Treasuries Gain, Asia Stocks Drop on Fitch Fallout: Markets Wrap

Asia stocks fell and haven assets advanced as Fitch Ratings’ downgrade of the US sovereign rating spurred demand for safety. #press

Fitch Cuts U.S. Long-Term Ratings From 'AAA' to 'AA+'

Fitch Ratings has downgraded US's long-term foreign currency debt rating to AA+ from AAA. Treasury Secretary Janet Yellen said in a statement that she "strongly" disagrees with Fitch's decision. Kathleen Hays reports on Bloomberg Television. (Source: Bloomberg) #press

Starbucks Revenue Misses Estimates as Its US Growth Slips

Starbucks Corp.’s quarterly sales fell short of analysts’ estimates as traffic growth slowed in the US. Higher prices and add-ons to beverages helped bolster profit. #press

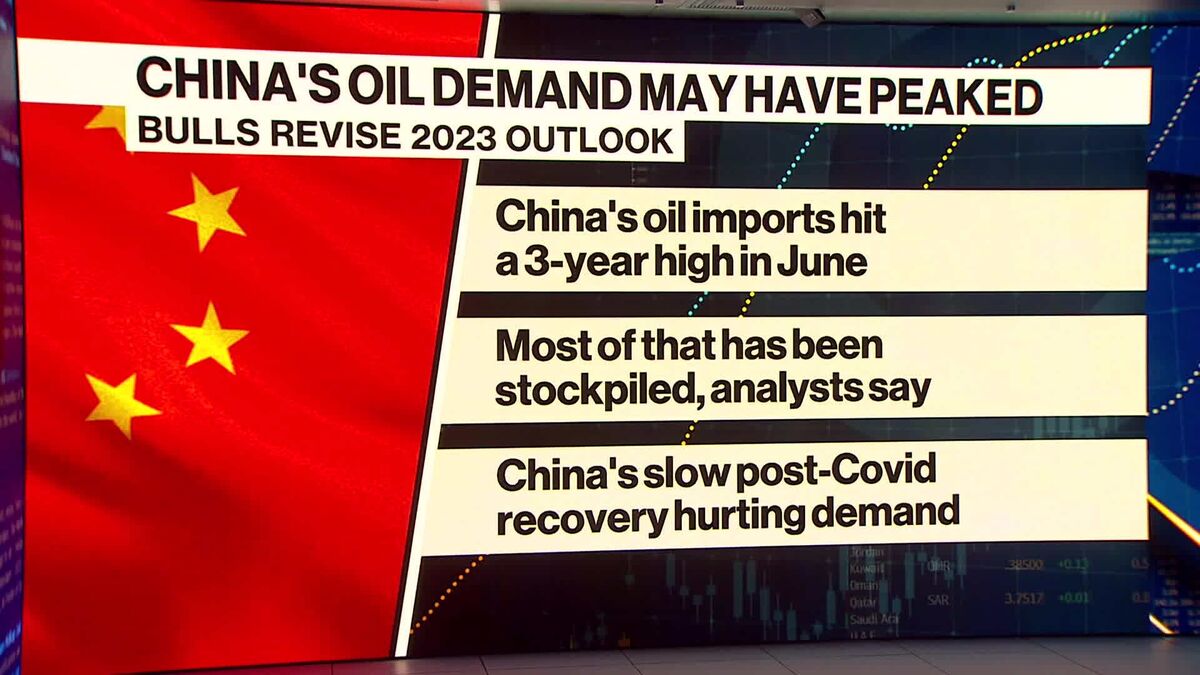

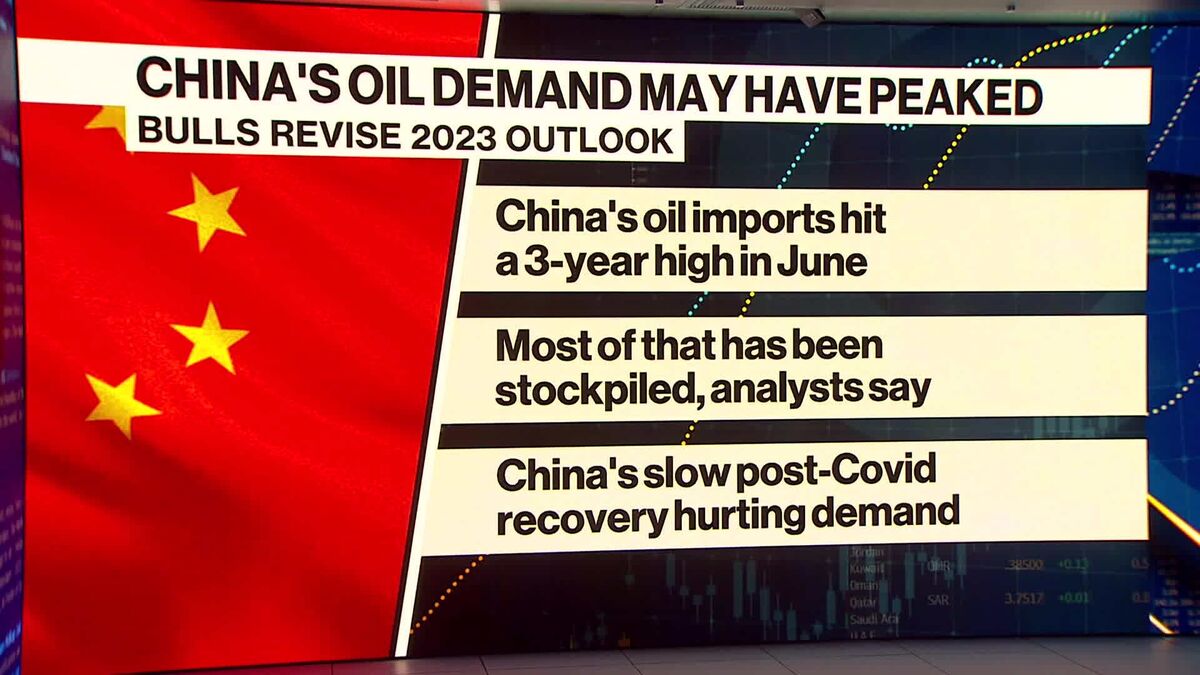

China’s Oil Demand May Have Peaked for 2023

Chinese demand for fuels and other oil-derived products may have already peaked for this year. Su Keenan reports on Bloomberg Television. (Source: Bloomberg) #press

Private Credit Is Hot. But Has It Gone Silly?

For now, no. Bigger, veteran operations are getting the lion’s share of business. Newbies still need to prove themselves. #press

Trump Indicted on Federal Charges in 2020 Election Probe

Donald Trump has been indicted in Washington on federal charges over his efforts to overturn the 2020 presidential election. Kailey Leinz reports on Bloomberg Television. (Source: Bloomberg) #press

US Credit Downgrade by Fitch Attacked as Baseless by Biden Officials

Biden administration officials objected strenuously to a decision by Fitch Ratings to strip the US of its top-tier credit rating on Tuesday and sought to control the political and economic fallout. #press

US Credit Rating Downgraded From AAA by Fitch

The US was stripped of its top-tier sovereign credit grade by Fitch Ratings, which criticized the country’s ballooning fiscal deficits and an “erosion of governance” that’s led to repeated debt limit clashes over the past two decades. #press

China’s Oil Demand May Have Peaked for 2023

Chinese demand for fuels and other oil-derived products may have already peaked for this year. Su Keenan reports on Bloomberg Television. (Source: Bloomberg) #press

Five Things You Need to Know to Start Your Day

Trump indicted in 2020 election probe. US stripped of AAA credit rating. Singapore PM to address graft probe. Here’s what you need to know today. #press

IFPR's Glauber on Food Security and Inflation

Joseph Glauber, Senior Research Fellow at the International Food Policy Research Institute, discusses his outlook for food security and inflation, in light of the recent extreme weather conditions. He speaks with Shery Ahn and Haidi Stroud-Watts on "Bloomberg Daybreak: Australia". (Source: Bloomberg) #press

US-EU Steel Talks Inch Ahead as Time for a Deal Runs Short

The US and European Union are unlikely to finalize a legally binding agreement to govern trade in steel and aluminum this year, setting up a decision to either extend an October deadline or allow the return of tariffs on billions of dollars of transatlantic exports. #press

State Street Undercuts BlackRock, Vanguard With Cheapest S&P ETF

State Street Global Advisors is challenging larger exchange-traded fund rivals BlackRock Inc. and Vanguard Group Inc. with its latest round of fee cuts. #press

Landlord Vivion Offers €1.4 Billion Bond Swap as Maturities Loom

Vivion Investments is asking investors to swap €1.4 billion ($1.5 billion) of existing bonds for new, longer-dated securities as the landlord faces a wave of maturing debt. #press

Luxury Hotels Up for Sale as Landlord Faces Tax Debt

A UK hotel group is looking to sell a pair of luxury London hotels, as a related company faces a winding-up petition from UK tax authorities. #press

PJT Plans ‘Quite Significant’ Hiring, Paul Taubman Says

PJT Partners CEO Paul Taubman says the firm plans to continue its recent hiring spree, taking advantage of the slump in mergers and acquisitions to acquire talent from its rivals. "Are we going to be much larger three, five years from now? Absolutely," he says on "Bloomberg Markets." (Source: Bloomberg) #press

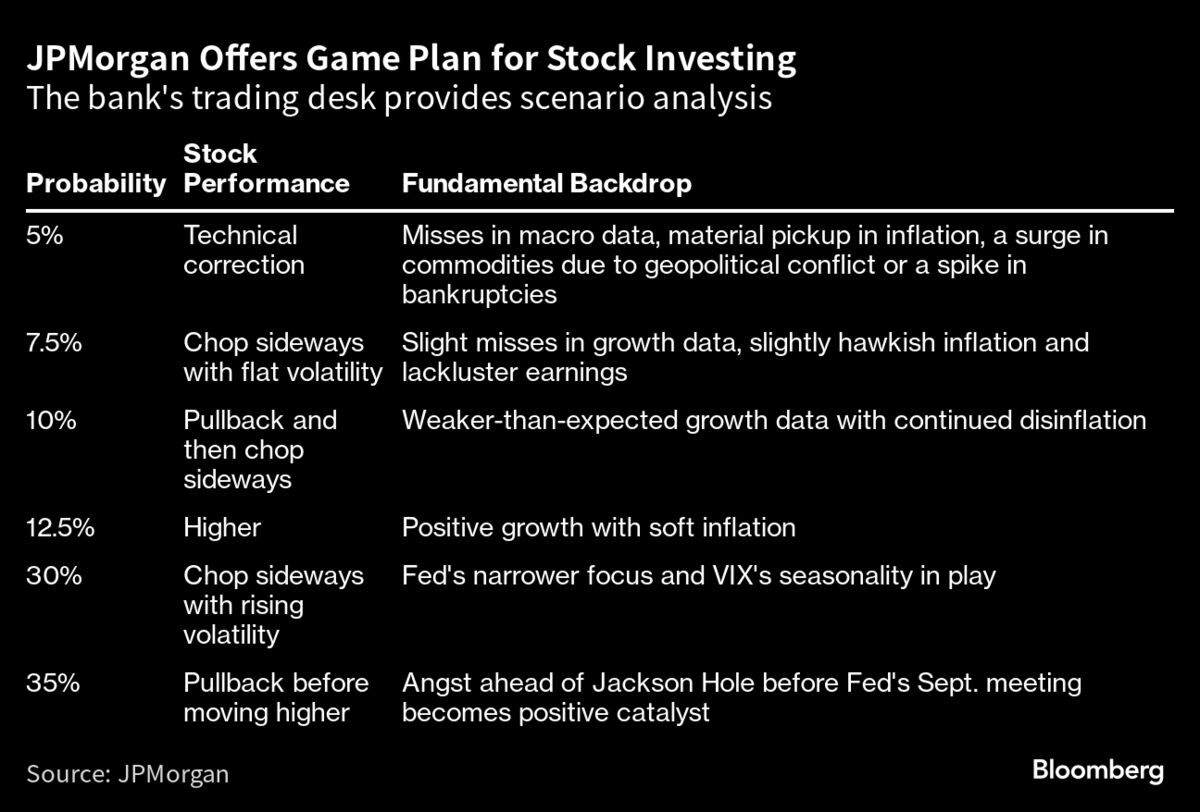

JPMorgan’s Trading Desk Says Record S&P 500 ‘Feels Inevitable’

While US stocks may pull back in coming weeks amid concern over Federal Reserve policy, the S&P 500 will reassert itself around September before climbing to an all-time high, according to JPMorgan Chase & Co.’s trading desk. #press

Russian Retail Traders Send Stock Index Back to Pre-War Levels

Russian stocks are at a level last seen before the invasion of Ukraine, with retail investors driving a market cut off from foreigners. #press

Shell is considering options for its global renewable power unit that include spinning it off into a separate business and selling a stake to outside investors https://trib.al/zsTaXrW #press

RT @BloombergTV: South Korean officials say at least 39 people have been killed in flooding and landslides across the country.

Here's the latest from @BloombergTV https://trib.al/cGZjnSD #press