I think they all, or most all already own BTC. There is no reason to advertise it.

Treasury departments around the globe are struggling with debt management, meanwhile central banks are accumulating gold. I saw the chart above this morning from the World Gold Council. The blue line tracks net central bank purchases of gold going back two years. With the exception of a three-month period in the spring of 2023, central banks have been net buyers. And by a fair margin.

Retail buyers in North America have not, for the most part, been buyers. You can measure this by changes in the gold holdings of exchange traded funds. US and European investors have been too busy with AI, Bitcoin, and anything else promising exponential growth and infinite wealth. Bitcoin is hard, scarce, backed by energy. You might want to get some, just in case it catches on. But you already know that.

Mellow down easy my friend nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk with the relaxing Sunday evening Daily Dose 🌟

And I’m in Ca. It’s tough out here. I’m way up north where we have more cows than people though.

So where do you live?

On Bubble Watch, (https://www.oaktreecapital.com/insights/memo/on-bubble-watch) by Howard Marks. How bright is the future? How much is it worth paying for now? Why do people forget that your return on an investment is hugely determined by the price you’re willing to pay for it? Tons of good stuff in here. Must read.

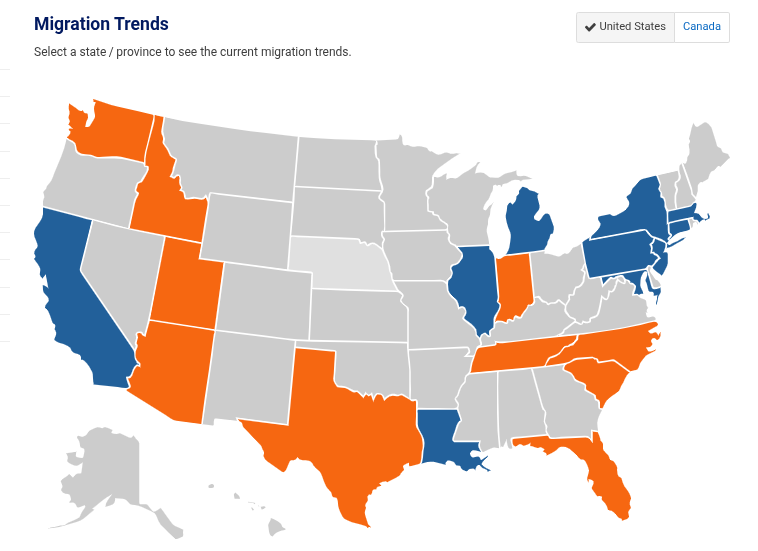

In the map below from U-Haul last week, California again finished dead last in the Migration Trends Report (https://www.uhaul.com/Articles/About/U-Haul-Growth-States-Of-2024-South-Carolina-Tops-List-for-First-Time-33083/) According to rental statistics from U-Haul, the states in blue saw net outflows in migration. The states in orange saw net inflows. Notice anything? And what’s going on in Indiana all of a sudden?

South Carolina (watch out Charlie!) dethroned Texas, which had held the top spot for the last three years (Texas migrants are probably coming to grips with the reality of rising property taxes on falling property prices). In order, North Carolina, Florida, Tennessee, Arizona, Washington, Indiana, Utah, and Idaho rounded out the top ten.

Treasury departments around the globe are struggling with debt management, meanwhile central banks are accumulating gold. I saw the chart above this morning from the World Gold Council. The blue line tracks net central bank purchases of gold going back two years. With the exception of a three-month period in the spring of 2023, central banks have been net buyers. And by a fair margin.

Retail buyers in North America have not, for the most part, been buyers. You can measure this by changes in the gold holdings of exchange traded funds. US and European investors have been too busy with AI, Bitcoin, and anything else promising exponential growth and infinite wealth. Bitcoin is hard, scarce, backed by energy. You might want to get some, just in case it catches on. But you already know that.

Welcome to #nostr

For 1000 sats I'll bring your profile Pic "to life"

Examples I've done in the past;

https://video.nostr.build/6a1eb6f80a91c28c0b7387b4b3eff22f9498511d249c8349a84d41273935cd95.mp4

https://video.nostr.build/be8d92f3293f7c0c5e20a9689b2aa159f7607afda15ae3c2a07fd91d6a40f432.mp4

https://video.nostr.build/669020514357e9b390741090899b3ef8ff91b7199e61fc4ee7d3786b627087da.mp4

https://video.nostr.build/0c31ab634546bb2f61e5024d24082f98c8802fdf3343f4c455823f967cfb74e8.mp4

https://video.nostr.build/5912931c891c98634180357a0fc9471ff22ee2780da7c5d9dcc31a7b1dbb9469.mp4

You ₿e chillin’ brah

The 4 year cycle is alive and kicking. As strong as ever.

The regulators cannot be trusted.

🤩nothing left to do but smile, smile, smile 😊

The higher the price goes the more retail FOM’s in. Scarcity at its finest.

A ₿eautiful day for a Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk to relish in from one of fittest, astute, respected and resilient bands in the biz.

https://open.spotify.com/track/2cbt59PL0tmgCsYNbM4PYk?si=o6YGGPAeRzKNKfccwtmNYA

?v=1736644685

?v=1736644685