China’s Woes Spell Caution for Australia’s Biggest Investors

China’s property turmoil, increasing intervention in markets, and lackluster economic growth are combining to cloud the outlook for some of Australia’s largest investors that have been cutting allocations to Chinese assets. #press

China’s Mortgage Rate Cuts Fall Short of ‘Game Changer’ Policies

China’s anticipated cut to rates on existing mortgages marks one of the most concrete actions yet to boost the beleaguered economy, though it likely won’t be enough on its own to shore up growth. #press

Bloomberg Daybreak: Asia 08/30/2023

Haidi Stroud-Watts in Sydney and Shery Ahn in New York drive to the Asia, Australia and New Zealand market opens while wrapping the biggest stories of the previous day on Wall Street. Today's guests: AlphaSimplex Group Chief Research Strategist & Portfolio Manager Kathryn Kaminski, BritCham China Vice-Chairman Chris Torrens, Fidelity... #press

Bloomberg Crypto 08/29/2023

Grayscale moved closer to launching a spot-based Bitcoin exchange-traded fund in the US, a potential watershed moment in the cryptocurrency industry’s quest to tap billions of dollars from everyday investors. A three-judge appeals panel in Washington overturned a decision by the SEC to block the ETF, which would be tied to the spot Bitcoin price. On... #press

https://www.bloomberg.com/news/videos/2023-08-29/bloomberg-crypto-08-29-2023?utm_source=press.coop

Country Garden Seeks to Add Grace Period for Maturing Yuan Bond

Country Garden Holdings Co. has proposed a grace period of 40 calendar days for a maturing yuan bond, marking the distressed Chinese developer’s latest effort to avoid what would be its maiden default. #press

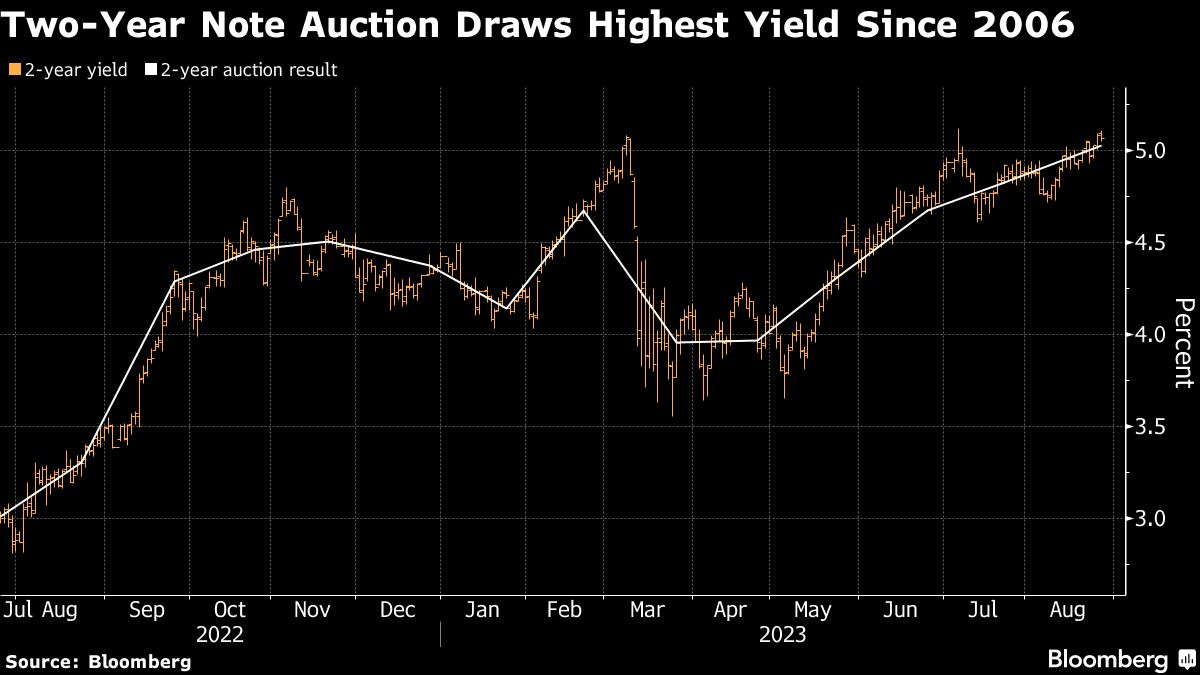

Two-Year Treasury Notes Draw Highest Yield Since 2006 at Auction

An auction of two-year Treasury notes Monday drew the highest yield since 2006, reflecting the US bond market selloff that deepened last week in anticipation of another Federal Reserve rate increase. #press

Bloomberg Daybreak: Europe 08/28/2023

Bloomberg Daybreak Europe is your essential morning viewing to stay ahead. Live from London, we set the agenda for your day, catching you up with overnight markets news from the US and Asia. And we'll tell you what matters for investors in Europe, giving you insight before trading begins. (Source: Bloomberg) #press

PIMCO's Lee On APAC Credit Markets Strategy

PIMCO Head of Credit Research Annisa Lee discusses her Asia credit markets strategy. She speaks with David Ingles and Rishaad Salamat on "Bloomberg Markets: Asia". (Source: Bloomberg) #press

Bloomberg Daybreak: Asia 08/28/2023

Haidi Stroud-Watts in Sydney and Shery Ahn in New York drive to the Asia, Australia and New Zealand market opens while wrapping the biggest stories of the previous day on Wall Street. Today's guests: Julius Baer Head of Asia Research Mark Matthews, Council on Foreign Relations Fellow for China Studies Zongyuan Zoe Liu, HSBC Chief Asia Economist... #press

Emerging-Market Funding Gets Creative as Dollar Bonds Dry Up

At the BRICS summit in Johannesburg this week, a key item on the agenda was reducing dollar dependence across emerging markets. In bond sales, it’s already happening. #press

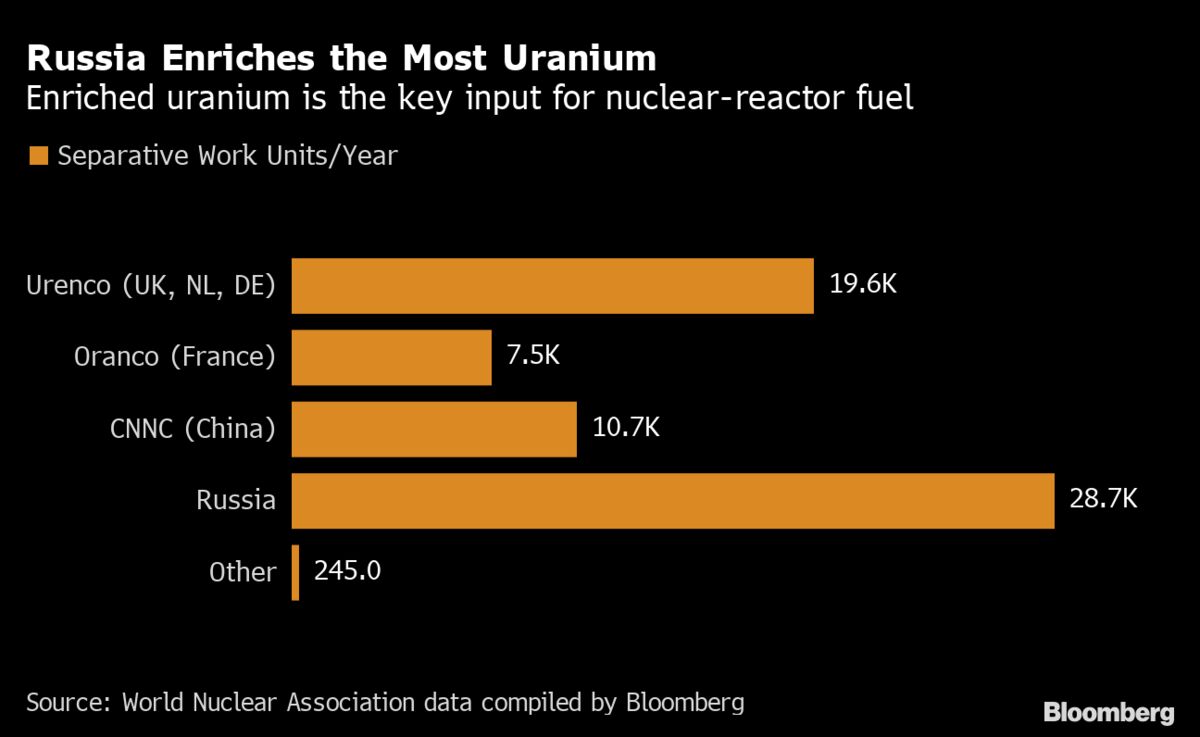

Why the US and Europe Still Buy Russian Nuclear Fuel

The US and its European allies moved fast to choke exports of Russian oil, natural gas and coal after Vladimir Putin ordered troops into Ukraine. When it comes to atomic energy, however, Kremlin-controlled Rosatom Corp. continues to be the dominant source of fuel for the world’s nuclear power stations —... #press

London Mayor Sadiq Khan Defends Stance on ULEZ Expansion

London Mayor Sadiq Khan defended the controversial expansion of city’s vehicle emissions area, known as ULEZ, the Sunday Times reported. #press

South Africa Says Distribution Is ‘Albatross’ of Power System

South Africa’s electricity distribution system is “an albatross” beset by fighting between the national power utility and municipalities as the government takes steps to stabilize the grid, according to the electricity minister. #press

Austria Boosts Energy Windfall Tax as Profit Debate Lingers

Austria plans to adjust a windfall tax on oil and gas companies so that it kicks in at lower profit levels, part of efforts to contain public discontent over growing corporate earnings at a time of rising living costs. #press

Riyadh Air to Focus on Flights to and From Saudi Arabia, FT Says

Riyadh Air, Saudi Arabia’s newest airline, plans to focus on flights to and from the kingdom, its chief executive officer told the Financial Times. #press

China Cuts Tax on Stock Trading to Boost Market Confidence

China lowered the stamp duty on stock trades for the first time since 2008, marking a major attempt to restore confidence in the world’s second-largest equity market. #press

Barclay Family Engages Gulf Investors for Debt Buyback, Sky Says

The Barclay family, which previously owned the UK’s Daily and Sunday Telegraph newspapers, made a proposal last week to buy back about £1 billion ($1.26 billion) of debt it owes to Lloyds Banking Group Plc, Sky News reported. #press

Fortescue Adds Ex-CSIRO Chief Larry Marshall to Board, AFR Says

Fortescue Metals Group Ltd. added Larry Marshall, former chief executive of the Commonwealth Scientific and Industrial Research Organisation, to its board, the Australian Financial Review reported. #press

How London’s ULEZ Charge Became a UK Election Issue

In a special election last month, the governing UK Conservative party unexpectedly held on to former Prime Minister Boris Johnson’s parliamentary seat in west London, even as it suffered losses elsewhere. One big issue that helped motivate voters there: the plan by the city’s mayor — from the... #press

Sinopec Profits Shrink as Economic Woes Weigh on Fuel Demand

Sinopec’s first-half profits shrank amid lower oil prices and fuel demand being weighed down by China’s sluggish economic recovery. #press