How to Avoid Getting Burned by AI Hype in the Stock Market

Steer clear of “newly minted companies that are AI-specific or adjacent,” veteran strategist Art Hogan says. #press

Tycoon Cheng Family Plans to Keep NWS Listed After Buyout Deal

Chow Tai Fook Enterprises Ltd., the private family office of billionaire Henry Cheng, will keep NWS Holdings Ltd. listed on Hong Kong’s stock exchange after its buyout of the majority stake is finalized, clearing up uncertainty among investors about the future of the infrastructure firm. #press

Why Are US Gas Prices Going Up? When Will They Fall?

Gasoline prices in the US are in the midst of a surprise late-season rally. Even small increases can have an outsize impact on consumer confidence and evoke painful memories of last year’s record surge in pump prices that helped drive inflation to a 40-year high. With the election season starting to heat up,... #press

US Stocks Still Face Hard Landing Risks, Bank of America Says

The Federal Reserve may very well be done hiking rates for now, but US stocks still face a pullback from the risk of a hard economic landing, according to Bank of America Corp. strategists. #press

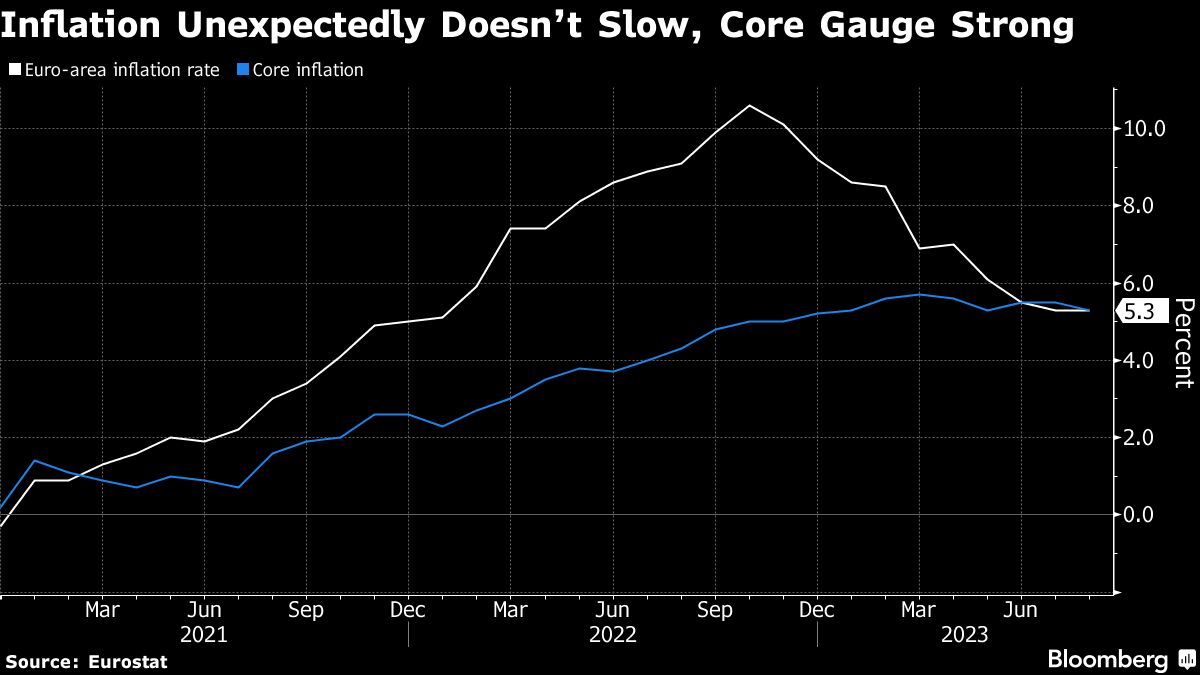

El-Erian: Markets, Central Banks Overly Data-Dependent

"I think the major issue is that the market has become overly data-dependent, just like our central banks have become overly data-dependent. So we're not looking beyond the next data release because we're worried about what will the Fed do in September, what will the ECB do in September."... #press

European Stocks Muted Ahead of Key US Jobs Data; Aurubis Sinks

European stocks were little changed as investors await readings of a key US jobs data to get clues on the Federal Reserve’s policy outlook. #press

Oligopolies Curb Nigeria’s Efforts to Tame Inflation, Study Says

Reforms are needed in Nigeria to increase competition and reduce the ability of large and dominant firms to dictate the cost of goods and services in Africa’s most populous nation, a central bank official said. #press

ECB’s Options Remain Open With Rate Peak Close, Villeroy Says #press

Bloomberg Daybreak: Europe 09/01/2023

Bloomberg Daybreak Europe is your essential morning viewing to stay ahead. Live from London, we set the agenda for your day, catching you up with overnight markets news from the US and Asia. And we'll tell you what matters for investors in Europe, giving you insight before trading begins. (Source: Bloomberg) #press

Al Ramz's Halawi: UAE Earnings Ahead of Consensus

Second quarter earnings in the region were "encouraging", according to the latest review by Al Ramz Corporation. The next market catalyst could be the Fed's rate decision in three weeks time. Amer Halawi, Head of Research at Al Ramz Corporation, speaks with Yousef Gamal El-Din and Manus Cranny on "Bloomberg... #press

MBMG's Gambles: Adding More China Tech

Paul Gambles, Managing Partner and Co-Founder at MBMG Group, discusses his global market outlook. He speaks with Yousef Gamal El-Din and Manus Cranny on "Bloomberg Daybreak: Middle East and Africa".

(Source: Bloomberg) #press

India Sees Russian Oil Imports Ebbing as Rival Suppliers Step Up

India’s splurge on cheap Russian crude may be over, as New Delhi’s traditional suppliers in the Middle East step back in with attractive conditions. #press

Driest August in More Than 100 Years Threatens India’s Growth

India’s weakest monsoon rains in about a century are becoming the biggest risk for the fast growing economy as food prices rise and farming incomes fall on lower crop production, according to economists. #press

Bloomberg Daybreak: Middle East & Africa 09/01/2023

Daybreak Middle East & Africa is your daily spotlight on one of the world's fastest-growing regions. Live from Dubai, we bring you the latest global markets and analysis, plus news-making interviews, with a special focus on MEA. All that and more, as you head to the office in the Gulf, pause for lunch in Hong... #press

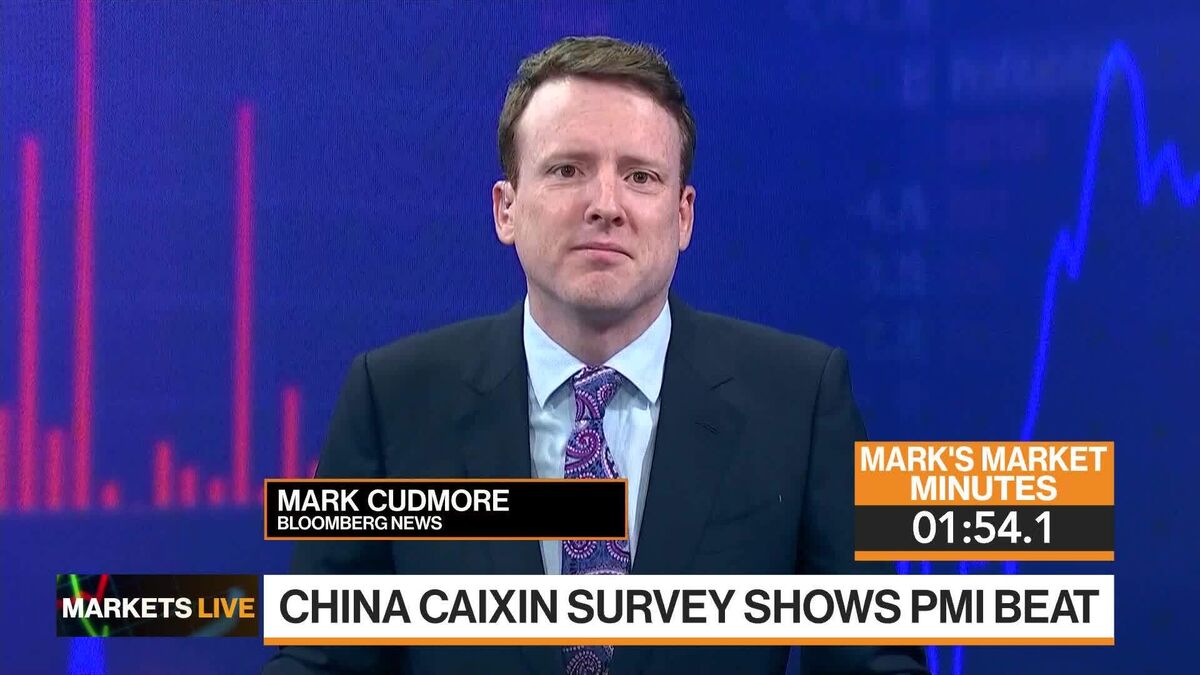

Markets in 3 Minutes: It's a Major Turning Week for Many Assets

Mark Cudmore and Anna Edwards break down today’s key themes for analysts and investors on “Bloomberg Markets Today.”

(Source: Bloomberg) #press

ECB Questions Power of Yield Curve Inversion as Recession Signal

The European Central Bank cautioned against reading too much into a bond-market metric often regarded as a harbinger of recession. #press

All China’s Stimulus Measures Are Encouraging: Yeung

Raymond Yeung, chief Greater China economist at Australia & New Zealand Banking Group Ltd., discusses China’s stimulus measures to help shore up the property market and what more the government should do. He speaks on Bloomberg Television. (Source: Bloomberg) #press

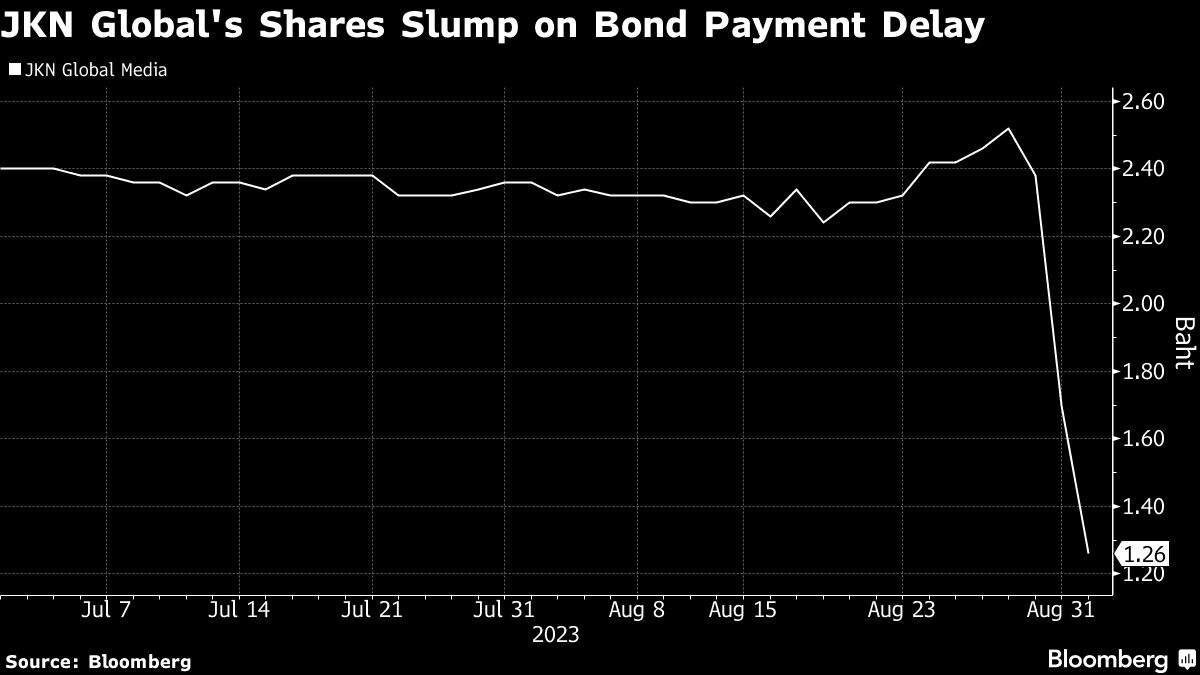

Thai Miss Universe Owner Loses Half Its Value on Payment Delay

Shares of JKN Global Group Pcl, a Thai media company that owns the Miss Universe beauty pageant brand, extended a record low after the company said it’s unable to fully honor its bond repayments. #press

Macau Casino Rebound Shows Travel Is Bright Spot Amid China’s Woes

Macau’s casino recovery is sustaining momentum, with gaming revenue in August rising 686% from a year earlier to the highest since January 2020, adding to signs that spending on travel and experiences is weathering consumer concerns about China’s economic slowdown. #press

China Issues Big Fuel Export Quota as Domestic Demand Peaks

China issued another large quota for fuel exports as refiners look to offset peaking domestic demand with more sales overseas. #press