It’s hard to find better #bitcoin resources to 🍊-pill with than these two talks by nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m & nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle.

What are the best #lighting wallets for zaps on #nostr?

It was a given that Wall Street would eventually #bitcoin bc their clients are.

Money has different meanings for different people. For some, it's a tool. For others, it's a liquidity resource that expands or evaporates quickly.

To me, money is real wealth and stores value across long periods of time, while liquidity is a claim on wealth that can easily distort the reality of our true net worth.

Money is backed by belief.

Liquidity is backed by emotion.

Strong belief systems last and provide abundance, while emotional systems irrationally expand and contract, creating unstable environments.

🔋 Belief > Money > Stability > Longevity

💥 Emotion > Currency (liquidity) > Instability > Fragility

Video: https://x.com/kanemcgukin/status/1767908365659738423?s=46&t=BCZ86Q6VE35kiDHSK1Vf6w

Yes! Get your time back. Get off dollars, out of the rat race, and into stores of value.

Seek and preserve what matters.

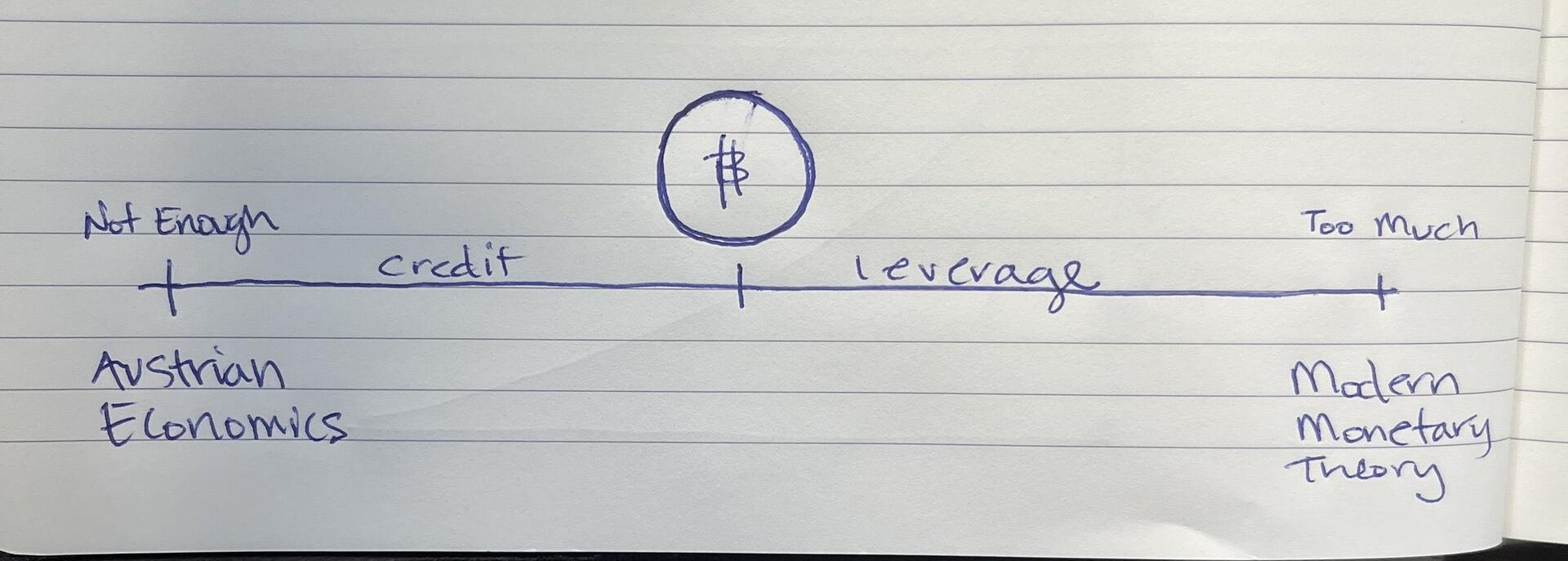

What financial markets face today is the same battle they faced between 1913 and the 1930s.

The battle of *REAL* wealth vs. *CLAIMS* on wealth 👇

It’s a simple choice, but we make it difficult due to the impact it has on the political *inability* to steal wealth.

Unpopular Opinion:

We believe we are different than animals. That humans do not poach like lions & tigers, etc.

Human greed begs to differ. It is proof that we are no different.

Is that why we call it Animal Spirits??

Society is in the process of cutting out the middleman…

across the board…

Broken values & incentive structures have finally pushed far enough to break the money. Forcing people to ask real questions & look for real solutions.

What’s the difference between economic data coming out of China and economic data coming out of the US?

Nothing.

It’s two governments making up statistics to support their own ideals and desires outcomes.

It really is as simple as that.

The Wall Street complex (TradFi) believes it to be rational and makes sense when $NVDA goes up endlessly by 5-10% per day…

BUT, screams *fraud* and it’s not real when #bitcoin does.

Interesting world! #FanBoy investing.

Investing hack: We all want more of an asset when it’s up, but when it’s down and we didn’t sell prior. We wish we had less.

The holy grail to investing is doing the exact opposite.

The 🔑 point in this convo w/ nostr:npub1uyz4w2w4rcphk0q5arzkutrecgscxwzajj4dkvh9mjyqjtxslm6qea8632 & Dr. Singh

https://youtu.be/UJsVYOfrc3M?feature=shared

TradFi’s shift from collateral based to credit/liquidity/leverage, makes it impossible to compute systemic risks.

#Bitcoin , wallets, “crypto” ecosystem solves… the lack of liquidity transparency.

IMO that is why new firms like:

Messari, look like old Wall Street research shops.

The Coinbase’s of the world, are a combo of old exhanges & prime brokerage.

And many of the #Bitcoin only co’s look very much like the original formation of Merrill/Morgan Stanley & PB.

It is true that most of the funding for terrorist activities begins when dollars are printed bc they are then transferred from agencies to bad actors for information.

Enjoyed chatting #Bitcoin Valuation Tools with @nsquaredcrypto. Timothy does a lot of great work on this front.

https://podcasts.apple.com/us/podcast/navigating-bitcoins-noise/id1583424361?i=1000641980817

Episode Topics:

🟠 Valuation Metrics: Upside/Downside

🟢 Kelly Criteria

🟡 MetCalfe's Law: network size + address growth

Enjoyed chatting #Bitcoin Valuation Tools with @nsquaredcrypto. Timothy does a lot of great work on this front.

https://podcasts.apple.com/us/podcast/navigating-bitcoins-noise/id1583424361?i=1000641980817

Episode Topics:

🟠 Valuation Metrics: Upside/Downside

🟢 Kelly Criteria

🟡 MetCalfe's Law: network size + address growth

#Bitcoin is playing in big leagues now and the game is at a new level.

How I suspect it plays out: An attempt to capture as much as #Bitcoin as possible including regulation to “try” to slow self custody of #Bitcoin (Warren et all) and leverage games on paper #Bitcoin to reduce price. (ETF’s)

Which “causes” more Bitcoiners aware of the manipulation and how the game is being played to use lower prices to buy and self custody more #Bitcoin (reducing supply)

Which at some point creates a short squeeze of MEGA proportions (maybe along with halving - maybe later ) that liquidates a major financial player. (Similar to FTX)

Money has become a monopoly because of the games that have been able to be played with others assets due to the centralization and control of those assets.

But Wall Street has never seen an asset like this. It is not gold and too many #Bitcoiners know how the game is played, meaning if you don’t play by the rules, eventually you will be caught short. (And no one is coming to save you)

Or as nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx says:

Stay humble and stack sats.

Agreed. Jeff. Hard to see it play out any differently. Suppression is the intention, but it’s never been tried on a truly scarce asset. Gold while scarce, is slightly more liquid.

It will depend on how much futures, stables and ETF dollar flows end up being, IMO.

Dangerous either way. Odd for an industry whose primary roll is fiduciary decisions.

Lessons the internet (TCP/IP) can teach us about #Bitcoin .

The Fundamental Value of Bitcoin👇👇

Curious about different answers to this. What was disappointing?

Most of the reporting from various services is so early it’s basically unusable and has about half the required info.

#m=image%2Fjpeg&dim=955x1012&blurhash=%7BCDc8vIUbvogMxRjELI%3A.TE0o%24R*V%40s.V%40oLs6t8D%25s%2BofRkj%5DbHMc%25LMvR%2Bbcj%3DkDoz0JtSajt6bckDnOnhwJso-pjZR%2BW%3DRibFNKR*t7a%7Eaxn%7EV%5BWBRjofRjWAV%40WCt7j%5D%24fofaybHoLn%2Bg3bH&x=5f0ec7384c56855654cfcaa3f84b4e03475333f373347737a8e63e1ab911286d

#m=image%2Fjpeg&dim=955x1012&blurhash=%7BCDc8vIUbvogMxRjELI%3A.TE0o%24R*V%40s.V%40oLs6t8D%25s%2BofRkj%5DbHMc%25LMvR%2Bbcj%3DkDoz0JtSajt6bckDnOnhwJso-pjZR%2BW%3DRibFNKR*t7a%7Eaxn%7EV%5BWBRjofRjWAV%40WCt7j%5D%24fofaybHoLn%2Bg3bH&x=5f0ec7384c56855654cfcaa3f84b4e03475333f373347737a8e63e1ab911286d