Zählen Finanzmarktinterventionen.... Rettungspakete, Monetarisierung von Anleihen etc etc.....

auch dazu?

Auch diese Interventionen müssen inflationär wirken, da sie eine (Fehl-)Allokation monetärer Resourcen darstellen. - - >

Sucht man nach der "BILANZSUMME" der EZB kommt man auf Faktor 12-13 !!! seit 1999, statt Faktor 4 (M2/75%).

Das würde auch zum Goldpreis seit Euro-Einführung passen:

Faktor 10-11!!!

Der Raub und Betrug an unserer Generation ist unglaublich.

Es bleibt einem schier der Atem weg.

Ohne Bitcoin keine Zukunft!!!

Great Explanation.

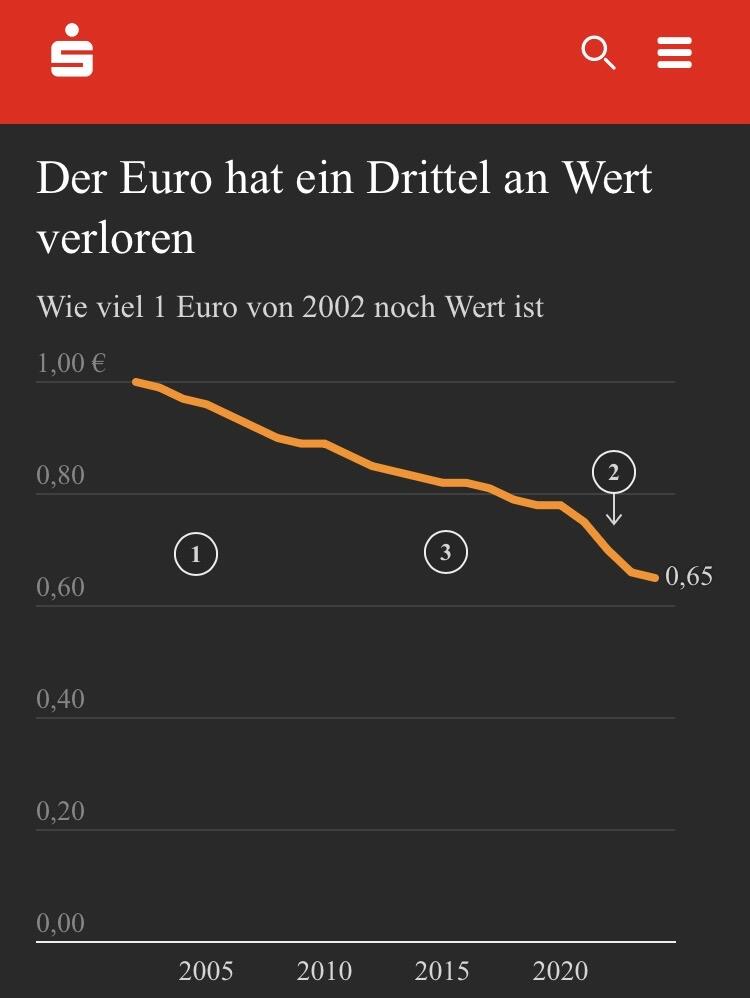

Tafel Milka(100g) in 2002: 0.49 €

Tafel Milka(90g) in 2025: 1.99 €

1/3 Wertverlust, is klar!

#Bitcoin crashed to 100.000$

Take a listen!

Less than 3% to ATH.

She's a Russian National Heroine. Former Attorney General of Crimea.

Natalia Vladimirovna Poklonskaya. (2014)

Someone recently statet that gold needed to reach the 1000$ mark (p.oz.) ~34 years. For the next 1000$ to 2000$/oz only 12 years. 4 more years to reach 3000$ (last December).

If look at this as a series of numbers, it's ~1/3 of the previous interval.

We will be at 4000$ late 2025/ early '26.

5000$ mid' 26.....

That means death of this system at least by late 2026.

Das Leben & das Geld der Anderen.

GM.

Tyrolean Speed Folk.

The ultimate genre.

Don't overcomplicate. If you mix the article but know the word and pronounce it halfways, every friendly German will look over it during any conversation.

You'll learn it when you use it.

Gern geschehen. ✌️🍀

We are witnessing a "currency reform", undertaken in slow motion.

It is voluntary only at first glance & but this time for the better.

Incredible trip to El Salvador to meet Bukele and see for myself what has changed since last time I was there.

I think most that follow me, know where I stand on #bitcoin. That, as long as it stays decentralized and secure (which means it must be used as a medium of exchange) it is IMPOSING the first global free market that has ever existed. A competitive, yet cooperative protocol and network that forces abundance broadly. We are both the map and territory - our actions within it, and aligned to it, strengthen and protect Bitcoin, bringing more people to it and they each, in turn grow in their own understanding - which in turn strengthens it further. We are bitcoin, we are Satoshi. Each node (us) of sovereignty adding our voice, time, energy into something that changes the course of history.

Because that map of “what will be, or “what already is” (as long as it remains decentralized and secure) has never existed before, our minds have a hard time with it. So instead, most revert to measuring #bitcoin from within the system they have always known. This leads to most of the fights within bitcoin. People far deeper down the rabbit hole, versus those just entering or choosing to remain trapped (and not being able to yet see the bigger picture)

You can imagine - that change would be chaotic because the change……is the change within each of us. All 8 billion of us, and we often can’t see our own hypocrisy, the lies we tell ourselves. Etc etc. In addition, with over 3000 years of us living in a zero sum game - where someone else had to lose for us to win. So for many, it would seem normal to play by the rules of the old game.

This is why I went to El Salvador. I went to meet the President and see for myself who he was and what choices he might make along the way. Ie - how deep was he down the rabbit hole? Did he see El Salvador and himself as part of system change to a global free market that would permeate around the world - or would he be a pawn and be captured in a game that created imperialism 3.0? It was a very deep discussion…..lasting almost 2.5 hours. I came away convinced that he gets it. Moreover, he might be the most impressive leader of a country I have ever seen. Said to me, more people in El Salvador need to be in self custody, more need to use it as a currency, not in stablecoin but natively on lightning, more in non custodial. He understands the larger forces at play here.

El Salvador is still Bitcoin country, but is still early. Having a nation with security is a big deal. 50 years of poverty, gangs, wars, fear in a society doesn’t change overnight. (All of that caused by broken money and psyops)

It takes time to rebuild trust. I was last here the day after all the gang violence (coincidentally starting after introducing Bitcoin as legal tender)

Huge changes since I was last here, not only safer, but hopeful. That hope will lead to opportunity for people, and that opportunity to value creation. The downtown core in San Salvador, previously one of the most dangerous places in Central America is feels a like a European city with thousands out walking. Cool Social houses (Video below) shops everywhere with the hustle and bustle of people and opportunities. Bitcoin isn’t yet used broadly, but making inroads. I spent in it almost everywhere - but you could tell - bitcoin transactions are fairly rare.

Lots more to do, and big plans underway. Stay tuned!!!

And a huge thanks to Max and nostr:npub1pq2ll9l7qdmxsfqyrd5w9gul8c7ftqy9yepcqvc8a2l2ys9zhd6sk42rew for all their work in El Salvador and in helping make this a fantastic trip.

What a time to be alive!

https://blossom.primal.net/3937c43a0c98ec9871ac97651bc23885c6698586d63734bff846c271423e4369.mov

This is beatiful.