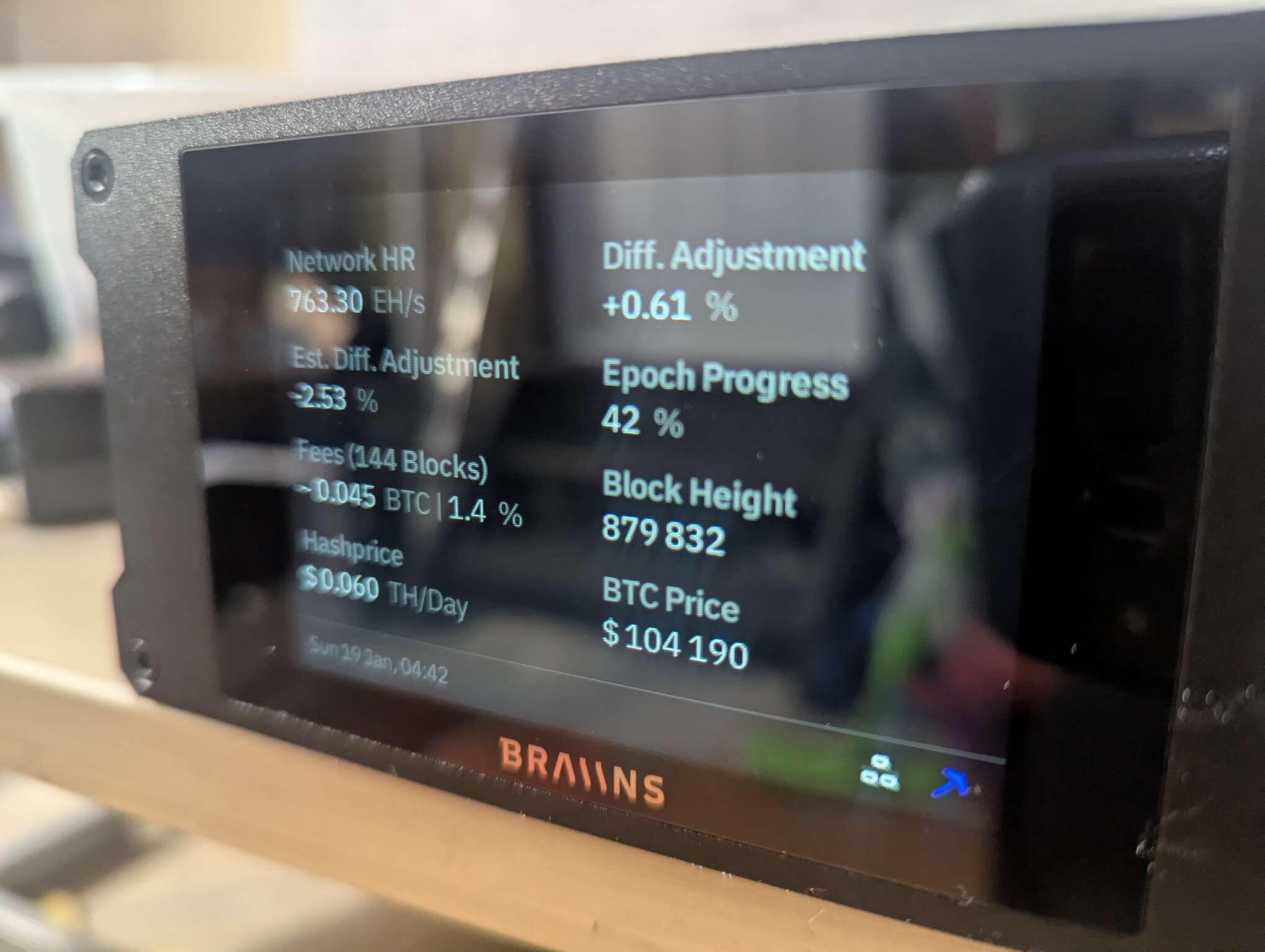

Bitcoin lottery miner engaged.

LFG 🚀

Please may I have another beating. 🤡

Dumbass

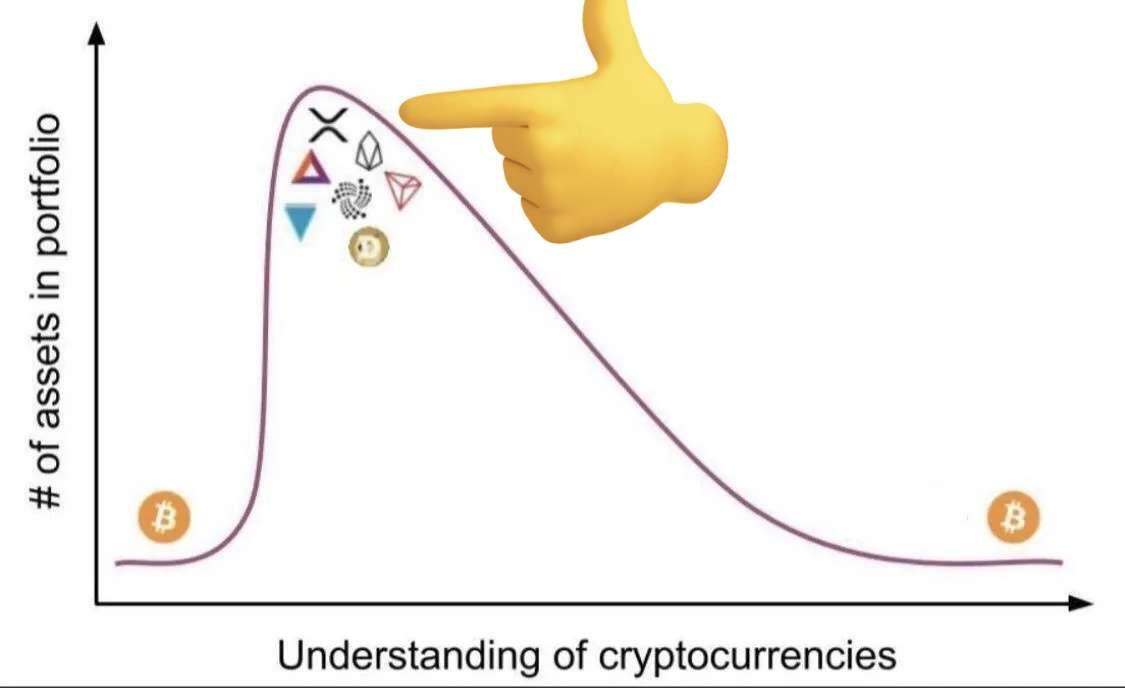

Cut the cord

Trump's are here.

What to Study? 👇

" the Bitcoin white paper" by Satoshi Nakamoto - The original paper that started it all.

" The Bitcoin Standard" by Saifedean Ammous - The first book that orange peeled more people than any other.

"Broken money" by Lyn Alden - About why our money is failing us and how to fix it.

"Mastering Bitcoin" by Andreas Antonopoulos - A technical deep-dive into how Bitcoin works

"Digital Gold" by Nathaniel Popper - Chronicles Bitcoin's early history and development

"Layered Money" by Nik Bhatia - Explores Bitcoin's role in the evolution of monetary systems

"The Price of Tomorrow" by Jeff Booth - Discusses deflation and Bitcoin's role in the future economy

"Thank God for Bitcoin" by Jimmy Song et al. - Examines Bitcoin from a moral and theological perspective

"21 Lessons" by Gigi - A philosophical exploration of Bitcoin and its implications

"When Money Dies" by Adam Fergusson - While not specifically about Bitcoin, it's widely read in the Bitcoin community for its analysis of hyperinflation

"The Internet of Money" series by Andreas Antonopoulos - Accessible explanations of Bitcoin's significance

"Inventing Bitcoin" by Yan Pritzker - A concise technical introduction to how Bitcoin works

"Bitcoin: Hard Money You Can't F*ck With" by Jason Williams - A straightforward guide to Bitcoin's value proposition

Start studying.

I want a Bitcoin job

://image.nostr.build/15a3eff4bf8cf5f071e5301bcb4370f4add84aa43abe3b74b04f29492f585fce.jpg

Friends don't let friends do mETH.

Bitcoin is the new monetary system.

Crypto is a casino.

🚫 STAY AWAY. 🚫

Not the same.

Tell your friends and family.

From a technical perspective, one of the most fascinating aspects of Bitcoin is how it solved the "Byzantine Generals Problem".

WTF is that?

It's a long-standing computer science challenge about achieving consensus in a distributed system where participants may be unreliable or malicious. (Think Governments)

Through its proof-of-work consensus mechanism and blockchain architecture, Bitcoin created the first practical solution to enable trustless digital transactions without requiring a central authority.

This breakthrough has implications beyond just digital currency.

It demonstrated that we could create systems where participants who don't trust each other can still reach agreement on the state of a shared ledger.

This is why Bitcoin is so awesome.

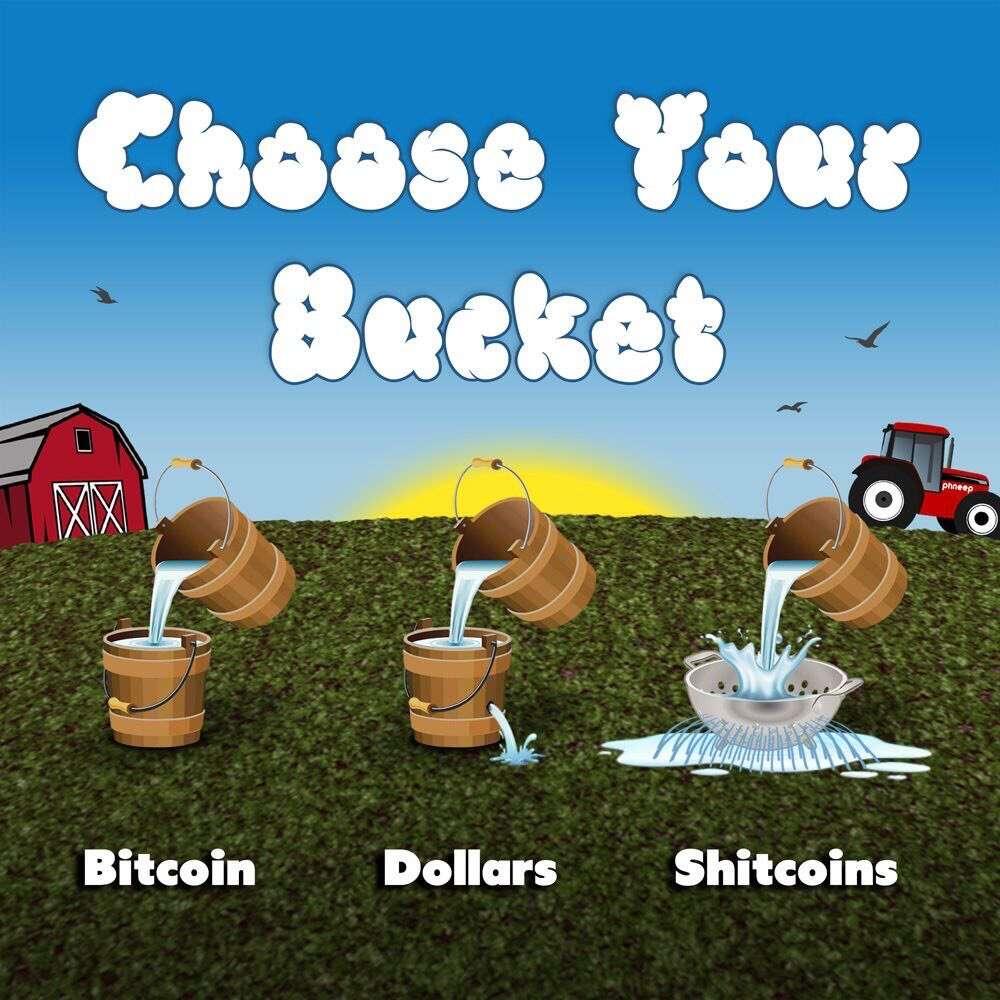

Choose your bucket

The government banning Bitcoin

60 of the 2,781 billionaires in the world own bitcoin.

🤔

Why hyperbitcoinization will take generations.

1. Look how long the gold standard took to fully fall - from 1914 to 1971, with major shifts over decades as the Bretton Woods system evolved and eventually collapsed.

2. The boomers grew up with total faith in banks and fiat. But millennials came of age during the 2008 crisis and Gen Z has never known a world without Bitcoin.

3. The education is happening naturally - every money printing cycle, every bank failure, every frozen account creates more Bitcoin believers. People are learning the hard way why "not your keys, not your coins" matters.

4. The infrastructure for a Bitcoin-native financial system is being built out slowly but surely. Each cycle adds more legitimacy, accessibility and security.

Bitcoin is a long-term transformation.

Each generation gets smarter. Even if they don't fully understand Bitcoin's monetary properties, they intuitively grasp digital scarcity and peer-to-peer value transfer.

The fiat debt bubbles and debasement may accelerate things, but true societal shifts in how we think about and use money take time to ripple through society.

If you already understand this, you are still ahead of 99% of the population.

Fiat printing and sovereign debt is going to accelerate in the next 10 years in several ways:

Demographics are brutal.

- More retirees drawing benefits

- Fewer workers paying into the system

- Exploding healthcare costs

- All while the tax base shrinks

Interest rates are the killer.

- Interest payments are consuming more of government budgets

- Refinancing old cheap debt at higher rates

- Creates a doom loop: higher rates → higher payments → more debt → higher rates

- The Fed trapped between inflation and destroying the bond market.

Unfunded liabilities

- Pension obligations

- Social security shortfalls

- Medicare/healthcare promises

- Most governments can't possibly make good on all promises

Politicians can't help but make it worse

- No politician wins by cutting benefits

- Money printing is the path of least resistance

- Each crisis leads to more intervention and more spending

It's not about "IF" but "WHEN" these bubbles pop.

The system requires exponential debt growth just to maintain itself making the current trajectory totally unsustainable.

#StudyBitcoin