Because some managers and Funds are obligated to own Bonds and Fixed income products by their investors. Like 10% of their portfolio for example must be allocated to Bonds. That in recent history has been just burning money but they are obligated to own it . Now MSTR offers them something (convertible bond offering) in that space that actually performs and managers will buy up every offering that they possible can.

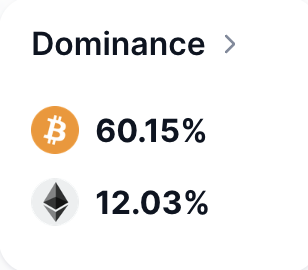

BTC is 100% priced against ETH. That's why the BTC-ETH spread exists and the ETH-BTC spread exists. This is how market making is done-this is what I do, bids and asks don't just magically appear. Watch the ETH-BTC spread for a day. It's blatant.

ETH was created by Lubin and JPM to control bitcoin.

That's alright, appreciate the gesture 👊🤙

Ever since WoS died I failed to get a new wallet setup.

You're not missing out on MSTR. If you have liquid capital that is able to get out of the system and into the bitcoin system you should be getting it into sats while you can.

How will a market maker (who you purchase sats from) be able to make a market in bitcoin bids and asks if there is nothing to price/arbitrage bitcoin against?

Right now bitcoin is priced against ETH. That's why ETH exists that's why ETH was created and that's why Bitcoin has a market price. ETHs whole purpose and creation is to keep the BTC market liquid. That's ending.

💫

For further reading

nostr:note1mevxxfh47he6vke5k0cuqcszxx37vnqxt9qmr4pj5udh4jrgxf2scusa7r

You will always be able to purchase MSTR; by design they will issue shares infinitely. There will be no bitcoin fiat market; when that happens buy some MSTR.

Once ETH-BTC spread goes to 0 there is no market and there is no fiat exchange rate.

I don't make the rules

¯\_(ツ)_/¯

nostr:note19clj5ad76ujl2n3p49a304fp7qt7rg60lm2c39mhqxaxsp8hjnmsh6yf8x

A lot going in on this thread that may help you understand it better.

Stay humble stack sats👊🤙

So you're making all this money in MSTR?

Is that real money?

Is that the correct measuring stick?

🤣🧐🤯

#Bitcoin

Lots of smoke and mirrors

Yes you should never own MSTR over cold storage sats. The fiat numbers are a lie.

Fixed income managers are only allowed to purchase fixed income products. They cant go outside of that bubble because the capital they manage forces them to only operate in bonds.

So if you go buy your generic bond fund in your retirement account there is some manager that has to source out the best bond offerings for the investors. MSTR just happens to be the best option by a mile. Their benchmark return is like 1-5% for a typical bond; now they are offered something that gives them 100%+ returns they will buy anything MSTR puts out there.

But most of that Fixed income / bond fund money will never make it over the bridge. It's permanently stuck capital that will never make it into the #Bitcoin system.

I expect some sort of market shutdown or "Banking holiday" in the following months. They can't let MSTR and bitcoin totally expose the system.

Most all of the Tradfi money will never make it over. It was all fake to begin with anyway.

There is a TON of money in fixed income land that can only get a yield of 1-5%. There are large swaths of capital and managers that are obligated to only purchase Fixed income (read Bonds) products. Those managers can purchase MSTR bonds (these are convertible bonds). Converts are convertible to stock at a certain point in the future.

MSTR issues convertible debt and fixed income managers are willing to loan MSTR money for the ability to convert that debt into stock shares in the future.

So as a fixed income manager who is stuck in the land of manipulated and artificially low interest rates the ability to get that money into a debt offering that gets you out of that dead money trap is a buy all day long.

Fixed income managers will buy ANY debt offering they make because that money is trapped in Tradfi otherwise. Most of it is permanently trapped but MSTR is offering them a bridge out. It all ends up in #bitcoin either way. Cold storage sats.

It's exponential

It is living off of the trapped FI guys who can only buy bonds and converts. That money has nowhere to go besides MSTR; literally only can buy debt offerings.

They actually bought converts at 0% yield. Paid for the option to convert to equity. They would pay a negative rate if the offered because the bond market is so mispriced.

We're entering VERY scary Tradfi territory.

"Most over the top node setup on Nostr"