时间是最宝贵的资源

金钱是时间的杠杆

比特币教会了我这一切

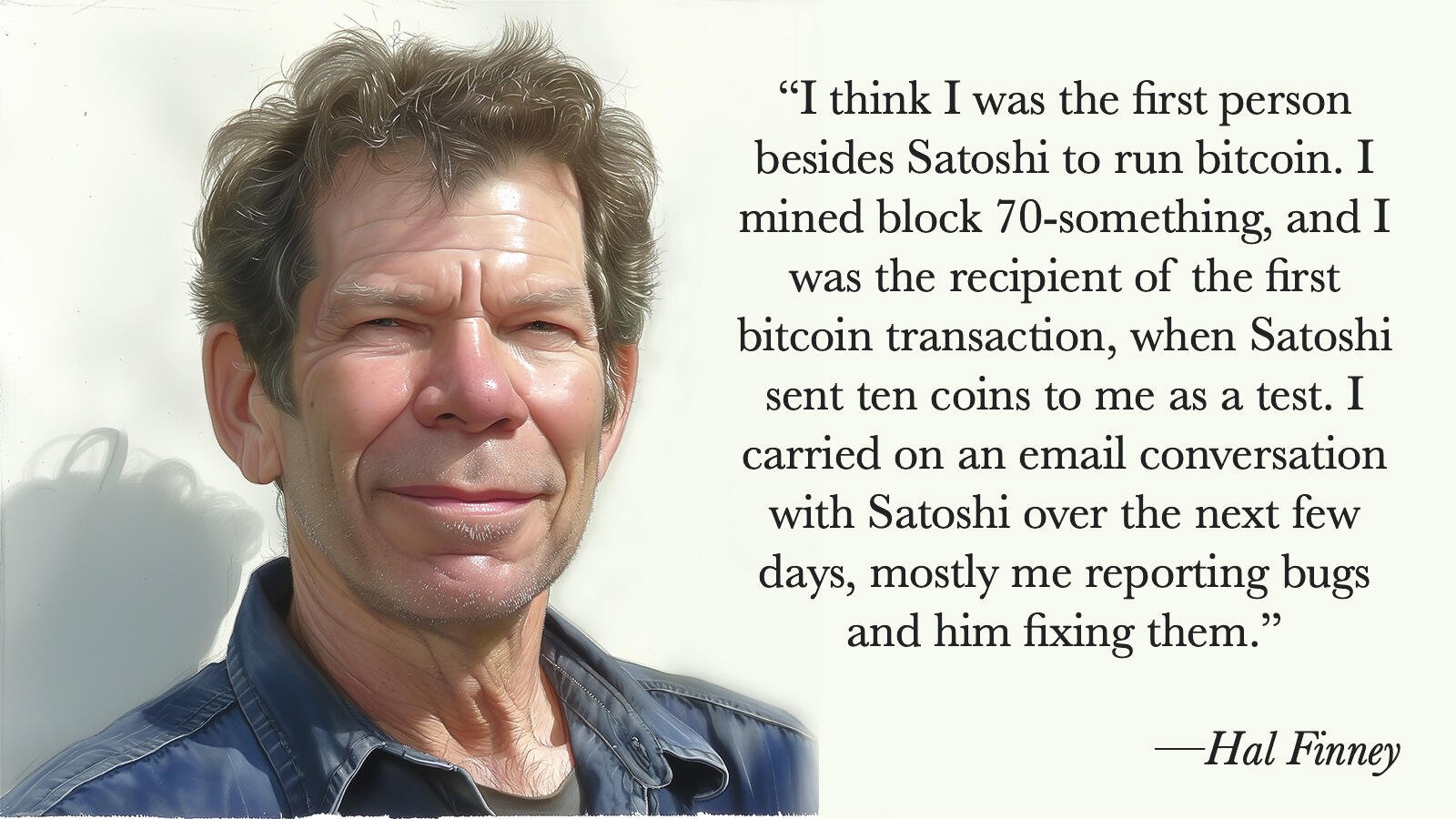

Value is subjective. Whether Bitcoin has value to someone is subjective. The more people believe that Bitcoin has value, the more scarce it becomes. The objective manifestation of this scarcity is reflected in its price. Currently, companies that are launching Bitcoin ETFs are telling their customers what the value of Bitcoin is, just as they did when promoting gold ETFs in the past. The future is promising.

要囤比特币,最重要的是,改变法币本位的理念

Our hero

摒弃噪音

专注现在

努力做正确的事

对于比特币,人们往往高估了现在

却也往往低估了未来。

这就是为什么储蓄如此困难

毕竟人的时间偏好都比较低

65 年历史,伟大的社会主义国家,古巴

I need a 🥃

The introduction of Bitcoin ETFs in the United States and their implications can be analyzed through the lens of Austrian School economics, particularly in relation to the key themes you have outlined.

Mainstream Institutional Acceptance of Bitcoin as an Investment Asset:

The launch of Bitcoin ETFs signifies a major shift in the perception of Bitcoin by mainstream financial institutions. The preparation of entities like BlackRock to seed their iShares Bitcoin ETF, for instance, has already impacted the price of Bitcoin significantly. This indicates a growing acceptance of Bitcoin as a legitimate investment asset. Austrian Economics, with its emphasis on free markets and individual freedom, may view this development as a validation of Bitcoin's potential to function as a market-driven investment vehicle, free from the constraints of centralized financial systems.

Bitcoin as a Hedge Against Inflation:

Bitcoin is increasingly viewed as a digital store of value, akin to digital gold, especially in the face of global economic uncertainties and the devaluation of fiat currencies. This aligns with the Austrian School's advocacy for sound money and its opposition to inflationary monetary policies. The finite supply of Bitcoin (capped at 21 million) and its decentralized nature enhance its appeal as a hedge against inflation, a perspective likely to be further solidified in the coming years.

Future Trends in Mainstream Funds' Adoption of Bitcoin:

The future trajectory suggests a continual increase in institutional adoption of Bitcoin. Corporate treasuries, hedge funds, and traditional financial institutions are expected to increasingly integrate Bitcoin into their portfolios. The advent of Bitcoin ETFs, providing a regulated and familiar investment vehicle, is poised to accelerate this trend, potentially bringing new waves of both retail and institutional investors into the Bitcoin ecosystem. This trend resonates with the Austrian School's principles of market-driven choices and the importance of entrepreneurial decisions in shaping economic landscapes.

Global Adoption of Bitcoin and Financial Inclusion:

Looking ahead, Bitcoin's borderless and permissionless nature positions it as a tool for global financial inclusion. Efforts to bring banking services to the unbanked and underbanked populations worldwide are anticipated to gain momentum, leveraging Bitcoin’s decentralized framework. This aligns with the Austrian School's emphasis on individual empowerment and resistance against centralized control.

In conclusion, from an Austrian Economics perspective, the introduction of Bitcoin ETFs in the U.S. is a significant step towards the mainstream acceptance of Bitcoin as a legitimate financial asset. It represents the realization of free market principles, individual choice, and decentralization in the financial sphere. The future of Bitcoin, especially in the context of ETFs, is likely to see it become a more integrated part of mainstream financial systems, potentially playing a role in global financial inclusion and as a hedge against inflation.

2024年是比特币历史上伟大的年份之一

1、5月份减半

2、全球最大的资产管理机构的ETF发行

3、defin,defi将在比特币上运行

不知道为啥,我的nostr的post一直无法正常显示。。

damus登陆后就马上闪退。。。

有大神指导下嘛?

damus登陆后一直显示“已删除账号”。

然后就退出。。。有人也有这种情况吗

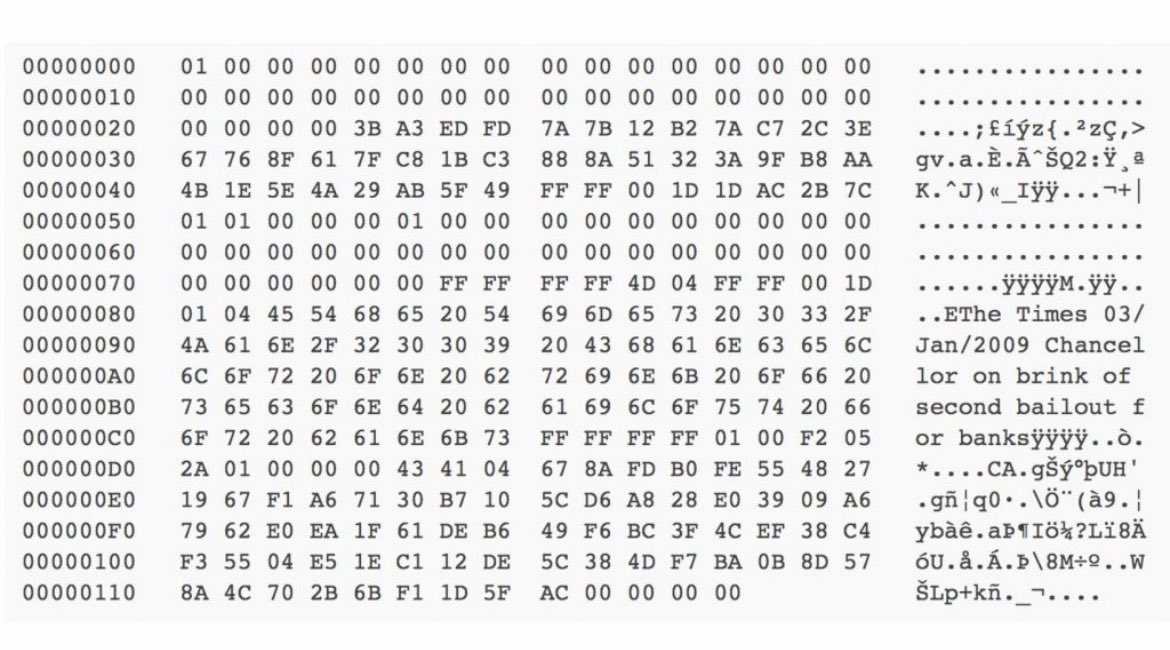

The greatest jpeg on the world

比特币第一次减半12 $

第二次减半600 $

第三次减半8800$

第四次减半??

Bitcoin maxi

Thank you capitalism

https://pbs.twimg.com/media/FnK5SFgWYAA78Gr?format=jpg&name=large

“A great civilization is not conquered from without until it has destroyed itself within.”

- Will Durant