DUNE: The Spice Melange is the rarest, most valuable commodity in the universe. Stockpiling it is considered a threat to the Imperium, due to its incredible value.

Spice took Arrakis from being a distant, poor, unimportant desert world to a greatly prized fief.

Sound familiar?

It’s a great read! Check it out sometime: https://www.activism.net/cypherpunk/manifesto.html

BEFORE THERE WAS #BITCOIN - THERE WAS THE CYPHERPUNK MANIFESTO

[some #cypherpunk history]

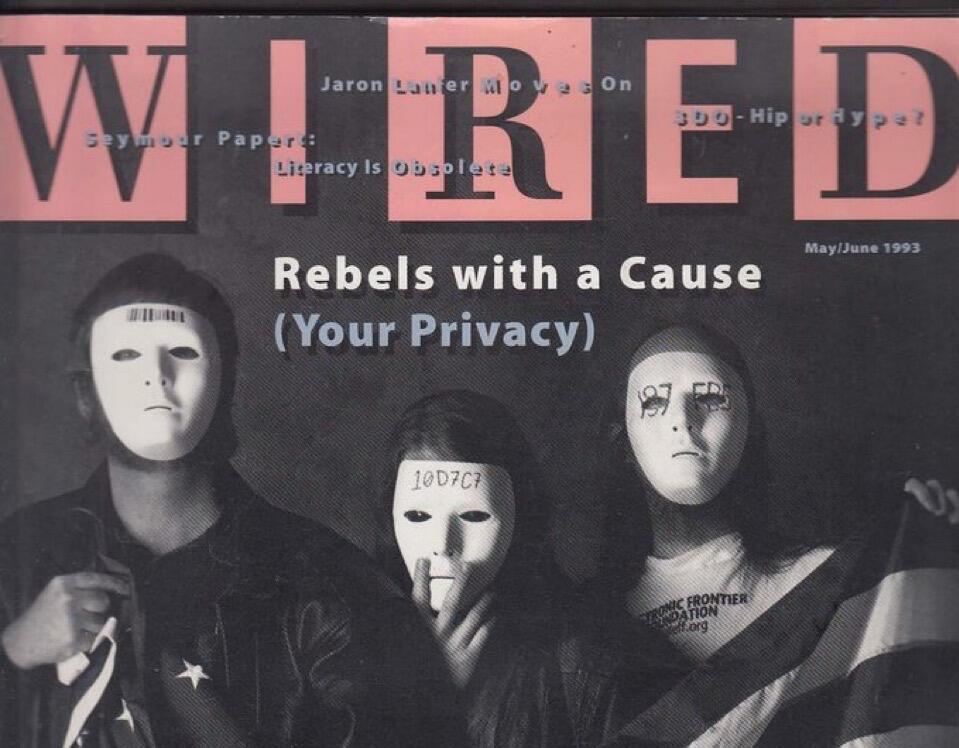

The Cypherpunks formed in the 1980’s and communicated regularly on the Cypherpunks mailing list on a range of topics related to cryptography, economics, and censorship. Eric Hughes, a mathematician and one of the founders of the Cypherpunk movement along with Timothy C. May and John Gilmore, published “A Cypherpunk's Manifesto” in 1993 that captures its ethos.

Read a few select quotes from it below👇

As you read these quotes that predate Bitcoins creation by 16 years, comment how you see how this manifesto INFLUENCED BITCOIN.

¶9: “Cypherpunks write code. We know that someone has to write software to defend privacy, and since we can't get privacy unless we all do, we're going to write it. We publish our code so that our fellow Cypherpunks may practice and play with it. Our code is free for all to use, worldwide. We don't much care if you don't approve of the software we write. We know that software can't be destroyed and that a widely dispersed system can't be shut down.”

¶6: “We cannot expect governments, corporations, or other large, faceless organizations to grant us privacy out of their beneficence.”

¶7: “We must defend our own privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place. People have been defending their own privacy for centuries with whispers, darkness, envelopes, closed doors, secret handshakes, and couriers. The technologies of the past did not allow for strong privacy, but electronic technologies do.”

A Cypherpunk’s Manifesto

by Eric Hughes (9 March 1993)

𝙈𝙔 𝙁𝙄𝙉𝘼𝙉𝘾𝙄𝘼𝙇 𝙇𝙄𝙁𝙀 𝙎𝙏𝙊𝙍𝙔: 𝘼 𝙡𝙞𝙩𝙩𝙡𝙚 𝙖𝙗𝙤𝙪𝙩 𝙢𝙚

I reached $100,000 in investments at age 29, and $500,000 by age 34.

I have been investing since I was 10. My father would let me buy/sell “fractional shares” with what I saved of my allowance, which was 25 cents a week × my age. My father taught me a low time preference. He taught me saving and investing before I could drive a car.

I have owned technology mutual funds, broad market index funds, diverse ETF’s, individual company stocks, real estate, and Bitcoin. Real estate has done well, but only due to buying in at the bottom of the ‘08 Financial Crisis. Fortunate timing. But a home isn’t the greatest store of value.

My best choice by far has been saving in Bitcoin. I was orange-pilled in 2021, like so many. I have endless respect for all those who got here even earlier.

I’ve read @saifedean.

I’ve studied economics.

I’ve read the Bitcoin source code (computer science major)

I’ve done the math.

I’ve put in the work.

I’m in agreement with @saylor.

I have never sold a sat.

I am convinced Bitcoin will continue to outperform all other assets for a long time.

I’m no genius, like many of you are. But I’m here to help, to orange-pill others, to spread knowledge, to respect and honor Bitcoins history and origins, to create and spread the memes, and to encourage us all to live a happy life amidst a messed up world.

Money is a protection in life.

It’s not the goal of life.

But handle it properly, and you won’t waste your life striving for protection - you’ll live your life protected the best you can.

𝐓𝐈𝐌𝐄 𝐏𝐑𝐄𝐅𝐄𝐑𝐄𝐍𝐂𝐄

True Bitcoiners must have a “𝐥𝐨𝐰 𝐭𝐢𝐦𝐞 𝐩𝐫𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞”

What does this mean?

Do you have it?

🄻🄾🅆 🅃🄸🄼🄴 🄿🅁🄴🄵🄴🅁🄴🄽🄲🄴 means someone focuses more on their well-being in the future, rather than the present.

Low time preference activities include: saving or investing money, exercising, eating high quality food, getting adequate sleep, producing quality, original artwork or craft work, etc.

A “tomorrow person”.

🄷🄸🄶🄷 🅃🄸🄼🄴 🄿🅁🄴🄵🄴🅁🄴🄽🄲🄴 people are more present-oriented and value consuming sooner. They prefer instant gratification and are less likely to save and invest.

High time preference activities include: buying things on credit, eating fast food, heavy consumption of media, tv, and social media, etc.

A “today person”.

In “The Bitcoin Standard”, @saifedean discusses time preference. Sound money, which Bitcoin is designed to be, can hold its value over time, which can lower people's time preference and encourage them to save and defer consumption.

Bitcoiners famous saying, “HODL”, is about delayed gratification. Hodling involves ignoring the drama of price charts, and setting your mind years into the future, trusting in Bitcoin's sound money characteristics and the potential benefits that might bring.

So… do YOU have a 𝐥𝐨𝐰 𝐭𝐢𝐦𝐞 𝐩𝐫𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞?

https://video.nostr.build/bf6e4b093a2e025c2a64f9d3e55796bb4742ad232e903675d75ea1fc19e61f86.mp4

https://video.nostr.build/bf6e4b093a2e025c2a64f9d3e55796bb4742ad232e903675d75ea1fc19e61f86.mp4

BREAKING: FED Chair J. Powell officially recommends buying Bitcoin https://video.nostr.build/b51b55589644a0071f3dd2cedc91175dbfddfccbb2169a0f304c5844b577ebf6.mp4

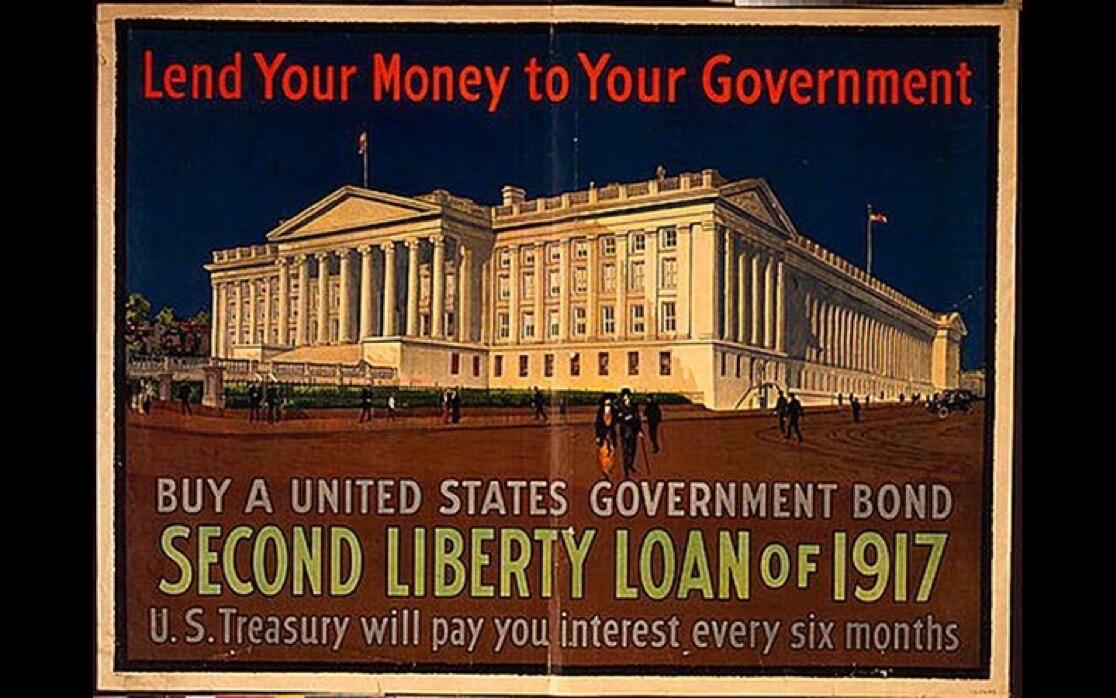

World War I was the first test of the new Federal Reserve System, and it was a trial by fire. Large inflows European gold to pay for US exports increased the US money supply.

The War brought financial havoc to Europe as their currencies became unstable, but it enhanced the standing of the U.S. dollar among the world’s currencies. The US dollar remained linked to gold, and that gold supply was growing - causing inflation, of course.

The Treasury introduced “war bonds”, the Federal Reserve took an active role in marketing war debt to the public.

By the end of World War II, the US had 75% of the world’s monetary gold supply, and the USD was the only currency still backed by gold.

In the decades following WWII as the world rebuilt itself, the US spent its gold on war torn nations, hunger for imports, and the Vietnam War.

What was the result? Belgium, Netherlands, Germany, France showed interested in redeeming their US dollars for the gold that “backed” it. Britain, in August 1971, did officially request to be paid in gold for their dollars.

But Nixon slammed the door shut on the redeemability of US dollars for gold, refusing to repay them. And thus, the gold standard came to an end.

A true international gold standard existed for less than 50 years - from 1871 to 1914.

Though a lesser form of the gold standard continued until 1971, its death had started centuries before with the introduction of paper money.

S

T

A

C

K

S

A

T

S

K

I

D

S

。 ・゚

。°*.

。*・

Follow her @HOTGIRL.ETH for financial advice https://video.nostr.build/73f1c86065b64f4a0a6214f3ae523f5c7eea2d59168a0c5c2a1ed8df72ab017a.mp4

Everything points to

👉🏿👇🏿👇🏿👇🏿👇🏿👇🏿👇🏿👇🏿👇🏿👇🏿👈🏿

👉🏿👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👈🏿

👉🏿👉🏾👇🏽👇🏽👇🏽👇🏽👇🏽👇🏽👇🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👇🏼👇🏼👇🏼👇🏼👇🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👉🏼👇🏻👇🏻👇🏻👈🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👉🏼BITCOIN👈🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👉🏼BITCOIN👈🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👆🏼👆🏼👆🏼👆🏼👆🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👆🏽👆🏽👆🏽👆🏽👆🏽👆🏽👆🏽👈🏾👈🏿

👉🏿👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👈🏿

👉🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👈🏿

BITCOIN v ETHEREUM

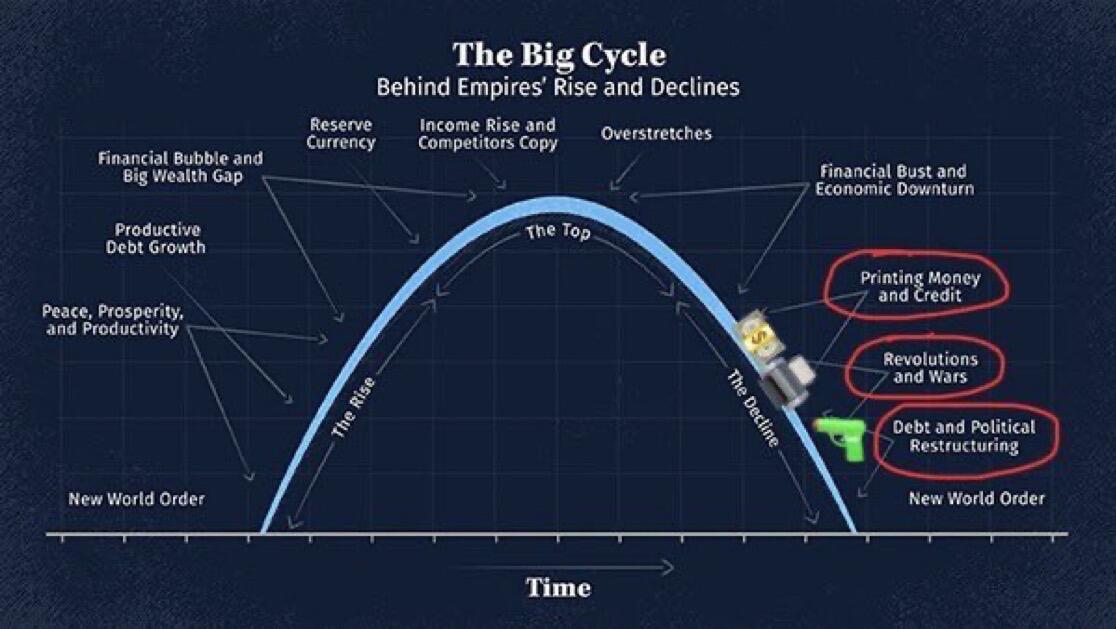

You are living in the time deep in the DECLINE of the USA and BRITISH empire.

It will soon end.

If nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg doesn’t have a button for GIFs, how am I supposed to communicate with my plebz?

Agreed! GIPHY integration needed 🤣

What is coming this week, plebs?

Can you feel it?

I said CAN YOU FEEL IT?!

Love it! Share your experience when you go.

Where have you visited in the country?

Hearing this banger everywhere lately 🔥🎶

We Call Them Poor https://video.nostr.build/5b21f5572d6a5549f4ef19fc9593e591e0a19c7effd71565db1e2e48fcc9a961.mp4

If I move to El Salvador, where should I live?