I think you added some lines between the ones you read between.

I may be giving him too much liberty, but I that conversation felt like more of identifying a common problem of anon accounts (the problem being that there’s no cost or recourse for anon behavior that in any other circumstance wouldn’t be tolerated by society at large).

Not currently. Our website, pos, & inventory management is all through the same software and they don’t offer it yet. We’re currently working on bringing all of that in-house so we can integrate nostr:nprofile1qqsv8fus0eeygg3k4mzlv9y5j9x5jka6pzvyfgkcyrug38hmutnfd5spzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqg5waehxw309aex2mrp0yhxgctdw4eju6t0ae4uvy

Once we do, to my knowledge, we’ll be the first business in Abilene, TX that accepts bitcoin.

Exciting stuff happening at the Flower Shop! Bitcoin payments coming soon.

Might be a hot take but I think i have more respect for a communist over a moral relativist

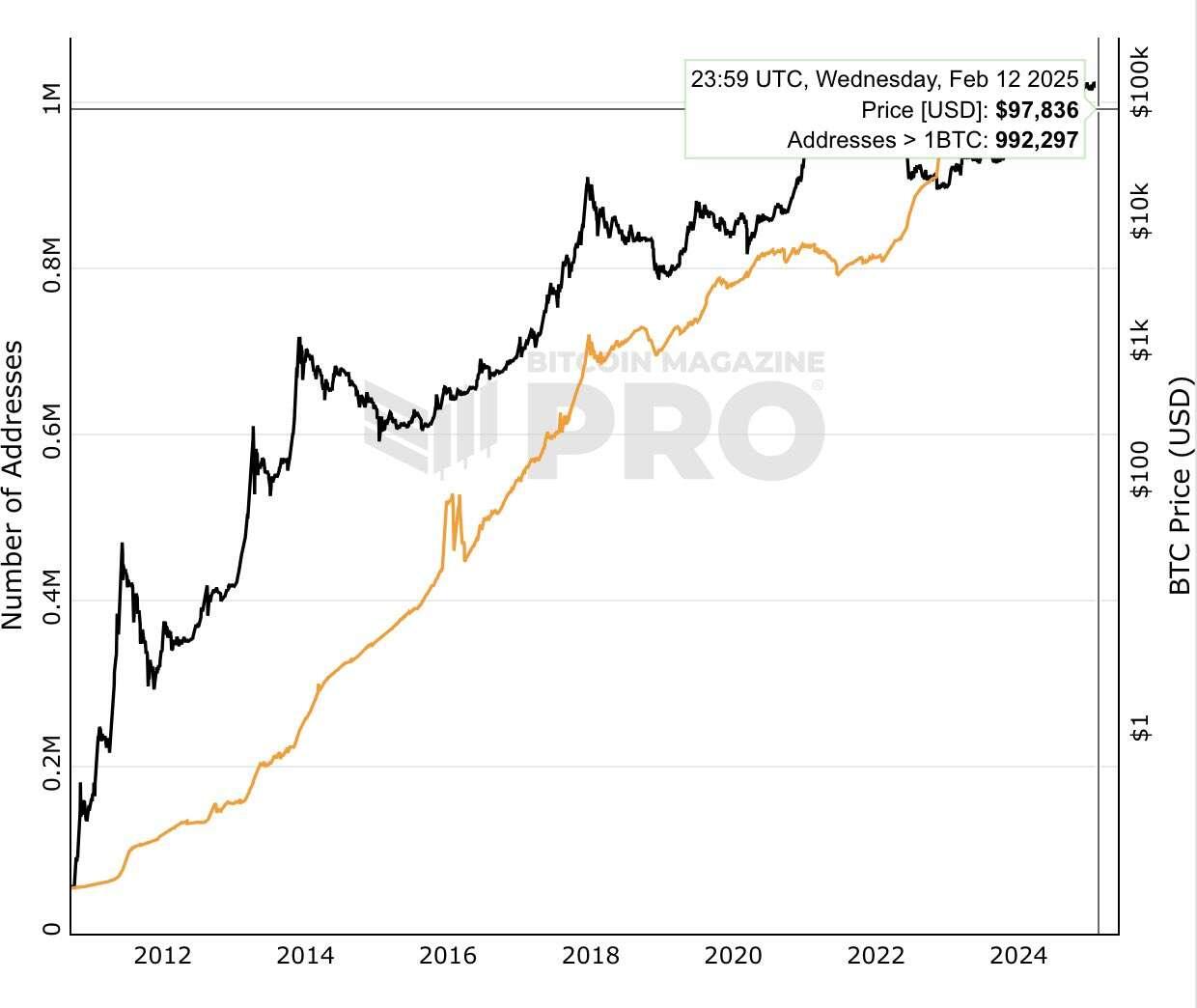

Wonder how many more people have claims to a whole coin via exchanges & ETF’s

Easter coffee with my birthday present from nostr:nprofile1qqsvuav5ls0u79ee2qq6mcr9nar0nw250xl7xphpq2nzxzratlw9ldqpzemhxue69uhhyetvv9ujumn0wd68ytnzv9hxgqghwaehxw309aex2mrp0yhxxatjwfjkuapwveukjygg475

People understand that my flowers die because it happens within a few weeks.

What happens when people realize currencies die?

My clients’ biggest barrier to entry is the accounting burden. We need tools that integrate with Quickbooks and the likes.

Once accounting is automated, I have clients that would start almost immediately.

I think all bitcoin exchanges should be allowed to fractionally reserve their bitcoin . . . contingent they follow the same public balance sheet disclosure laws fiat banks do.

Let the bank runs begin!

I opened a Coinbase account in 2021 to first buy bitcoin but got recommended Swan before I transferred any money.

Now I just keep the account open so I can be first to know when the eventually announce bitcoin withdraw limits :)

This is what AI is meant to be used for. It unlocks a whole new avenue for creativity. This is hilarious! (watch to the end) 😂

Wait for it

https://video.nostr.build/d86b45532f008f1f9cd3ae9a8d92c20ecfa03a97441b1119db0d4e341ec0acaf.mp4

#BULLISHBOUNTY

How many sats for an hour long podcast of Jesus and Theo Von?

Absolutely! If you find yourself in West Texas let’s play a round!

The biggest shift I made from 90’s to 80’s golf was telling myself I was playing bogie golf. Kept me fighting during holes I started to fall apart. Either get to the green in regulation with an extra putt or still feeling like I had two putts after an extra shot to get there.

Still working on how to get to 70’s golf lol

What’s holding you back from 80’s?

I’m working on 50 yard and in shots. Missing a lot of greens and then still two putting after the chip.

Sale increase has to justify the accounting headache, ease of use, and time spent learning.

One option is for Bitcoiners to spend sats and give incentives for adoption, another option is to build programs that make Bitcoin easier to adopt.

In my accounting practice, accounting issues are the largest hurdle to business adoption.

That’s incredible!

The business savings is separate from personal savings. You’d be surprised how thin most businesses run on cash. Most don’t have any savings, so having even a year of net income set aside puts the business head and shoulders above most.

Unfortunately, I have some short-term expenses coming up so I won’t be participating past my normal DCA

My Guess:

1 Year of Net Income -> 2 Years of Saving

5 Years of Net Income -> 5 Years of Saving

10 Years of Net Income ->8 Years of Saving

My business is currently setting aside 20% of business profits.

How long until my retained profits represents:

1 Year of Net Income

5 Years of Net Income

10 Years of Net Income

Whelp, my prediction flopped.

Shitcoin 1 sold today, shitcoin 2 closes tomorrow!