I don't know, I like "reactions". I am more of a fan of nostr:nprofile1qqsf3d23f5vqdnkfrem3kmvfq5hf4puwszgfnvurn4syu0s6w53s50cpzdmhxue69uhhwmm59e6hg7r09ehkuef00lr5ay ability to add all kinds of reactions. I am NOT gonna zap every single post I come across on my Nostr. But I will send a reaction and acknowlege I'd seen it and make this person feel like they are not entirely alone talking to a wall all the time (after all 99.9999% of people on here do not get a daily 24 hour 1st position on the trending note spot on primal like nostr:nprofile1qqsqfjg4mth7uwp307nng3z2em3ep2pxnljczzezg8j7dhf58ha7ejgprpmhxue69uhhqun9d45h2mfwwpexjmtpdshxuet5qyt8wumn8ghj7un9d3shjtnswf5k6ctv9ehx2aqpr9mhxue69uhhxetwv35hgtnwdaekvmrpwfjjucm0d5klqft7 does every single day 😂). Most folks don't get any interaction whatsoever. So I may not wanna zap or comment but I will interact with a like.

Personally, I am not a fan of the heart ❤️ only reaction on primal because well often "love" is not my reaction.

1 sat zap > heart or thumbs up or whatever. Zap, repost or comment

X influencers who championed freedom of speech but also have bills to pay

I can zap you just fine

Likes are a cop out

nostr:note100p43ej87vh9c82z9v6j8hmlare0msnv8aetzsz2xuwlh4x6e9cq9mznrv

Who is going to give you an unsecured loan of 25k at 12%?

If you can get the loan, you don’t need it.

Lots of people will give you that loan.

If you buy a pristine asset and pay it back with an inflating piece of crap, you win.

Memba when the 10Y nearly hit 5% and the banking system started breaking? I memba.

Is nostr:npub1zh36wt34eav4tugmd3r7f4tr99suj6p9ps2ezneugdvyfvrw3rpqtx4qq9 posting on Nostr yet?

Analyses.

You are right, I don’t think this is advisable at a cycle top.

But it you can do it at a cycle bottom the results would be even better.

For sure: 33k turned into 138k in 5 years ain’t bad.

If you scale the risk correctly, the loan can accelerate your stacking significantly

If you took out a $25,000 unsecured loan 5 years ago, at 12%, you could have purchased roughly 3 bitcoin.

That monthly payment would be $556.11. Over the course of 5 years you would pay $33,366.60 in loan payments.

Buying $556.11 of bitcoin once a month during that same time period would have amounted to 1.38 bitcoin.

The loan, which gave you $25,000 in capital, has you up with more than double the bitcoin if you didn’t borrow.

Using 25% less capital, buying bitcoin in a lump sum significantly out performed a DCA strategy.

GM - do epic shit today

But come on, pay that. Chop, chop. Barry has a credit card bill to pay off. He was super generous at Christmas.

It’s for good cause. Give me credit and I pay you later.

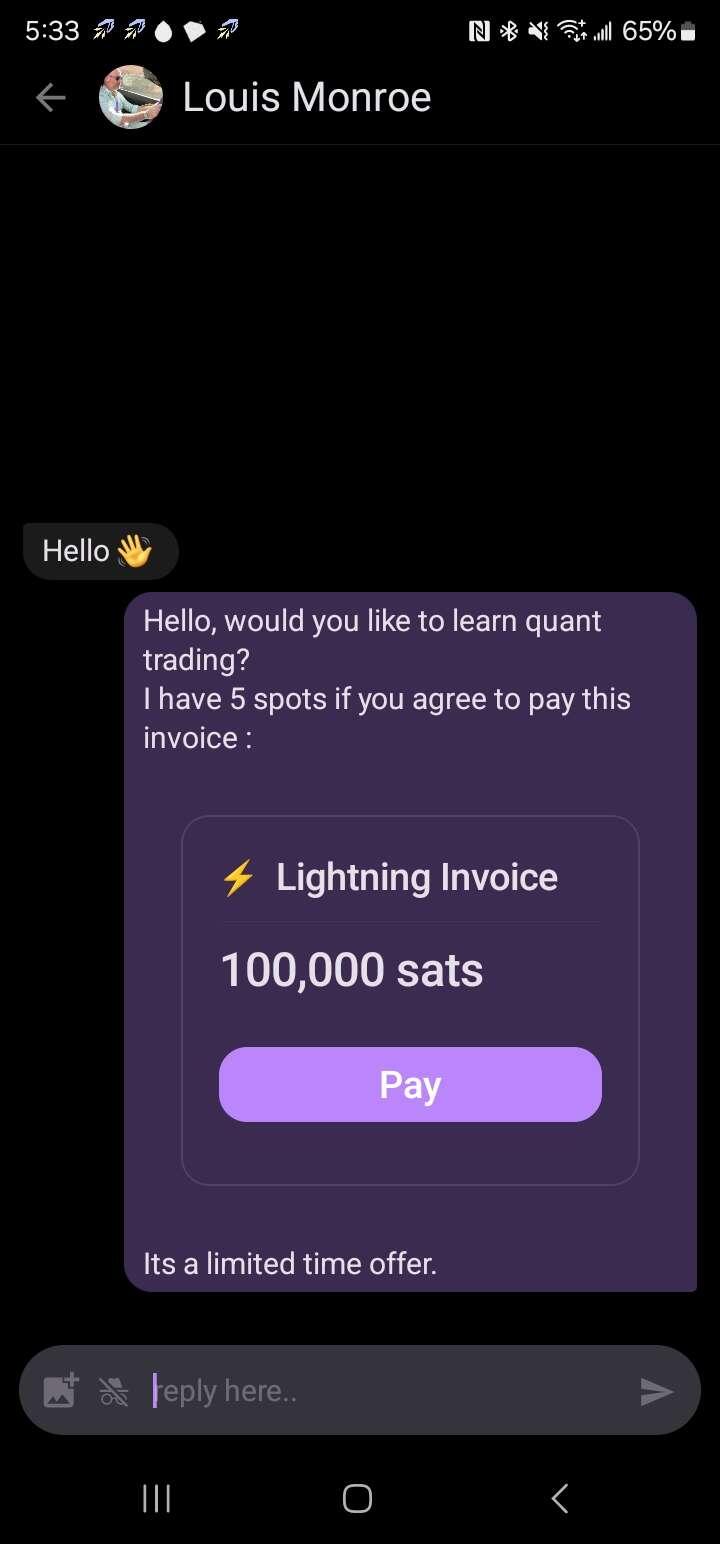

lnbc1m1pnhm0ylpp5ajcvmm9alfj98kav3vu2eh0z87a57rpz0npvdg9rlyth2q7sa5wqdpswdshgueqvehhygz0w35x2ujzv9e8y72qwpexjmtpdshxuet5cqzzsxqrrs0fppqm8t7yueq2s5ww9jnx8rhdr2j9k3pyewpsp55l3jkaxjv3z4d58xu0mm4gt6zdeqtg22c0urvptjndxkufgx66zs9qxpqysgqj324zp2u25444x85q6gr0wmfpkx5rft9hxj6apussqy5m2xd0am8cq7xf3pp4kprq6qy3yz5f2s8zzkmd4tjnlqpzh0fjxwx36xue7gp83mkvk