There are 60 million millionaires in the world, and every single one of them has a store of value problem. And so does everyone else in the world.

The cost to ship a sizable amount of gold internationally costs hundreds of thousands or millions of dollars. Even if you just buy hundreds of thousands of dollars worth of gold domestically and bring it home, you're paying a spot markup of thousands of dollars. The cost to close a luxury mansion real estate deal (which many wealthy people just own and leave empty as a store of value) can be hundreds of thousands of dollars or more, and then depending on their jurisdiction they pay hundreds of thousands of dollars per year in property taxes on it. An international wire transfer often costs like $30 and takes days and is entirely permissioned/centralized/credit-based. Credit card fees are like 3%. The global banking industry generates hundreds of billions of dollars in fees per year even though it's all centralized.

Bitcoin is a decentralized global liquid store of value and settlement network. You can send money to any internet-connected person in the world generally in an hour or less depending on desired block confirmations. You can indefinitely self-custodially store value in a unit that is scarcer than gold and scarcer than real estate and that unlike both gold and real estate is globally portable. It currently costs like $35 to do this and everyone is losing their minds at how expensive that seems. But $35 is an *outstanding* price for this service, and in ten years I have no idea what the price will be but there are many scenarios where it could be way higher.

Right now, bitcoin fees are higher than normal because people are trading frogs on the timechain and so forth. But regardless, people need to be ready for the prospect of sustained high fees if bitcoin adoption continues to grow structurally with limited block space. This means users, developers, businesses, etc. To put it into this bigger context, fees are still insanely cheap compared to other alternatives listed above that give similar store of value and global payment properties at scale.

I'm a bit surprised fees haven't *already* been $35 on a regular basis by now. So to flip it around; fees aren't expensive because there are frogs on the timechain; fees are still cheap because relatively few people are using bitcoin to send and store money compared to the total addressable market that could be doing so.

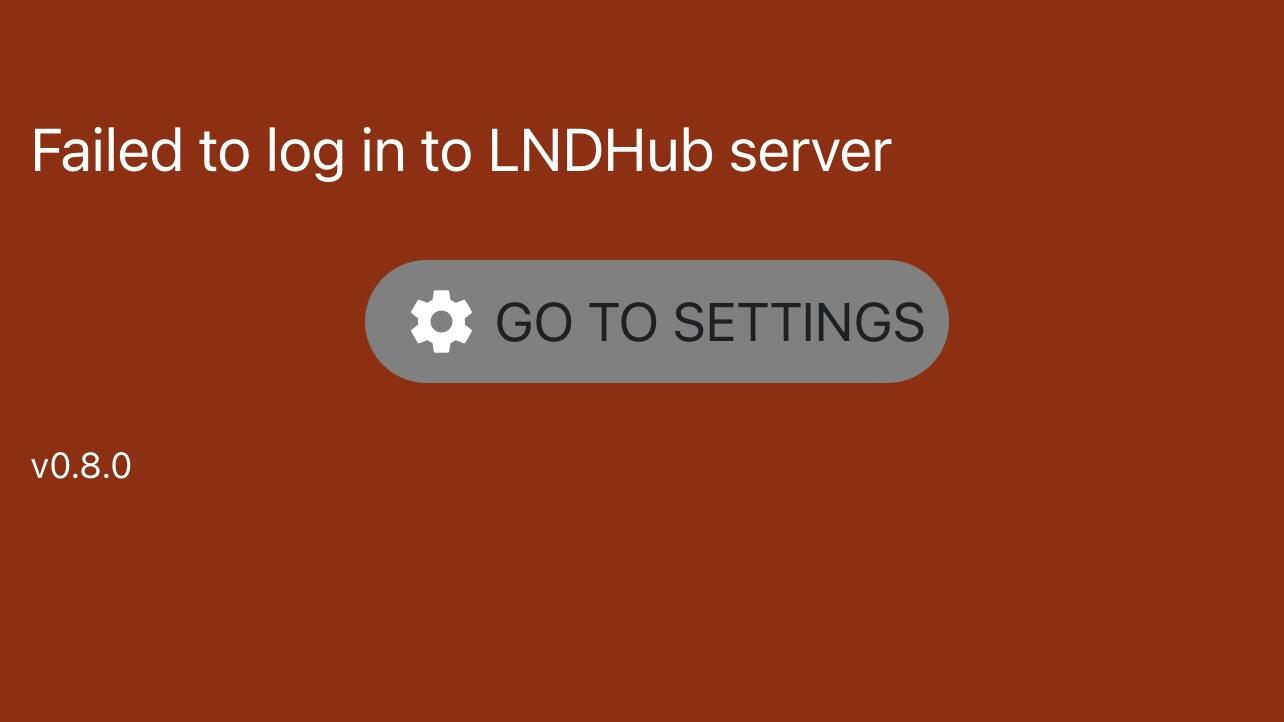

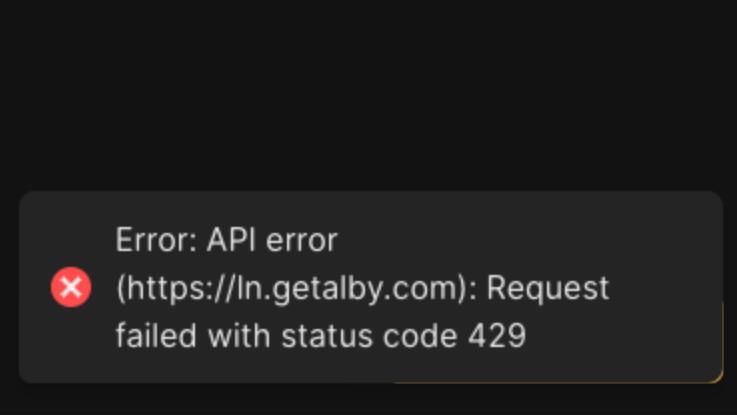

Does this price out small users? Unfortunately, yes. That's where layers come in, and the options vary depending on if someone is a power user or not. Hal Finney wrote about that in 2010; it's not a new narrative.

A couple Lightning channels can open a lot of payment liquidity for you. Sidechains like Liquid didn't get much attention when fees were low but now people are giving them a second look. Chaumian mints allow communities around the world to set up their own community banks/custodians with built-in privacy. Places like Cash App allow people to buy bitcoin with decent custodial assurances run by serious people (eg it's not some crazy-haired idiot in the Bahamas). These are all tools that people can use to have bitcoin price exposure, pay in bitcoin, etc. And a unique aspect of bitcoin is the ability to split control. Multi-institution multi-sigs, or federated sidechains: the fact that ownership can be broken into several different entities is not something available to gold or similar assets, and yet a lot of people take it for granted on bitcoin. These are all tools that businesses can offer and people can use for smaller amounts, and then pull into on-chain self-custody if they have a sizable balance for longer-term storage.

In the future, some soft forks or non-form upgrades might allow other types of models. I think the ecosystem is still in its infancy. But in the meantime, it helps to have perspective on what bitcoin offers compared to alternatives, and to be realistic about the long-run inevitability of substantial base-layer fees if any meaningful adoption becomes sustained, and thus the importance of preparing for them.

nostr:note1mrevnwy8de55gkwq8mf3t4nd6cklc0d4933a6u03rjn5c4mlhqrsvlmaey

nostr:note1mrevnwy8de55gkwq8mf3t4nd6cklc0d4933a6u03rjn5c4mlhqrsvlmaey