The entire stock market and BTC this week 😂

Bitcoin has to move from OGs that bought large stacks at $10, $100, $1000, and even $10,000 to newer HODLers during these consolidations. Once that transition of coins is completed, sell pressure decreases to mostly traders only, buy pressures continue (think DCAs), shorts get overzealous at the same time as a bullish catalyst, and price legs up. Patience.

Did someone use a men in black flasher on all the pilots and nobody knows how to airplane anymore? What is happening?

Is it even remotely possible that Trump issuing these tariffs and tanking the market the week after FOMC giving him no rate cuts is him throwing a tantrum about not getting the rate cuts he demanded? This is one way to manufacture market weakness I guess, right? If he makes some comment insinuating the rates being held steady are to blame for the market tanking, I think that’s a pretty clear indication.

Life seems to boil down to this: you want something until you get it, then you want something else.

The trick is not to stop wanting more and be content with what you have, nor is it to never be happy with what you have and let your ambitions consume you.

The real cheat code is to enjoy what you have while pursuing what you want, remembering that everything you now have was once something you wanted but could not yet have.

Let your ambitions drive you, but do your best to enjoy what you have built and acquired as much as you hoped you would when those things were still out of reach.

There’s no way they write this with a straight face anymore. No way.

Selling weekly #MSTR 400 puts gets you over $3000 per contract right now, with your risk being you may own MSTR shares at ~$40 per share below current price 👀

#BTC

-Repealing SAB-121

-Strategic BTC Reserve

-Removing gains tax on #BTC

What are the other big ones (hopefully) coming up?

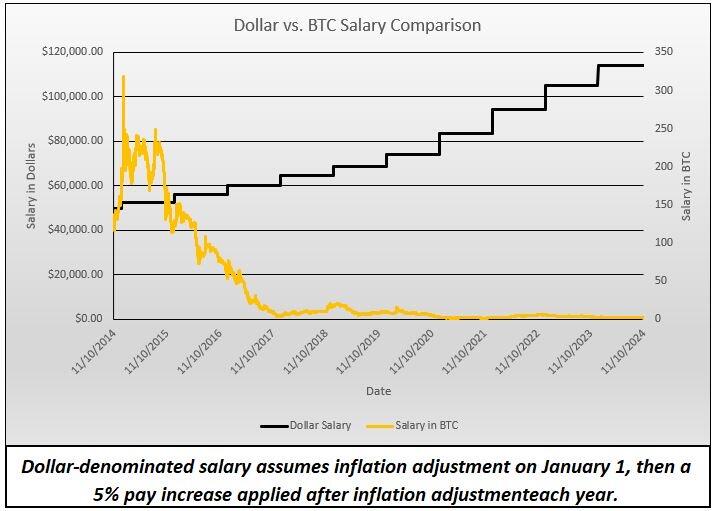

Income in dollars vs income in #BTC over 10 years. Waiting to stack BTC is expensive!

Finally a true inflation-adjusted all-time high. NOW we’re in new territory. Game on #BTC

Post-election rally to $100k by EOY. $250k in 2025. Place your bets.

#BTC

Can anyone please tell me why I’ve never heard of BITX in the hundreds if not thousands of hours of Bitcoin podcasts I’ve listened to or in any of the books I’ve read? Is there a “gotcha” that I’m missing with it?

It seems like a 2x leveraged Bitcoin play would be of interest to at least someone in the space. I know the fees are high but 1.9% on 2x Bitcoin returns seems negligible.

To be clear, I’m not suggesting this as an alternative to holding real BTC or even to holding MSTR or regular ETFs. This would probably only make sense to use in certain situations, short term, and in managed amounts.

I’m just a little confused that I’d never even heard it mentioned in passing before I found it by chance myself last week. What am I missing?

Just saw an ad on Disney+ about how Trump killed Roe vs Wade. I’m not the sharpest tool in the shed, but wasn’t someone else in office at that time?

Sixty yayt!

Bitcoin is still down about 13% adjusted for inflation from 2021. That’s not bearish. That just means sats are STILL on sale relative to 3 years ago. Attack the stack, even sales this long don’t last forever.

One of the coolest inherent features about Bitcoin is that the little guy gets theirs first. Big players can’t come in with any significant size until the cap gets big enough to do so, driven by normies getting in first. Another reason to love #BTC

Peter Schiff is Satoshi. For sure. No one can be that irrationally against Bitcoin unless they’re faking it. Nice try HBO, but you missed the obvious answer.

People seem to forget that the other way the #MSTR premium can resolve is that #BTC goes up.