I prefer the works of Allan Poe Edgar, because we Apes here!

Lol I leave them there as a reminder of why I didn't stack hard enough and I can't afford to slip now, eyes on the prize

Ricki spitting flames, lol in SA our target inflation rate is 4-4.5% that's what first world markets see as unacceptable

After paying my bills, looking at what I have left over to stack sats, generating new public keys to withdraw funds, consolidating UTXOs, rebalancing my Lightning channel, updating my node, reviewing my potential stacking rate excel sheet and looking at the charts for a couple of minutes just to refresh where we are in the cycle

Me:

https://video.nostr.build/eb7d5adbca670d966d0df2124a99ef3649a23e929f7bf84660b030902e0806c2.mp4

The Banco Central de Bolivia has lifted its ban on Bitcoin transactions, #Bolivia 🇧🇴 has stepped off the bench and they're back in the game, lol eventually they all capitulate don't they?

https://coinfomania.com/bolivia-reverses-bitcoin-ban-allows-bank-facilitated-transactions/

It's only fine if it's in the 3rd world for mining copper and cobalt, lol nah but for real, at what point does the symptoms of debt become redonk and people refuse to comply? Throwing the kids under the bus is so sad

Brollups :)

Wild Hogs 2 Updates: Why Disney Canceled The Sequel

While the 2007 movie was a surprise hit, the planned follow-up, Wild Hogs 2: Bachelor Ride, didn't happen. Here's why the comedy sequel was canceled.

https://screenrant.com/wild-hogs-2-sequel-updates-disney-canceled/

Some things should not be sequalised

What was your poison? Drop some pics of your guilty pleasure

Lol I'm sold on the idea, if anyone can show me how to go about it, I volunteer as tribute

https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcS9wQey6ut9wgeKP9vR5-QMTrwzwhewng3rKA&s

Farcaster founder is now going after nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qy08wumn8ghj7mn0wd68yttsw43zuam9d3kx7unyv4ezumn9wshsz8thwden5te0dehhxarj9e3xjarrda5kuetj9eek7cmfv9kz7qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7qghwaehxw309aex2mrp0yh8qunfd4skctnwv46z7qgewaehxw309aex2mrp0yh8xmn0wf6zuum0vd5kzmp0qyfhwumn8ghj7mmxve3ksctfdch8qatz9uq3samnwvaz7tmjv4kxz7fwvd6hyun9de6zuenedyhszxnhwden5te0vdskx6r9xvh8qunfd4skctnwv46z7a33qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcl7a98v and Nostr. Take it as a complement. He's scared 💀.

Lol the fact they take the time to lay into nostr, has to mean we're on to something here right?

The moment the defence, Aka army and police no longer accept or believe in the currency it tends to die pretty fast, or so I've read from Roman history

Decided to try out my first nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyzvsj7vrkax8pqqtrq4tcmmyq34twpq8a89te4k02u9r3tdfaa6a2cvlzu4 to Lightning payment using #marinawallet, still 1330 liquid blocks to go before the transaction is finalised and I can't request a refund

The things I am willing to waste sats on, and have mild stress about so I can learn by doing lol

For sure if you can automate the admin, you can reduce a lot of the cost versus traditional debt collection and I guess they have a certain repayment rate they are happy with if a few suckers are paying it back, it can cover some that dont

Okay now you're starting add the pieces to the puzzle, so they're banking on overcharging the customer, reminds me a lot of those rent to own places where you can buy a appliance for say $30 a month, but at the end you paying $400 for a $120 appliance

I found this video on YouTube talking about the biggest firms in the BNPL space, also firms that pitched themselves as tech companies, so they managed to raise insane amounts of money without needing to show much upfront revenue

Thanks, understood, but for the provider making money on selling data can't be all that much revenue, or do they sell the debt on to brokers or funds too?

Because how do you manage the debt book, that costs money to chase up delinquent payments or do repo goods if that is even possible, doesn't seem like the most sustainable business model without strict access to this payment option, but if you strict you limit your reach of customer base

And Klarna I assume for Sweden, but why would people opt for these services over credit cards?

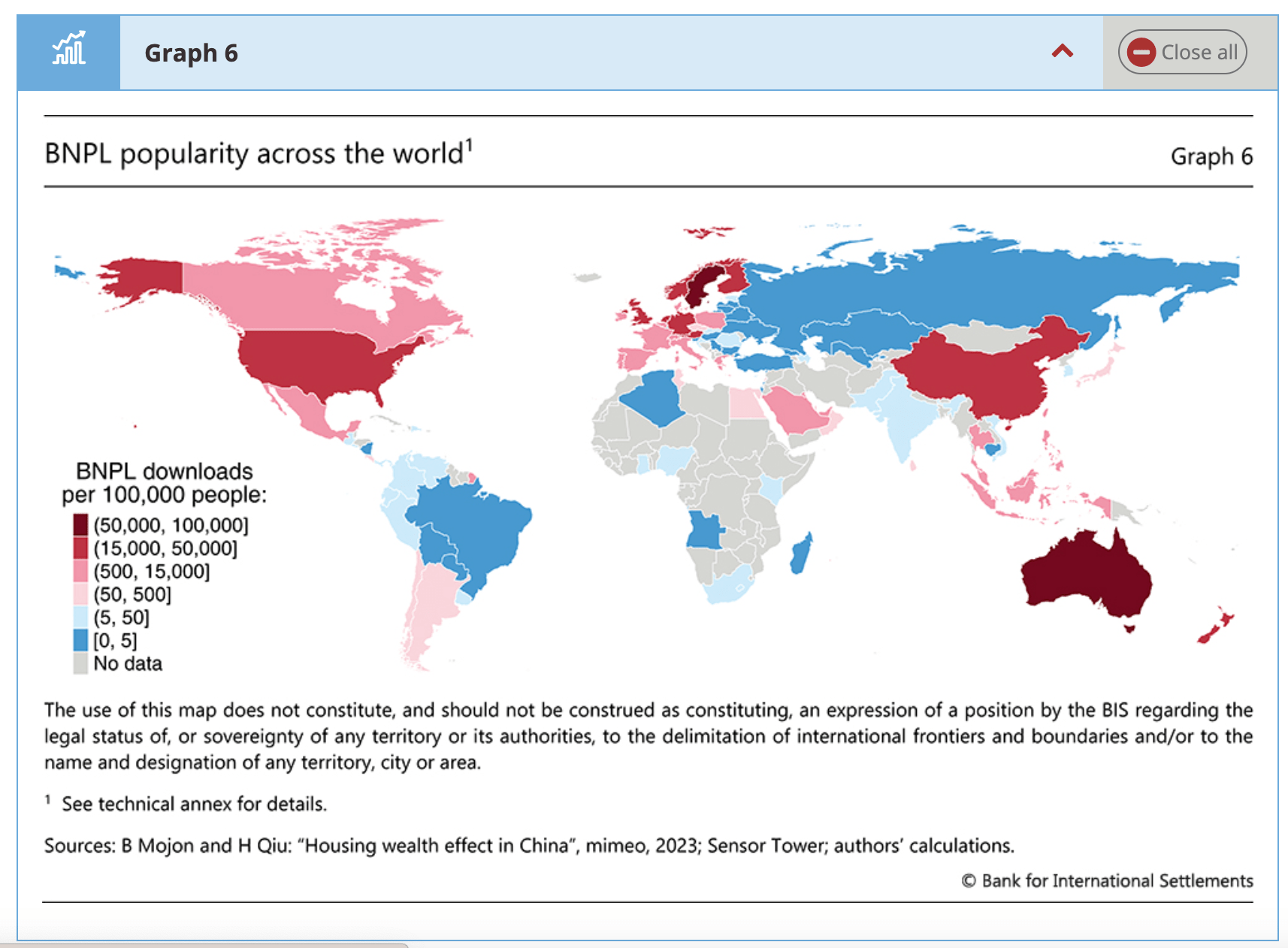

I found this chart rather interesting, why is #Sweden and #Australia so heavily into buy now pay later #BNPL services?

Buy gold and hodl and then roll that into google stock as it gets listed and then roll all of that into bitcoin when it launches lol trillionaire energy right there