"I don't believe we shall ever have a good money again before we take the thing out of the hands of government, because we can't take them violently out of the hands of government. All we can do is by some sly roundabout way introduce something that they can't stop." ~ 1984 | Friedrich Hayek | Economist

Hayek’s words raise an interesting question: Have you ever stopped to think about why governments control money in the first place? Most people don’t, but it’s worth considering — especially when you realize how this system impacts your wallet.

The money we use today is called fiat currency. It’s not backed by anything tangible, like gold or silver; its value comes entirely from trust in the government that issues it. This setup gives governments a lot of power — they can print more money whenever they want. But here’s the catch: printing too much money causes inflation. That’s why prices seem to creep up every year. Inflation isn’t just annoying; it slowly eats away at the value of your savings and income.

Now here’s where things get ironic. The U.S. government, which runs one of the biggest fiat systems in the world, has started building a Bitcoin Strategic Reserve. Yes, Bitcoin — the decentralized digital currency designed to resist inflation — is being stockpiled by the very institutions that control dollars.

Unlike fiat money, Bitcoin has a fixed supply, so it can’t be inflated. It’s almost like the government is admitting that its own system has some flaws.

Hayek dreamed of “good money” that couldn’t be manipulated by governments. And now, in a twist he probably never imagined, governments are turning to Bitcoin — a currency born out of distrust in centralized systems - as a strategic asset. It makes you wonder: Is this just a clever move by the U.S., or could it be the start of something bigger?

Bitcoin Mendocino

This truck has been a part of so many memories—late-night drives under the stars, early morning fishing trips, and countless family outings. It's more than just a vehicle; it's a piece of our family's history.

Wait…what happened to the separation of money and state?

With the establishment of the Strategic Bitcoin Reserve and approximately 200,000 seized Bitcoin, the United States now officially HODLs more Bitcoin than any other country.

Bitcoin Mendocino

Bitcoin Mendocino

I ran into an acquaintance today. Small talk at first. Then the tone changed. He was frustrated by inequality. He said there should be a limit on how much ‘money’ one person should have. It wasn’t the right time to bring it up but I knew what he was looking for was bitcoin.

Once you see how our financial system is controlled by 12 individuals at the Federal Reserve (which is not a federal agency and has no reserves…)

Once you understand how this system drives financial inequality and facilitates endless wars…

…bitcoin starts to make sense.

Bitcoin Mendocino

Bitcoin Mendocino

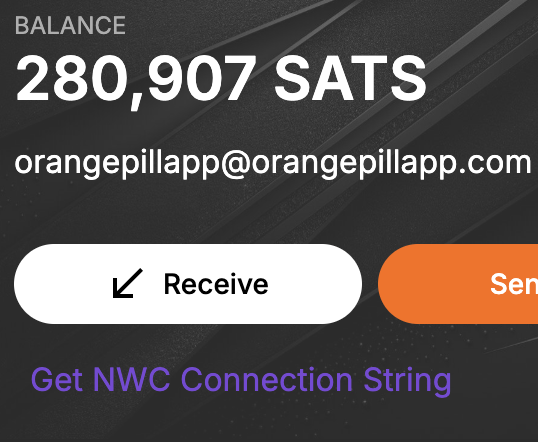

I’ve been trying out the LNURLs of different wallets sending to and from my OPA wallet and it works perfectly.

This bitcoin thing might actually catch on!

Bitcoin Mendocino