99.99875% of the 8 Billion people don’t understand what this image says.

DON’T YOU THINK WE ARE SUPER (MILLION TIMES MORE) EARLY?  nostr:note18ky4y00cv0slvy3lh8xpn3ag0r3mm90tuahzn95sxg98wg6757hsejz03m

nostr:note18ky4y00cv0slvy3lh8xpn3ag0r3mm90tuahzn95sxg98wg6757hsejz03m

I AM TELLING YOU AGAIN, EVEN AFTER 16 YEARS OF #bitcoin WE ARE

SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER

SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER SUPER

SUPER SUPER SUPER SUPER SUPER SUPER

EARLY

Edited the meme #bitcoin 🤪

Nikola Tesla to Walter Russel about his book “The Universal One”.

#universe

#tesla

Get on the #bitcon standard and then do this👇

Fiat dead companies are rising on a Bitcoin Standard.

First Indian public company to have Bitcoin on the balance sheet.

Market cap jumped from ₹380 Million to ₹650 Million, adding ₹270 Million to the market cap.

Company owns 12 Bitcoin worth of ₹108 Million.

Trading at 6 mNaV.

JetKing.

My cat loves to be near a basil plant.

❤️🥰

“Asymptotically Perfect: How #Bitcoin Realizes John Nash’s Vision”

-Bhavik

Bitcoin represents a revolutionary convergence of ideas, many of which trace their origins to principles discussed by thinkers like John Nash and schools of thought like Austrian economics. Let’s dive into these interconnected topics:

1. Bitcoin: The Realization of Ideal #Money

Bitcoin embodies the concept of ideal money—a form of money that is resistant to manipulation, inflationary policies, and centralized control. It offers:

• Decentralisation: No central authority controls Bitcoin; its governance relies on a distributed network.

• Fixed Supply: The 21 million cap on Bitcoin ensures #scarcity, addressing inflationary pressures seen in fiat currencies.

• Transparency: The blockchain ensures trustless verification and immutability.

• Global Neutrality: Bitcoin transcends borders and ideologies, offering a universal monetary protocol.

2. John Nash’s “Ideal Money”

John #Nash, in his 2002 paper Ideal Money, described the characteristics of a currency that could maintain stable value and universal acceptance:

• Stable Value: Nash suggested that ideal money would be measured against a universal standard (like a basket of commodities) rather than being subject to inflationary monetary policies.

• Trustless Stability: Unlike fiat currencies, which are subject to government manipulation, ideal money would incentivize stability and global cooperation.

Nash envisioned that asymptotically ideal money would emerge in a free-market environment where incentives push competing monetary systems toward increasingly stable and universally desirable characteristics.

Bitcoin mirrors many of Nash’s ideas:

• Its limited supply prevents inflation.

• Its decentralized protocol creates a system immune to arbitrary tampering.

• Its acceptance grows asymptotically as more people recognize its value as a neutral monetary standard.

3. Nash Equilibrium and Bitcoin

The Nash equilibrium—a fundamental concept in game theory—occurs when individuals in a system choose strategies that maximize their outcomes given the choices of others. Applied to Bitcoin:

• #Mining: Miners must collaborate (to secure the network) while competing (for block rewards). The equilibrium lies in adhering to Bitcoin’s rules; deviating (e.g., creating invalid blocks) results in economic penalties.

• Adoption: As more people adopt Bitcoin, others are incentivized to do the same, creating a positive feedback loop. This aligns individual incentives with collective outcomes, enhancing Bitcoin’s network effects.

4. Asymptotically Ideal Money and Bitcoin

Nash argued that the concept of ideal money could evolve asymptotically—approaching perfection over time as monetary systems are refined through competition and market forces. Bitcoin fits this model:

• Constant Refinement: Its protocol evolves cautiously via decentralized consensus, ensuring gradual improvements without compromising stability.

• Global Competition: Competing fiat systems, once threatened by Bitcoin’s principles, might adopt sound monetary policies to remain relevant. This creates a competitive dynamic that gradually pushes global currencies closer to an “ideal” state.

5. Free Markets and Incentives

Bitcoin aligns with the principles of free-market economics by:

• Decentralizing Control: It removes monetary authority from centralized institutions, empowering individuals.

• Incentivizing Good Behavior: Miners are rewarded for maintaining the network, and users benefit from holding and transacting in a scarce, deflationary asset.

• Enabling Choice: It offers an alternative to fiat, allowing individuals to opt out of manipulated systems.

Austrian economics highlights the role of incentives and market forces in shaping optimal outcomes. Bitcoin’s design—driven by incentives rather than coercion—reflects these principles:

• It uses economic incentives (block rewards, transaction fees) to secure its network.

• It creates trust through transparency and competition rather than centralized oversight.

6. #Austrian Economics and Bitcoin

Austrian economics emphasizes individual liberty, free markets, and the rejection of central planning. Key Austrian principles reflected in Bitcoin include:

• Sound Money: Austrians advocate for money backed by intrinsic value or scarcity. Bitcoin’s fixed supply addresses this ideal better than fiat systems.

• Decentralization: Austrians distrust central banks and government intervention. Bitcoin operates independently of centralized institutions.

• Market-Driven Adoption: Austrian economists argue that markets—not governments—should determine what constitutes money. Bitcoin’s organic adoption illustrates this principle in action.

7. Bitcoin and the Future of Incentive Structures

Bitcoin fundamentally shifts global incentives:

• Wealth Storage: It allows ordinary individuals to store wealth securely without needing access to elite financial instruments like real estate or stocks.

• Global Collaboration: Its borderless nature fosters cooperation beyond national boundaries.

• Innovation: Bitcoin’s open-source model encourages innovation in financial technology, driving efficiency and inclusivity.

#Enlightenment Through Synthesis

Bitcoin is not just a digital asset; it’s a philosophical and economic movement:

• John Nash’s Vision: Bitcoin approaches the idea of ideal money through its stability, universality, and resistance to manipulation.

• Nash Equilibrium: It aligns individual incentives to secure the network and expand adoption.

• Austrian Economics: Bitcoin realizes the Austrian ideals of sound money and free-market monetary systems.

• Asymptotic Growth: As Bitcoin adoption spreads and monetary policies compete, it pushes humanity closer to a stable, universally accepted monetary standard.

Bitcoin is, in essence, a synthesis of these timeless ideas—a testament to the power of incentives, free markets, and the human desire for liberty.

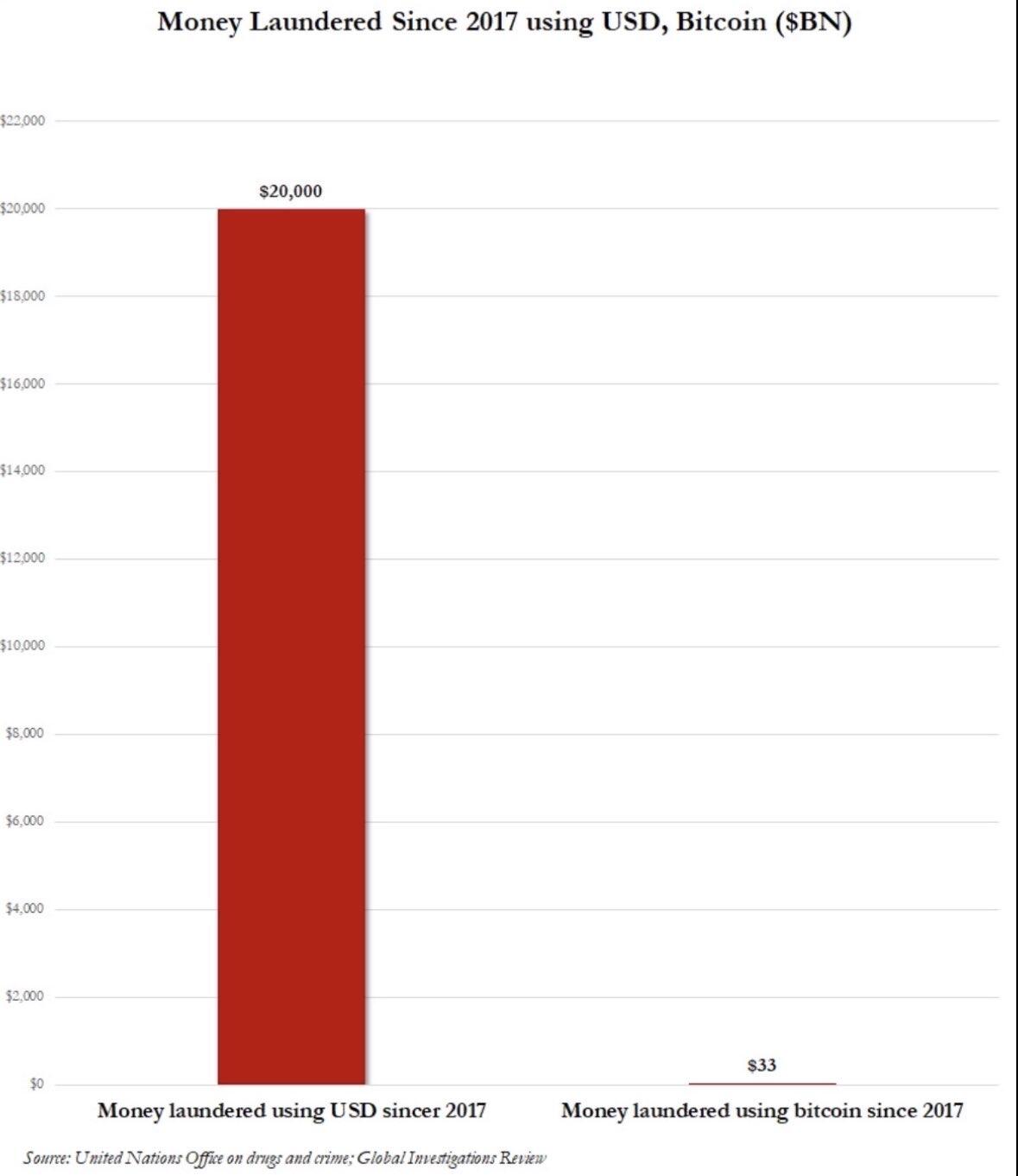

#bitcoin is for money laundering!

Cash transportation vehicle going to load some cash into ATM somewhere in 🇮🇳 INDIA.

Vs.

The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

One is closed monopoly, non transparent, runs by mafia(you know them!) and manipulative tactics. Other is open, run by everybody, transparent, runs on Proof-Of-Work with energy.

Choose wisely.

🫵🏻😎

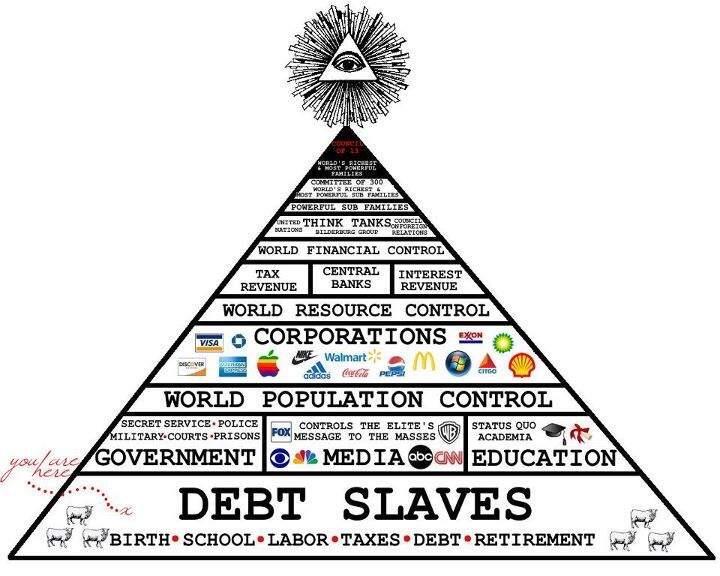

#bitcoin will destroy the pyramid.

note13wvle8cl4t59drn5gm77hxr63yq7k62k0tr7vt3w7zhag0rzqlesfj73jz

The ecash section of the nostr:npub13s5mxgws70rpxsug96jfvglggackjrxs2ehypwg0prjaxsek42sqd9l03e guide is live! Thanks to all the #Cashu and #Fedimint devs who helped out. I got to think through some of the unique nuances of ecash and suggest some design best practices. Check it out and let me know your thoughts: https://bitcoin.design/guide/how-it-works/ecash/introduction/

I love Cashu!

It is the year 2044 and 10000 sats buys you a big luxury villa with a huge backyard!

$1 = 1005 Sats

₹1 = 10 Sats

Maybe next time!

#bitcoin

It is not the question of IF, but When.

Things become cheaper on Bitcoin standard + your balance sheet becomes robust and businesses become recession proof.

World will be able to fight and bear any Black Swan event including big natural shock!

Soon 0.1 Sats/min Kieran😃 nostr:note17htlrfqj9h94az4e5vzher0eveexgr5l2m25rnpas0hs9jktqprsznzch3

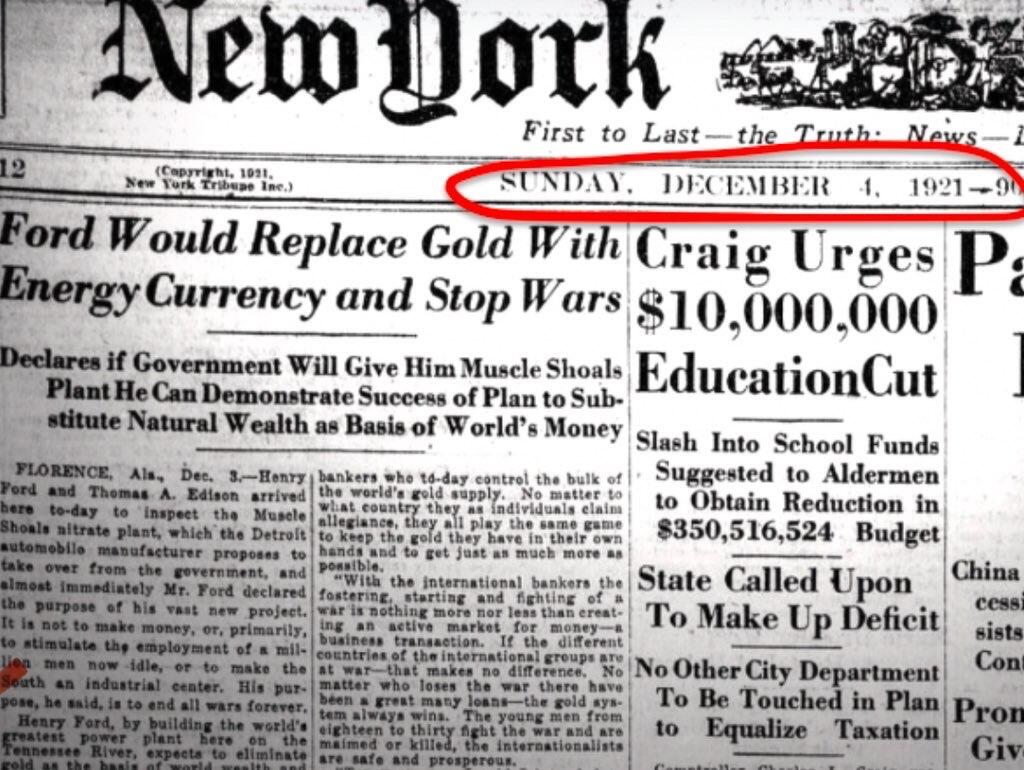

Predictions of #bitcoin 104 years ago in 1921 by Henry Ford