In a recent **TFTC podcast episode**, Parker Lewis outlined a **mathematical inevitability**—a liquidity crisis unfolding in 2025. While optimism around the Trump administration’s economic policies exists, Lewis argues that **no fiscal policy can counteract the Federal Reserve’s tightening liquidity**. The real issue? **Too much debt and not enough dollars.**

This reflection expands on **Lewis’ key arguments**, breaking down:

1. **Where the liquidity crisis is coming from**

2. **Why it’s a structural problem**

3. **What the consequences are**

4. **Why Bitcoin matters in this scenario**

---

### 1. Where Is the Liquidity Crisis Coming From?

The crisis stems from a fundamental imbalance:

- Debt levels have skyrocketed, particularly post-2008 and post-COVID.

- Dollars needed to service this debt are shrinking because of Federal Reserve tightening (QT, interest rates, and shrinking reserves).

#### The Math Behind the Liquidity Squeeze

- In 2007, there was $53 trillion in U.S. dollar-denominated debt, but only $900 billion in base money—a 50:1 leverage ratio.

- By 2023, FED policies had drained dollars from the banking system, while debt levels continued to explode higher. The result? A liquidity-starved financial system dependent on an ever-smaller money pool.

---

### 2. The Structural Problem: FED Policy is the Real Driver

While fiscal policy (tax cuts, tariffs, and deregulation) can marginally improve economic conditions, it cannot stop a liquidity crisis. Lewis emphasizes that the Federal Reserve is the key player in determining financial stability.

#### What the FED Has Done to Shrink Liquidity

- Quantitative Tightening (QT): Actively reducing the money supply by letting bonds roll off the balance sheet.

- Interest Rate Hikes (2022–2023): Made borrowing more expensive, slowing credit creation.

- Reverse Repo Drain: Reduced excess bank reserves, limiting lending ability.

- Shrinking Bank Reserves: With fewer reserves, banks lend less, tightening financial conditions.

This means the liquidity crisis isn’t theoretical—it’s already happening.

---

### 3. The Warning Signs: Cracks in the Financial System

Lewis points to clear signals that liquidity is disappearing:

- Rising delinquencies in commercial mortgage-backed securities (CMBS) – approaching post-2008 highs.

- Credit card delinquencies – nearing 2008 levels.

- Treasury yield inversion anomalies – typically, rate cuts lead to falling long-term bond yields, but that’s not happening, suggesting market pessimism. Bank failures in 2023 (SVB, First Republic, Signature Bank) – early signs of systemic liquidity stress.

The takeaway? Debt is growing, but the available money to service it is shrinking—a recipe for financial instability.

### Consequences: What Happens If Liquidity Remains Tight?

If the FED continues draining liquidity, we may see:

✔ More bank failures, as weaker institutions struggle to survive.

✔ Debt defaults rise, particularly in real estate and corporate debt.

✔ Stock market volatility, as credit-dependent sectors suffer.

✔ A potential recession, triggered by a credit crunch.

The FED may eventually be forced to reverse course and print more money, but waiting too long could trigger a financial shock first.

---

## Final Thoughts: The Crisis is Already Unfolding

This isn’t just speculation, it's a mathematical inevitability. The FED's policies have set the stage for a debt-starved economy with fewer dollars available to sustain it. The next 12 months could be highly volatile, with financial stress increasing.

### Key Takeaways

✅ Trump’s policies may be positive, but they won't prevent a liquidity crisis.

✅ The FED is the dominant force, and its liquidity-draining policies are causing systemic risks.

✅ Leading indicators suggest we’re already in a liquidity crunch.

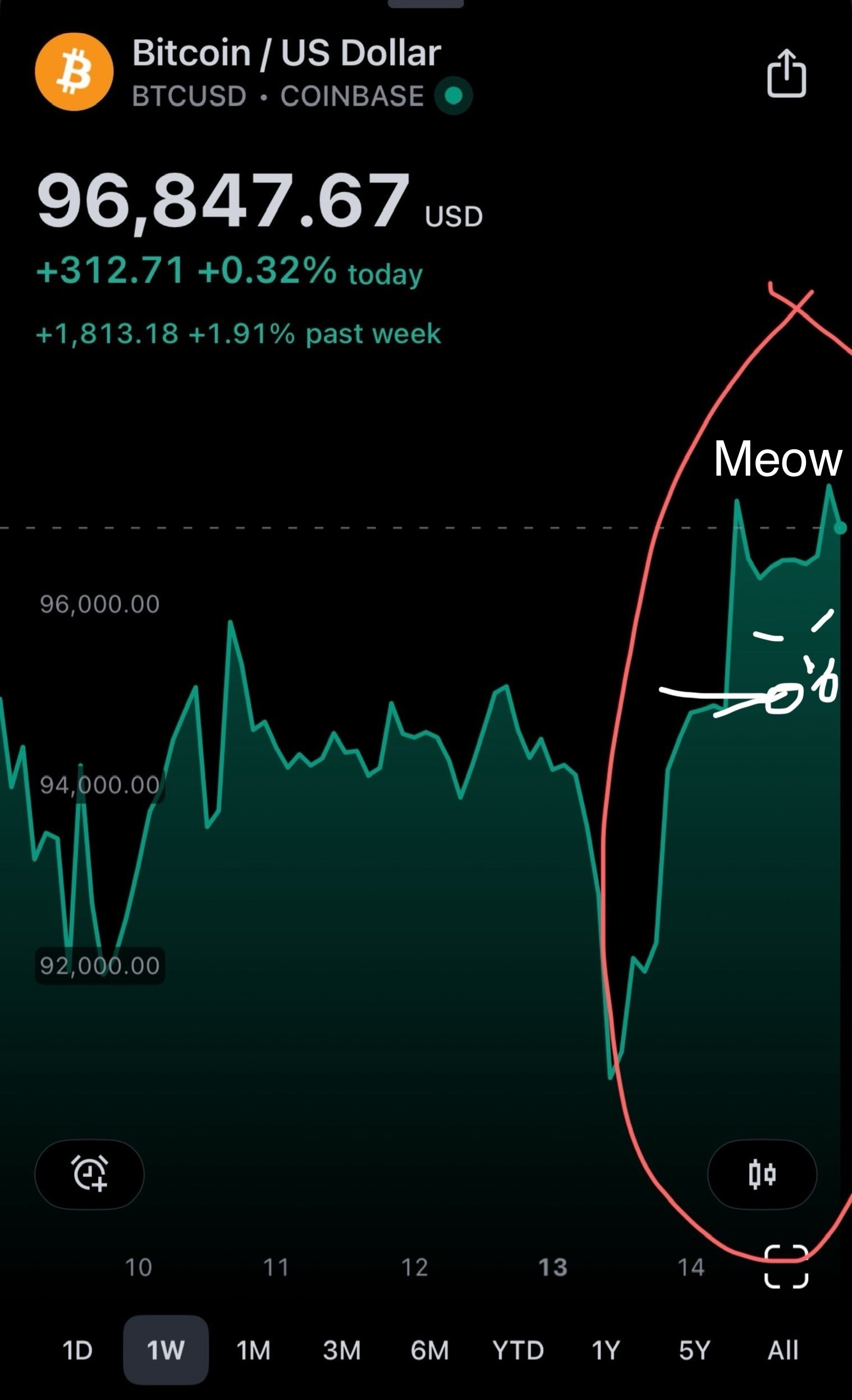

✅ Bitcoin remains a strategic hedge as the FED eventually returns to money printing.

### What to Expect?

A volatile 2025—prepare for financial instability and potential FED intervention.

##

nostr:note1jtt6e3fupsv6mu87em6umrrk46fnr6lssrphf8u4xvvjnxmj2upqvfj2lf

nostr:note1jtt6e3fupsv6mu87em6umrrk46fnr6lssrphf8u4xvvjnxmj2upqvfj2lf