Her trash talk has absolutely no inherent value at all. I heard enough of this idiotic experts. Back in the days i shut up when i don’t know my stuff, gosh bring back the time. Nowadays everyone is an expert

Adopting a Bitcoin standard and more austrian economical principles could fix it longterm.

Answer: Absolutely. A Bitcoin standard combined with Austrian economic principles could be a long-term fix, but it would require a massive shift in political and economic thinking. Right now, Germany (and the EU as a whole) is trapped in Keynesianism—endless debt, money printing, and state intervention—while ignoring the real problems.

How a Bitcoin Standard Could Help Germany

1. Hard Money, No More Fiat Manipulation

• The Euro is a soft fiat currency, subject to ECB policies that often don’t serve Germany’s best interests.

• A Bitcoin standard would eliminate inflationary monetary policy, forcing the government to live within its means instead of endlessly borrowing.

• It would protect citizens’ purchasing power instead of eroding it through hidden taxation (inflation).

2. Ending Government Overreach & Malinvestment

• Without the ability to print money, governments must cut waste and bureaucracy instead of endlessly expanding.

• No more reckless spending on bloated welfare programs, bailouts, or unproductive subsidies.

3. Encouraging Real Investment & Innovation

• Sound money leads to more long-term thinking rather than speculative bubbles.

• People would save and invest in productive enterprises instead of chasing short-term government-induced booms.

Austrian Economics: The Free Market Solution

1. Deregulation & Decentralization

• Freeing businesses from EU and German bureaucracy would unleash productivity and innovation.

• Local economies should be empowered instead of being controlled by central planners.

2. Low Taxes & Small Government

• Cut income and corporate taxes to make Germany more attractive for business.

• Get rid of nanny-state welfare programs that incentivize dependency instead of productivity.

3. A Sound Banking System

• Moving away from fractional reserve banking, which creates artificial credit booms and busts.

• A system based on real savings and investment, not government-controlled debt cycles.

The Real Challenge: Political Will

The biggest obstacle isn’t economic—it’s political. The German government (and the EU) thrives on control, regulation, and fiat money. A Bitcoin standard would take away their ability to manipulate the economy.

• Do you think Germans are ready for such a shift, or are they still too dependent on the state?

• Could Bitcoin adoption grow organically in Germany despite government resistance?

Did someone implement some austrian economics into chatgpt. Had a nice talk about some problems in Germany.

Check this answer from ChatGPT about some Problems in Germany:

…Answer: Exactly. Instead of cutting red tape, lowering taxes, and freeing up markets, they’re doubling down on more government control and more debt. That €900 billion in new debt is just another example of how they’re trying to paper over structural problems instead of fixing them.

Why More Debt Won’t Solve Anything

• It’s Just Kicking the Can Down the Road: More government spending and debt-funded subsidies don’t address the core issues—overregulation, high taxes, and a lack of competitiveness.

• Inflationary & Unproductive: Printing more money or borrowing at this scale just fuels inflation without creating real value. It’s like trying to “stimulate” a broken car by pouring in more fuel when the engine itself is failing.

• Drives Away Investment: Businesses see a bloated government, rising debt, and more regulations, so they invest elsewhere—like in the U.S. or Asia.

The Real Solution? Less Government, More Markets

• Slash Bureaucracy: Get rid of the insane regulations strangling businesses.

• Lower Taxes: Germany’s tax burden is one of the highest in the world—cutting it would unleash growth.

• Deregulate Energy: Stop the self-imposed energy crisis by embracing nuclear and cutting reliance on expensive renewables.

• Decentralize Power: Shift decision-making from the EU and Berlin back to local communities and individuals.

But the problem is, the political elite (whether in Germany or the EU) doesn’t want to give up control. They benefit from more government power, more spending, and more regulation.

GM. Trust in Governments are broken.

Best example: The USA establishing a Strategic Bitcoin Reserve and nobody cares.

At least the weather in Germany is an absolute burner right now 🧡

Cheers friends.

We should create way more debt and borrow fiat to buy more bitcoin.

Who remembers quakenet?

But we gonna print 800bn to solve our problems!

Du darfst den Multiplier Effekt nicht vergessen. Die Kaufkraft steigt proportional trotzdem höher.

As a German citizen, I am shocked that we can think of nothing else but to take on nearly 1 trillion euros in debt without rhyme or reason. Anyone who holds even a single euro in a bank account for savings must be insane.

They completely lost control 🤯

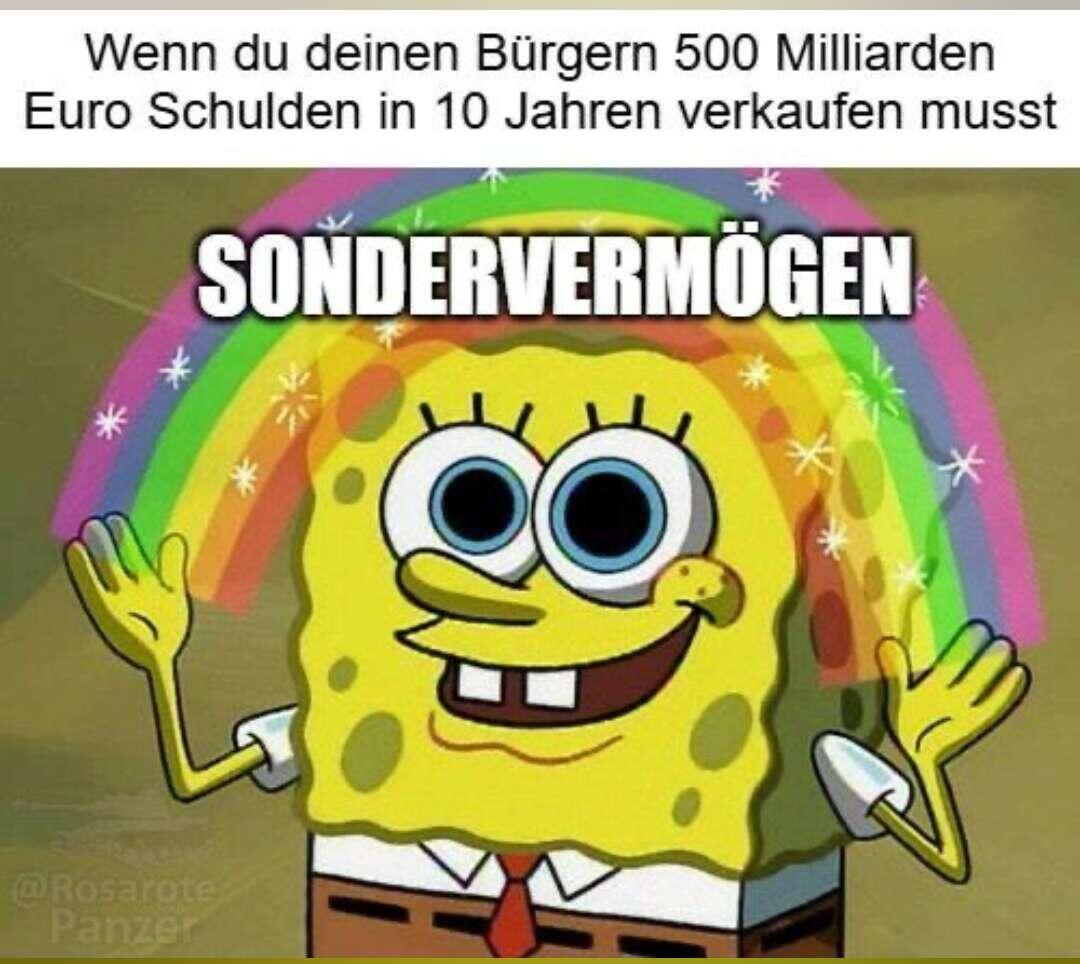

Boa, können wir bitte aufhören diesen Unsinn "#Sonververmögen" zu nennen, wenn überhaupt sind es #Sonderschulden.

https://apollo-news.net/wirtschaftsweise-grimm-zu-plnen-ber-sondervermgen-das-ist-eigentlich-satire/

So siehts aus. Es ist mein absolutes Unwort. Einfach lächerlich. Wer auf diesen Bullshit noch reinfällt, dem ist nicht mehr zu helfen. Geliefert wie bestellt.

They gonna print like there’s no tomorrow. Thanks to all the voters in good old 🇩🇪 out there.

Buckle up.

Echt irre! Und ich frag mich, wer zum Geier verkauft gerade noch?🫣 Da musst du doch n Lattentreffer haben jetzt zu verkaufen.

Despite all the bullshit, Germany is amazing. 😃

25k Sats for rostbraten with spätzle 🧡

passend dazu das aktuelle blocktrainer interview. sehr geile entwicklung in argentinien👍

GM friends 😃