Occasionally someone is sending me 1 sat. Is that to tease me?

How Central Banks Can Use Gold Revaluation Accounts in Times of Financial Stress

“Central banks can use entries in their gold revaluation accounts to turn into capital, pay for expenses, or transfer it to their respective Treasuries.”

PBoC in a Hurry to Buy Gold: Covertly Bought 593t of Gold YTD

The PBoC is in a hurry to buy enormous amounts of gold, indicating it’s preparing for substantial changes in the dollar-centric international monetary system.

https://www.gainesvillecoins.com/blog/pboc-in-hurry-to-buy-gold-covertly

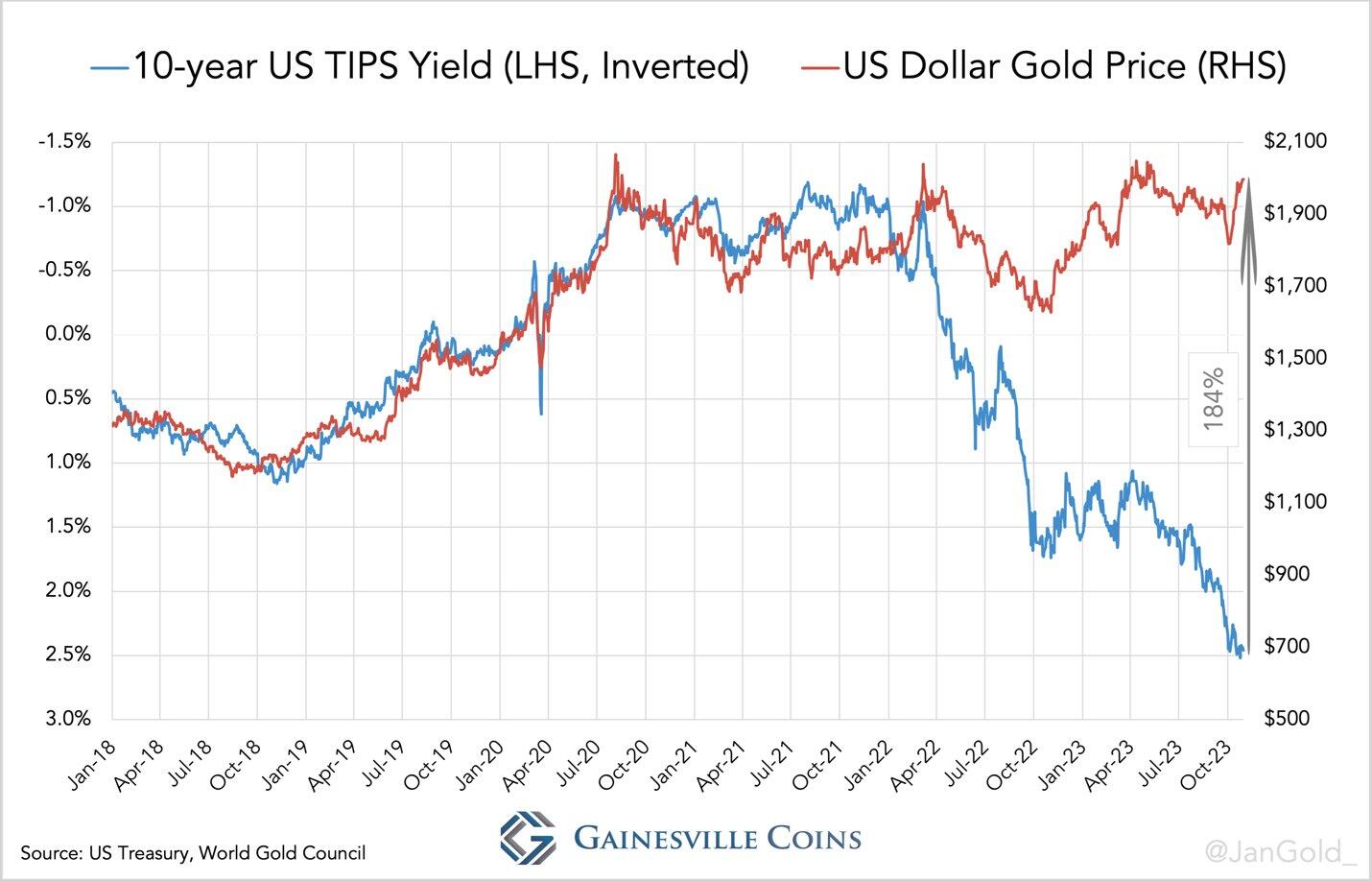

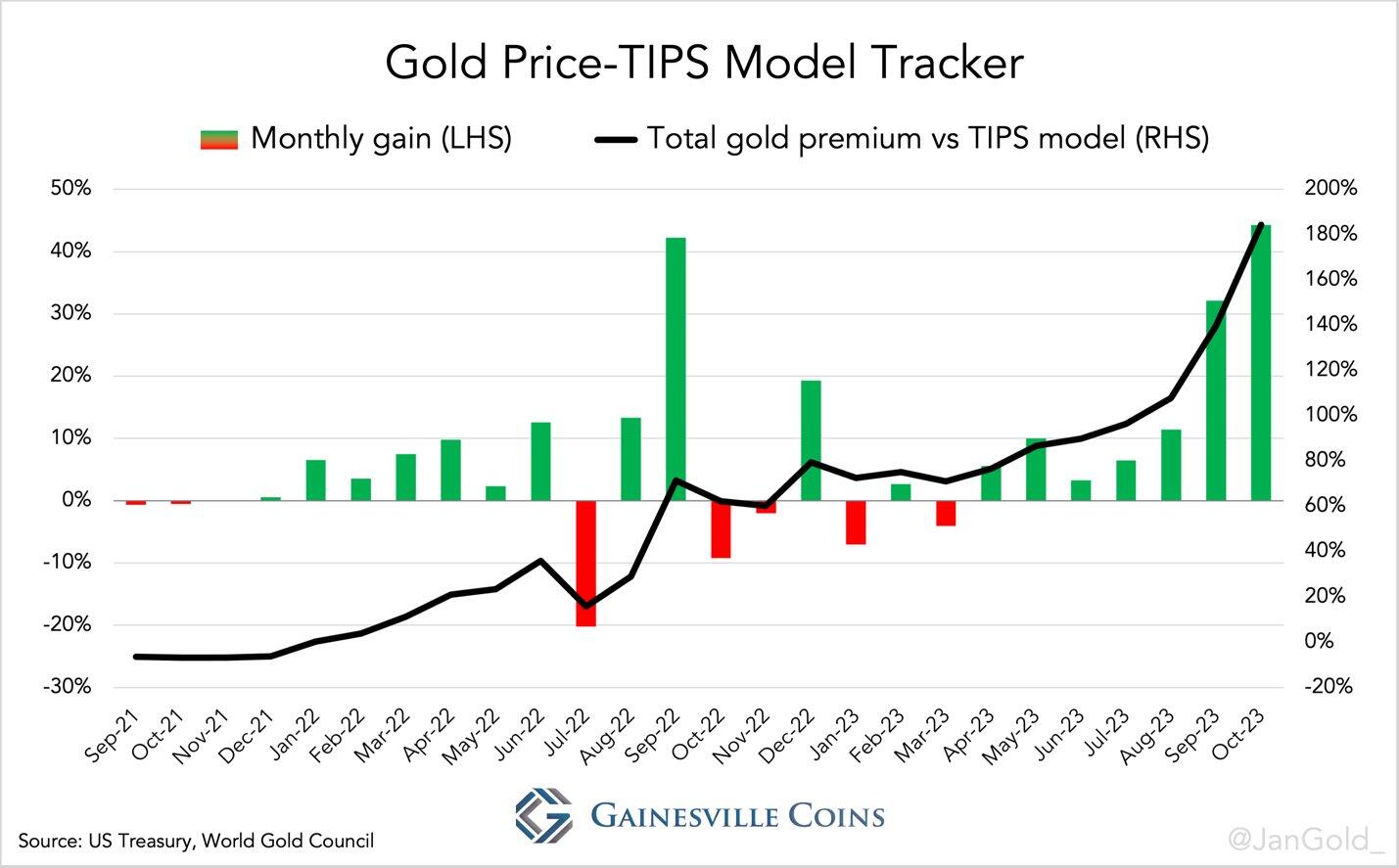

Our monthly Gold Price–TIPS Model Tracker for October shows the gold price added a record 44% to its premium relative to the TIPS yield. The total gold premium reached 184%.

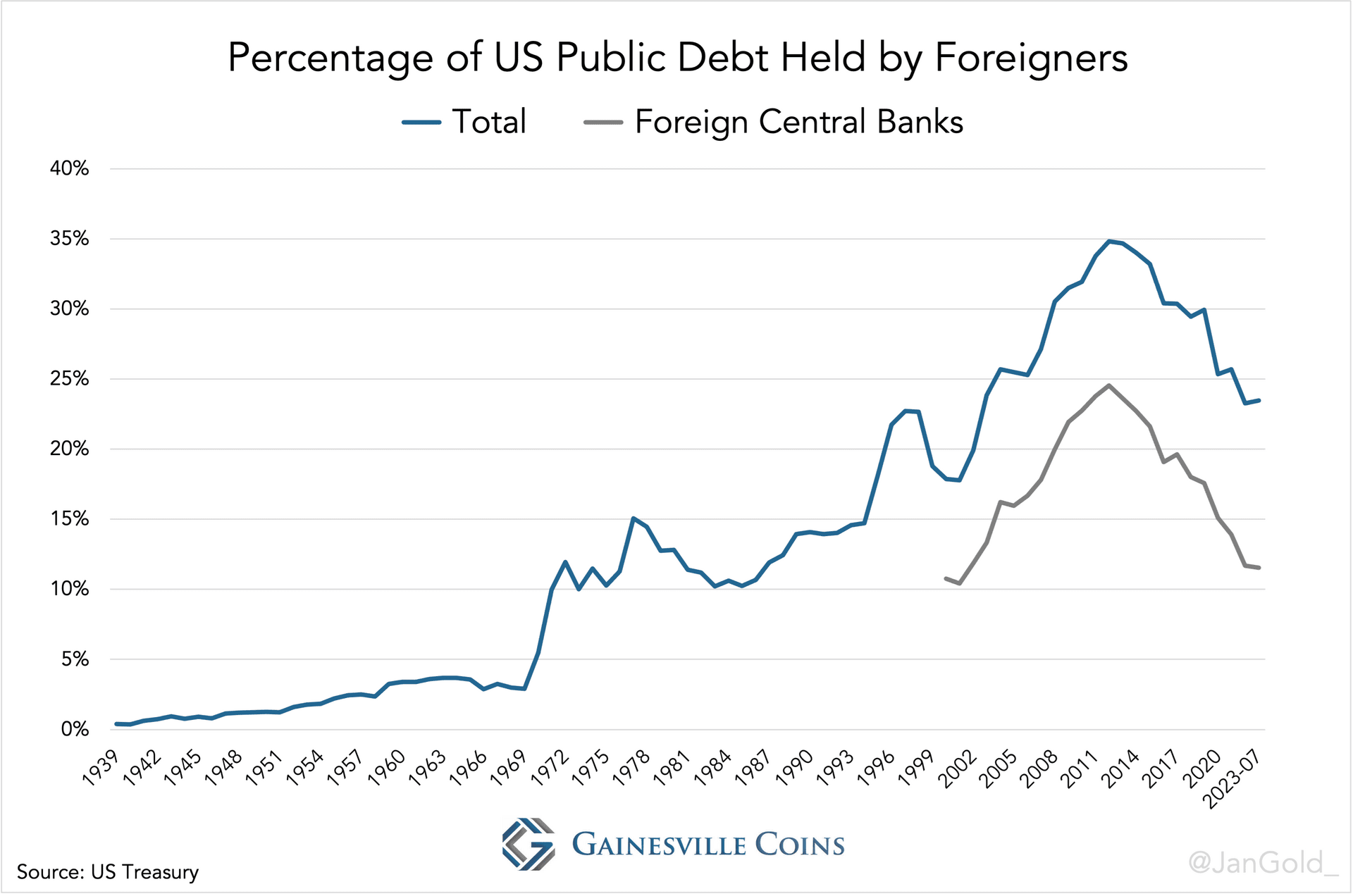

In the month of October, the US dollar gold price rallied 7% while real rates (10-year TIPS yield) went up from 2.24% to 2.46%. The total gold premium versus the “TIPS model” reached 184%, adding a record monthly gain of 44%, reflecting a form of de-dollarization.

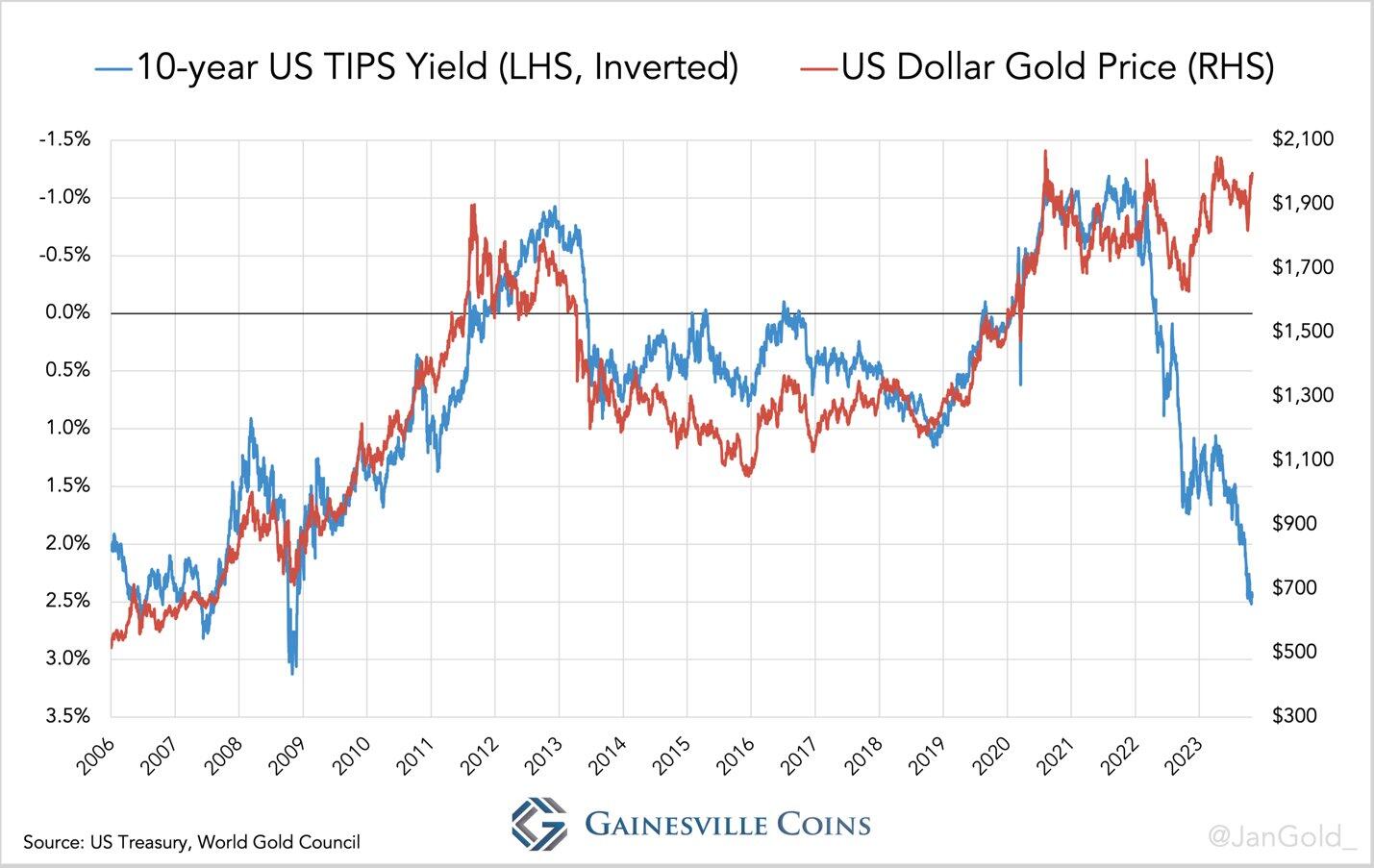

As we have reported extensively, at the start of the Ukraine war when geopolitical tensions increased, the gold price began moving higher than the 10-year TIPS yield, to which gold was inversely correlated since 2006, suggested. We measure the difference between the actual price of gold and the price suggested by the old model, with our Gold Price-TIPS Model Tracker (for more info on the Tracker read shorturl.at/rGIJY).

Since the war (February 2022) the market prices gold higher, as holding US government bonds has become riskier due to the confiscation of dollar assets held by Russia. The war in Gaza, which can spill over to other countries, is further igniting geopolitical tensions, and hence the gold premium to the TIPS model made a record jump in October 2023. The Tracker shows gold moved up 44% vs the TIPS model, and the total premium has now crossed 180%.

The Gold Price-TIPS Model Tracker is a measure of de-dollarization, not into renminbi or rupees, but into gold. We suspect inflation expectations (due to the US public debt and fiscal situation) are also a driver for the gold price to decouple from the TIPS yield.

Did anyone of my followers ever had a “buggy experience” using Lightning?

What are its flaws?

Gold Held Up Extremely Well in September Against Rising Real Rates

“I’m introducing the “Gold Price–TIPS Model Tracker” to improve our understanding of how the gold price is set and its future potential.”

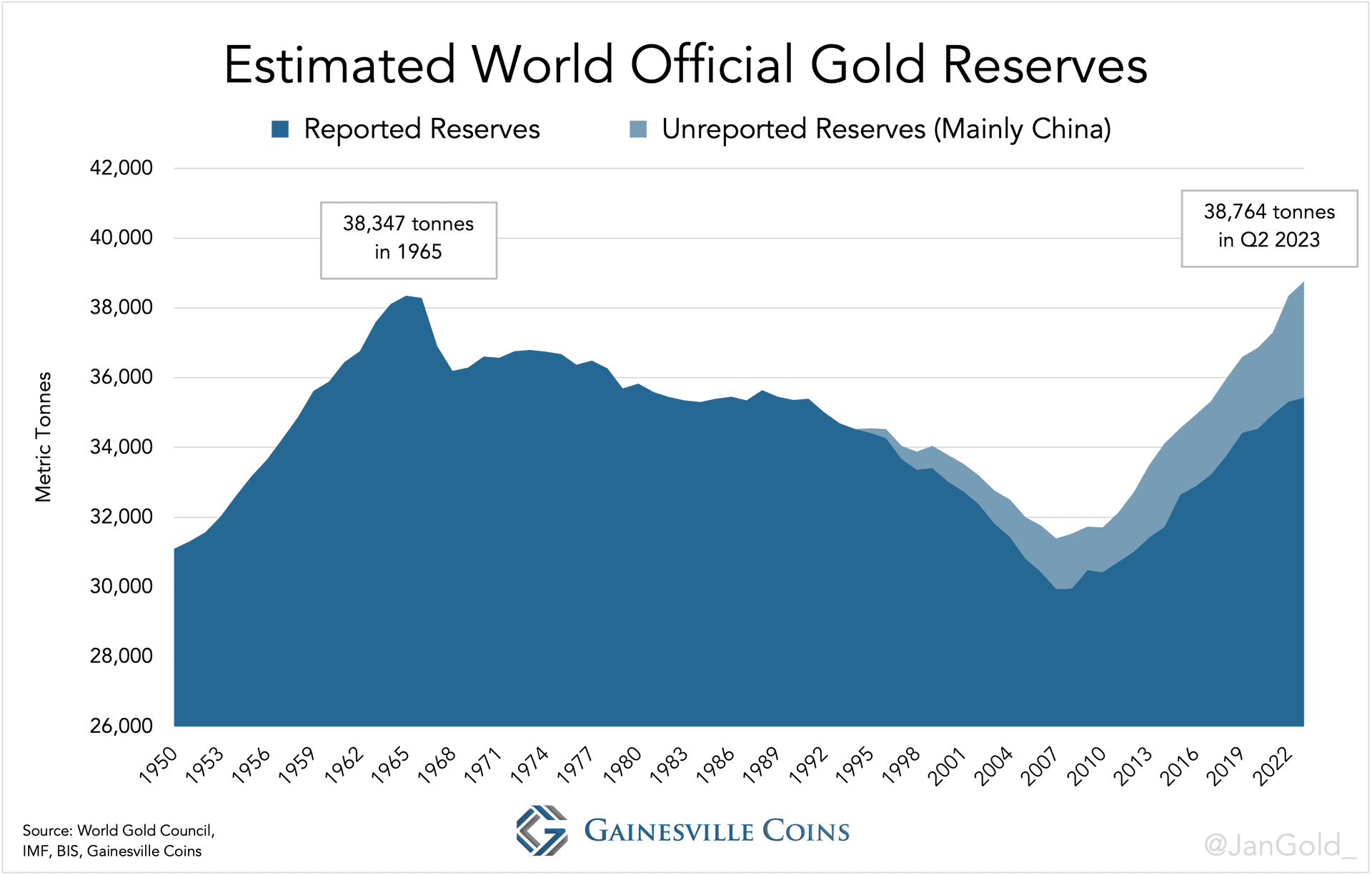

World Official Gold Holdings Reach Record High

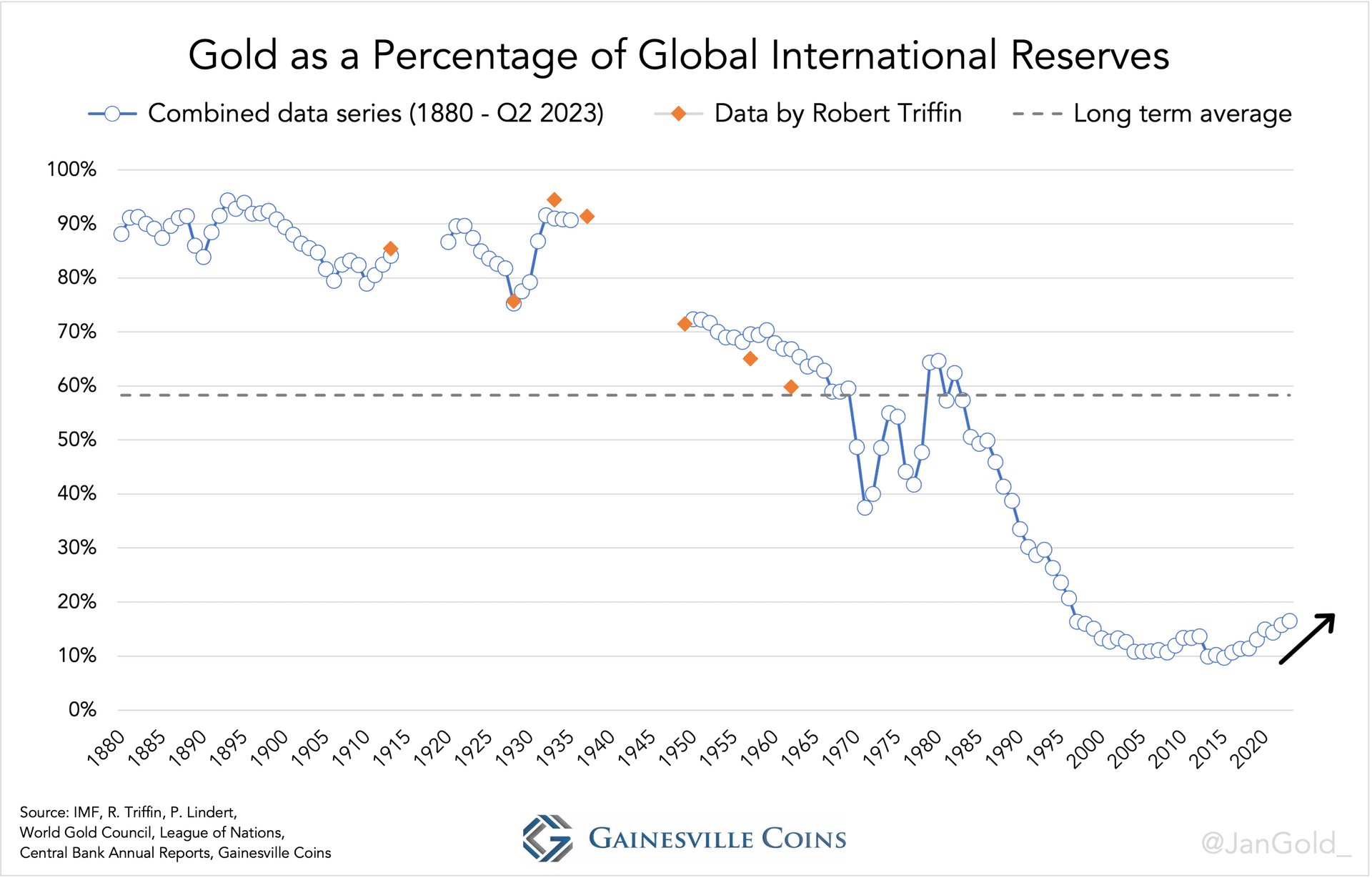

My estimation of global official gold reserves hit 38,764 tonnes in Q2 2023, breaking its previous record from 1965. The new high confirms the world has entered a new era of gold. Central banks will continue to accumulate gold and the metal’s role in the international monetary system will increase to the detriment of the US dollar.

https://www.gainesvillecoins.com/blog/estimated-world-official-gold-holdings-reach-record-high

Estimated Chinese Gold Reserves Cross 5,000 Tonnes

In the first six months of 2023 the Chinese central bank bought an estimated 353 tonnes. Although demand in H1 2023 was down 34% from H2 2022, demand was still strong and a driving force of the price of gold.

https://www.gainesvillecoins.com/blog/estimated-chinese-gold-reserves-cross-5000-tons

The West Is Losing Control Over the Gold Price

The East has been driving up the gold price, predominantly in late 2022 and the first months of 2023, breaking the West’s long standing pricing power.

https://www.gainesvillecoins.com/blog/the-west-is-losing-control-over-gold-price

German Central Bank: Gold Revaluation Account Underlines Soundness of Balance Sheet

“[This] accentuate gold’s role as a remedy regarding financial challenges created by boundless money printing.”

The PBoC Manipulates the SGE Gold Price https://www.gainesvillecoins.com/blog/pboc-manipulates-sge-gold-price

"The US dollar price of gold has been declining in the past two months, though it continues to show significant strength against the 10-year TIPS yield. Gold’s performance since early 2022 must be seen as bullish." https://www.gainesvillecoins.com/blog/gold-strengthening-despite-declining-price

The Shanghai International Gold Exchange and Its Role in De-Dollarization

De-dollarization can be accomplished by using yuan to settle international trade and store surpluses in gold through the SGEI.

https://www.gainesvillecoins.com/blog/shanghai-international-gold-exchange-and-de-dollarization

COMEX Gold Futures Explained Part 1: The Basics

In this first part we will discuss the history of futures trading and the basics of COMEX gold futures.

https://www.gainesvillecoins.com/blog/comex-gold-futures-explained-part-1

Is Saudi Arabia Selling Oil to China for Gold?

“De-dollarising could be done by using the renminbi as a trade currency and converting yuan revenue into gold on the Shanghai International Gold Exchange.”

https://www.gainesvillecoins.com/blog/is-saudi-arabia-selling-oil-to-china-for-gold

You got 3,000 sats for that? 😵💫

Great read. But when I started researching it the core message appeared not to be true. Typically Graeber