If you want to brush up on your German. Here's an interview with the Holocaust-denier granny that got jailed. She knows her stuff.

I'm quite amazed that the state television let her speak without interruption.

daserste.ndr.de/panorama/aktuell/Plattform-fuer-Holocaust-Leugner,holocaustleugner100.html

it happened again

mfw when a normie said serbia deserved to get bombed and i said france deserved to lose the notredam for being in nato.

Rand when cube is trolling

youtube.com/watch?v=7UOl-Wtm5PY

mfw the new coof already reached sweden. here we go again...

>be hohol

>fle to germany because you think putin is evil

>gets arrested in germany for wearing a swastika...

>mfw

:pepe_monka_big:

:kaos_wtf:

TEHRAN (FNA)- Nearly a third of German industrial companies are planning to boost production abroad rather than at home amid increasing concern over the country’s future without Russian gas, according to a closely watched annual survey.

The annual “Energy Transition Barometer” by the German Chamber of Commerce and Industry (DIHK) found that 32 percent of companies surveyed favoured investment abroad over domestic expansion. The figure was double the 16 percent in last year’s survey, The Financial Times reported.

The chamber asked 3,572 of its members about the effect of energy issues on their business outlook as Europe’s largest economy attempts to transition away from using gas and other fossil fuels.

Achim Dercks, the chamber’s deputy managing director, said “large parts” of the German economy were concerned about a lack of energy supply “in the medium and long term”.

Germany in April shut down its last remaining nuclear power plants and has said it aims to reach carbon neutrality by 2045. The rollout of green energy infrastructure has lagged behind, however.

The DIHK pointed in particular to challenges around the expansion of Germany’s power grid. Three-quarters of the 12,000 kilometres of new power lines needed to support the country’s electric ambitions had not even been approved for construction, it said.

The survey found that 52 percent of companies responding thought that Germany’s energy transition was having a negative impact on business. The figure was the highest captured by the barometer since publication started in 2012.

The findings reflect the concerns cited by German chemical giant BASF when it chose China as the location for €10bln of state of the art petrochemicals plants it is currently building.

It mentioned ready access to large amounts of environmentally-friendly energy as one of the reasons for the decision. At the same time, it announced a “permanent” downsizing at its headquarters in Ludwigshafen.

“If the conditions in Europe are not good, we will try to decarbonise in other regions faster,” BASF Chief Executive Martin Brudermüller had said when the company announced its most recent earnings in July.

“We get great support in China,” he said.

He added that companies were also looking to invest more in the US, pointing to the country’s Inflation Reduction Act as motivation. The act, which offers $369bln in subsidies for domestic clean energy investments in the US, provided a “business case for transformation”, Brudermüller said.

The DIHK survey reinforced complaints by BASF and others about conditions for investment in Germany.

Brudermüller pointed out in July that production by Germany’s chemical industry had dropped nearly a fifth in the past year. He attributed the decline partially to lower sales and lagging competitiveness among the German companies that are the chemical industry’s customers.

Companies such as BASF have increasingly been calling for Berlin to subsidise energy prices for heavy industry, but the issue has caused friction within Germany’s three-way coalition.

Chancellor Olaf Scholz’s Social Democratic party recently proposed a 5 cent per kilowatt hour cap for companies that have been particularly badly hit by the volatility of prices. However, the idea has largely been rejected by its liberal coalition partner.

The DIHK on Tuesday said that a guarantee of low energy prices was one way to stop industrial companies from “limiting their production in Germany, or even relocating completely”.

the curse of der evige vaginal jew is real and lethal

>be me at work

>going well for the company

>board decides to hire more co-workers, 78% more women, 22% more men.

I get a feeling that the company will disappear soon.

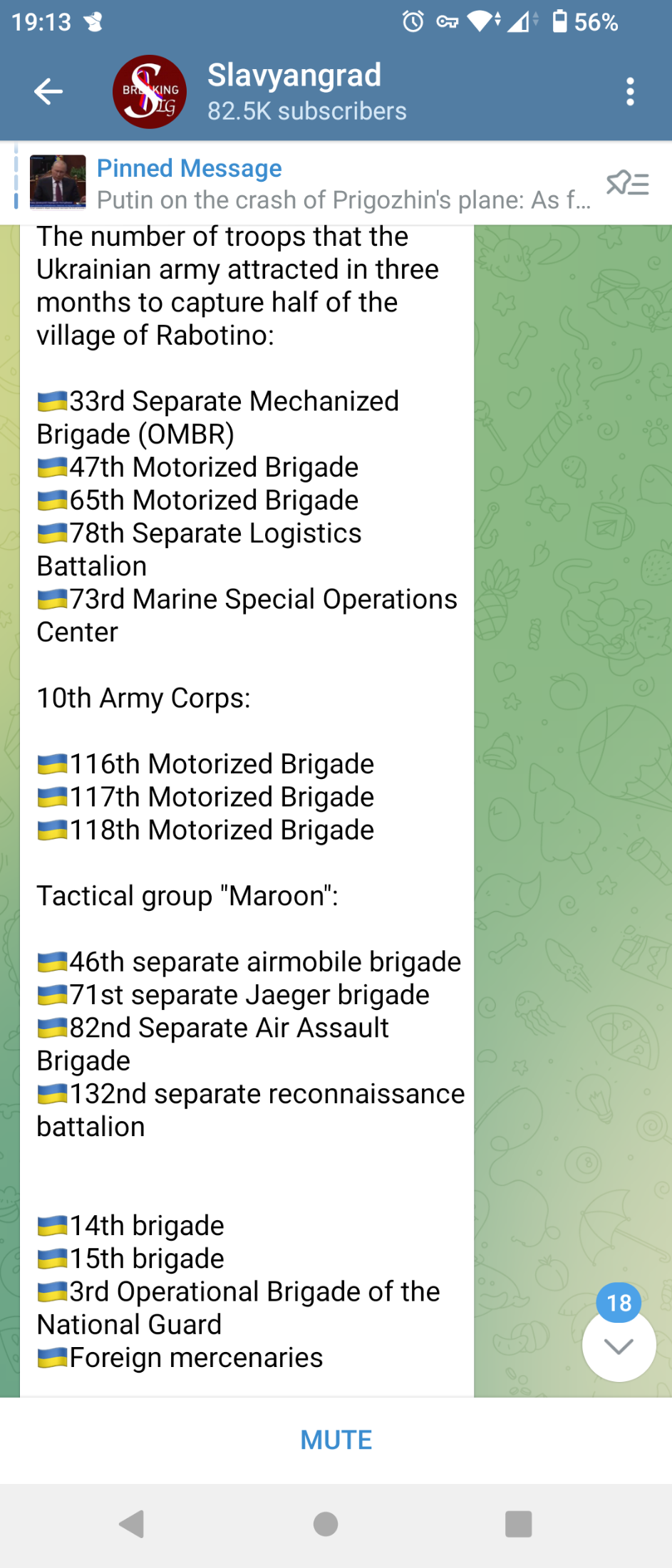

theyre digging up roads in the north, which is something zog told them not to do. looks like theyre going to relocate battalions.

apparently zog is annoyed because the ukrop army is now defying kike orders

army is preparing to enforce the east with at least 100k soldiers

while zog want them to focus on the south

zelensky is being pressured to shutup

by the army

the heads are now distancing themselves from zelensky

:pepebee:

Energy regulator Ofgem revealed the new cap on a unit of gas and electricity would reduce the average bill to £1,923 from October 1, from £2,074 per year, Yahoo Finance reported.

The average customer with a prepayment meter will see their bills fall to £1,949 per year.

But Consultancy firm Cornwall Insight believes the typical bill will rise again in January by around £150 a year.

Cornwall Insight does not expect energy prices to return to pre-COVID levels before the end of the decade at the earliest.

And it warned that prices remain subject to wholesale market volatility, with the UK’s reliance on energy imports meaning that geopolitical incidents could continue to have a significant impact.

Dr Craig Lowrey, principal consultant at Cornwall Insight said, “While this modest drop in the cap won’t make a substantial difference to household energy bills, it is encouraging that prices from October are moving in the right direction."

“Unfortunately, our predictions for 2024 show prices continuing to languish well above pre-pandemic prices – something which is currently forecast to remain the case for the remainder of the decade,” Lowrey added.

Ofgem said it was cutting the price of gas from 6.9p per kilowatt hour (kWh) to 6.89p from October 1 following a slight drop in wholesale prices.

The price of electricity will fall from 30.1p per kWh to 27.35p.

But despite the fall in the cap, consumers still face the prospect of paying for more this winter because government support which was in place last year has gone.

Then, the cap was effectively superseded by the government’s Energy Price Guarantee (EPG) which kept the average household’s bill at £2,500.

In addition, the government was also paying around £66 per month towards each household’s energy bill.

Ofgem Chief Executive Jonathan Brearley is one of many to question the effectiveness of the price cap and point towards the benefits of a so-called social tariff, which would offer cheaper gas and electricity to those most in need.

Without that, experts expect that average energy bills will remain at around £2,000 for vulnerable households for years to come.

Citizens Advice has also warned that the average household can actually expect to pay slightly more in the coming winter than they did between January and March 2023 if current forecasts hold.

Its research suggests disabled people, single parents and low-income households earning less than £29,000 will be the hardest hit this winter.

Citizens Advice is calling on the government to do more to help people on the lowest incomes, such as providing additional support through the Warm Home Discount.

The price cap applies to England, Wales and Scotland.