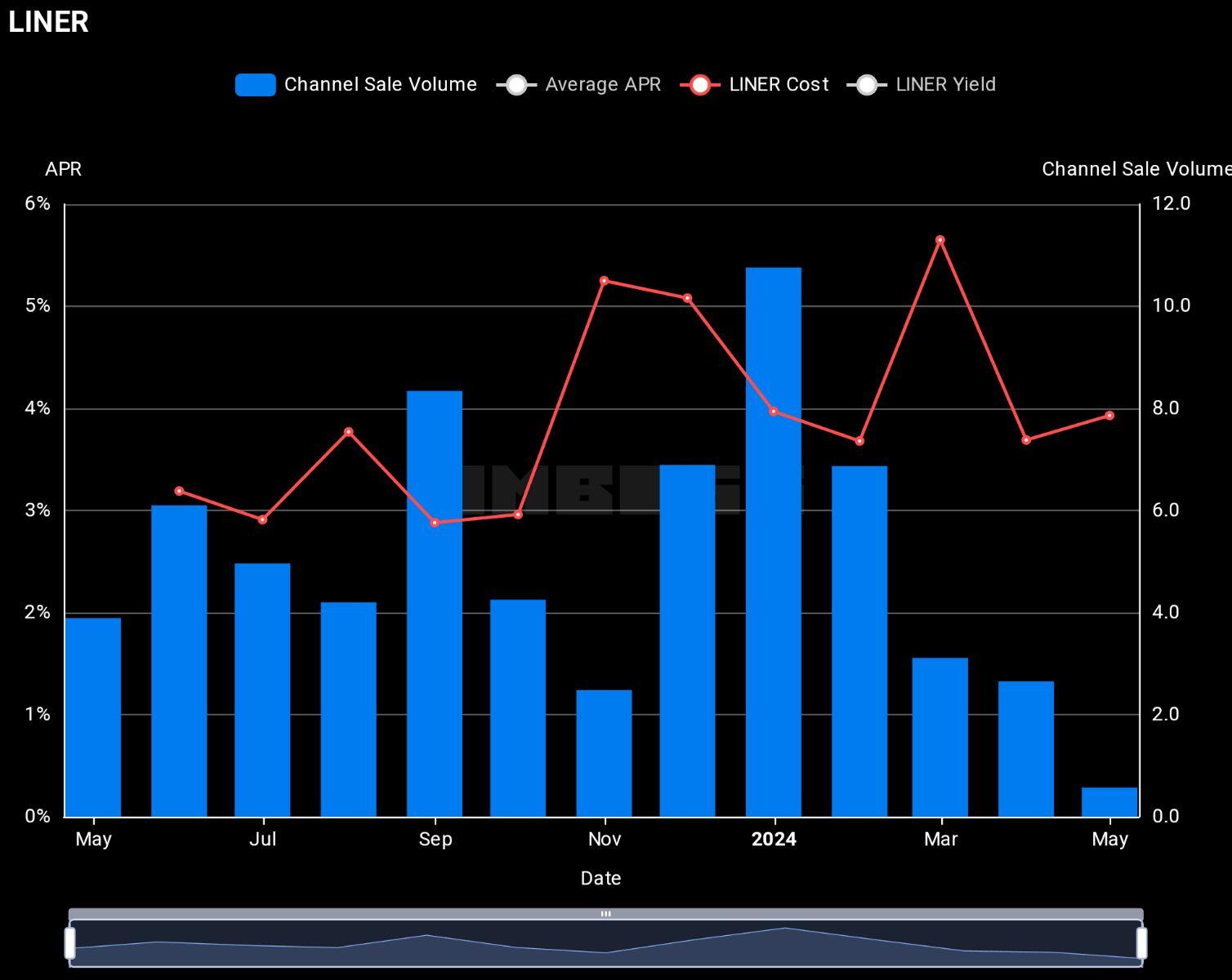

The LINER (Lightning Network Rate) has two sides: liquidity buyers and liquidity sellers.

Liquidity buyers are leasing swap space for payments. Since transaction fees have risen, the cost of capital for that swap space has risen.

This is tracked as the LINER Cost. 🧵

Lightning channels are reusable payments infrastructure, gaining efficiency with each lightning payment versus on-chain Bitcoin transactions or traditional card payments.

The swap space required is the monthly *NET* payment inflows. Any payments made from a lightning business reduce the swap space required.

Lightning is therefore ideally suited for low margin businesses where payment processing costs are large relative to profit margins.

Lightning Network becomes a competitive edge for the pioneers of better payments.

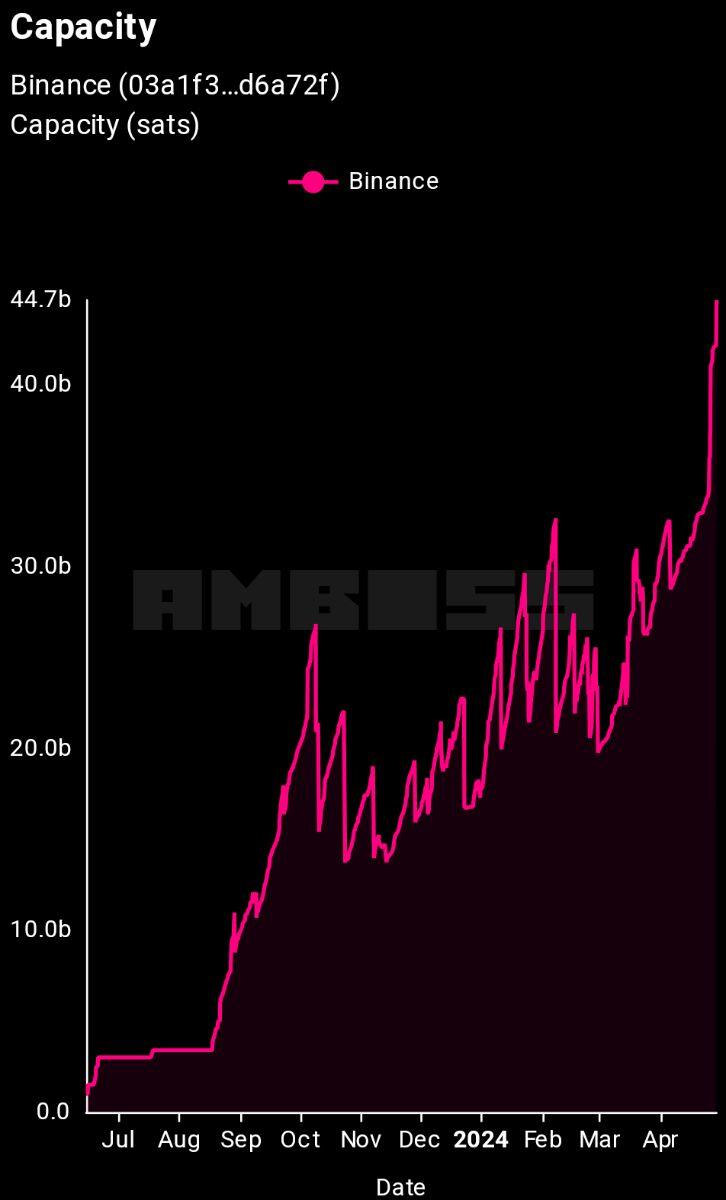

Lightning network capacity is trending upwards again in #bitcoin terms while holding steady in USD terms.

With exchange volumes expecting growth, are exchanges prepared for a high fee environment with a #lightningnetwork strategy?

Lightning nodes are resuming growth following the halving and recent news events.

There's a growing desire to build self-sovereign infrastructure and systems that respect privacy.

#lightningnetwork

Binance lightning node capacity is teleporting higher.

We're seeing fear ripple through the BTC and LN ecosystem after the recent US enforcement action.

The chilling effect is devastating to US innovation and the network effect of better payments technology.

The best counter to fear is taking a risk management approach.

It's vital to protect businesses and builders of this innovation.

Let's figure out the path forward and protect better payments technology in the US.

DM sent 🤝

Sending money around the world is extremely easy thanks to bitcoin and lightning.

How can a business best protect their operations amidst regulatory crackdowns?

Simple risk management.

Taking proactive steps now to reduce risk pays dividends with documented efforts.

We don't currently have one.

We haven't been subpoenaed by law enforcement to provide data about our users.

We also do not store data in a way that is useful for breaking payment-level privacy, so demanding our data would be pointless.

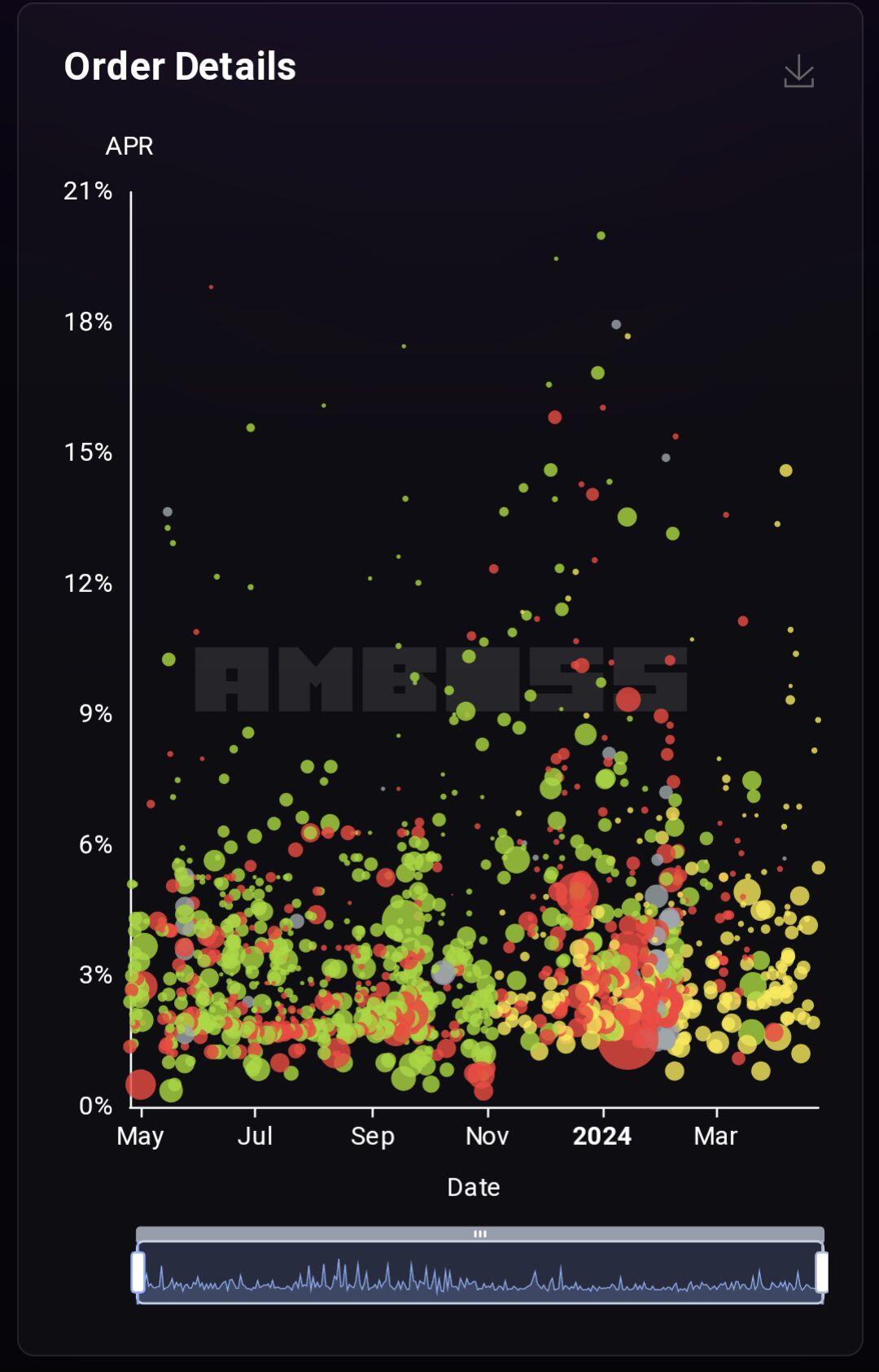

Buying lightning channels typically stops completely during high fee spikes, as visualized in Magma channel sales:

Lightning is perfect to avoid these events with existing channels.

Sustained high fees, however, drive channel purchases. Why do a single use transaction when you can make a reusable channel txn?

## Need liquidity to your node?

Use Hydro. https://amboss.space/hydro

## Want to become an LSP by selling channels?

Use Magma. https://amboss.space/magma

For regulated Money Service businesses, having an effective AML program is essential.

We've learned that existing solutions are:

1) too expensive

2) too invasive

3) ineffective for lightning

To prove it can be better, we're launching a free trial of our continuous monitoring.

Is this for every node on the lightning network?

Absolutely not.

Running bitcoin infrastructure is freedom in finance.

Running a Money Service Business is specific, regulated activity that operates within a jurisdiction and must abide by AML laws as well as OFAC.

For other businesses that send payments, bitcoin is digital cash of the future that's primed to help businesses grow: it's like hooking your business up to the internet.

Unfortunately, that doesn't stop wild accusations of terrorist finance occurring in bitcoin.

The early days of the internet scared regulators into thinking it's only for drug dealers and pornographers.

The reality is much different: the internet is for cat videos.

The future of finance shouldn't get bogged down by naive accusations of terrorism and money laundering.

Instead, bitcoin businesses need our support to show that commerce can happen on better financial rails with bitcoin. It's not money for criminals; it's money for humanity.

What's needed for businesses is a consistent program that demonstrates precautions against funding terrorists and money launderers. That doesn't need to be expensive or invasive.

We'll prove it with a 14 day trial of continuous risk monitoring.

In a daily email, your business will receive actionable steps to avoid:

* OFAC Risks,

* Ransomware,

* Sanctions violations

This is part of a comprehensive program to secure your lightning operations against risks, and minimize the attack surface for unhinged accusations.

To find out more about our Reflex Payment Operations suite for businesses, visit https://rpo.dev .

#bitcoin #complaince #AML #riskmanagement #crypto #defi #sanctions

Following Bitcoin's fourth halving, bitcoin mining pools will be looking for ways to improve experiences for miners in their pool. That means lower payout thresholds and shorter waiting times by integrating payouts on the Lightning Network.