Fiat is IOUs backed by the promise of future IOUs paid in those same IOU units. After 10+ year trying to ‘understand’ it that is the best way I can describe it and it still doesn’t make sense 🤣

When you press ❤️ to see who liked a note and you end up liking your own note and can’t undo 😳 nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg

Awesome client overall !

nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u nostr:npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg your podcast on ecash / cashu is amazing 🤯🤩👍

This is right outside the LSE (London school of economics) building 😉

From Satoshi / Malmi email archive

(…) My choice for the number of coins and distribution schedule was an

educated guess. It was a difficult choice, because once the network is

going it's locked in and we're stuck with it. I wanted to pick

something that would make prices similar to existing currencies, but

without knowing the future, that's very hard. I ended up picking

something in the middle. If Bitcoin remains a small niche, it'll be

worth less per unit than existing currencies. If you imagine it being

used for some fraction of world commerce, then there's only going to be

21 million coins for the whole world, so it would be worth much more per

unit. Values are 64-bit integers with 8 decimal places, so 1 coin is

represented internally as 100000000. There's plenty of granularity if

typical prices become small. For example, if 0.001 is worth 1 Euro,

then it might be easier to change where the decimal point is displayed,

so if you had 1 Bitcoin it's now displayed as 1000, and 0.001 is

displayed as 1.

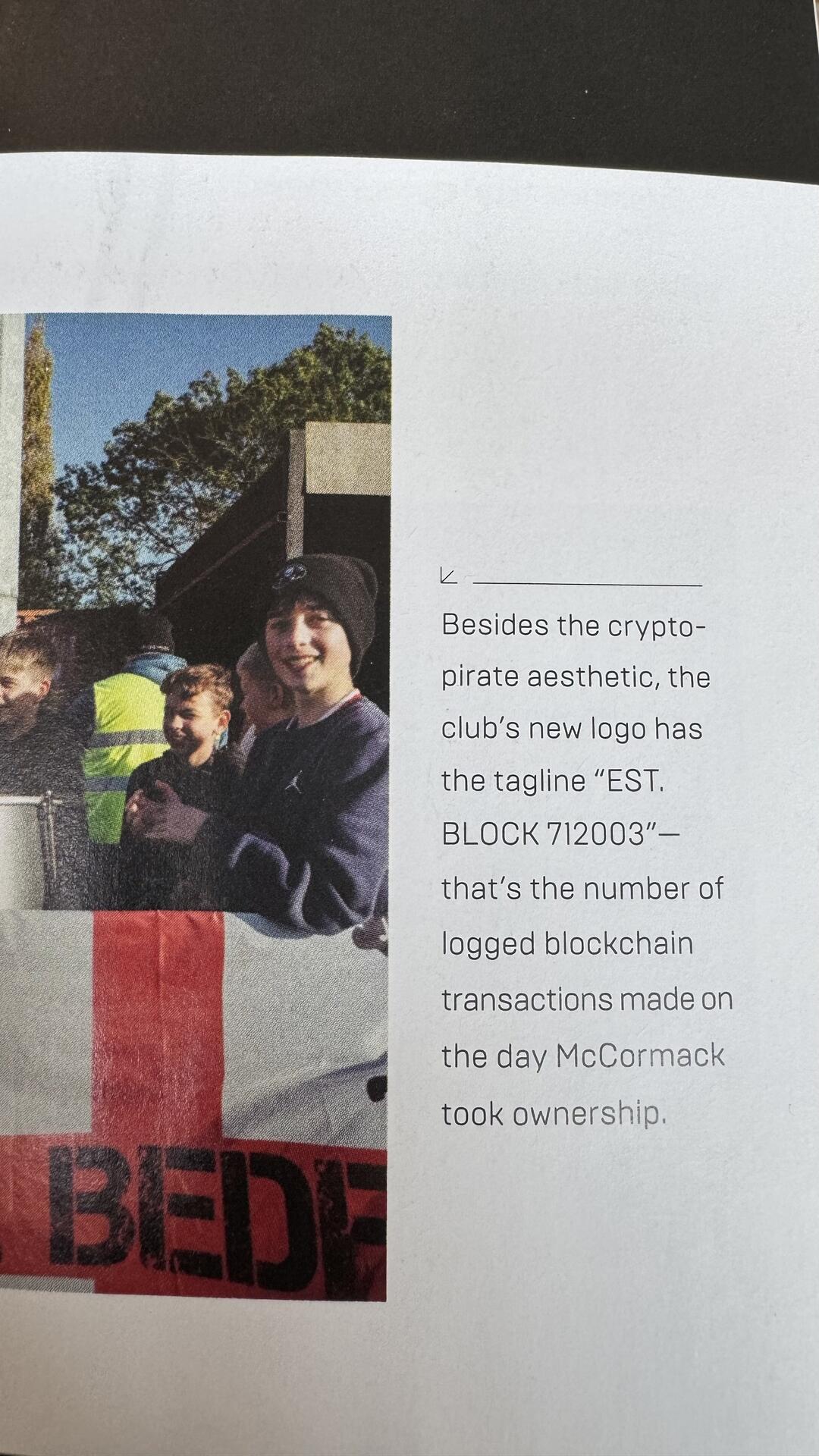

Wired magazine in 2024 still without basic understanding of the bitcoin time chain 🤦♂️ congrats nostr:npub14mcddvsjsflnhgw7vxykz0ndfqj0rq04v7cjq5nnc95ftld0pv3shcfrlx for great coverage though!

US corps will indirectly begin ‘buying’ massive amounts of BTC via combination of 401k matching & ETFs - contributing to the speculative attack on fiat 😂

Bitcoin is more than twice the age of the Euro on genesis day.

Reverse god candle > dog candle ? 😂

In a nutshell - how do you transfer ownership of an unspendable utxo ?

Is there a graph showing global percentage and total value of utxos which have become unspendable eg tx fees > market value ? Is that about to become a massive issue if tx fees go x10 or x100 and opening lightning channel becomes prohibitive ?

Would there be a way to transform / mint them into bearer instruments ? Does cashu / fedimint possibly help there ? Could a custodian issue physical notes backed by real but unspendable utxos?

If the minting has a tx cost then it’s time sensitive to mint before minting cost exceeds utxo value.

It’s all about the journey

Is this the only community with a positive outlook on the future and a non-coercive plan to get there?

Posted from freefrom - loving the early bird vibes.