Today, a good friend of mine accused me of stealing money from a baby with my trading portfolio. I told him luck often favors the prepared ✨

Printing Bitcoin. HaHa :-)

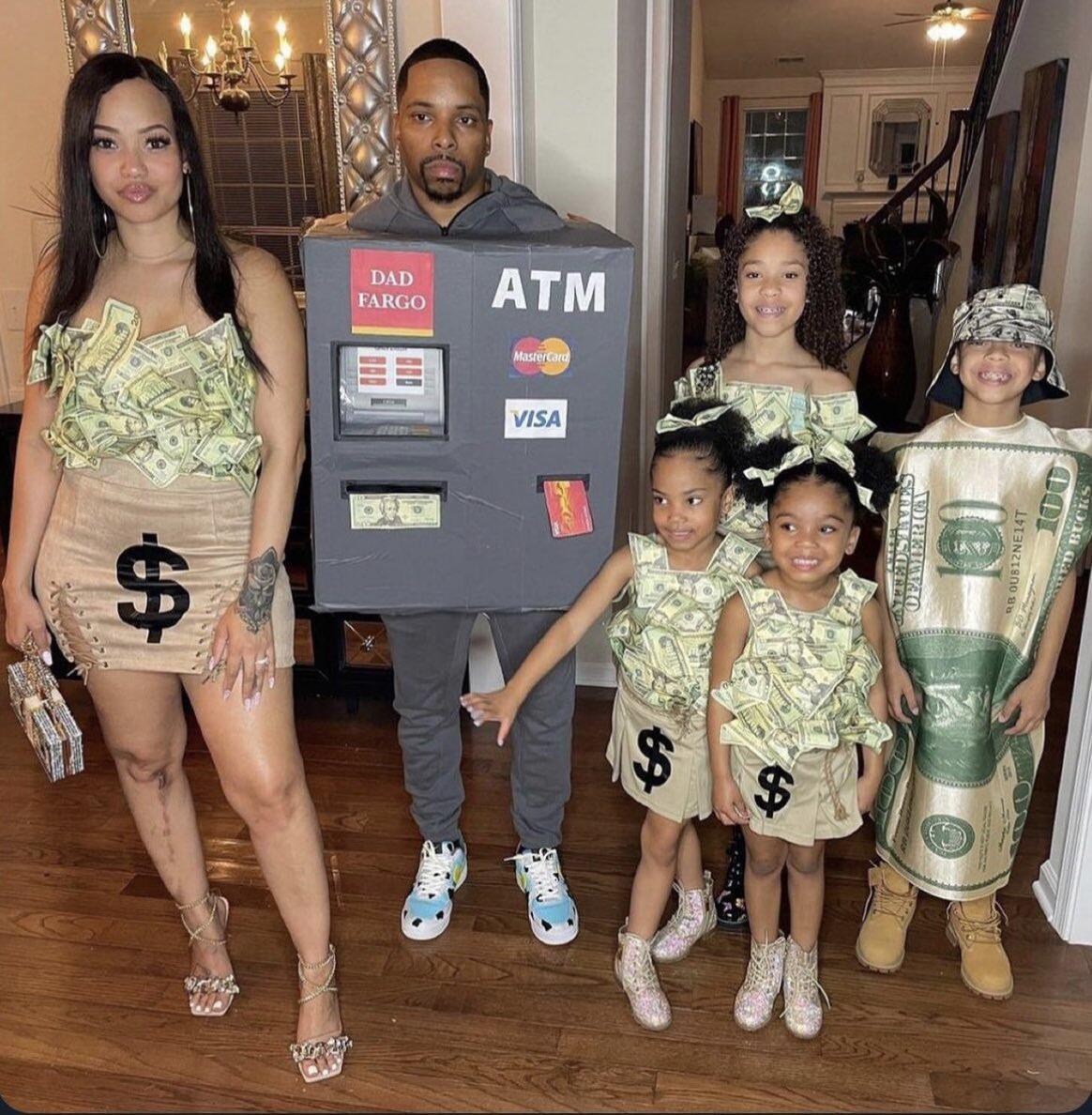

The only one not smiling is Dad. HaHaHa!!!

Just started following you. Looks like a lot of fun!!!

AAAAHHHH. Dreamy!!!

nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk Sunday mornings Daily Dose has come around 🙏

https://open.spotify.com/track/1qTLYAQcXTs1JGbt8DfedM?si=zOKn7P9MS1ugVY2qXoVPMw

SUNDAY MORNING HAS COME AROUND. WHAT A ₿LESSING.

The ₿itcoin dominance is currently 56.22% after seeing a decrease of 0.02% in the last 24 hours. ₿itcoin's market capitalization is currently 1.35T. Down 0.18% in the last 24 hours.

nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk Maybe you’re getting ready for a shift tonight and you want a little pick me up. This could be that with a Daily Dose of espresso 🤩

https://open.spotify.com/track/2HRqTpkrJO5ggZyyK6NPWz?si=VVWHp-B4TiCsyTO6qFyRpg

People are more excited about taking risk in the stock market than they were in late 2021, just before the S&P 500 Index lost 25% of its value and the Nasdaq fell 36%. They're more excited about the riskiest bonds in the market than they've been since 2003, even though a greater percentage of the companies issuing them are losing money than any time since the mid-1990s (except for early 2021). At the same time, gold is hitting new highs and Bitcoin is close to it's all time high. What they're all so excited about? It's not that hard to figure out.

Central banks around the world are cutting rates. Last month, they did it 21 different times, the highest number since March 2020 – when pandemic lockdowns shut down the entire global economy. So everyone figures that they should just buy everything and anything. It's risky though because through the history of rate-cutting cycles, its often that this is accompanied by recessions and bear markets. They think they're buying a "sure thing," but they're really getting high on speculation and risk-taking. They think risk assets are safer, but they're not. They're riskier than ever. I am holding more cash and Bitcoin than usual in risky times like this. This sets me up for a wide range of outcomes.

Ranking of the top monetary assets world wide :

Kamala is a Marxist. Period. 🔥 https://video.nostr.build/81ef20bf34a94877ccd2896594e5b2751e2baa22308afc9d57cf4fce3a44c619.mp4

BAM. MIC DROP!!!

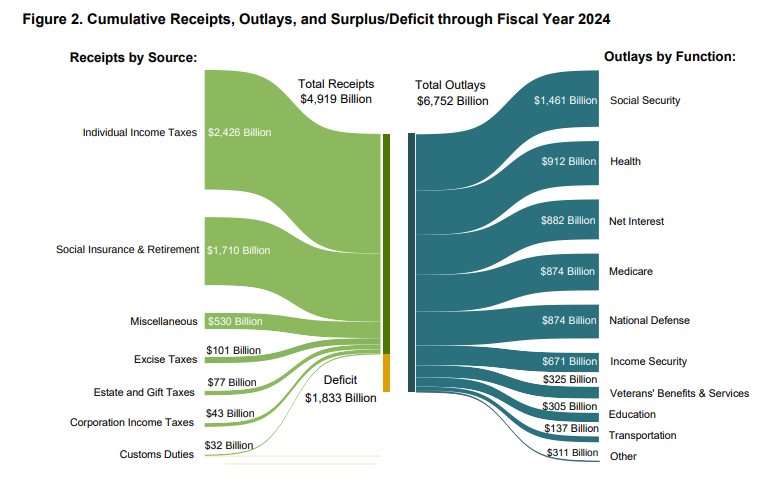

The Monthly Statement of the Treasury for September (https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0924.pdf) came out yesterday after the markets closed. For September, a rare $64 billion surplus. And for the entire fiscal year? A deficit of $1.83 trillion. Spending on ‘net interest’ was the third largest line item for the fiscal year. That's a debt trap.

The prediction/betting markets broke massively for Trump this week. Polymarket, the largest betting market, has Trump at 60% and Harris at 40%. It also has Trump with more than ten point leads in Michigan, Wisconsin, Pennsylvania, and Georgia. Other, smaller betting markets are showing the same big swing. Betting markets are real people making bets with real money. By definition, this means that only people with money, who believe they understand what’s going on in the world, are making the market. Do those people really know more? Does anybody really know anything? And with early voting and mail in ballots, a lot of the vote may already be in.