#Inflation measurement from zero overlooks the deflationary effects of technological advancements. Technologies constantly improve efficiency, reducing production costs and prices, effectively causing a natural deflationary trend.

By measuring inflation from this implied #deflationRate, we gain a more accurate understanding of price stability. Failing to account for technological advancements skews economic policy decisions and may lead to unnecessary interventions.

Recognizing the deflationary impact of technology allows for more informed monetary policy and fosters a clearer perspective on long-term economic trends.

Voting for a #fiatPolitician tacitly supports the allocation of government funds obtained through inflation, essentially endorsing how those funds are distributed.

Since fiat currency loses value over time due to inflation, voting for politicians who control its allocation influences who benefits from this "silent theft" of purchasing power, shaping economic policies and resource distribution.

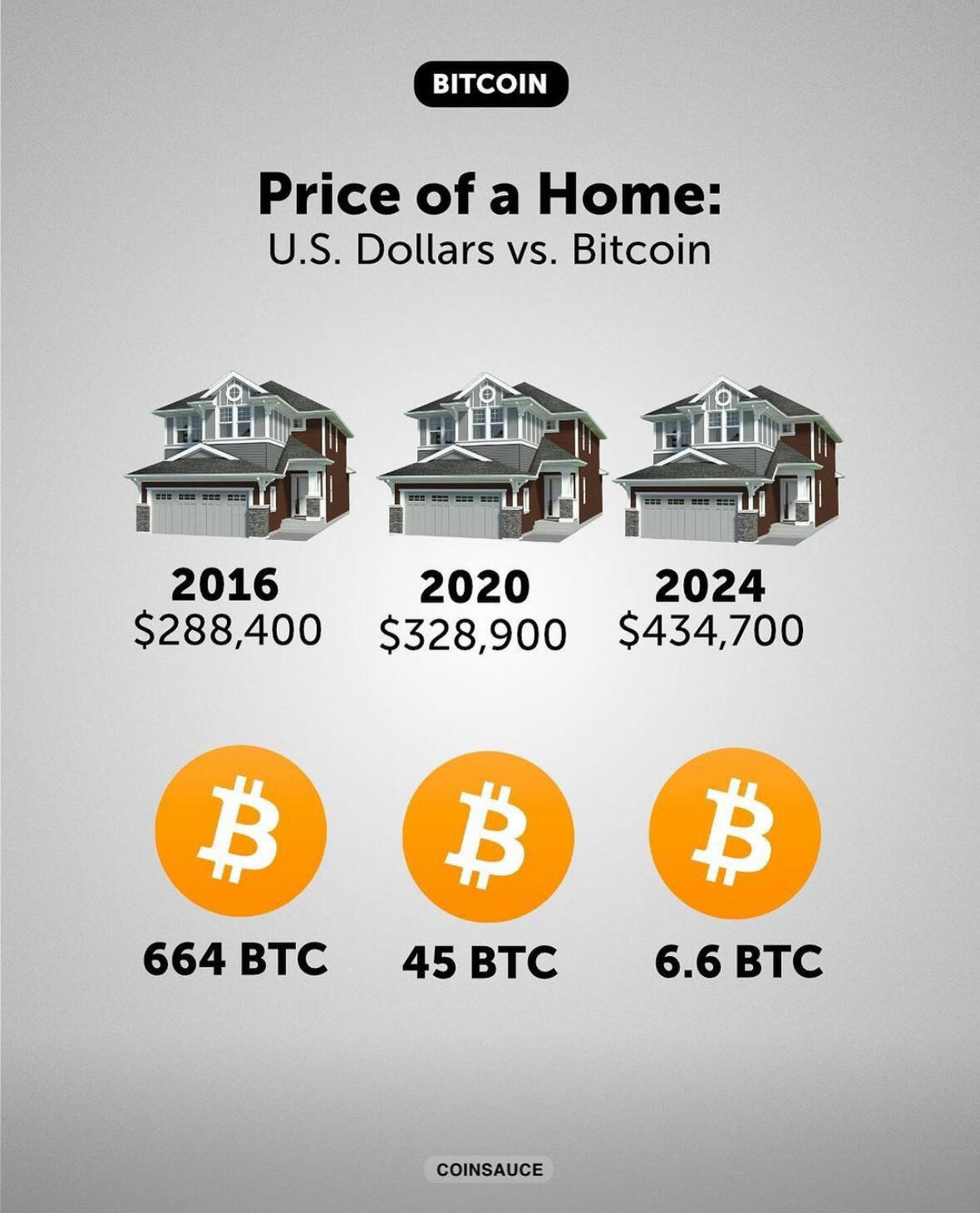

I love this picture is a hard reality nostr:note1yqgudajgpq422f35rrf4x00ewsg78nn3c5gp2ynw5rtuqvkjx2xsmp4dzs

You feel like talking in a vacuum, nobody can hear you, nobody listen…

Bitcoin halving is an event that happens every four years, where the rewards for miners are reduced by half. The first Bitcoin halving occurred in November 2012 when the miner rewards were reduced from 50 BTC to 25 BTC. This event coincided with the discovery of the Higgs-Boson particle and marked a significant milestone in Bitcoin's journey. With only 11 million coins in circulation at that time, this halving helped ensure scarcity and maintain value over time as there would never be more than 21 million Bitcoins created. #BitcoinHalving #BTC #Cryptocurrency

#Wbtm

#MicroStrategy Orange Protocol for #DID Decentralised ID

Very interesting Mr. nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

Enjoy the article here:

https://decrypt.co/229087/orange-decentralized-identity-ordinals-inscriptions-microstrategy?amp=1

#ConsumerInflation refers to the general increase in prices of goods and services over time, impacting purchasing power.

#AssetInflation, on the other hand, refers to the rise in the prices of assets like stocks, real estate, or cryptocurrencies, often driven by excess liquidity and speculation.

While consumer inflation affects everyday expenses, asset inflation influences investment returns and wealth distribution.

Satoshi Nakamoto's creation of Bitcoin solved a fundamental problem in money: how to maintain a ledger that cannot be tampered with. By implementing proof-of-work and difficulty adjustments, Satoshi created an unforgeable costliness that ensures the security and integrity of the Bitcoin network. Additionally, his decision to set a hard monetary policy helps combat inflation and provides consistency in value over time. Through understanding these principles, Satoshi revolutionized the way we think about money by creating a decentralized global consensus without intermediaries. #Bitcoin #SatoshiNakamoto #Cryptocurrency

https://youtu.be/d7ID3fKAFQM?si=C_gdMSeNtJ3GHCRG

#Wbtm

The US Dollar is displaying several telling signs of decline, as outlined in the "five stages of collapse" theory. This model suggests that societies and institutions exhibit indications for imminent ruin such as excessive debt, falling productivity and inflation - all of which are true for USD. Bitcoin offers a potential solution to these issues with its limited supply nature and decentralized technology, effectively reducing external manipulation and making it insulated from political pressures. Asset managers must take account of these trends when investing portfolios by diversifying holdings away from traditional fiat assets into more stable investments such as commodities or digital assets like Bitcoin. #Bitcoin #FinancialTrends

#Wbtm

Adding Bitcoin to your investment portfolio can be a wise move, particularly in light of its potential as a disruptive force in the financial industry. As Satoshi Nakamoto noted, there is always a chance that Bitcoin could "catch up" and make significant gains in value relative to traditional assets like fiat currency or gold. By investing even a small portion of one's overall holdings into Bitcoin, investors can potentially benefit from this rise in value while also diversifying their risk and exploring new opportunities for financial growth and success. #Bitcoin #DiversifiedInvesting

https://youtu.be/0Fg30bxX9BA?si=TjYHVpbM5lyZLUTa

#Wbtm

James A. Garfield's 20th president of the USA 🇺🇸 quote emphasizes the power of controlling a country's money supply.

By determining how much money is in circulation, one wields immense influence over the economy, industry, and commerce.

This control enables manipulation of interest rates, inflation, and economic activity, shaping the fate of businesses and individuals alike.

Essentially, whoever holds this control holds significant sway over the entire economic landscape, dictating its course and outcomes.

Okay, imagine the government needs money.

They can either take it from people through taxes (which nobody likes) or borrow it.

When they borrow, they sell IOUs called bonds.

The Federal Reserve can buy these bonds or add money digitally.

This means the government can spend more, but it can also lead to other problems like inflation.

A group of #bigbankers created the #FederalReserveAct in secret because it served their interests.

By establishing a central bank with private and public elements, they aimed to stabilize the financial system, protect their investments, and maintain control over monetary policy.

However, publicly criticizing the bill allowed them to appear as advocates for transparency and accountability while shaping the narrative to their advantage.

This tactic helped mitigate potential public backlash and legitimize the #FederalReserve's existence.

Ultimately, the secrecy surrounding its creation and subsequent public criticism underscore the complex interplay between private interests and government regulation in shaping financial institutions.

I LOST MY #BITCOIN

Rushing into self-custody without adequate preparation risks loss of funds due to theft or technical mishaps.

Self-custody for Bitcoin requires time to understand and design a proper security system due to its unique nature.

Unlike traditional assets, Bitcoin is decentralized and relies on cryptographic keys for ownership.

Securing these keys is paramount, involving practices like hardware wallets, multi-signature setups, and backups. Understanding these concepts and implementing them effectively takes time and education.

Therefore, dedicating several hours to grasp the intricacies of Bitcoin security and designing a robust system is essential for safeguarding one's assets in the long term.

I almost lost them for not taking the time to learn but I’m good in case you were wondering, I have a good design #multisig multi geography setup 🫡

Governments print money 💰

Governments can print money they don't need to borrow under certain circumstances, such as during economic downturns or emergencies, to stimulate spending and investment.

This strategy, known as monetary financing, allows governments to avoid accumulating debt and potentially reduce the need for austerity measures. However, it carries risks, including inflation and loss of confidence in the currency.

Additionally, excessive printing can devalue the currency and harm economic stability. Therefore, while it's a tool available to governments, it must be used judiciously and in conjunction with other fiscal policies to ensure long-term economic health and stability.

Wep im missing 🤓🙏

It's challenging to let go of our previously held beliefs, especially when it comes to complex systems such as finance and economics. However, admitting that past assumptions were based on incomplete or inaccurate information is essential for personal growth and financial success. In the case of Bitcoin, recognizing its potential as a viable alternative to traditional forms of currency may require reevaluating long-held beliefs around which financial institutions should be trusted with stewarding one's investments. #Bitcoin #GrowthMindset

https://youtu.be/3bXCIxigV60?si=bOsBJ2X4kymO3hsW

#Wbtm

Bitcoin's high liquidity offers distinct advantages over assets like real estate when it comes to mobility and portability. Whereas selling a property can take months or even years, Bitcoin can be sold and transferred instantly with minimal transaction fees. This makes it easier for people to relocate to jurisdictions that may offer them greater legal or financial freedom without the constraints of physical assets holding them back. As countries continue to implement stricter regulations around capital controls, Bitcoin will only grow in popularity as a means of facilitating borderless payments and wealth management. #Bitcoin #BorderlessFinance

#Wbtm