Reading all the clever responses to the pizza lady is making me hurt 😆 😂 😂

Caught the interactions with Samantha and nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a and nostr:npub1uyz4w2w4rcphk0q5arzkutrecgscxwzajj4dkvh9mjyqjtxslm6qea8632

There should be more IRL debates between the skeptics and supporters. The only real debates I’m aware of are with peter schiff on the pomp podcast. Debates would be extremely helpful for those that don’t understand bitcoin.

Why do so many “smart” people think something isn’t scarce if you can slice it into small pieces? Then to lecture everyone on “MATH”.

https://nitter.cz/SamanthaLaDuc/status/1746537693775835194#m

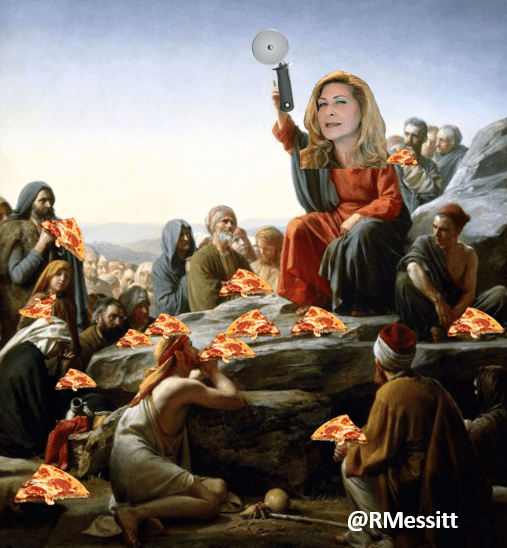

This meme made me laugh!

“The feeding of the 5000”

That makes sense. Everyone should know how to build something. It’s great if you can also turn it into a business and later build your own place.

Hopefully you’re building in a freedom-oriented place. That’s the hard part these days. A lot of shifting sands. The great thing about construction is that it could be a skill that you can take anywhere.

I used to be a big believer in accumulating rental properties but now I have a hard time justifying any investment into real estate.

Even if I could double my capital in a year or two, I suspect I’ll do better keeping that in bitcoin.

Also i wouldn’t be willing to take on government risk. Eg California, most blue states, etc. Rent controls, etc.

The only exception I would personally make is to invest into a perfect place for a growing family, if I couldn’t otherwise rent an equivalent. I would view that as an investment into the family which i would generally value more than BTC returns.

I wonder what it would take to move the needle. Perhaps nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a knows.

It’s nothing to be self-conscious about. Eventually most men reach that point in their lives where their little inner drummer can no longer be ignored. I hope that you’re able to quickly find a support group of guitarists and vocalists. 🤘

Somebody once asked me whether regulators were scared that bitcoin would contribute to inflation.

Without thinking too deeply about it, I said no. Now I think my answer may be incorrect. Perhaps it’s possible that bitcoin, especially in the form of an ETF, could contribute to inflation.

As we know, an increase in the money supply drives inflation. Banks create base money out of thin air when they issue loans.

Will the ETF drive more loans and therefore more base money? Now I think it might.

Shares of an ETF might be margin-eligible making it easy to borrow money with the shares as collateral.

MicroStrategy has been borrowing money to buy bitcoin and short the dollar. The ETF might make this strategy accessible to almost everyone.

These new loans might increase base money and inflation, creating a reflexive feedback loop. As the price of bitcoin rises, more people will borrow money on margin, creating more inflation and a higher bitcoin price.

Could the ETF be the Trojan horse that consumes the financial system from the inside? 🤔

This makes sense to me. The implication seems to be that only a few large stackers will be able to be sovereign. Everyone else will be hodling in some form of custodial system.

I’m optimistic that the community will eventually figure out a better and more decentralized layer.

1. nostr:npub1u8lnhlw5usp3t9vmpz60ejpyt649z33hu82wc2hpv6m5xdqmuxhs46turz's piece is worth a read.

2. nostr:npub1jfujw6llhq7wuvu5detycdsq5v5yqf56sgrdq8wlgrryx2a2p09svwm0gx gets better every day.

3. There are *serious* sats committed to author and commenters.

I’m still wondering how much covenants will help in a high fee environment.

Let’s say we have covenants and I lockup a 1 sat UTXO payable to you. The reality is that you’ll never get it.

I must be missing something, because I don’t understand how covenants to pay in the future can solve our scaling issue when you don’t know the cost of the transaction fees at that future time.

It does seem that sovereign Lightning will be an oxymoron soon for plebs and small merchants.

Besides the complexity, merchants won’t be happy that their overall fees are higher than credit cards.

Try the new aqua wallet to see if that’s acceptable. Lightning moves into and out from Liquid. Perhaps that’s better. 🤷♂️

A while back, I saw a video that made an impression on me. There was an overweight, homely girl in a trans reveal to her friends. After she excitedly explained that she was now a boy, all of her friends absolutely love-bombed her. “Oh my … you’re so amazing! … so brave!… so special!”.

To me, that explained the “rapid onset gender dysphoria” happening to tween girls.

Anyway, I see the following types in the trans community:

- the OGs

- insecure people who want to feel special and belong to a community

- gays in denial (as you mentioned)

- uncompetitive or lower status people who want to use it as a source of power or advantage against others (males competing in sports against females, access to jobs, etc).

Yes, blackpilled for a long time, combined with non-agreeable personality. 😏

There are a lot of us in the bitcoin community. I love meetups because I find we’re all instant friends.

It’s incredibly sad when people so young are affected like that. I’m glad you were able to resist. Hope someday they realize that you got it right.

Looking increasingly likely. So twisted. Not holding my breath for any accountability though.

Lucky to have my whole family as conspiracy theorists. None of us (adults or kids) got vaxxed.

The worst part of the whole sordid Epstein saga is how Harvard professor Alan Dershowitz, who was apparently a frequent guest of Epstein, crafted a “no prosecution agreement” with the US government.

This indicates that elements of the US government knew what Epstein was doing, and protected him from prosecution.

I admire the courage that Giuffre had to speak out publicly. She must have legit feared that she would increment the Clinton body count.

https://nitter.cz/EricRWeinstein/status/1742721513642717505#m

There is probably a law that all custodians will take greater risk in the quest for higher revenues until they eventually blow up.

Buy 6 months before the halving. Sell 18 months after the halving. Charge fees for the “service”. Then start adding leverage to goose returns.

There is probably a law that all custodians will take greater risk in the quest for higher revenues until they eventually blow up.

Readable thread for those of us without twitter accounts:

https://nitter.cz/bitschmidty/status/1742909238211424587?s=46