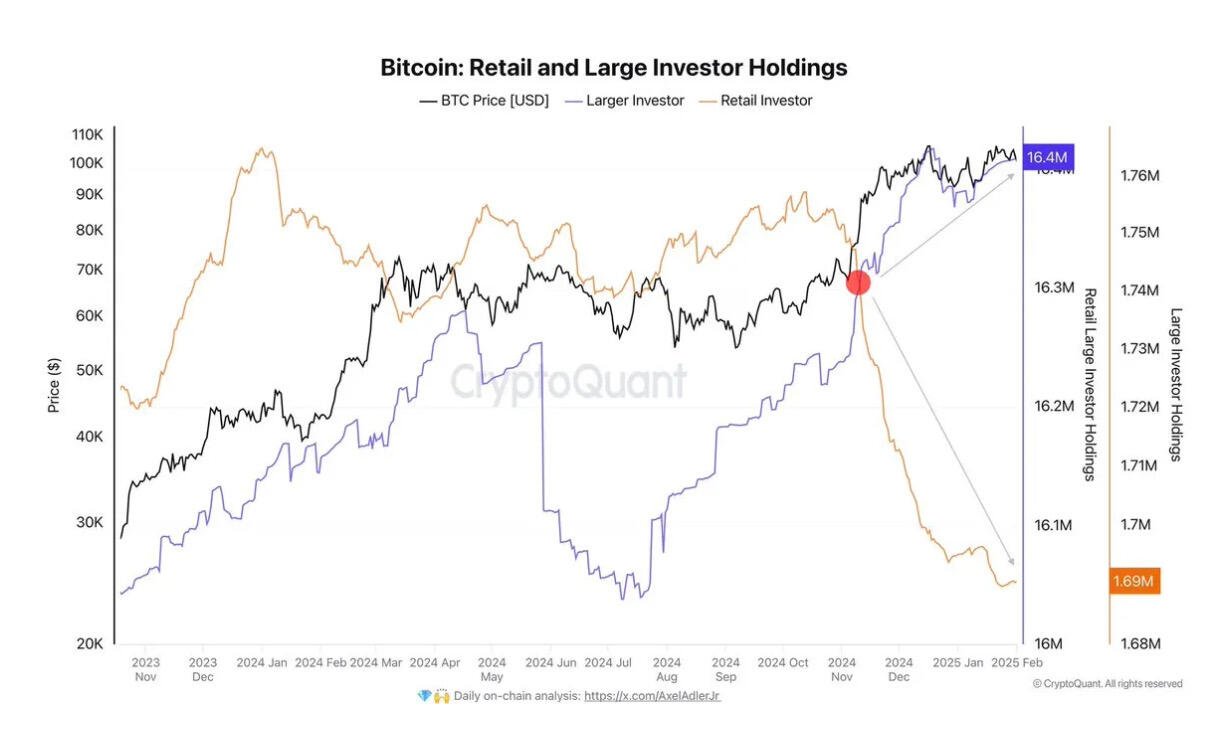

Notable trend worth keeping an eye on. But the scales on these charts are borderline chart crime.

Big day call from nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

Pure speculation:

35%: New strategy, expanding on 21/21

5%: Realized gains exclusion request approved, FASB fair value accounting implemented for Q42024.

60%: He has just learned a few tricks from Senator Lummis on how to entice the markets & get attention.

#BTC #MSTR #bitcoin

Buying opportunity incoming

Capitulation 👀 #BTC #bitcoin

Key Tariff Takeaways:

1: The Triffin Dilemma

- The US dollar's reserve currency status creates a trade imbalance: the US must run deficits to supply dollars globally.

- The US benefits from borrowing cheaply but wants to reduce its overvaluation.

- Tariffs serve as a tool to weaken the dollar, similar to the 1985 Plaza Accord.

2: Trump’s Personal Incentives

Trump’s primary goal is to lower the 10-year Treasury yield to boost real estate, which he is personally invested in.

He will pursue this goal aggressively, regardless of economic side effects.

3: Bitcoin as the Ultimate Hedge

- A weaker dollar and lower interest rates will drive capital into Bitcoin, contrary to mainstream belief.

- Inflation and economic distortions will push foreign nations to stimulate their economies, further debasing currencies.

- Unlike in the past, Bitcoin provides a digital escape from monetary manipulation.

Conclusion:

Tariffs are a short-term tool, but the long-term result is a weaker dollar, inflation, and capital flight into Bitcoin.

Both sides of the trade war dynamic will ultimately favor Bitcoin, making its rise inevitable.

Micro Strategy is the event horizon of Bitcoin #BTC #MSTR

Leverage taken out, going higher. #BTC #maxpain

Headline Job Growth ≠ Labor Market Strength

December 2024 jobs report: +216k jobs, 3.7% unemployment. Strong? Not quite. Full-time jobs are shrinking as part-time work grows (+500k YoY). Labor force participation is down, and sectors like temp help services are shedding jobs—an early warning signal.

Beneath the headline, the market is softening. Are we mistaking quantity for quality? ⚖️

#JobsReport #LaborMarket #EconomicTrends #inflation

MicroStrategy and Unrealized Gains: Why the FUD Doesn’t Hold Up

Recent headlines suggesting that MicroStrategy might face taxes on unrealized Bitcoin gains under the Corporate Alternative Minimum Tax (CAMT) seem to be classic FUD. Here’s why:

1. Regulatory Clarity in Progress: MicroStrategy, alongside a coalition, petitioned the IRS to exclude unrealized gains from CAMT calculations. With guidance still in development and a public hearing scheduled for early 2025, no immediate enforcement seems likely.

2. Pro-Crypto Administration: Both the new Treasury Secretary, Scott Bessent, and crypto advisor David Sacks are strong advocates for Bitcoin. Their focus on fostering innovation and avoiding punitive measures on crypto investments makes such taxation policies improbable.

3. Economic Strategy: Taxing unrealized gains would contradict the administration’s goal to establish the U.S. as a crypto capital. It would discourage investment and innovation in digital assets—a move that seems counterproductive given current priorities.

For shareholders like me, this presents an opportunity. The market uncertainty might allow increasing stakes in MSTR at a discount. Once clarity is achieved, I expect this issue to boost confidence and value.

Bitcoin thrives on resilience, and so will those who stay focused through the noise.

#btc #bitcoin #mstr #microstrategy