Not based on any data or knowledge but I like to think the degens are having to sell their BTC aggressively to keep their shitcoin to BTC ratios afloat.

teahupoo?

Hey, remember that time nostr:npub1m0n0nautpnk0jntmg89kgjucfwygrsppcpf963um5eqkjehqwess7rd0un discovered these mining pools (in purple) were all in cahoots with Antpool?

We haven’t forgotten either.

🔥 #DecentralizeMining 🔥

🔗 https://blog.bitmex.com/pow-centralisation-hysteria-what-size-war-chest-is-required/

Braiins moving to Ant templates feels like such a rug.

“Drift” sounds like “Hack” in my head.

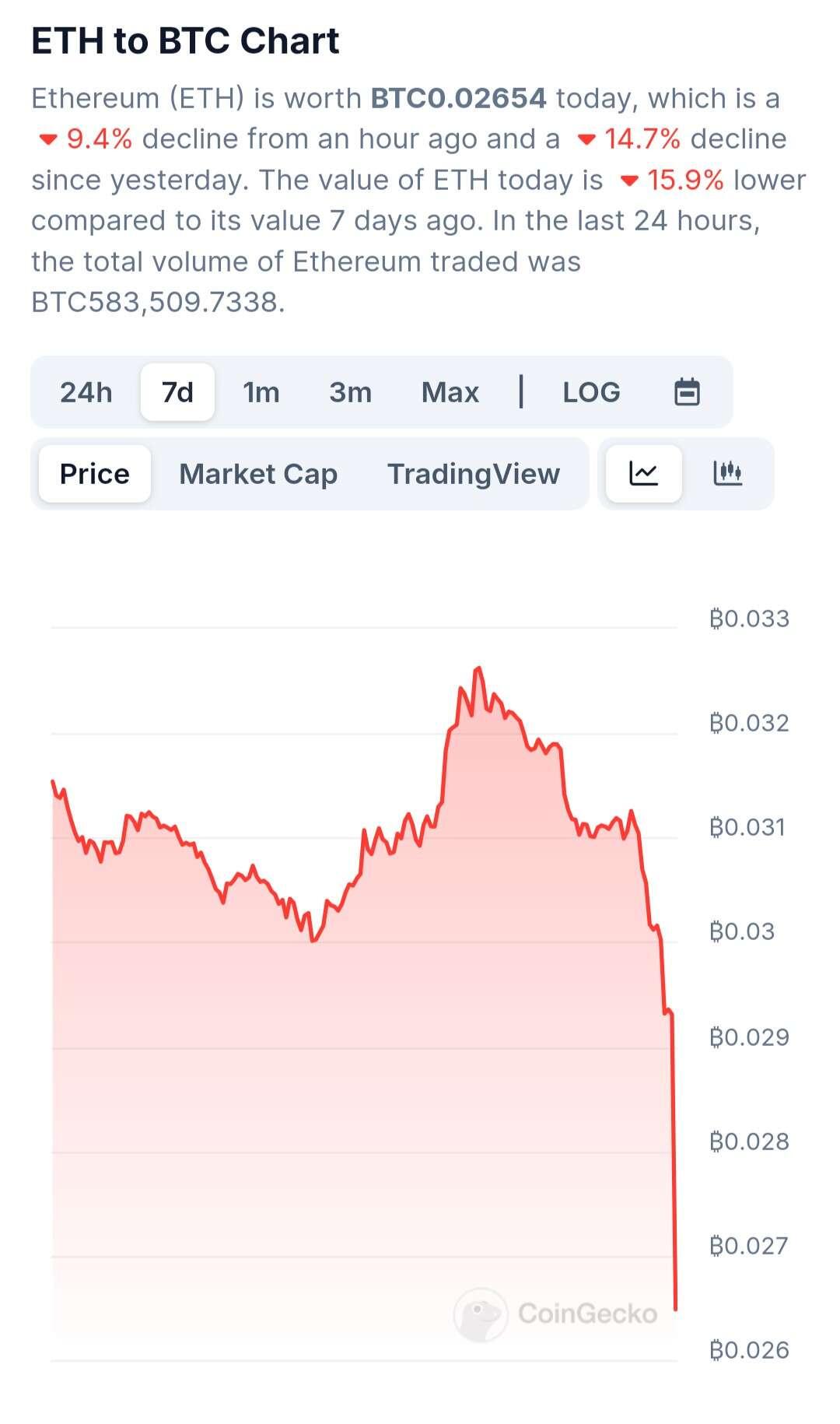

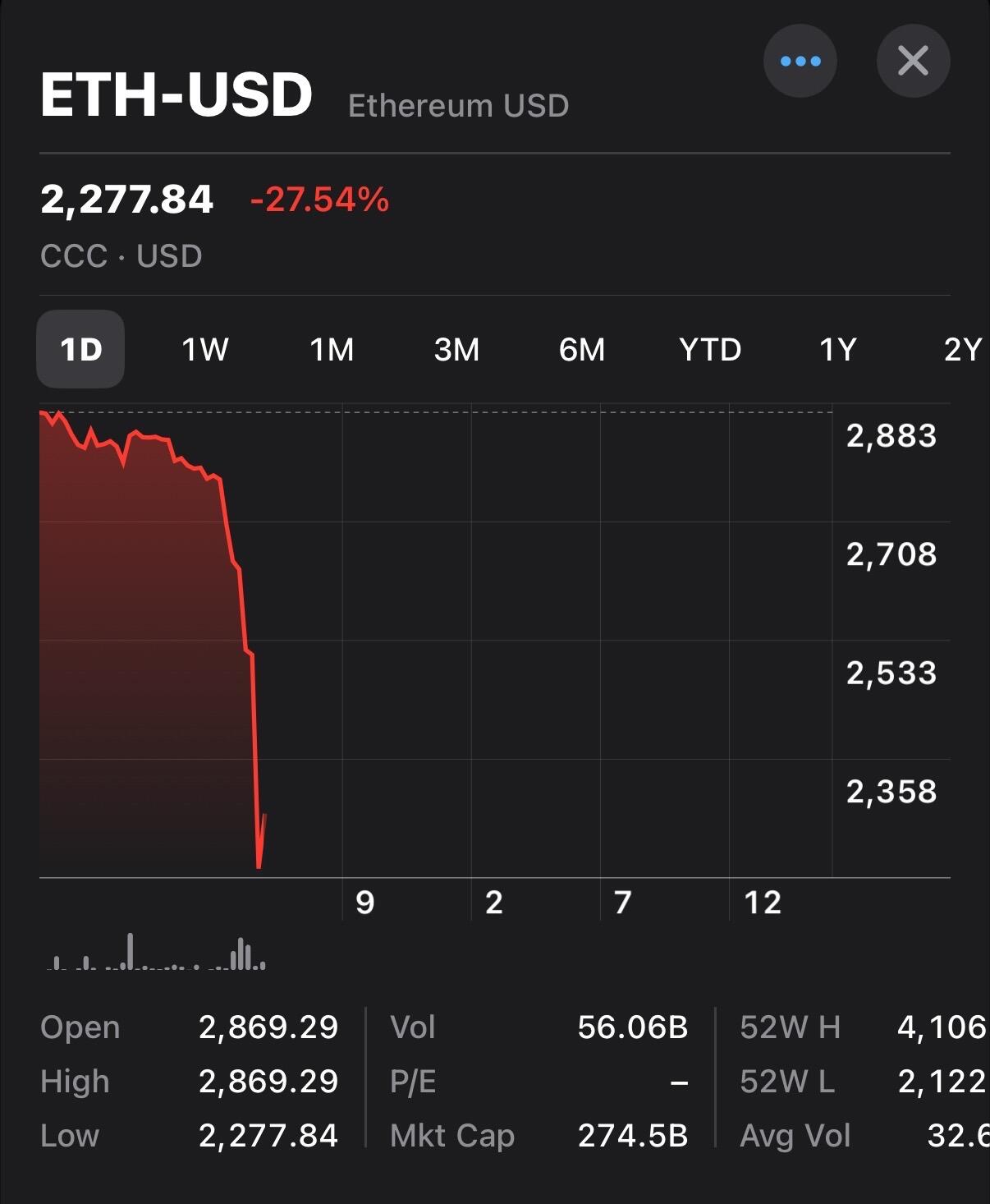

Floppening

I’m still interested in why F2Pool was mining way less transactions this week compared to other mining pools.

Interesting I was referring to self funded loans where you supply the bitcoin. The other format which I think is more in the lenders interest and risk management seems like a better setup. That structure still seems like a no brainer if you’re a lender that can make it happen.

I think they go down because the house decided to take profit rather than fund the illusion with previous profits.

This is hilarious, checked in with ETH earlier but missed this total capitulation. Love it.

Forgot to mention:

- Running #bitaxe with nostr:npub1qtvl2em0llpnnllffhat8zltugwwz97x79gfmxfz4qk52n6zpk3qq87dze nostr:note1452zfqdz0qwkkkcwsdryxdmw2maase6q4az704d7rer3dlhrd4sq29vpr9

Ocean is the only pool worth considering IMO 🧡

As i understand them the margin calls would be relatively frequent. I have not seriously considered them and am no expert. 10 year loans are pretty common in fiat, if that was the margin call timeline I’d be more interested. Still handing over your coins feels pretty risky whatever the terms or legal “protections”.

It a shame Schiff hates Bitcoin, I feel like Gold plays on the same team.

Has to happen / there is a lot of money that needs to get an “in” this cycle.

Yeah it’s an interesting concept but the timeline of any margin calls need to be built in at longer timeframes or it just seems like a trap.