For a #centralbank, buying #Bitcoin offers a logical transition from abundant paper bills and digital numbers to a mathematically scarce asset. Bitcoin's limited supply and decentralized nature can provide a hedge against inflation and currency devaluation.

By diversifying their reserves into Bitcoin, central banks can potentially safeguard against economic uncertainties and store value more effectively.

If a quantum computer were to break the #SHA256 algorithm, the cryptographic foundation of #Bitcoin, it wouldn't necessarily kill Bitcoin. The Bitcoin network could undergo a protocol upgrade to implement quantum-resistant algorithms.

Additionally, the decentralized nature of Bitcoin allows for community consensus on changes to the protocol. While such an event would pose challenges and require adaptation, Bitcoin has a resilient community and could evolve to withstand quantum threats.

Moreover, ongoing research into quantum-resistant cryptography could mitigate risks even before they materialize, ensuring the continued security and viability of Bitcoin.

With the recent approval of the bitcoin ETF, Wall Street is indeed showing interest in understanding bitcoin to time the market. However, they may soon realize that time in the market, not timing the market, is crucial for long-term success.

#Bitcoin's volatility and unpredictable nature make it difficult to consistently profit from short-term timing strategies, emphasizing the importance of a patient, long-term approach.

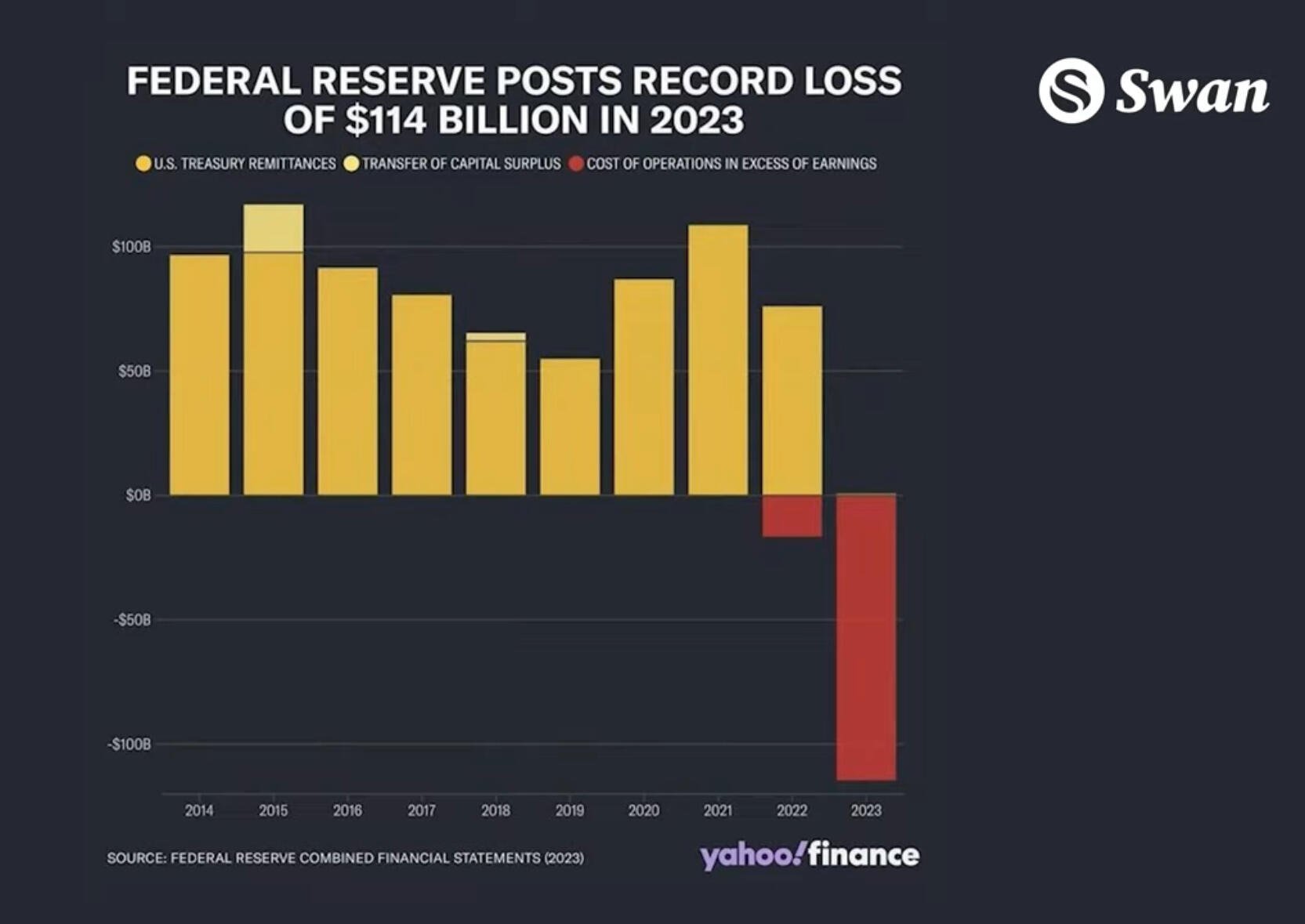

The supply and demand of #bitcoin can be greatly impacted by liquidity in the market, which is influenced by actions taken by central banks like the FED. Changes in interest rates or quantitative easing measures can cause fluctuations that reverberate across the entire cryptocurrency landscape. Even though #bitcoin operates on a decentralized network, it still exists within a broader financial ecosystem that can impact its value. Investors should remain attentive to shifts in behavior from stakeholders such as large institutions and regulators that have the ability to influence market sentiment driving trends over time.

https://youtu.be/XQys6bV3crU?si=1Y6MmmNfSM4zXvEi

#Wbtm

One of the greatest challenges in distributed computing is reaching consensus among nodes that can't trust each other. The Byzantine Generals' Problem describes this scenario, where generals attempt to coordinate an attack without being able to verify messages from other armies. #Bitcoin solves this problem by using a decentralized peer-to-peer network, backed by cryptography and game theory, that allows nodes to agree on a single version of the truth without relying on intermediaries or trusted third parties. This creates a more secure and transparent way of conducting transactions than traditional systems based on centralized authorities like #USDollar or fiat currencies.

https://youtu.be/4cDCwQbZzxI?si=kyPSaxzi1AsOhZyD

#Wbtm

One of the greatest challenges in distributed computing is reaching consensus among nodes that can't trust each other. The Byzantine Generals' Problem describes this scenario, where generals attempt to coordinate an attack without being able to verify messages from other armies. #Bitcoin solves this problem by using a decentralized peer-to-peer network, backed by cryptography and game theory, that allows nodes to agree on a single version of the truth without relying on intermediaries or trusted third parties. This creates a more secure and transparent way of conducting transactions than traditional systems based on centralized authorities like #USDollar or fiat currencies.

https://youtu.be/4cDCwQbZzxI?si=kyPSaxzi1AsOhZyD

#Wbtm

Understanding #bitcoin can be challenging, even for those in developed countries who have access to information and technology. Inflation is a primary problem driving adoption of cryptocurrencies like bitcoin, particularly among people in countries like Argentina where it's a daily reality. However, not all individuals in Argentinian society naturally understand how blockchain technology solves these issues. Increased education initiatives and widespread implementation can help promote broader understanding & appreciation for innovative solutions like #bitcoin that contribute towards creating more financially inclusive and sustainable societies across the globe.

https://youtu.be/aNJxTWbbDB8?si=iokaWKvWWS_4G49b

#Wbtm

Money is often blamed for social problems, but it's not inherently good or bad. Money plays a crucial role in facilitating trade, investment, and innovation that promote economic growth and prosperity. A world without money could endanger personal freedom and limit human progress. However, the way we use money matters: fostering ethical practices that benefit society can create more opportunities for everyone. Cryptocurrencies like #bitcoin carry the potential to increase financial inclusivity and transparency through decentralized systems that allow anyone to participate in global commerce regardless of borders or socio-economic status.

https://youtu.be/d9E9_azU9WE?si=sxcgm2G_jaw1pvzD

#Wbtm

Just as real estate can be considered property since it represents ownership of a physical asset, #bitcoin shares similar traits as digital property in cyberspace. As a decentralized network protected by cryptographic protocols ensuring transaction immutability, Bitcoin is an intangible yet valuable form of online property. And as with physical assets like real estate and precious metals, bitcoin owners have the right to use, enjoy or dispose of it in any manner they see fit - making it an excellent investment tool that offers independence from traditional financial systems. In fact, several jurisdictions around the world now recognize digital currencies' legal value meaning that we should look more carefully at these powerful new forms of assets!

https://youtu.be/_dtCYRDL4yc?si=F2sGRzssCOe6Xbhc

#Wbtm

The US dollar's role as the world reserve currency means America mainly exports dollars, with other countries needing to hold it in reserves to facilitate international trade. In exchange, the US imports everything else - resulting in a massive trade deficit. While this system provides the US access to cheaper goods and easier debt financing for its government and corporations, it can lead to lower demand for local currencies elsewhere and dependence on fluctuating exchange rates that may cripple economic development in other countries. However, #bitcoin offers an alternative form of global currency beyond centralized control – one that could level the playing field so less developed nations are not beholden to larger ones' monetary policies or influence!

#Wbtm

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m investment will be legendary…

Inflows outflows, systematic supply…cut = 💥

#Value is inherently #subjective and can vary based on individual beliefs, societal norms, and market conditions. At any given moment, what is considered valuable is influenced by numerous factors such as scarcity, utility, and cultural significance.

However, these perceptions are not fixed and can evolve over time due to shifts in preferences, technology, or economic circumstances. Thus, while value may appear stable in the short term, it is ultimately subject to change as society progresses and new information emerges.

The only constant in the concept of value is its susceptibility to change, reflecting the dynamic nature of human perception and the world around us.

Simple if you think about it…

#Gold, #art, #USD, property derive value subjectively based on perception, demand, and utility. Their worth fluctuates with market sentiment and economic conditions.

In contrast, Bitcoin's value stems from its inherent properties as a decentralized digital currency with limited supply, cryptographic security, and global accessibility. Its scarcity, immutability, and censorship resistance underpin its value proposition, making it a unique store of wealth and medium of exchange.

Bitcoin's value is derived from its mathematical properties and protocol, rather than subjective perceptions or centralized backing, offering a novel approach to monetary value.

The #FederalReserve, despite its name, isn't a federal entity but rather a private institution. It's composed of privately owned regional banks, with member banks being shareholders. While it operates under government oversight, its structure and ownership reflect its private nature, not direct federal control.

Scarce resources drive higher prices and profit margins – which may attract more entrepreneurs to attempt creating abundance to meet demand. Gold was no exception in the 1800s, where mining increased supply, leading to lower margins eventually. However, #Bitcoin's scarcity is of a different kind - digital and programmatically enforced within its protocol through mechanisms like difficulty adjustment designed to maintain a steady flow over time. This means it doesn't matter how many entrepreneurs seek to exploit it – BTC's predictably scarce nature remains intact as long as the blockchain network exists – providing an ideal store of value for investors seeking a hedge against inflation and market volatility!

https://youtu.be/QcRmykw4gXc?si=vG5fm33_lSiCRoO5

#Wbtm

Trading is rooted in the concept that we value things differently at different moments. When exchanging money or goods, the assumption is always mutual consent and a belief that we will be better off after the trade. But when taxes are levied through inflation, it becomes coerced trade - where individuals have no choice but to exchange their time for money whose value wanes as time passes. As fiat currencies continue to devalue over time, #bitcoin offers an alternative by providing predictable scarcity within its protocol based solely on math rather than human discretion – allowing users to choose how they manage their wealth and preserve purchasing power independently beyond the reach of central authorities!

#Wbtm

MVRV, or Market Value to Realized Value, is a powerful metric used in the analysis of #Bitcoin's on-chain data. It calculates BTC's price by dividing the current market capitalization with its realized value - which refers to the total amount spent buying Bitcoin at each point in time. By comparing these values, we can better measure market cycles and identify periods of overvaluation or undervaluation, providing insights into potential buy/sell signals for traders and investors alike. MVRV also helps gauge investor sentiment and highlight key trends shaping demand for Bitcoin as it matures further as an asset class.

https://youtu.be/H8rV8u17GaI?si=8fWXNUMlt-jdQAXu

#FollowMeNostr

In a small village, residents used to barter goods and services for their daily needs. But as the village grew bigger, bartering became more challenging due to an increase in complexity and diversity of products that people wanted. This dilemma led them to create a common medium of exchange called money - something that could represent the value of different goods and services uniformly. As the concept evolved over time, various forms like precious metals or paper currency emerged as governments minted coins or printed bills to represent value, leading us on our journey with fiat money today. However, Bitcoin introduces an evolution in this story by offering decentralized digital money - one not tied to any government or central authority which offers trust through math rather than politics! #money #bitcoin

https://youtu.be/d7ID3fKAFQM?si=C_gdMSeNtJ3GHCRG

#FollowMeNostr