Early Good Morning my fellow freedom fighter

Value has fallen in the Fiat world so badly that they have to show empty plates on the Bank Card😉

#visa

#fiat

how a one can start who doesn't have any coding development background

post good photos in comment and i will zap you some sats as daily ritual

nostr:note1pad7s8n0jtd2vm7h96s5w7tag8qngcdz36s7kelwp6lsjmjfmf4q6q3yuz

it's blossoming here🪴

Any opinion on BitVM?

Is it practical thing and can wr really build anything on #Bitcoin in a Trust minimised way?

Amazing episode once again nostr:npub1g0587hzzckcncxfm78n0996qe2s58nspy29wf02tqcj5sdzcpj4q6j40hv nostr:npub14mcddvsjsflnhgw7vxykz0ndfqj0rq04v7cjq5nnc95ftld0pv3shcfrlx and Mark 👏 ! Here's a summary of what was discussed in case you need convincing:

====== Bitcoin Podlights ======

What Bitcoin Did with Peter McCormack - Why We Shouldn’t Trust BlackRock with Whitney Webb & Mark Goodwin

- 🌐 The potential development of a new global financial system led by entities like Blackrock, aiming to minimize risk for large asset managers while expanding their control and ownership.

- 🎙️ The popularity and impact of a previous episode featuring Whitney Webb on the "What Bitcoin Did" podcast.

- 🤝 The collaboration between Whitney Webb and Mark Goodwin on recent articles, including one focused on Blackrock's plans for a "fractionalized world."

- 💼 Larry Fink's background, the role of ETFs, the desire to tokenize various assets, and partisan politics in the U.S.

- 🪙 Discussions around the tokenization of assets, including Bitcoin, as a means for asset storage and the implications for the financial sector.

- 🏛️ The relationship between partisan politics, the "Uni-party" control in the U.S., and the broader implications for financial and political systems.

- 🌿 The role of sustainable development policies, global carbon markets, and the push for a digital financial governance system.

- 🏦 The connection between private sector initiatives and the perpetuation of the debt slavery model historically used by multilateral development banks.

- 📈 The involvement of Wall Street giants and figures like Larry Fink in shaping a new financial paradigm and the risks associated with their expansive control.

- 📰 The shifting landscape of independent media and the potential manipulation of public opinion by influential figures and funding sources.

- 🔄 The dynamic between public and private sector interests and the efforts to sway public perception towards acceptance of digital IDs and programmable money.

- 🔗 The importance of critical thinking, media literacy, and independent research in the age of widespread information manipulation and psychological operations.

- 📢 The need for the Bitcoin community to reflect on the direction of the cryptocurrency and its potential co-option by Wall Street for commoditization rather than as a tool for financial sovereignty.

====== The End. Pura Vida. ======

#podlights #wbd #bitcoin #blackrock

nostr:npub10hcsqj6587uc5whzzuhgk274ke6g7ruh80enjm74ucln2m24hyxq2gf8fn check it out, this is the type of summary I had mentioned

oh great. it did a great job. Let me send you some other podcasts too

Good morning My fellow Nostrians❤️

JimBOB 🙏🏻

miniBits handes? any link to get familiar with it?

i have iOS. using Primal & Damus & Nostur & Iris

they don't show I fear

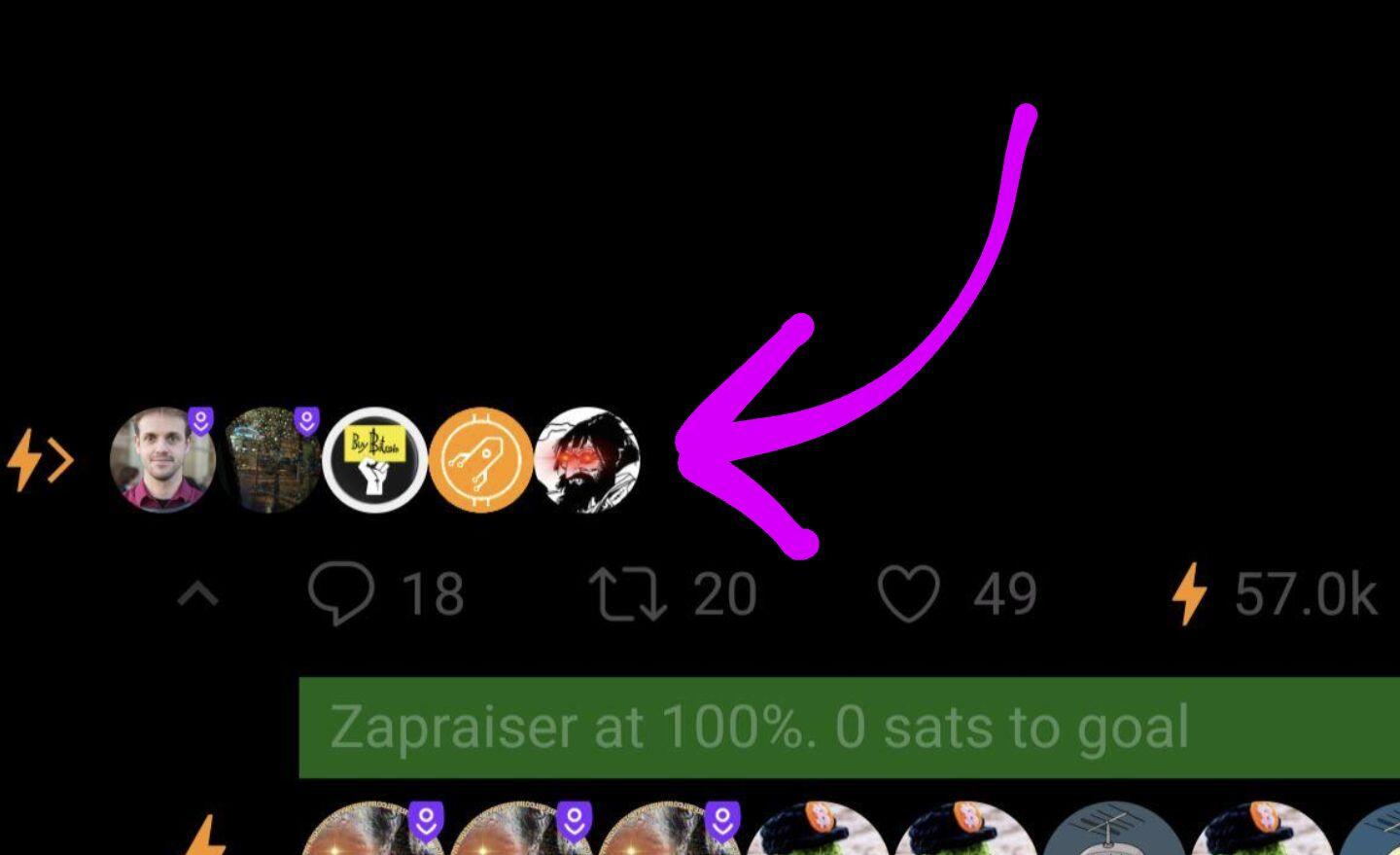

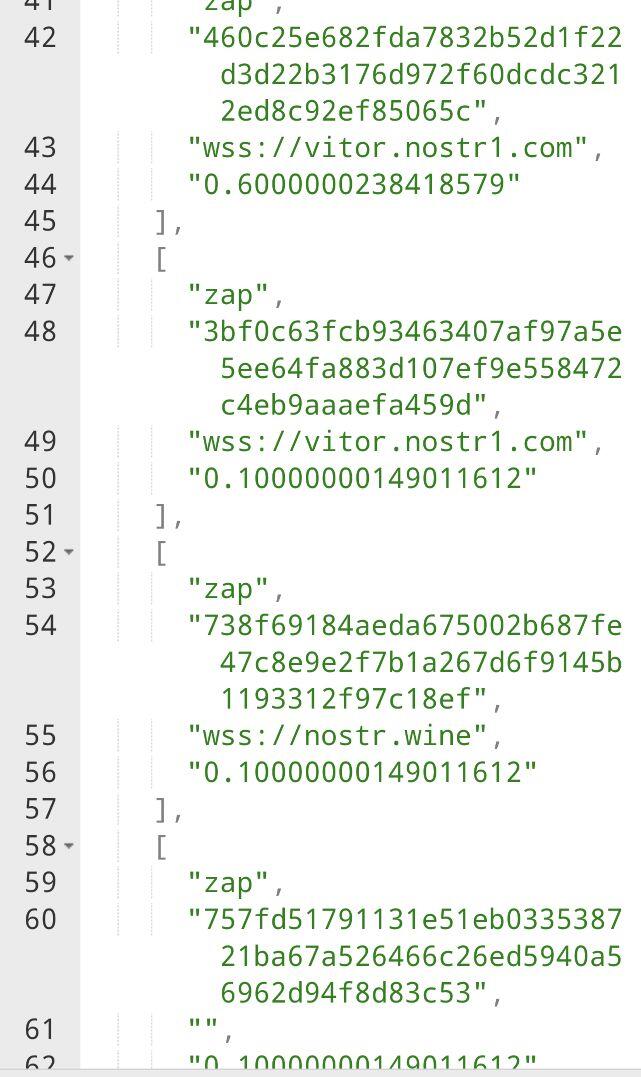

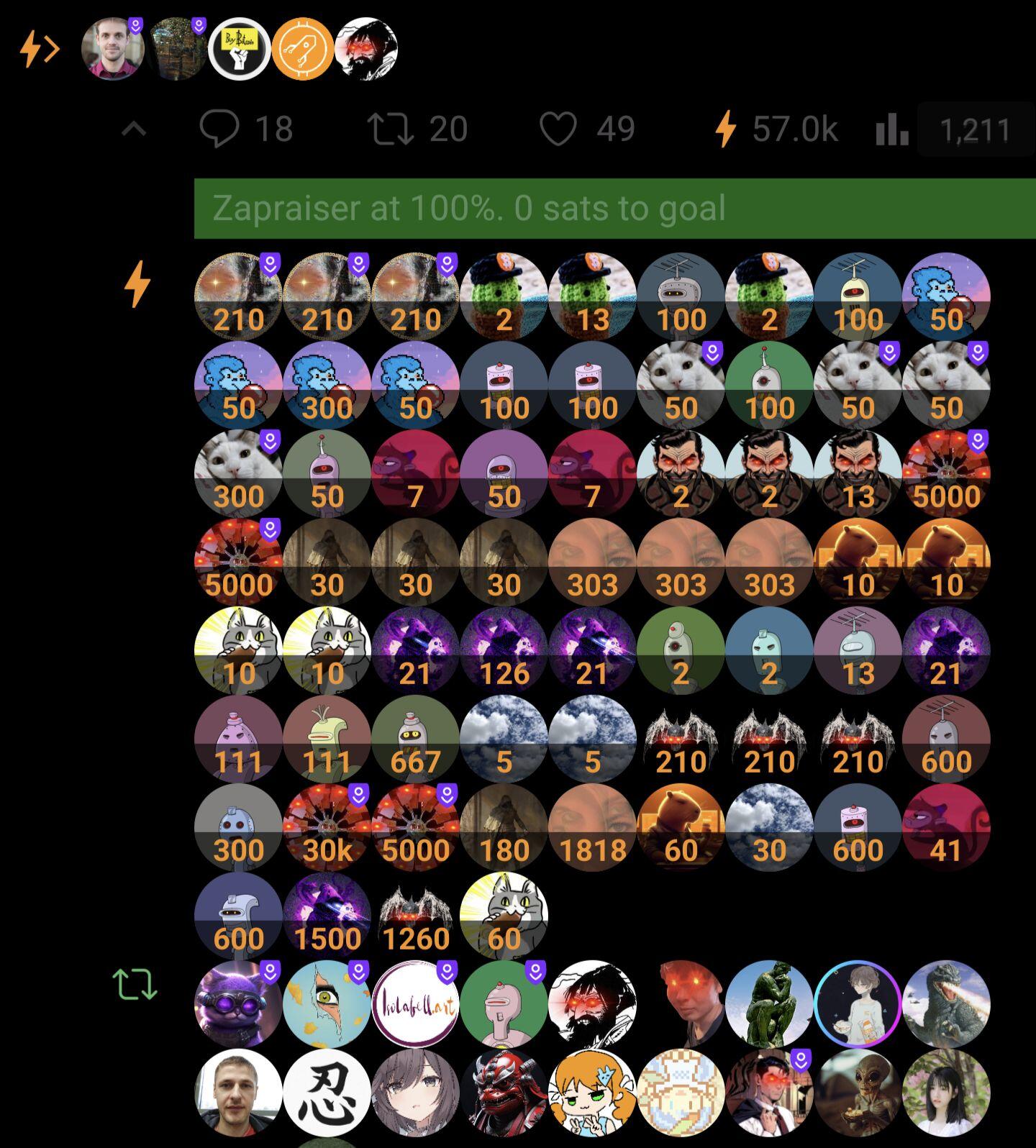

can we see how ZapRaisers amd Zap Splits look like. Website please. i found Zaplife.lol

how to see Zap Splits

UK is in recession and #Bitcoin is just below 15% of All Time High in UK.

#bitcoin is the asset which rises during the recession.

there is no recession for those who even have few dollars of #bitcoin

even more than that

how it should be $120,000

it should even be $1 Billion per coin now if eveyone realises

if you are using Primal App, There are options for different feeds. you can follow them there.

right top on the Primal App