Vanguard is making a big mistake right now, adapt or die.

#vanguard #Bitcoin #etf

Demand incoming 🕰️ 🍿

Is Grayscale’s Spot Bitcoin ETF (conversion) getting the nod today, What’s your take?

#bitcoin #etf #SEC

This situation is another example of why we need a trust-less base layer for civilization. We need a form of government that serves society, not one that is focused on personal financial gain.

#bitcoin #etf #SEC

How do these things happen 😂! SEC is so sus, I don’t know what to believe anymore. Fuck it, smash buy.

#bitcoin #etf #SEC

New video out now! Rumor has it that the Spot Bitcoin ETF’s will be approved this coming week. Join me as I break down the bullish case upon approval and the potential scenario of a delayed decision from the SEC. Subscribe and enjoy!

https://youtu.be/SLPLWfQJdY8?si=zUr2IZmrf1x3FFJY

#bitcoin #etf #demand

While I believe that we will most likely see an approval of spot Bitcoin ETF’s next week, I do see some reasons why they would choose to delay.

1. Halt momentum: There are many bullish catalysts on the horizon this year. With the approval of a Spot Bitcoin ETF, the halving and a weakening dollar economy, they may not be ready to pour fuel on the fire.

2. To allow big players (BlackRock, US gov, others) to buy Bitcoin at a lower price. We’ve seen a nice run-up to where we are today in anticipation of this news. If we get a delay, we will most likely see a decent pullback.

3. Eliminate outsiders: We have the final deadline for Ark next week. I also see incentive for the SEC to keep Grayscale out of the Spot Bitcoin ETF race due to their massive Bitcoin position. This will give them an advantage and the SEC may look to counter this advantage. They may need more time to do so.

4. To allow time to get the anti-self-custody bill passed & clear up legal issues with Coinbase. They want to control Bitcoin and they would prefer to keep Bitcoin in one place. I think we’ll see a major effort from the gov to co-opt Coinbase over the coming years. If the Bitcoin stays there, it is easier to monitor/take/tax.

#bitcoin #etf

I front-run the front-runners

Some say we will have a “blockchain” money, backed by commodities. Why does it need to be backed by commodities? The reason people make this argument is because commodities have scarcity. The idea here is that since there is a limited supply of commodities, you won’t be able to create an unlimited supply of currency units. This is a credit based system, that will not work. The world could never coordinate this system and the commodities will never be held 1 to 1 with the currency (we got a taste of this with the gold standard). With Bitcoin the scarcity is built into the money, eliminating the need for the money to be backed by a scarce asset. This eliminates the inefficient and detrimental step of trusting all the network participants to have all the currency-backed commodities that they claim to have but never will.

#money #bitcoin

If I was a large entity looking to get in on Bitcoin, I would want to buy Bitcoin before the ETF approval. I’d at least allocate a chunk of my capital prior to my approval date prediction.

#bitcoin #etf

The more I think about it, the riskier I think the stock market is. Businesses keep their money at the bank, and they invest heavily in treasuries. Also, stocks may become a luxury people can’t afford, whether that’s caused by inflation and/or unemployment/loss.

#stocks #risk

The problem with the stock market is that businesses are too intertwined with the dollar system. If a business is heavily invested in cash, treasuries, banks and other stocks then they may be exposed in a contagion event. I’d be much more inclined to invest in a business if they store their value in Bitcoin.

#business #bitcoin #investing

Happy New Year! This year let’s all try to grow more than Bitcoin, gonna be tough 😬😅

#happynewyear #bitcoin

It will be interesting to see the impact of California’s new minimum wage of $20 per hour for fast food employees, starting next year. So far we’re seeing it lead to layoffs and higher prices. Maybe we need a better thought out solution to this problem.

#California #inflation

When there is no market for treasuries, the Ponzi scheme falls apart.

#debt #print

Happy holidays baby! New video out now! The Fed confirmed that they will be pivoting to a looser monetary policy in 2024. Join me as I discuss what this means for the dollar, treasuries, bitcoin, gold, equities and real estate. Subscribe and enjoy!

https://youtu.be/kd_6C0WSArI?si=3PwMyHcHP-Ei9vJ3

#markets #fed #bitcoin #nostr

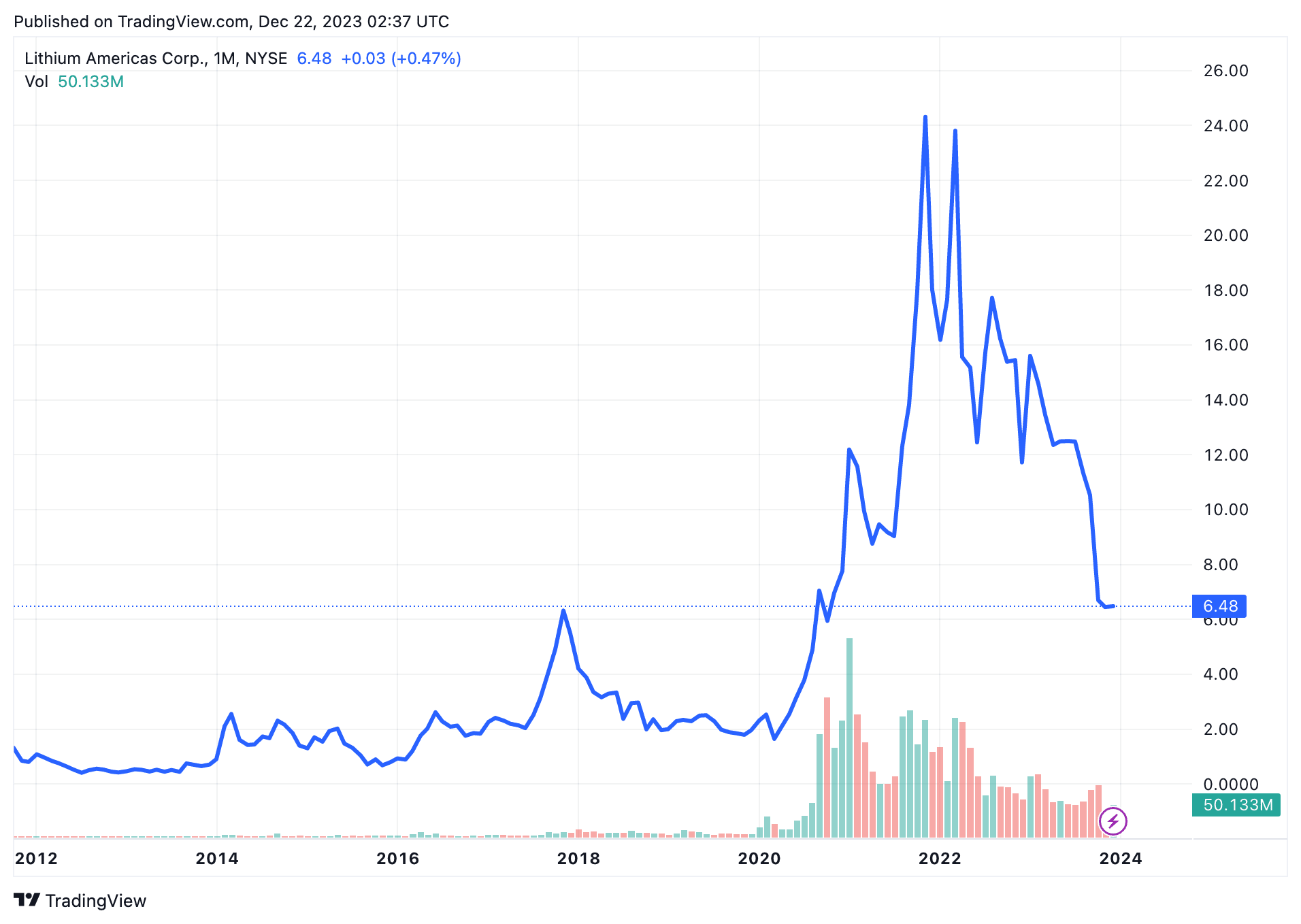

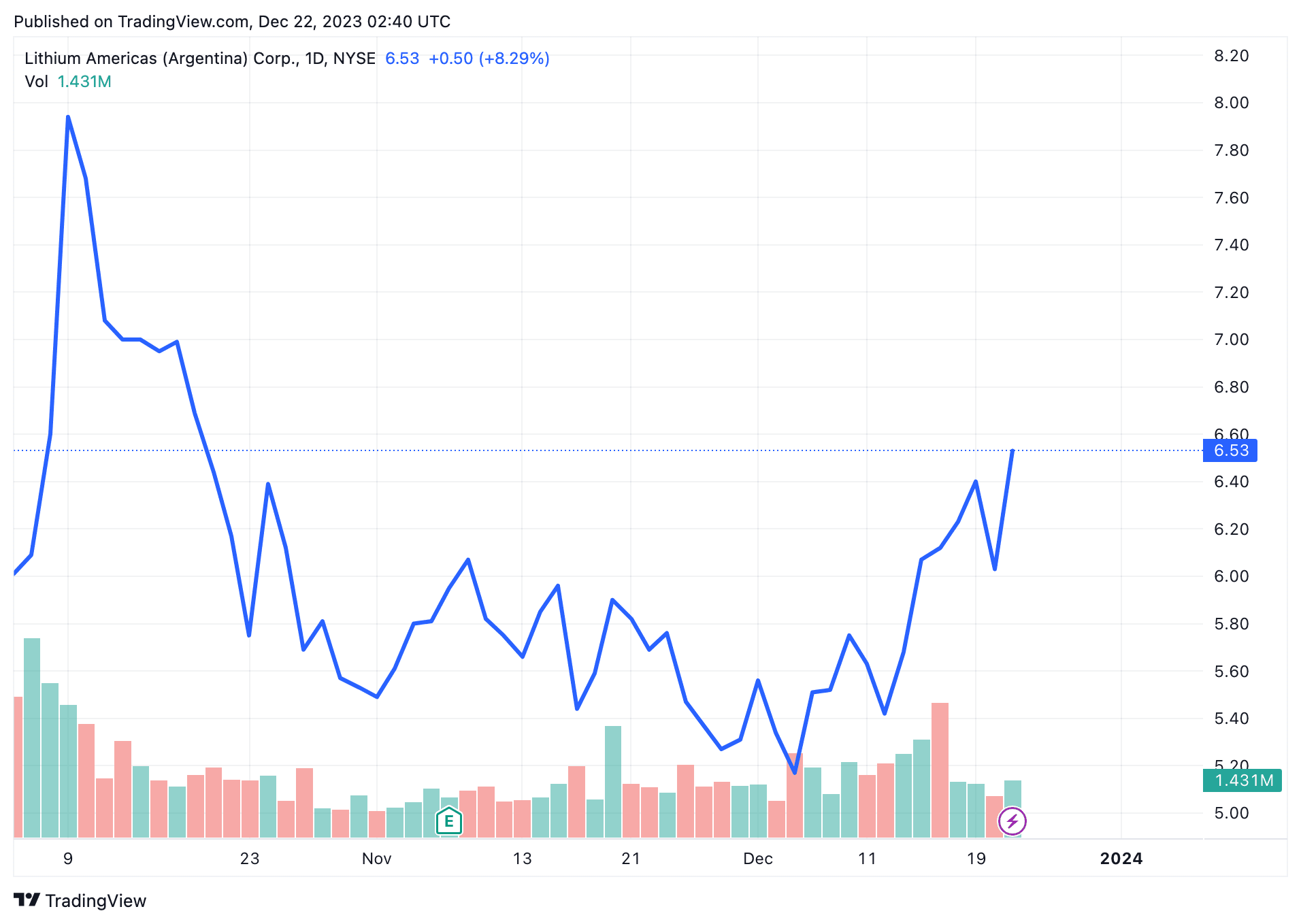

Two stocks that I’m bullish on long-term are Lithium Americas Corp (LAC) and Lithium Americas (Argentina) Corp (LAAC). On 10/03/23 Lithium Americas Corp reorganized into two separate publicly traded companies, one for their operations in Thacker Pass (Nevada, United States) and one for their operations in Argentina. I see a lot of upside potential for both companies.

Lithium Americas Corp is focused on their Thacker Pass project. Thacker Pass is a large lithium mine located on the southern end of the McDermitt Caldera, the largest lithium reserve in the United States. LAC is currently in stage 1 of their multi-year construction plan and looking to start producing lithium in the second half of 2026. There is not a lot of competition when it comes to lithium production in the United States (although it is growing), most of our lithium is imported. The Thacker Pass project has a ton of potential if all goes to plan.

Lithium Americas (Argentina) Corp is focused on lithium production in Argentina. Argentina is one of the most lithium rich countries in the world. LAAC Is already seeing great production with their Cauchari-Olaroz project. The company also has two exploration projects in Argentina, the Pastos Grandes project and Sal de la Puna project. LAAC is already producing results and has a lot of room to grow. LAAC also may face less obstacles in their lithium production as Argentina may be less restrictive when it comes to lithium mining.

With an increased demand for lithium over the coming decades, I think now is a good time to get exposure to lithium equities. I see value and room for growth in both companies. Both companies have also stated that they strive to operate under the highest environmental, social, governance and safety standards.

#lithium #stocks #value

Disclaimer: This is not financial advice, this content is created for entertainment purposes only.

Over the next decade we will see an exodus from the dollar and treasuries. The pace of dollar devaluation will increase more every year, forcing people out of the system. Where will that value travel to? I can think of a couple places.

#value #economics #money

The higher Bitcoin’s price goes, the more businesses think, “Maybe I should start accepting Bitcoin as payment.” This is how Bitcoin’s function as a medium of exchange evolves.

#bitcoin #money