Kartais tiesiog sunku suprasti vertę. Bet atsiranda žmonių kurie supranta ir pradeda burtis aplink vertę. #Bitcoin

Sell the news?

#m=image%2Fjpeg&dim=1080x1142&blurhash=%7C154%7EzKc-UIANbEL4%3AXANK%7Epv%7D%250InIoIq9uT0Ipx%40%5DBtRR5IoENIpOZIps%24ot%25fVsIpSiSPNyIVZhWn%3D%7CJ6Ios%3BOYS5M%7Cwxr%3FnORjn%2Co%7DNdV%5BShx%5DxtNFr%40M%7BkWjINHoftSsmbabukWs%3AR%25X8s%3AV%40M%7BahV%5Bn%25S0f%25xabE&x=cea5bd0d67f2a64a9c37aeea21e87bb13f6c24e3b1f072d9feeeeac7fe89ac0e

#m=image%2Fjpeg&dim=1080x1142&blurhash=%7C154%7EzKc-UIANbEL4%3AXANK%7Epv%7D%250InIoIq9uT0Ipx%40%5DBtRR5IoENIpOZIps%24ot%25fVsIpSiSPNyIVZhWn%3D%7CJ6Ios%3BOYS5M%7Cwxr%3FnORjn%2Co%7DNdV%5BShx%5DxtNFr%40M%7BkWjINHoftSsmbabukWs%3AR%25X8s%3AV%40M%7BahV%5Bn%25S0f%25xabE&x=cea5bd0d67f2a64a9c37aeea21e87bb13f6c24e3b1f072d9feeeeac7fe89ac0e

Many disciplined, smart investors are coming. End of Kindergarten.

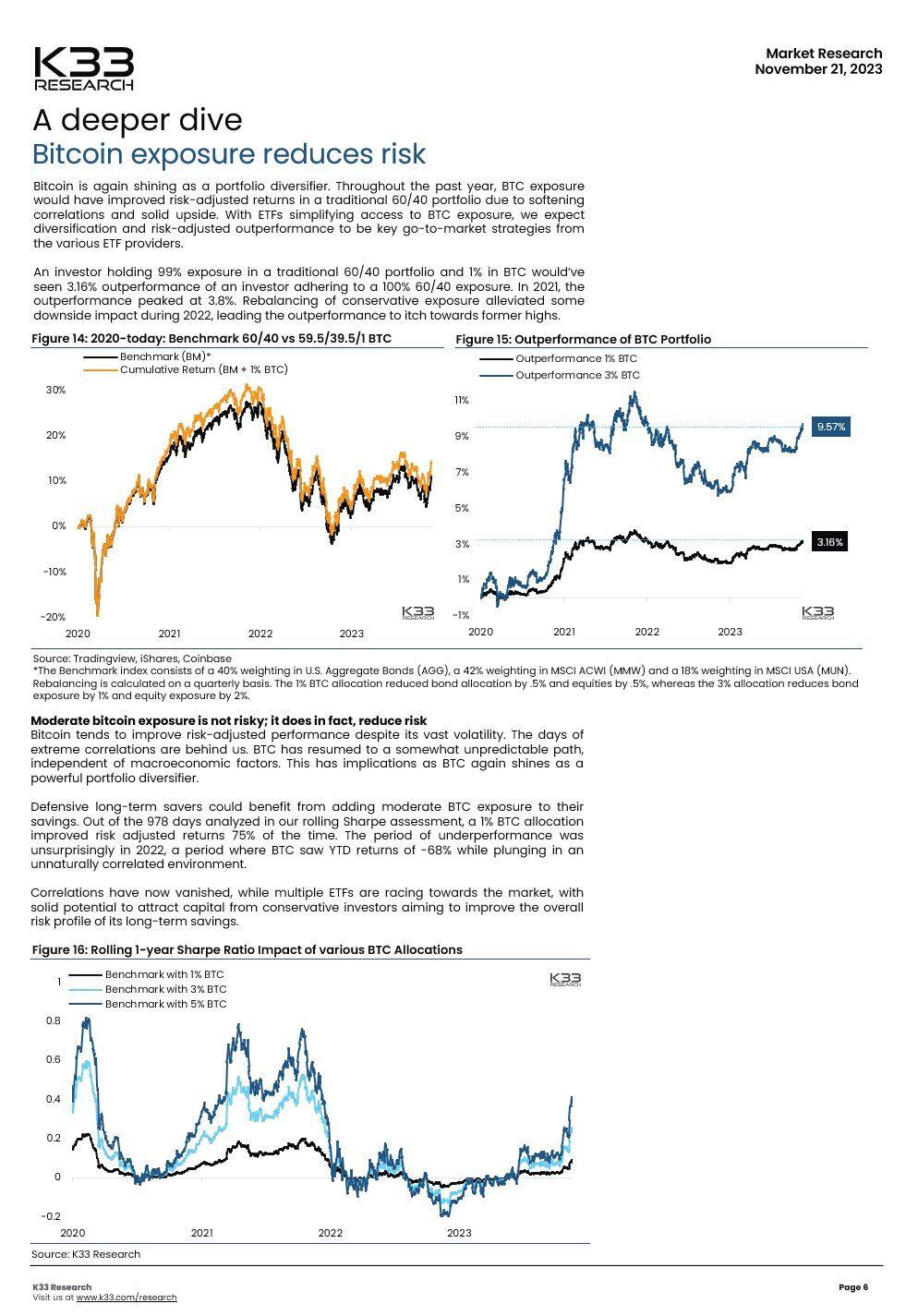

Man visda patinka "K33 research" šaltas protas ir skaičiais pagrįsta analitika.

https://k33.com/research/articles/january-outlook-greater-than-going-to-be-a-big-month

Patvirtinu #Bitcoin ETF kainos svyravimai turėtų sumažėti.

Kaip gauti pakvietimą?

This is a very large amount

Nedarykite to. Jeigu tik turite galimybę mokintis - mokinkitės. Bitcoin niekur nedings.

https://learn.robosats.com/ Labai įdomus projektas

GM

Child's English homework in Norway. #Bitcoin

Aš nesižaviu Argentinos prezidentu. Aš nesižaviu politikais.

When you have to work for 8 hours it causes trouble

The fact that #Bitcoin call options open interest has just hit $10B, surpassing the peak of the 2021 bull run, while retail investors are nowhere to be seen, is a significant indicator of institutional interest in Bitcoin.

Call options are contracts that give the buyer the right, but not the obligation, to buy an asset at a predetermined price on or before a certain date. Open interest is the total number of outstanding options contracts.

A high level of open interest in call options indicates that there is a lot of bullish sentiment in the market. In the case of Bitcoin, it suggests that institutional investors are betting on the price of Bitcoin rising in the future.

The fact that retail investors are nowhere to be seen is further evidence of this institutional interest. Retail investors are typically more active in the spot market, where they buy and sell Bitcoin directly. Institutional investors, on the other hand, are more likely to use derivatives markets, such as options, to manage their risk and exposure.

The overall implication is that institutional investors are becoming increasingly bullish on Bitcoin and are using options markets to express this view. This is a significant development, as it suggests that Bitcoin is becoming more widely accepted as a legitimate asset class by institutional investors.

Here are some possible reasons why institutional investors are becoming more bullish on Bitcoin:

* **Inflation:** Bitcoin is seen by many as a hedge against inflation, as it has a limited supply and its value is not controlled by any central bank.

* **Geopolitical instability:** Bitcoin is also seen as a safe haven asset, as it is not tied to any particular government or financial system.

* **Maturity of the Bitcoin market:** The Bitcoin market has matured significantly in recent years, with more regulated exchanges and custodians. This makes it easier for institutional investors to invest in Bitcoin.

It is important to note that the options market is complex and risky. Investors should carefully consider their investment objectives and risk tolerance before trading options.