Thames Water Lender to Offload £500 Million of Loans Amid Election Limbo

A lender to beleaguered utility Thames Water is looking to sell about £500 million ($635.5 million) of the company’s loans, according to people with knowledge of the matter. #press

Booming Hedge-Fund Options Trade Risks Getting Crushed by Crowds

A once-niche stock trade beloved by hedge funds and volatility players has ballooned into one of the biggest options strategies on Wall Street, stirring fears it will get crushed by its own popularity. #press

Foreign Investment in China Drops for Fourth Month in April

Foreign investment into China slowed for a fourth straight month in April, underscoring Beijing’s struggle to attract more overseas funds to boost its flagging economic growth. #press

Five Things You Need to Know to Start Your Day: Americas

Good morning. Stocks wilt on bets the Fed might have to keep rates on hold for longer, while a policy maker questions if the central bank’s main tool has become less effective. Here’s what’s moving markets. — David Goodman #press

ECB’s Nagel Says Likelihood of June Cut Is Winning Traction

The European Central Bank is on track to lower borrowing costs at its next meeting, according to Bundesbank President Joachim Nagel. #press

Wickhams Hill: Short on Lifestyle Communities

Lloyd Moffatt, founding partner at Wickhams Hill, discusses why he is short on Lifestyle Communities and the investment opportunities in the region. He speaks on "Daybreak Australia," after the Sohn Hong Kong Investment Leaders Conference. (Source: Bloomberg) #press

Real Estate Supply-Demand Imbalance Is 'Buying Opportunity': Tikehau Capital

The Co-Founder of alternative asset management company, Tikehau Capital says a supply-demand imbalance in some illiquid assets, including real estate, is creating "buying opportunities". Mathieu Chabran discussed the firm's investment outlook with Bloomberg's Francine Lacqua. (Source:... #press

Carry Trade Is All the Rage Across Global Bond and FX Markets

Exploiting differences in interest rates is set to become one of the most popular investment strategies in coming months as markets bet shallower cuts will keep volatility subdued. #press

Hong Kong Home Prices Drop to Erase Gains After Property Tax Cut

Hong Kong’s secondhand residential prices fell for the fourth week to the lowest in more than two months, erasing the gains in values after the government removed property curbs in February. #press

France Calls for Shared G-7 Assesment of China Overcapacities

French Finance Minister Bruno Le Maire said the Group of Seven needs to establish a fair and in-depth assessment of excess Chinese industrial exports and the tools countries can use to address it. #press

Jailed Russian Tycoon Wins UK Ruling to Block $7.5 Billion Payout

A jailed Russian tycoon won a UK court ruling blocking a sanctioned Russian entity from getting $7.5 billion in a suit linked to control of a strategically crucial port in the Black Sea. #press

America Has a Retirement Problem, Ghilarducci Says

Labor economist Teresa Ghilarducci talks about the problem with America's retirement system. She speaks to Bloomberg's Sonali Basak in a wide ranging interview about the shortcomings and what needs to change. (Source: Bloomberg) #press

War Dealing Severe Blow to Palestinian Economy, World Bank Says

The Palestinian economy is suffering a “severe blow” as a result of the war in Gaza, facing a widening financing gap alongside deteriorating growth and dire job losses, according to estimates by the World Bank. #press

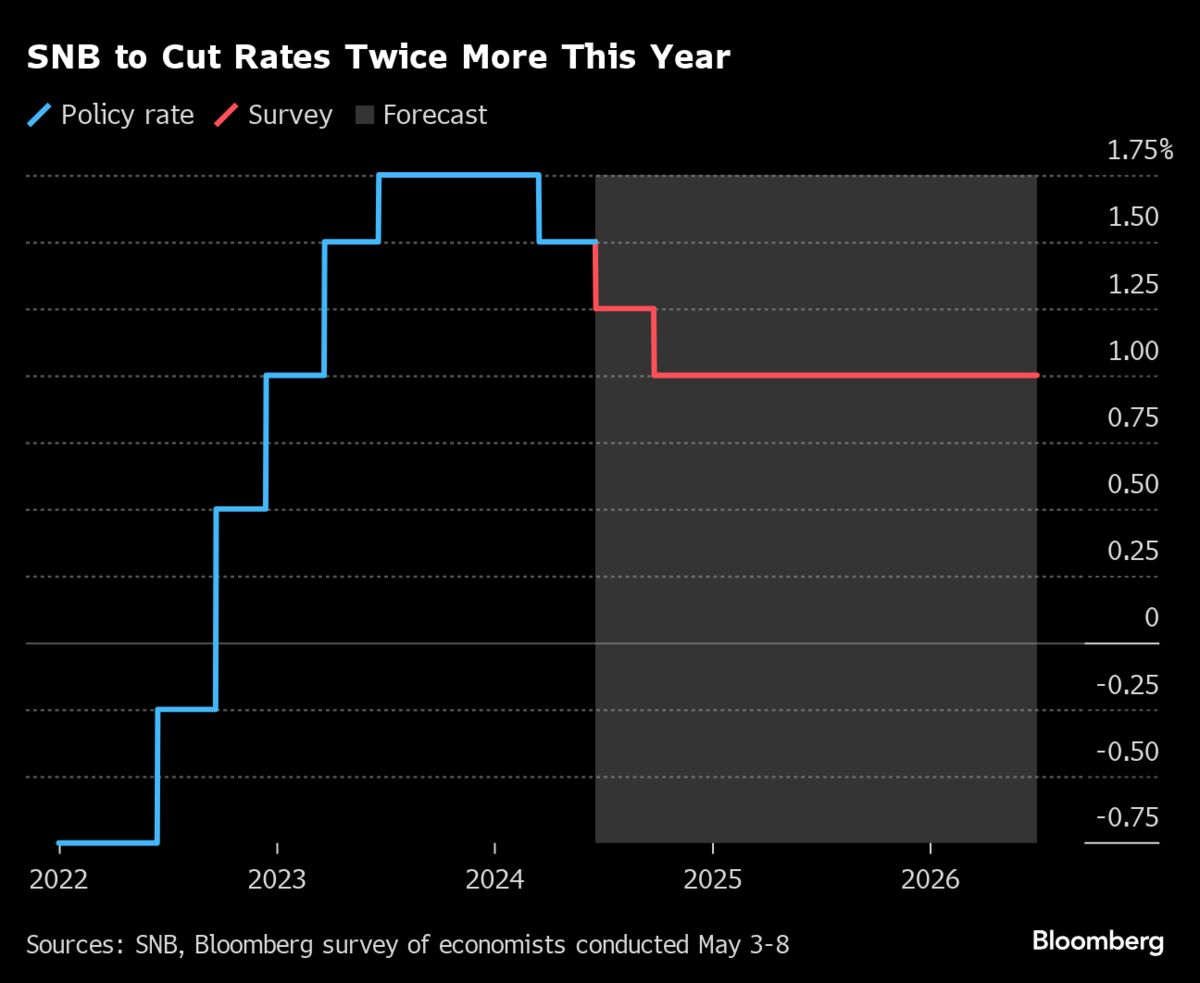

SNB Doesn’t Have to Follow Peers on Transparency, Jordan Says

The Swiss National Bank should stick with its approach of not publishing minutes of policymakers’ discussions, according to President Thomas Jordan. #press

London Exchange Loses Half of ETF Team Ahead of Crypto Launch

London Stock Exchange Group Plc has lost half of its four-person team overseeing exchange-traded funds, just as it prepares to list its first products tied to cryptocurrencies. #press

Stock Traders Prepare Game Plan for Biggest Shakeup Since Brexit

The earlier-than-expected UK election is prompting traders to prepare for the country’s biggest political shakeup since Brexit, despite the mostly muted market reaction since the announcement was made. #press

America's $38 Trillion Retirement Problem

Labor economist Teresa Ghilarducci says the government needs to help workers more when it comes to retirement planning. She speaks to Bloomberg's Sonali Basak. (Source: Bloomberg) #press

The So-Called Easiest Bond Trade of 2024 Still Isn’t Working

Welcome to the Weekly Fix, the newsletter where supply and demand is perfectly balanced. I’m cross-asset reporter Katie Greifeld. #press

Indian Rupee Advances by Most in Five Months as Stocks Climb

The Indian rupee strengthened by the most in five months, as the country’s key equities gauge hit a record high. #press

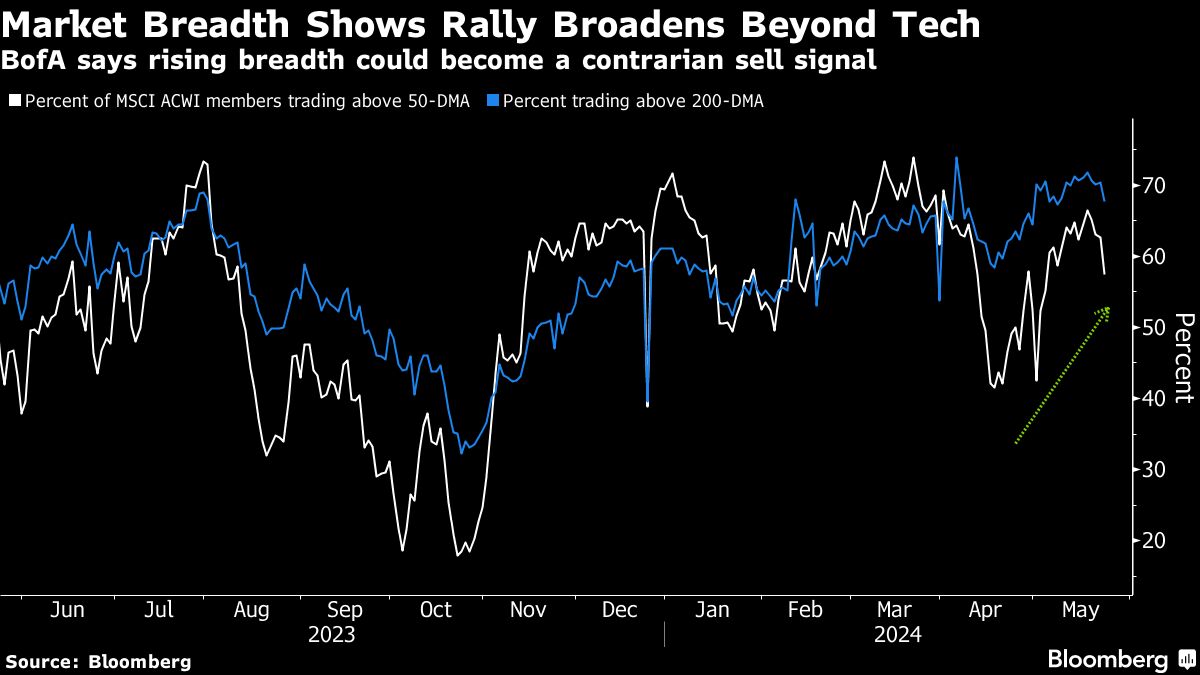

BofA’s Hartnett Says Stock Rally Is Moving Closer to Sell Signal

The rally in global equity markets is at risk of overheating, according to Bank of America Corp. strategist Michael Hartnett. #press