India’s $775 Billion Stock Boom at Risk as Small Caps Overheat

The rally in Indian equities that has swelled the market’s total valuation by $775 billion in a little more than five months has been accompanied by a notable shift in investor preference to smaller stocks. #press

Bloomberg Daybreak: Australia 09/07/2023

Haidi Stroud-Watts in Sydney and Shery Ahn in New York drive to the Asia, Australia and New Zealand market opens while wrapping the biggest stories of the previous day on Wall Street. Today's guests: Franklin Templeton Portfolio Manager Kim Strand, Vectis Energy Partners Principal Tamar Essner (Source: Bloomberg) #press

Millennium Portfolio Manager Watson Leaves for Rival Balyasny

James Watson, a senior portfolio manager at Millennium Management, left to join rival Balyasny Asset Management, according to people with knowledge of the matter. #press

JPMorgan’s David Kelly Says Another Fed Hike Would Be Dangerous

The Federal Reserve risks pushing US consumers into a “dangerous” place if it ramps up interest rates yet again while inflation is already slowing, JPMorgan Asset Management’s David Kelly warned. #press

Europe Luxury Stocks Slide as Richemont Chairman Says Inflation Is Denting Demand

Luxury-goods stocks slumped in Europe after Richemont Chairman Johann Rupert said inflation is starting to dent demand across the region. #press

Top Court Tells Hong Kong to Create Legal Framework for Same-Sex Unions

Hong Kong’s top court has ordered the government to establish laws recognizing same-sex partnerships. This is one of the biggest victories yet for LGBTQ activists in the financial hub. Bruce Einhorn reports on Bloomberg Television. (Source: Bloomberg) #press

Jeremy Grantham Explains the Case for His Latest Doom Prophecy

While many on Wall Street have stopped obsessing about a recession, Jeremy Grantham has not. That should shock no one who has followed the career of Grantham Mayo Van Otterloo & Co.’s co-founder. #press

Saudis Prolong 1 Million Barrel Oil Output Cut for 3 Months

Saudi Arabia prolonged its unilateral oil production cut by another three months as the kingdom seeks to support a fragile global market. Russia joined with an extension to its own export curbs. #press

Wall Street Rethinks Turkish Rate Path as Inflation Heads to 70%

Wall Street banks are again having to rewrite their outlooks for Turkish interest rates, as inflation climbs faster than expected. #press

Singapore Billion Dollar Money Laundering Case Exposes Gaps in Defenses

A billion-dollar Singapore money laundering probe is shining a light on fund flows from abroad and raising questions about loopholes that enabled an alleged crime syndicate to accumulate luxury property, Bentley cars and cryptocurrency. #press

SoftBank’s Arm Seeks to Raise Up to $4.87 Billion in Anticipated IPO

SoftBank Group Corp.’s Arm Holdings Ltd. is planning to raise as much as $4.87 billion in what would be the biggest initial public offering of the year, though smaller than the once-obscure designer of phone chips previously considered. #press

Slovene Banks Face New Tax to Help Fix €7 Billion Flood Damage

Slovenia plans to slap a five-year tax on bank profits to help fund flood reconstruction following the country’s worst natural disaster in at least three decades. #press

World Bank in Talks to Double Turkey Exposure to $35 Billion

The World Bank is in advanced talks to potentially double its exposure to Turkey to $35 billion to help stabilize the Middle East’s largest non-oil economy, according to people with direct knowledge of the matter. #press

Goldman Revises US Recession Chances Down to 15%

Goldman Sachs Group Inc. now sees only a 15% chance the US will slide into recession, down from 20% on cooling inflation and a still-resilient labor market. Valerie Tytel reports on Bloomberg Television. (Source: Bloomberg) #press

ECB: July Consumer Inflation Expectations Edge Higher

The European Central Bank says three-year consumer expectations for euro-area inflation inched up in July to 2.4% from 2.3% in its monthly survey. Zoe Schneeweiss reports on Bloomberg Television. (Source: Bloomberg) #press

GIC Weighs Sale of Tokyo Office Tower for More Than $2 Billion

Singapore sovereign wealth fund GIC Pte is considering the sale of a top-grade Tokyo skyscraper and has approached potential buyers about the property, according to people with knowledge of the matter. #press

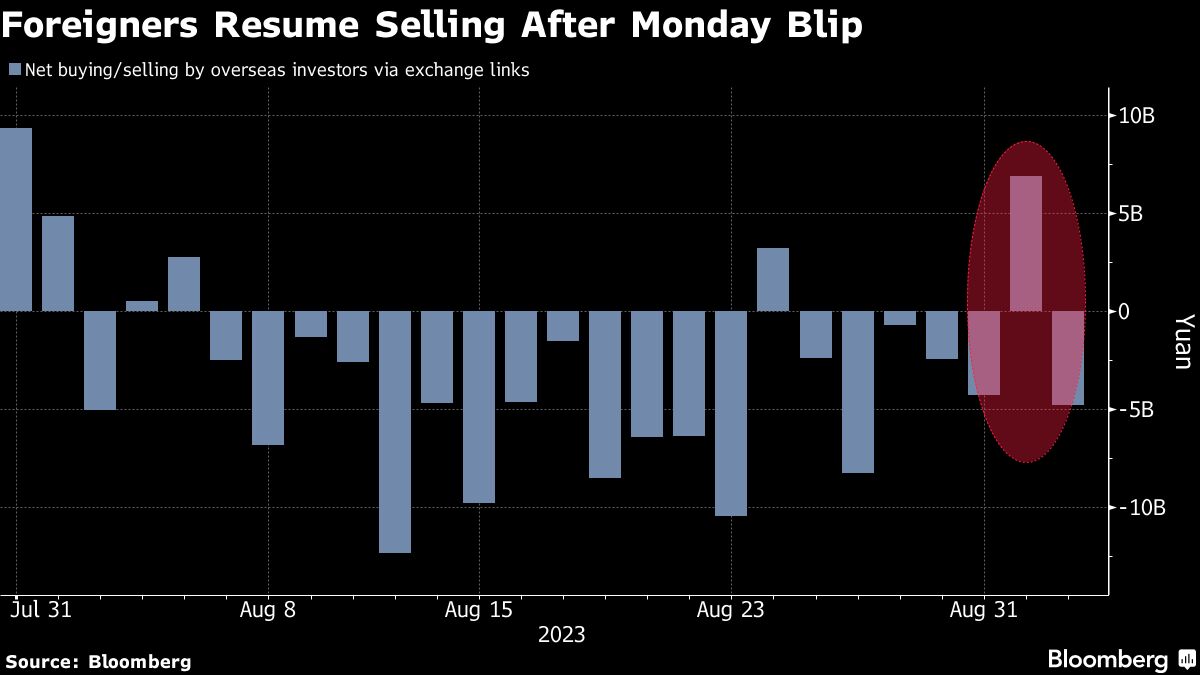

Global Funds Slash China Stock Positions to Lowest Since October

A record selloff in Chinese stocks by global funds has pushed their positioning to the lowest since October, with money managers unswayed by the stimulus measures that have been coming through over the past few weeks. #press

ECB Says Consumer Inflation Expectations Edged Higher in July

Consumer expectations for euro-area inflation inched up in July, remaining above the European Central Bank’s 2% target as officials ponder whether to hike or hold interest rates next week. #press

Axiata, Sinar Mas Revive Talks for Indonesian Unit Deal, Sources Say

Malaysia’s biggest wireless carrier Axiata Group Bhd. and Indonesian conglomerate PT Sinar Mas Group have revived talks that could lead to a merger of their telecommunications operations in Indonesia, according to people familiar with the matter. #press

Reserve Bank of Australia Extends Rate Pause as Governor Lowe Exits

The Reserve Bank of Australia has kept its key interest rate unchanged at 4.10% again at Governor Philip Lowe's last meeting. Still, the central bank maintained a tightening bias. Valerie Tytel reports on Bloomberg Television. (Source: Bloomberg) #press