Try not to use custodial services. Look into self custody solutions. We don't want paper bitcoin.

Yes. The problem is when you get punished for exercising privacy. That shouldn't happen.

The issue is that cashu is so easy, and newbies walk in asking for help. You know they are going to use a custodial service one way or another. You can 'tell' them to run their own node but i highly doubt they are going to do it on average.

Everyone has something to hide. Nothing wrong with that.

You have to run your own node

I'm saying it more as a joke, sorry. Some people are scared of having a little privacy and freedom

That depends if you want 'illegal' #cashu #ecash or legal #lightning

or setup your own node to receive pure lightning.

IMHO, you should do both

The problem is that people are going to trust these custodial services no matter what we tell them. So I say do away with the traditional custodial lightning, and move it into cashu. How to get users into self custody is the delimma.

Crap. I think i deleted my message that you were responding to because i missunderstood your prior statement.

I think cashu works better for receiving money through a LN Address, even better than self hosting, assuming you are expecting to receive small amounts, e.g. a regular user, as it adds a level of privacy.

There are no tricks, secrets. It's not a fair system. They make up the rules as they go. Want a tip? If you want to play by the rules then don't use bitcoin.

The value prop of Bitcoin is permissionless which is incompatible with white markets by definition.

If one is going to make transactions that follow the rules, there is little reason to have or use Bitcoin. In fact, it might even end up worse than just using fiat.

Lightning uses TOR, #cashu uses #ecash. So now mixing your money through TOR is perfectly legal, but using ecash is a fedral crime? Where do people come up with this stuff?

So you are unfamiliar with the de mimimis rule for crypto. You are required to report everything regardless of size. My tax software makes me enter in gifts, and any receipt is income. Doesn't matter if it's 21 sats.

https://www.coindesk.com/policy/2023/09/19/crypto-wants-a-de-minimis-tax-exemption-in-the-us/

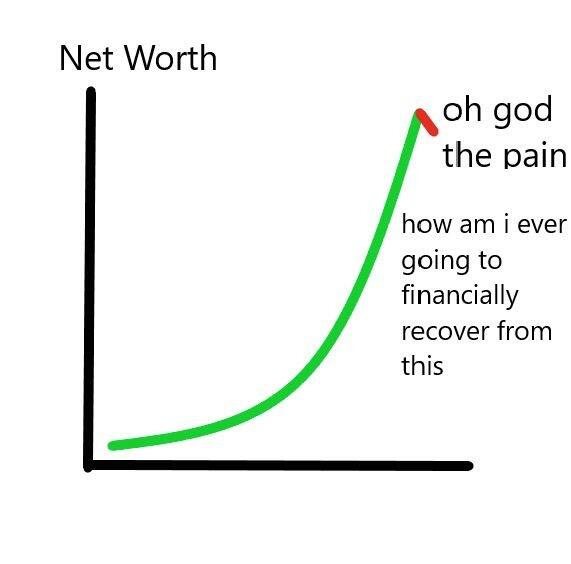

And it's much worse than paying 'back taxes'. The IRS puts you to work. They make you trace all your coins around the blockchain, asking for more and more information. A years worth of transaction data is not small. They will 'claim' this movement of funds is a taxible event even though you just moved it from your wallet A to wallet B, then you move it back, another 'claim' that it's income. So no they taxed you twice for the same event, which wasn't even a taxable event. Burden of proof is on you. Then eventually the agent gives up and you get assigned a new agent, start all over, picking up where the old one left off. Goes on for 3 years. All because you wanted to use lightning.

You clearly don't know how capital gains work. It's FIFO. You have to match up each sale/spend transaction with a corresponding buy based on the FIFO rules. If you are buying coffee every morning, semding tips around, etc for 365 days It is nearly impossible to comply with. It has to be manually entered in. Also, there are numerous wallets installed. How many sats do you pass around and receive, etc. It all adds up.

It's 'easy enough to just pay if you sell and have profit'. There is no tax software that supports lightning. It only handles on chain transactions. On chain is not reality.

And of you want to go on about how we need to pay our taxes then please provide at least one tax software package that can handle lightning transactions. Oh wait, there are none. Now what?